2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Frankfurt am Main, Germany<br />

Athens, Greece<br />

Contact<br />

<strong>NAI</strong> apollo<br />

+49 69 970 50 50<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

137,882<br />

2.0%<br />

$3,358.24<br />

$41,235.74<br />

1.4%<br />

7.1%<br />

1.0%<br />

81.44<br />

As forecasted by experts in 2010, Germany is reaching<br />

its economic strength once again. Three years after the<br />

economic crisis, the German GDP gained a constant growth<br />

rate between 1.5% and 2% over the last one and a half<br />

years. At the end of 2011 the German GDP growth rate is<br />

expected to reach its high point at 3.5%, before it returns<br />

to a moderate level about 2% in <strong>2012</strong>.<br />

Other economic key factors demonstrate the recovery of the<br />

German economy. The unemployment rate has been<br />

consistently decreasing since 2005 (currently at 7%). This<br />

is the lowest unemployment rate since the German reunion<br />

in 1990. Inflation and buying power remain stable. As one<br />

of Europe’s most important cities Frankfurt/Main is clearly<br />

one of the main drivers responsible for this boost. Even<br />

though it anticipates a considerable increase in its<br />

population (from about 650,000 inhabitants in 2005 up to<br />

about 690,000 in 2011), unemployment in Frankfurt is<br />

sinking and currently even at 1.4% below the German<br />

average. Another hint of the economic strength of the<br />

city is the wealth of its inhabitants. The generated GDP<br />

per capita in Frankfurt is almost three times higher than<br />

the average, the buying power per capita is currently at<br />

22,000 € while the common German citizen has just under<br />

19,000 € at his disposal.<br />

In Frankfurt the rents for Class A retail space like Zeil and<br />

Goethestraße increased about €10/SM since 2010. The top<br />

rent on this famous shopping street is now at €240/SM. Due<br />

to the limited availability of retail space at these top<br />

locations, it is expected that the prices will continue to rise<br />

about 2% in <strong>2012</strong>. Furthermore, this trend was reflected<br />

through the biggest investment that took place here so far<br />

in 2011. Allianz Versicherungen bought 80% of the project<br />

Skyline Plaza at a price of €290,000,000. When finished,<br />

a large part of the building will contain retail spaces.<br />

In the office market, a slight reduction in the vacancy rate<br />

took place. The rate dropped to 16.6% while rents remained<br />

stable. Overall there was a take-up of 311,000 SM of office<br />

space through the end of October 2011. An additional<br />

258,000 SM are expected to be constructed by the end of<br />

<strong>2012</strong>.<br />

The biggest lease of 2011 took place at the northern edge<br />

of Frankfurt. Bafin Wertpapier Aufsicht leased 24,200 SM<br />

of office space. A second big lease signing happened at the<br />

Airport. Fraport AG signed a contract for 20,000 SM.<br />

Contact<br />

<strong>NAI</strong> <strong>Global</strong><br />

+1 609 945 4000<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

50,949<br />

-2.6%<br />

$291.40<br />

$26,025.80<br />

2.2%<br />

14.6%<br />

1.0%<br />

11.197<br />

As of November 2011, the Greek property market faced a<br />

daunting period of reduced consumer spending, rising taxes,<br />

falling property values, a surplus of properties and a frozen<br />

construction industry. Since 2009 the country has faced an<br />

acute economic crisis, the economy has shrunk by 12% to<br />

15% in the last three years, unemployment is at 20% and<br />

the country faces the risk of defaulting on its debts and<br />

being ejected from the Eurozone.<br />

In Athens, there is a falling demand from occupiers as<br />

companies downsize or actually close. Take-up was 50,000<br />

SM. Tenants continue to renegotiate their rents downward<br />

and there remains a short supply of good quality stock. Top<br />

rents are falling towards EUR 20/SM per month.<br />

There is limited interest in the industrial market and an<br />

increasing over supply of product as occupiers downsize.<br />

There are few transactions to <strong>report</strong>, rental values around<br />

Athens have fallen back to EUR 5/SM per month or lower.<br />

There has been a severe reduction in demand for retail<br />

space with many shops closing (68,000 small business<br />

closures estimated for 2010 and 2011 plus an additional<br />

50,000 expected to close in <strong>2012</strong>), especially in secondary<br />

locations with up to 25% vacancy, and many tenants<br />

renegotiating their rents downward by 30% or more. New<br />

shopping center projects are still proceeding although at a<br />

much slower pace. Recent openings including; River West<br />

18,000 SM, Athens Metro Mall 25,000 SM and Athens<br />

Smart Park with up to 80,000 SM on completion.<br />

In the residential sector there is surprisingly still some<br />

recognizable demand for good quality, medium size new<br />

developments in the middle income to upper income<br />

neighborhoods in Athens (price range EUR 3,500<br />

to 4,000/SM), from cash rich investors seeking safer<br />

alternatives. Small new apartments in the central areas also<br />

continue to attract buyers (c. EUR 3,000/SM). However the<br />

general state of the residential property market remains<br />

severely depressed with tens of thousands of unsold<br />

new apartments, and banks are unable to offer finance<br />

opportunities to potential borrowers.<br />

There is a reduced interest from international investors<br />

investing in commercial property due to the risk of Greece<br />

possibly defaulting, but there remains continued, limited<br />

interest from some of the local investment groups and also<br />

high net worth individuals seeking more safe investment<br />

alternatives than stock or money markets.<br />

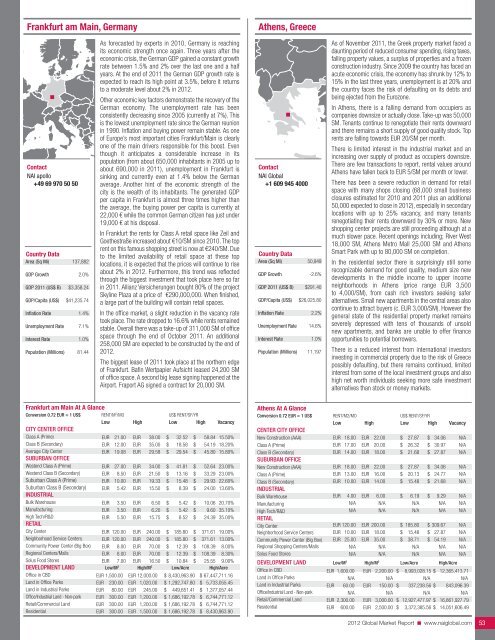

Frankfurt am Main At A Glance<br />

conversion 0.72 eur = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

cItY center offIce<br />

Class A (Prime)<br />

Class B (Secondary)<br />

Average City Center<br />

suburban offIce<br />

Westend Class A (Prime)<br />

EUR 21.00<br />

EUR 12.00<br />

EUR 19.08<br />

EUR 27.00<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

38.00<br />

35.00<br />

29.58<br />

34.00<br />

$<br />

$<br />

$<br />

$<br />

32.52<br />

18.58<br />

29.54<br />

41.81<br />

$<br />

$<br />

$<br />

$<br />

58.84 15.50%<br />

54.19 18.20%<br />

45.80 15.80%<br />

52.64 23.00%<br />

Westend Class B (Secondary) EUR 8.50 EUR 21.50 $ 13.16 $ 33.29 23.00%<br />

Suburban Class A (Prime)<br />

EUR 10.00 EUR 19.33 $ 15.48 $ 29.93 22.60%<br />

Suburban Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

5.42<br />

3.50<br />

3.50<br />

5.50<br />

EUR<br />

EUR<br />

EUR<br />

EUR<br />

15.50<br />

6.50<br />

6.20<br />

15.75<br />

$<br />

$<br />

$<br />

$<br />

8.39<br />

5.42<br />

5.42<br />

8.52<br />

$<br />

$<br />

$<br />

$<br />

24.00 13.60%<br />

10.06 20.70%<br />

9.60 35.10%<br />

24.39 35.00%<br />

City Center<br />

Neighborhood Service Centers<br />

EUR 120.00<br />

EUR 120.00<br />

EUR<br />

EUR<br />

240.00<br />

240.00<br />

$ 185.80<br />

$ 185.80<br />

$<br />

$<br />

371.61 19.00%<br />

371.61 13.00%<br />

Community Power Center (Big Box)<br />

Regional Centers/Malls<br />

Solus Food Stores<br />

EUR<br />

EUR<br />

EUR<br />

8.00<br />

8.00<br />

7.00<br />

EUR<br />

EUR<br />

EUR<br />

70.00<br />

70.00<br />

16.50<br />

$<br />

$<br />

$<br />

12.39<br />

12.39<br />

10.84<br />

$<br />

$<br />

$<br />

108.39<br />

108.39<br />

25.55<br />

8.00%<br />

8.30%<br />

9.00%<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

EUR 1,500.00 EUR 12,000.00 $ 8,430,963.90 $ 67,447,711.16<br />

EUR 230.00 EUR 1,020.00 $ 1,292,747.80 $ 5,733,055.45<br />

EUR 80.00 EUR 245.00 $ 449,651.41 $ 1,377,057.44<br />

EUR 300.00 EUR 1,200.00 $ 1,686,192.78 $ 6,744,771.12<br />

EUR 300.00 EUR 1,200.00 $ 1,686,192.78 $ 6,744,771.12<br />

EUR 300.00 EUR 1,500.00 $ 1,686,192.78 $ 8,430,963.90<br />

Athens At A Glance<br />

conversion 0.72 eur = 1 us$ RENT/M2/MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

center cItY offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

City Center<br />

Neighborhood Service Centers<br />

Community Power Center (Big Box)<br />

Regional Shopping Centers/Malls<br />

Solus Food Stores<br />

EUR 18.00 EUR 22.00 $ 27.87 $ 34.06 N/A<br />

EUR 17.00 EUR 20.00 $ 26.32 $ 30.97 N/A<br />

EUR 14.00 EUR 18.00 $ 21.68 $ 27.87 N/A<br />

EUR 18.00 EUR 22.00 $ 27.87 $ 34.06 N/A<br />

EUR 13.00 EUR 16.00 $ 20.13 $ 24.77 N/A<br />

EUR 10.00 EUR 14.00 $ 15.48 $ 21.68 N/A<br />

EUR 4.00 EUR 6.00 $ 6.19 $ 9.29 N/A<br />

N/A N/A N/A N/A N/A<br />

N/A N/A N/A N/A N/A<br />

EUR 120.00 EUR 200.00 $ 185.80 $ 309.67 N/A<br />

EUR 10.00 EUR 18.00 $ 15.48 $ 27.87 N/A<br />

EUR 25.00 EUR 35.00 $ 38.71 $ 54.19 N/A<br />

N/A N/A N/A N/A N/A<br />

N/A N/A N/A N/A N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

EUR 1,600.00<br />

N/A<br />

EUR 2,200.00 $<br />

N/A<br />

8,993,028.15 $<br />

N/A<br />

12,365,413.71<br />

N/A<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

EUR 60.00<br />

N/A<br />

EUR 150.00 $<br />

N/A<br />

337,238.56 $<br />

N/A<br />

843,096.39<br />

N/A<br />

Retail/Commercial Land EUR 2,300.00 EUR 3,000.00 $ 12,927,477.97 $ 16,861,927.79<br />

Residential<br />

EUR 600.00 EUR 2,500.00 $ 3,372,385.56 $ 14,051,606.49<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 53