2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

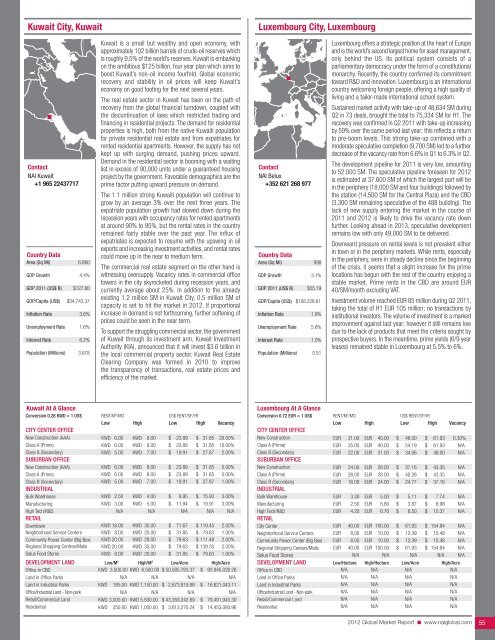

Kuwait City, Kuwait<br />

Luxembourg City, Luxembourg<br />

Contact<br />

<strong>NAI</strong> Kuwait<br />

+1 965 22437717<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

6,880<br />

4.4%<br />

$127.80<br />

$34,743.37<br />

3.6%<br />

1.6%<br />

6.2%<br />

3.678<br />

Kuwait is a small but wealthy and open economy, with<br />

approximately 102 billion barrels of crude-oil reserves which<br />

is roughly 9.5% of the world’s reserves. Kuwait is embarking<br />

on the ambitious $125 billion, four year plan which aims to<br />

boost Kuwait’s non-oil income fourfold. <strong>Global</strong> economic<br />

recovery and stability in oil prices will keep Kuwait’s<br />

economy on good footing for the next several years.<br />

The real estate sector in Kuwait has been on the path of<br />

recovery from the global financial turndown, coupled with<br />

the discontinuation of laws which restricted trading and<br />

financing in residential projects. The demand for residential<br />

properties is high, both from the native Kuwaiti population<br />

for private residential real estate and from expatriates for<br />

rented residential apartments. However, the supply has not<br />

kept up with surging demand, pushing prices upward.<br />

Demand in the residential sector is booming with a waiting<br />

list in excess of 90,000 units under a guaranteed housing<br />

project by the government. Favorable demographics are the<br />

prime factor putting upward pressure on demand.<br />

The 1.1 million strong Kuwaiti population will continue to<br />

grow by an average 3% over the next three years. The<br />

expatriate population growth had slowed down during the<br />

recession years with occupancy rates for rented apartments<br />

at around 90% to 95%, but the rental rates in the country<br />

remained fairly stable over the past year. The influx of<br />

expatriates is expected to resume with the upswing in oil<br />

exports and increasing investment activities, and rental rates<br />

could move up in the near to medium term.<br />

The commercial real estate segment on the other hand is<br />

witnessing oversupply. Vacancy rates in commercial office<br />

towers in the city skyrocketed during recession years, and<br />

currently average about 25%. In addition to the already<br />

existing 1.2 million SM in Kuwait City, 0.5 million SM of<br />

capacity is set to hit the market in <strong>2012</strong>. If proportional<br />

increase in demand is not forthcoming, further softening of<br />

prices could be seen in the near term.<br />

To support the struggling commercial sector, the government<br />

of Kuwait through its investment arm, Kuwait Investment<br />

Authority (KIA), announced that it will invest $3.6 billion in<br />

the local commercial property sector. Kuwait Real Estate<br />

Clearing Company was formed in 2010 to improve<br />

the transparency of transactions, real estate prices and<br />

efficiency of the market.<br />

Contact<br />

<strong>NAI</strong> Belux<br />

+352 621 268 977<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

998<br />

3.1%<br />

$55.19<br />

$108,226.61<br />

1.9%<br />

5.6%<br />

1.0%<br />

0.51<br />

Luxembourg offers a strategic position at the heart of Europe<br />

and is the world’s second largest home for asset management,<br />

only behind the US. Its political system consists of a<br />

parliamentary democracy under the form of a constitutional<br />

monarchy. Recently, the country confirmed its commitment<br />

toward R&D and innovation. Luxembourg is an international<br />

country welcoming foreign people, offering a high quality of<br />

living and a tailor-made international school system.<br />

Sustained market activity with take-up of 48,634 SM during<br />

Q2 in 73 deals, brought the total to 75,334 SM for H1. The<br />

recovery was confirmed in Q2 2011 with take-up increasing<br />

by 59% over the same period last year; this reflects a return<br />

to pre-boom levels. This strong take-up combined with a<br />

moderate speculative completion (9,700 SM) led to a further<br />

decrease of the vacancy rate from 6.6% in Q1 to 6.3% in Q2.<br />

The development pipeline for 2011 is very low, amounting<br />

to 52.000 SM. The speculative pipeline foreseen for <strong>2012</strong><br />

is estimated at 37.600 SM of which the largest part will be<br />

in the periphery (18,000 SM and four buildings) followed by<br />

the station (14,500 SM for the Central Plaza) and the CBD<br />

(3,300 SM remaining speculative of the 488 building). The<br />

lack of new supply entering the market in the course of<br />

2011 and <strong>2012</strong> is likely to drive the vacancy rate down<br />

further. Looking ahead in 2013, speculative development<br />

remains low with only 49,000 SM to be delivered.<br />

Downward pressure on rental levels is not prevalent either<br />

in town or in the periphery markets. While rents, especially<br />

in the periphery, were in steady decline since the beginning<br />

of the crisis, it seems that a slight increase for the prime<br />

locations has begun with the rest of the country enjoying a<br />

stable market. Prime rents in the CBD are around EUR<br />

40/SM/month excluding VAT.<br />

Investment volume reached EUR 85 million during Q2 2011,<br />

taking the total of H1 EUR 105 million; no transactions by<br />

institutional investors. The volume of investment is a marked<br />

improvement against last year; however it still remains low<br />

due to the lack of products that meet the criteria sought by<br />

prospective buyers. In the meantime, prime yields (6/9 year<br />

leases) remained stable in Luxembourg at 5.5% to 6%.<br />

Kuwait At A Glance<br />

conversion 0.28 kWd = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

cItY center offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center (Big Box)<br />

Regional Shopping Centres/Malls<br />

Solus Food Stores<br />

KWD 6.00 KWD 8.00 $ 23.89 $ 31.85 20.00%<br />

KWD 6.00 KWD 8.00 $ 23.89 $ 31.85 10.00%<br />

KWD 5.00 KWD 7.00 $ 19.91 $ 27.87 2.00%<br />

KWD 6.00 KWD 8.00 $ 23.89 $ 31.85 5.00%<br />

KWD 6.00 KWD 8.00 $ 23.89 $ 31.85 5.00%<br />

KWD 5.00 KWD 7.00 $ 19.91 $ 27.87 1.00%<br />

KWD 2.50 KWD 4.00 $ 9.95 $ 15.93 5.00%<br />

KWD 3.00 KWD 5.00 $ 11.94 $ 19.91 3.00%<br />

N/A N/A N/A N/A N/A<br />

KWD 18.00 KWD 30.00 $ 71.67 $ 119.45 2.00%<br />

KWD 8.00 KWD 20.00 $ 31.85 $ 79.63 1.00%<br />

KWD20.00 KWD 28.00 $ 79.63 $ 111.48 2.00%<br />

KWD 20.00 KWD 35.00 $ 79.63 $ 139.35 2.00%<br />

KWD 8.00 KWD 20.00 $ 31.85 $ 79.63 1.00%<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

KWD 3,500.00 KWD 6,500.00 $ 50,585,783.37 $ 93,945,026.26<br />

Land in Office Parks<br />

N/A N/A N/A N/A<br />

Land in Industrial Parks<br />

KWD 185.00 KWD 1,150.00 $ 2,673,819.98 $ 16,621,043.11<br />

Office/Industrial Land - Non-park<br />

N/A N/A N/A N/A<br />

Retail/Commercial Land<br />

KWD 3,000.00 KWD 5,500.00 $ 43,359,242.89 $ 79,491,945.30<br />

Residential<br />

KWD 250.00 KWD 1,000.00 $ 3,613,270.24 $ 14,453,080.96<br />

Luxembourg At A Glance<br />

conversion 0.72 eur = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

cItY center offIce<br />

New Construction<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

31.00<br />

35.00<br />

22.00<br />

24.00<br />

26.00<br />

16.00<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

40.00<br />

40.00<br />

31.00<br />

28.00<br />

28.00<br />

24.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

48.00<br />

54.19<br />

34.06<br />

37.16<br />

40.26<br />

24.77<br />

$ 61.93<br />

$ 61.93<br />

$ 48.00<br />

$ 43.35<br />

$ 43.35<br />

$ 37.16<br />

6.30%<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

Bulk Warehouse<br />

Manufacturing<br />

EUR<br />

EUR<br />

3.30<br />

2.50<br />

EUR<br />

EUR<br />

5.00<br />

5.80<br />

$<br />

$<br />

5.11<br />

3.87<br />

$<br />

$<br />

7.74<br />

8.98<br />

N/A<br />

N/A<br />

High Tech/R&D<br />

retaIl<br />

EUR 4.20 EUR 6.70 $ 6.50 $ 10.37 N/A<br />

City Center<br />

EUR 40.00 EUR 100.00 $ 61.93 $ 154.84 N/A<br />

Neighborhood Service Centers<br />

Community Power Center (Big Box)<br />

EUR<br />

EUR<br />

8.00<br />

8.00<br />

EUR<br />

EUR<br />

10.00<br />

10.00<br />

$<br />

$<br />

12.39<br />

12.39<br />

$ 15.48<br />

$ 15.48<br />

N/A<br />

N/A<br />

Regional Shopping Centers/Malls<br />

Solus Food Stores<br />

EUR 40.00<br />

N/A<br />

EUR 100.00<br />

N/A<br />

$ 61.93<br />

N/A<br />

$ 154.84<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land low/Hectare High/Hectare low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 55