2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Toronto, Ontario, Canada<br />

Montreal, Quebec, Canada<br />

Contact<br />

<strong>NAI</strong> Ashlar Urban<br />

+1 416 205 9222<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

3,855,100<br />

2.7%<br />

$1,632.89<br />

$47,340.29<br />

2.0%<br />

7.5%<br />

1.0%<br />

34.493<br />

Canada, in particular the major urban regions, continues to<br />

look strong relative to the rest of the world. The country<br />

produced over 60,000 new jobs in September pushing the<br />

unemployment rate to its lowest since the recession in<br />

December 2008. This has followed suit in a year that has<br />

produced 300,000 jobs to date. Q4 2011 should shed light<br />

on what to expect for the next fiscal year in both local and<br />

global markets.<br />

Office space occupancy rates in downtown Toronto continue<br />

to improve steadily despite economic uncertainty in the rest<br />

of the world. The success of developed and developing office<br />

buildings such as the PWC Building, 16 York Street and<br />

134 Peter Street (Queen-Richmond Center West) has<br />

proved how strong the market really is as the recent influx<br />

of space has not detracted from absorption rates.<br />

The periphery markets (downtown west & downtown east)<br />

have shared success with the financial core and enjoyed<br />

similar vacancy rates creating a landlord friendly market<br />

across the board. Much of this positive growth can be<br />

attributed to a noticeable push for employers to be located<br />

within the city of Toronto. This should be seen as no<br />

coincidence when looking at the numerous condominium<br />

developments taking place within the city limits. Availability<br />

rates for the downtown office market have continued to<br />

decline and look to settle at just over 8%. Net rents have<br />

followed the strength of the economy and we have seen a<br />

steady increase in rates averaged over the first three quarters.<br />

Toronto continues to be an attractive location for investors.<br />

The combination of low vacancy rates, low lending rates<br />

and solid net rental rates make even low cap rate<br />

purchases make sense. Vacancy rates may show an<br />

increase in the coming months due to the construction of<br />

new office space in and around the core. This should have<br />

little to do with market strength as absorption rates are<br />

expected to continue their steady rise. Expect net rental<br />

rates to continue to increase marginally as well.<br />

As Toronto, and the rest of Canada venture into this time of<br />

economic uncertainty, we should continue to be cautiously<br />

optimistic when investing in the real estate market. A<br />

possibility of a slower pace in the following quarters must<br />

be acknowledged as we are not isolated in today’s global<br />

economy.<br />

Contact<br />

<strong>NAI</strong> Commercial Montreal<br />

+1 514 866 3333<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

3,855,100<br />

2.7%<br />

$1,632.89<br />

$47,340.29<br />

2.0%<br />

7.4%<br />

1.0%<br />

34.493<br />

Montreal is the second largest francophone city in the world.<br />

There are nearly 3.6 million inhabitants and 80% of the<br />

business people are bilingual. It is currently ranked first<br />

among Canadian metropolitan regions in investments. It has<br />

seen a drop in the unemployment rate down to 7.4% in<br />

August 2011, as well as the highest increase in monthly job<br />

creation since 2002.<br />

A leader in the new technologies industry, Montreal is home<br />

to such companies as Bombardier Inc. and Airports Council<br />

International. Its enviable reputation in the video game<br />

industry has been further maintained with the establishment<br />

of new companies alongside big names such as Ubisoft, EA<br />

Games and THQ.<br />

Office market data is encouraging. There is a decrease in<br />

the vacancy rate downtown, which is currently at 7.9%<br />

(compared to 9.5% during Q1 2007), and this trend should<br />

continue for the entire agglomeration of Montreal, where the<br />

current rate is 9.7%. Though the market is very active for<br />

spaces 10,000 SF or less in the agglomeration, it is even<br />

more active in the suburbs, where Class A buildings are<br />

scarce and where there is existing demand in certain<br />

sectors, with a vacancy rate of 1.2% in eastern areas of the<br />

South Shore.<br />

Retail sales represent $41 billion and make Montreal the<br />

second largest commercial hub in Canada. The economic<br />

benefits for this sector will have a positive effect on the value<br />

of commercial buildings, which has increased by 22.3%<br />

compared to 2007.<br />

In order to satisfy market demand, industrial buildings<br />

in Montreal require recent structures that comply with<br />

current requirements of height and loading docks. This<br />

obsolescence however does not apply to the suburban<br />

market where industrial buildings are more recent.<br />

Additionally, the credit variation granted to businesses is on<br />

the rise (+5.6% in April 2011), which indicates an active<br />

economy confirmed by the fact that entrepreneurs are<br />

very confident (index of 6.78% in March 2011) about the<br />

evolution of their business.<br />

In conclusion, despite the economic crisis in 2009, real<br />

estate investment in Montreal constitutes a good investment.<br />

The proof being a 22.4% increase in the city’s total real<br />

estate value compared to 2007.<br />

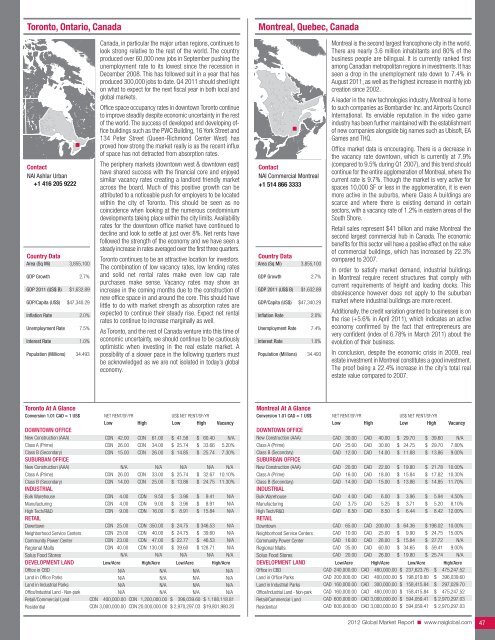

Toronto At A Glance<br />

conversion 1.01 cad = 1 us$ NET RENT/SF/YR US$ NET RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

CDN 42.00<br />

CDN 26.00<br />

CDN 15.00<br />

N/A<br />

CDN<br />

CDN<br />

CDN<br />

61.00<br />

34.00<br />

26.00<br />

N/A<br />

$ 41.58<br />

$ 25.74<br />

$ 14.85<br />

N/A<br />

$ 60.40<br />

$ 33.66<br />

$ 25.74<br />

N/A<br />

N/A<br />

5.20%<br />

7.30%<br />

N/A<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

CDN 26.00<br />

CDN 14.00<br />

CDN<br />

CDN<br />

33.00<br />

25.00<br />

$ 25.74<br />

$ 13.86<br />

$ 32.67 10.10%<br />

$ 24.75 11.30%<br />

Bulk Warehouse<br />

Manufacturing<br />

CDN<br />

CDN<br />

4.00<br />

4.00<br />

CDN<br />

CDN<br />

9.50<br />

9.00<br />

$<br />

$<br />

3.96<br />

3.96<br />

$<br />

$<br />

9.41<br />

8.91<br />

N/A<br />

N/A<br />

High Tech/R&D<br />

retaIl<br />

CDN 9.00 CDN 16.00 $ 8.91 $ 15.84 N/A<br />

Downtown<br />

CDN 25.00 CDN 350.00 $ 24.75 $ 346.53 N/A<br />

Neighborhood Service Centers<br />

Community Power Center<br />

CDN 25.00<br />

CDN 23.00<br />

CDN<br />

CDN<br />

40.00<br />

47.00<br />

$ 24.75<br />

$ 22.77<br />

$ 39.60<br />

$ 46.53<br />

N/A<br />

N/A<br />

Regional Malls<br />

Solus Food Stores<br />

CDN 40.00<br />

N/A<br />

CDN 130.00<br />

N/A<br />

$ 39.60<br />

N/A<br />

$ 128.71<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land low/acre High/acre low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

CDN 400,000.00 CDN 1,200,000.00 $ 396,039.60 $ 1,188,118.81<br />

CDN 3,000,000.00 CDN 20,000,000.00 $ 2,970,297.03 $19,801,980.20<br />

Montreal At A Glance<br />

conversion 1.01 cad = 1 us$ NET RENT/SF/YR US$ NET RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

CAD 30.00<br />

CAD 25.00<br />

CAD 12.00<br />

CAD 20.00<br />

CAD 16.00<br />

CAD 14.00<br />

CAD<br />

CAD<br />

CAD<br />

CAD<br />

CAD<br />

CAD<br />

40.00<br />

30.00<br />

14.00<br />

22.00<br />

18.00<br />

15.00<br />

$ 29.70<br />

$ 24.75<br />

$ 11.88<br />

$ 19.80<br />

$ 15.84<br />

$ 13.86<br />

$ 39.60<br />

$ 29.70<br />

$ 13.86<br />

$ 21.78<br />

$ 17.82<br />

$ 14.85<br />

N/A<br />

7.80%<br />

9.00%<br />

10.00%<br />

10.30%<br />

11.70%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

CAD<br />

CAD<br />

CAD<br />

4.00<br />

3.75<br />

6.50<br />

CAD<br />

CAD<br />

CAD<br />

6.00<br />

5.25<br />

8.50<br />

$<br />

$<br />

$<br />

3.96<br />

3.71<br />

6.44<br />

$<br />

$<br />

$<br />

5.94<br />

5.20<br />

8.42<br />

4.50%<br />

8.10%<br />

12.00%<br />

Downtown<br />

CAD 65.00 CAD 200.00 $ 64.36 $ 198.02 10.00%<br />

Neighborhood Service Centers CAD 10.00 CAD 25.00 $ 9.90 $ 24.75 15.00%<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

CAD 16.00<br />

CAD 35.00<br />

CAD 20.00<br />

CAD<br />

CAD<br />

CAD<br />

28.00<br />

60.00<br />

26.00<br />

$ 15.84<br />

$ 34.65<br />

$ 19.80<br />

$ 27.72<br />

$ 59.41<br />

$ 25.74<br />

N/A<br />

9.00%<br />

N/A<br />

deVeloPment land low/acre High/acre low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

CAD 240,000.00 CAD 480,000.00 $ 237,623.76 $ 475,247.52<br />

CAD 200,000.00 CAD 400,000.00 $ 198,019.80 $ 396,039.60<br />

CAD 160,000.00 CAD 300,000.00 $ 158,415.84 $ 297,029.70<br />

CAD 160,000.00 CAD 480,000.00 $ 158,415.84 $ 475,247.52<br />

CAD 600,000.00 CAD 3,000,000.00 $ 594,059.41 $ 2,970,297.03<br />

CAD 600,000.00 CAD 3,000,000.00 $ 594,059.41 $ 2,970,297.03<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 47