2012 Global Market report - NAI Global

2012 Global Market report - NAI Global 2012 Global Market report - NAI Global

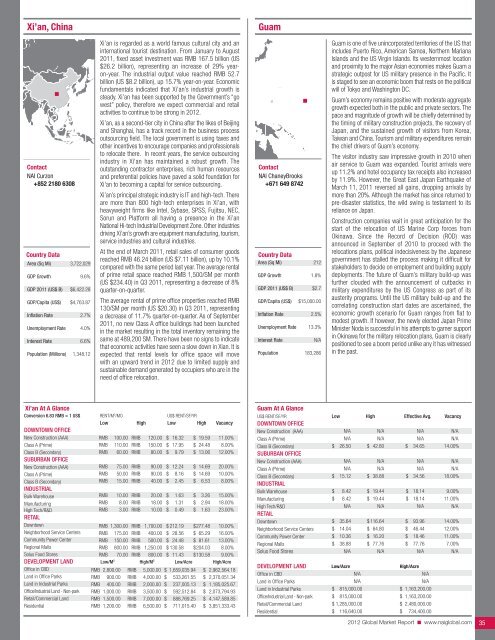

Xi’an, China Guam Contact NAI Curzon +852 2180 6308 Country Data Area (Sq Mi) GDP Growth GDP 2011 (US$ B) GDP/Capita (US$) Inflation Rate Unemployment Rate Interest Rate Population (Millions) 3,722,029 9.6% $6,422.28 $4,763.87 2.7% 4.0% 6.6% 1,348.12 Xi’an is regarded as a world famous cultural city and an international tourist destination. From January to August 2011, fixed asset investment was RMB 167.5 billion (US $26.2 billion), representing an increase of 29% yearon-year. The industrial output value reached RMB 52.7 billion (US $8.2 billion), up 15.7% year-on-year. Economic fundamentals indicated that Xi’an’s industrial growth is steady. Xi’an has been supported by the Government’s “go west” policy, therefore we expect commercial and retail activities to continue to be strong in 2012. Xi’an, as a second-tier city in China after the likes of Beijing and Shanghai, has a track record in the business process outsourcing field. The local government is using taxes and other incentives to encourage companies and professionals to relocate there. In recent years, the service outsourcing industry in Xi'an has maintained a robust growth. The outstanding contractor enterprises, rich human resources and preferential policies have paved a solid foundation for Xi'an to becoming a capital for service outsourcing. Xi’an’s principal strategic industry is IT and high-tech. There are more than 800 high-tech enterprises in Xi'an, with heavyweight firms like Intel, Sybase, SPSS, Fujitsu, NEC, Sorun and Platform all having a presence in the Xi’an National Hi-tech Industrial Development Zone. Other industries driving Xi’an’s growth are equipment manufacturing, tourism, service industries and cultural industries. At the end of March 2011, retail sales of consumer goods reached RMB 46.24 billion (US $7.11 billion), up by 10.1% compared with the same period last year. The average rental of prime retail space reached RMB 1,500/SM per month (US $234.40) in Q3 2011, representing a decrease of 8% quarter-on-quarter. The average rental of prime office properties reached RMB 130/SM per month (US $20.30) in Q3 2011, representing a decrease of 11.7% quarter-on-quarter. As of September 2011, no new Class A office buildings had been launched in the market resulting in the total inventory remaining the same at 489,200 SM. There have been no signs to indicate that economic activities have seen a slow down in Xian. It is expected that rental levels for office space will move with an upward trend in 2012 due to limited supply and sustainable demand generated by occupiers who are in the need of office relocation. Contact NAI ChaneyBrooks +671 649 8742 Country Data Area (Sq Mi) GDP Growth GDP 2011 (US$ B) GDP/Capita (US$) Inflation Rate Unemployment Rate Interest Rate Population 212 1.8% $2.7 $15,000.00 2.5% 13.3% N/A 183,286 Guam is one of five unincorporated territories of the US that includes Puerto Rico, American Samoa, Northern Mariana Islands and the US Virgin Islands. Its westernmost location and proximity to the major Asian economies makes Guam a strategic outpost for US military presence in the Pacific. It is staged to see an economic boom that rests on the political will of Tokyo and Washington DC. Guam’s economy remains positive with moderate aggregate growth expected both in the public and private sectors. The pace and magnitude of growth will be chiefly determined by the timing of military construction projects, the recovery of Japan, and the sustained growth of visitors from Korea, Taiwan and China. Tourism and military expenditures remain the chief drivers of Guam’s economy. The visitor industry saw impressive growth in 2010 when air service to Guam was expanded. Tourist arrivals were up 11.2% and hotel occupancy tax receipts also increased by 11.9%. However, the Great East Japan Earthquake of March 11, 2011 reversed all gains, dropping arrivals by more than 20%. Although the market has since returned to pre-disaster statistics, the wild swing is testament to its reliance on Japan. Construction companies wait in great anticipation for the start of the relocation of US Marine Corp forces from Okinawa. Since the Record of Decision (ROD) was announced in September of 2010 to proceed with the relocations plans, political indecisiveness by the Japanese government has stalled the process making it difficult for stakeholders to decide on employment and building supply deployments. The future of Guam’s military build-up was further clouded with the announcement of cutbacks in military expenditures by the US Congress as part of its austerity programs. Until the US military build-up and the correlating construction start dates are ascertained, the economic growth scenario for Guam ranges from flat to modest growth. If however, the newly elected Japan Prime Minister Noda is successful in his attempts to garner support in Okinawa for the military relocation plans, Guam is clearly positioned to see a boom period unlike any it has witnessed in the past. Xi’an At A Glance conversion 6.83 rmb = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR low High low High Vacancy doWntoWn offIce New Construction (AAA) Class A (Prime) RMB RMB 100.00 RMB 110.00 RMB 120.00 $ 16.32 150.00 $ 17.95 $ 19.59 $ 24.48 11.00% 8.00% Class B (Secondary) suburban offIce RMB 60.00 RMB 80.00 $ 9.79 $ 13.06 12.00% New Construction (AAA) RMB 75.00 RMB 90.00 $ 12.24 $ 14.69 20.00% Class A (Prime) RMB 50.00 RMB 90.00 $ 8.16 $ 14.69 10.00% Class B (Secondary) IndustrIal Bulk Warehouse Manufacturing High Tech/R&D retaIl RMB RMB RMB RMB 15.00 RMB 10.00 RMB 8.00 RMB 3.00 RMB 40.00 $ 20.00 $ 18.00 $ 10.00 $ 2.45 1.63 1.31 0.49 $ $ $ $ 6.53 3.26 2.94 1.63 8.00% 15.00% 18.00% 23.00% Downtown RMB 1,300.00 RMB 1,700.00 $ 212.19 $277.48 10.00% Neighborhood Service Centers Community Power Center RMB RMB 175.00 RMB 150.00 RMB 400.00 $ 28.56 500.00 $ 24.48 $ 65.29 $ 81.61 16.00% 13.00% Regional Malls RMB 800.00 RMB 1,250.00 $ 130.58 $204.03 8.00% Solus Food Stores RMB 70.00 RMB 800.00 $ 11.43 $130.58 9.00% deVeloPment land low/m 2 High/m 2 low/acre High/acre Office in CBD Land in Office Parks Land in Industrial Parks Office/Industrial Land - Non-park Retail/Commercial Land Residential RMB 2,800.00 RMB 5,000.00 $ 1,659,035.94 $ 2,962,564.18 RMB 900.00 RMB 4,000.00 $ 533,261.55 $ 2,370,051.34 RMB 400.00 RMB 2,000.00 $ 237,005.13 $ 1,185,025.67 RMB 1,000.00 RMB 3,500.00 $ 592,512.84 $ 2,073,794.93 RMB 1,500.00 RMB 7,000.00 $ 888,769.25 $ 4,147,589.85 RMB 1,200.00 RMB 6,500.00 $ 711,015.40 $ 3,851,333.43 Guam At A Glance US$ RENT/SF/YR low High effective avg. Vacancy doWntoWn offIce New Construction (AAA) Class A (Prime) Class B (Secondary) suburban offIce New Construction (AAA) Class A (Prime) $ N/A N/A 26.50 N/A N/A N/A N/A $ 42.80 N/A N/A $ N/A N/A 34.65 N/A N/A N/A N/A 14.00% N/A N/A Class B (Secondary) IndustrIal Bulk Warehouse Manufacturing High Tech/R&D retaIl $ $ $ 15.12 8.42 8.42 N/A $ 38.88 $ 19.44 $ 19.44 N/A $ 34.56 $ 18.14 $ 18.14 N/A 18.00% 9.00% 11.00% N/A Downtown Neighborhood Service Centers Community Power Center Regional Malls Solus Food Stores $ $ $ $ 35.64 14.04 10.36 38.88 N/A $ 116.64 $ 64.80 $ 16.20 $ 77.76 N/A $ $ $ $ 93.96 46.44 18.46 77.76 N/A 14.00% 12.00% 11.00% 7.00% N/A deVeloPment land Office in CBD Land in Office Parks Land in Industrial Parks Office/Industrial Land - Non-park Retail/Commercial Land Residential Low/Acre High/Acre N/A N/A N/A N/A $ 815,000.00 $ 1,163,200.00 $ 815,000.00 $ 1,163,200.00 $ 1,285,000.00 $ 2,480,000.00 $ 116,640.00 $ 734,400.00 2012 Global Market Report n www.naiglobal.com 35

Chennai, India Mumbai, India Contact NAI Hemdev's International Realty Services +91 44 2822 9595 Country Data Area (Sq Mi) GDP Growth GDP 2011 (US$ B) GDP/Capita (US$) Inflation Rate Unemployment Rate Interest Rate Population (Millions) 1,269,219 8.4% $1,598.39 $1,296.68 6.7% 9.4% 7.3% 1,232.68 Chennai’s economy, known for its broad base in the automobile, computer, technology, hardware manufacturing, financial services, telecom and health care industries, has continued its growth momentum of 2010 through the first half of 2011.The IT/ITES sectors continue to be the major driver of demand for good quality office space in Chennai. Over 3.5 million SF has been leased in Chennai in the first three quarters of 2011. The most prominent transactions were Cognizant Technology Solutions (650,000 SF), Hewlett Packard (350,000 SF), Infosys (100,000 SF), Verizon (140,000 SF), HSBC (170,000 SF) and IBM (140,000 SF). The cautious optimism that was witnessed in the real estate market in Chennai in the first half of 2011 has taken a hit with the news of a possible slowdown in the economies of North American and European countries in Q3 2011. The IT/ITES industry is largely dependant on the well being and expansion of the North American and European economies. There could be an impact on the take up of large space going forward if there is a contraction in these economies. With rental values correcting, a plethora of opportunity is represented for occupiers. Companies looking at owning properties will be well positioned to take advantage of the availability of good, quality supply with correction in the prices. The demand for return on investment properties i.e., purchase of office/commercial premises with tenants for rental returns, continues to be strong in Chennai given the ROI coupled with property appreciation. Demand from the hospitality, education and health care sectors will continue to grow given the opportunities being created by a growing economy. Chennai’s High Street continues to remain a favorite location for retailers due to better conversion rates. Proximity to the city center, instant recall, premium residential catchments and easy access are some of the key drivers for high-end streets. The suburbs of Chennai which are witnessing significant residential activity have made way for more retail activity which has prompted developers like PS Srijan, Prestige, Phoenix Market City and Marg to develop malls. Large catchments, reasonable rentals and a one stop destination will drive retailers to increase their presence in the suburbs. Contact NAI Sure Shot Suggestions +91 022 26126105 Country Data Area (Sq Mi) GDP Growth GDP 2011 (US$ B) GDP/Capita (US$) Inflation Rate Unemployment Rate Interest Rate Population (Millions) 1,269,219 8.4% $1,598.39 $1,296.68 6.7% 9.4% 7.3% 1,232.68 Mumbai seems to be, yet again, the costliest city for real estate in the country with speculation that it might remain so for some time to come. Mumbai is likely to witness an appreciation of 5% to 8% in the city with the suburbs seeing a rise of 7% to 11%. Population is yet another influencing factor for the rise in demand to match the supply. More buyers are coming forward to invest in properties fitting their specific needs. Nariman Point is certainly feeling the pressure, with its capital and rental rates dropping substantially over the past several years. Another commercial area, which has been developing slowly, is the mill area in Worli and Lower Parel, but this is mainly a retail sector. Nariman Point is making a come back. More buyers are coming forward to invest in properties fitting their needs in that market as well. Mumbai is quickly being recognized across the globe as an IT and ITES hub. High literacy levels, easy availability of intellectual talent at 50% to 60% lower costs compared to other international cities, better productivity and a time zone difference of eight to10 hours making it possible for offshore corporations to respond quickly since processing is done in Mumbai during the night, are some factors that have made Mumbai the most favored destination to China, Singapore, Philippines, Ireland and UK. Several companies have closed down their offices all over Mumbai and consolidated under one roof in the Bandra- Kurla complex. Prime examples of this are ICICI, IL & FS and Citibank. The Bandra-Kurla complex has succeeded in attracting some major financial institutions and companies. The S.T.P.I (Software technology parks India) is encouraging more and more IT parks. These buildings are specifically customized for IT and ITES corporate users. The commercial market in Kalyan is also picking up. The areas adjacent to the roads near the Kalyan railway station are an important commercial area. It is a boom time for real estate markets in the suburbs of Mumbai. Worli is the second largest commercial area in South Mumbai. Worli has several key institutions including the National Stock Exchange (NSE) and Nehru Science Center. It is also home to the famous Worli Dairy. Worli boasts good connectivity for markets throughout Mumbai. All business areas in Mumbai can be easily accessed from Worli. Chennai At A Glance conversion 52.49 Inr = 1 us$ RENT/SF/MO US$ RENT/SF/YR low High low High Vacancy doWntoWn offIce New Construction (AAA) Class A (Prime) INR 65.00 INR 60.00 INR 70.00 INR 70.00 $ 15.00 $ 13.85 $ 16.15 $ 16.15 N/A N/A Class B (Secondary) suburban offIce New Construction (AAA) Class A (Prime) INR 35.00 INR 25.00 INR 30.00 INR 50.00 INR 45.00 INR 45.00 $ $ $ 8.08 5.77 6.92 $ 11.54 $ 10.38 $ 10.38 N/A N/A N/A Class B (Secondary) IndustrIal Bulk Warehouse Manufacturing High Tech/R&D retaIl INR 20.00 INR 15.00 INR 15.00 INR 18.00 INR 30.00 INR 22.00 INR 20.00 INR 25.00 $ $ $ $ 4.62 3.46 3.46 4.15 $ $ $ $ 6.92 5.08 4.62 5.77 N/A N/A N/A N/A Downtown Neighborhood Service Centers Community Power Center INR 100.00 INR 50.00 N/A INR 150.00 INR 80.00 N/A $ 23.08 $ 11.54 N/A $ 34.62 $ 18.46 N/A N/A N/A N/A Regional Malls Solus Food Stores INR 35.00 N/A INR 60.00 N/A $ 8.08 N/A $ 13.85 N/A N/A N/A deVeloPment land low/acre High/acre low/acre High/acre Office in CBD Land in Office Parks Land in Industrial Parks Office/Industrial Land - Non-park Retail/Commercial Land Residential INR 4,500.00 INR 7,500.00 $ 86.54 $ 144.23 N/A N/A N/A N/A INR 3,200,000.00 INR 10,000,000.00 $ 61,538.46 $ 192,307.69 N/A N/A N/A N/A INR 594,000,000.00 INR 11,000,000.00$11,423,076.92 $ 211,538.46 INR300,000,000.00 INR 7,000,000,000.00 $ 5,769,230.77 $ 13,461,538.46 Mumbai At A Glance conversion 52.49 Inr = 1 us$ NET RENT/SF/MO US$ RENT/SF/YR low High low High Vacancy doWntoWn offIce New Construction (AAA) Class A (Prime) Class B (Secondary) suburban offIce New Construction (AAA) Class A (Prime) Class B (Secondary) IndustrIal INR INR INR INR INR INR 225.00 200.00 175.00 100.00 90.00 80.00 INR 350.00 INR 275.00 INR 225.00 INR 175.00 INR 125.00 INR 100.00 $ $ $ $ $ $ 51.44 45.72 40.01 22.86 20.58 18.29 $ 80.02 $ 62.87 $ 51.44 $ 40.01 $ 28.58 $ 22.86 20.00% 35.00% 40.00% N/A N/A N/A Bulk Warehouse Manufacturing High Tech/R&D retaIl INR 8.00 N/A N/A INR 13.00 N/A N/A $ 1.83 N/A N/A $ 2.97 N/A N/A N/A N/A N/A Downtown Suburban Malls Neighborhood Service Centers Community Power Center Solus Food Stores INR INR 250.00 125.00 N/A N/A N/A INR 450.00 INR 250.00 N/A N/A N/A $ $ 57.15 28.58 N/A N/A N/A $ 102.88 $ 57.15 N/A N/A N/A N/A N/A N/A N/A N/A deVeloPment land low/acre High/acre low/acre High/acre Office in CBD Land in Office Parks Land in Industrial Parks Office/Industrial Land - Non-park Retail/Commercial Land Residential INR 800,000,000.00 INR1,000,000,000.00 $15,240,998.29 $19,051,247.86 INR 500,000,000.00 INR 750,000,000.00 $ 9,525,623.93 $14,288,435.89 INR 250,000,000.00 INR 400,000,000.00 $ 4,762,811.96 $ 7,620,499.14 INR 100,000,000.00 INR 200,000,000.00 $ 1,905,124.79 $ 3,810,249.57 INR 500,000,000.00 INR 750,000,000.00 $ 9,525,623.93 $14,288,435.89 INR 250,000,000.00 INR 500,000,000.00 $ 4,762,811.96 $ 9,525,623.93 2012 Global Market Report n www.naiglobal.com 36

- Page 1 and 2: 2012 Global Market report Values, t

- Page 3 and 4: n n n table of contents General Inf

- Page 5 and 6: Global Outlook US Year in Review As

- Page 7 and 8: On the Road to Recovery % of Loss S

- Page 9 and 10: 55% (1.1 million) owning and 45% (8

- Page 11 and 12: short-term leases, the multifamily

- Page 13 and 14: Alberta is home to Canada’s oil a

- Page 15 and 16: Office The sovereign debt crisis an

- Page 17 and 18: Area Type Q1 2010 Q2 2010 Q3 2010 Q

- Page 19 and 20: obust telecom infrastructure and av

- Page 21 and 22: egion’s cities. Nevertheless, lea

- Page 23 and 24: For 2012, absorption in the commerc

- Page 25 and 26: n us Highlights - northeast region

- Page 27 and 28: n us Highlights - midwest region n

- Page 29 and 30: n us Highlights - West region n Ari

- Page 31 and 32: Adelaide, Australia Brisbane, Austr

- Page 33 and 34: Sydney, Australia Beijing, China Co

- Page 35: Shanghai, China Shenzhen, China Con

- Page 39 and 40: Jakarta, Indonesia Tokyo, Japan Con

- Page 41 and 42: Christchurch, New Zealand Wellingto

- Page 43 and 44: Taipei, Taiwan Ho Chi Minh City, Vi

- Page 45 and 46: Calgary, Alberta, Canada Edmonton,

- Page 47 and 48: Halifax, Nova Scotia, Canada Ottawa

- Page 49 and 50: Regina, Saskatchewan, Canada Contac

- Page 51 and 52: The Baltics (Latvia/Estonia/Lithuan

- Page 53 and 54: Helsinki, Finland Paris - lle de Fr

- Page 55 and 56: Tel Aviv, Israel Almaty, Kazakhstan

- Page 57 and 58: Amsterdam, The Netherlands Oslo, No

- Page 59 and 60: Moscow, Russia St. Petersburg, Russ

- Page 61 and 62: Madrid, Spain Stockholm, Sweden Con

- Page 63 and 64: Istanbul, Turkey Kiev, Ukraine Cont

- Page 65 and 66: Leeds, England, United Kingdom Lond

- Page 67 and 68: Latin America sectIon contents Buen

- Page 69 and 70: Rio de Janeiro, Brazil Sao Paulo, B

- Page 71 and 72: San Jose, Costa Rica Contact NAI Co

- Page 73 and 74: Guadalajara, Jalisco, Mexico Guanaj

- Page 75 and 76: Mexico City, Mexico Contact NAI Mex

- Page 77 and 78: Saltillo, Coahuila, Mexico San Luis

- Page 79 and 80: Lima, Peru Caracas, Venezuela Conta

- Page 81 and 82: Birmingham, Alabama Huntsville/Deca

- Page 83 and 84: Little Rock, Arkansas Bakersfield,

- Page 85 and 86: Oakland, California Orange County,

Xi’an, China<br />

Guam<br />

Contact<br />

<strong>NAI</strong> Curzon<br />

+852 2180 6308<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

3,722,029<br />

9.6%<br />

$6,422.28<br />

$4,763.87<br />

2.7%<br />

4.0%<br />

6.6%<br />

1,348.12<br />

Xi’an is regarded as a world famous cultural city and an<br />

international tourist destination. From January to August<br />

2011, fixed asset investment was RMB 167.5 billion (US<br />

$26.2 billion), representing an increase of 29% yearon-year.<br />

The industrial output value reached RMB 52.7<br />

billion (US $8.2 billion), up 15.7% year-on-year. Economic<br />

fundamentals indicated that Xi’an’s industrial growth is<br />

steady. Xi’an has been supported by the Government’s “go<br />

west” policy, therefore we expect commercial and retail<br />

activities to continue to be strong in <strong>2012</strong>.<br />

Xi’an, as a second-tier city in China after the likes of Beijing<br />

and Shanghai, has a track record in the business process<br />

outsourcing field. The local government is using taxes and<br />

other incentives to encourage companies and professionals<br />

to relocate there. In recent years, the service outsourcing<br />

industry in Xi'an has maintained a robust growth. The<br />

outstanding contractor enterprises, rich human resources<br />

and preferential policies have paved a solid foundation for<br />

Xi'an to becoming a capital for service outsourcing.<br />

Xi’an’s principal strategic industry is IT and high-tech. There<br />

are more than 800 high-tech enterprises in Xi'an, with<br />

heavyweight firms like Intel, Sybase, SPSS, Fujitsu, NEC,<br />

Sorun and Platform all having a presence in the Xi’an<br />

National Hi-tech Industrial Development Zone. Other industries<br />

driving Xi’an’s growth are equipment manufacturing, tourism,<br />

service industries and cultural industries.<br />

At the end of March 2011, retail sales of consumer goods<br />

reached RMB 46.24 billion (US $7.11 billion), up by 10.1%<br />

compared with the same period last year. The average rental<br />

of prime retail space reached RMB 1,500/SM per month<br />

(US $234.40) in Q3 2011, representing a decrease of 8%<br />

quarter-on-quarter.<br />

The average rental of prime office properties reached RMB<br />

130/SM per month (US $20.30) in Q3 2011, representing<br />

a decrease of 11.7% quarter-on-quarter. As of September<br />

2011, no new Class A office buildings had been launched<br />

in the market resulting in the total inventory remaining the<br />

same at 489,200 SM. There have been no signs to indicate<br />

that economic activities have seen a slow down in Xian. It is<br />

expected that rental levels for office space will move<br />

with an upward trend in <strong>2012</strong> due to limited supply and<br />

sustainable demand generated by occupiers who are in the<br />

need of office relocation.<br />

Contact<br />

<strong>NAI</strong> ChaneyBrooks<br />

+671 649 8742<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population<br />

212<br />

1.8%<br />

$2.7<br />

$15,000.00<br />

2.5%<br />

13.3%<br />

N/A<br />

183,286<br />

Guam is one of five unincorporated territories of the US that<br />

includes Puerto Rico, American Samoa, Northern Mariana<br />

Islands and the US Virgin Islands. Its westernmost location<br />

and proximity to the major Asian economies makes Guam a<br />

strategic outpost for US military presence in the Pacific. It<br />

is staged to see an economic boom that rests on the political<br />

will of Tokyo and Washington DC.<br />

Guam’s economy remains positive with moderate aggregate<br />

growth expected both in the public and private sectors. The<br />

pace and magnitude of growth will be chiefly determined by<br />

the timing of military construction projects, the recovery of<br />

Japan, and the sustained growth of visitors from Korea,<br />

Taiwan and China. Tourism and military expenditures remain<br />

the chief drivers of Guam’s economy.<br />

The visitor industry saw impressive growth in 2010 when<br />

air service to Guam was expanded. Tourist arrivals were<br />

up 11.2% and hotel occupancy tax receipts also increased<br />

by 11.9%. However, the Great East Japan Earthquake of<br />

March 11, 2011 reversed all gains, dropping arrivals by<br />

more than 20%. Although the market has since returned to<br />

pre-disaster statistics, the wild swing is testament to its<br />

reliance on Japan.<br />

Construction companies wait in great anticipation for the<br />

start of the relocation of US Marine Corp forces from<br />

Okinawa. Since the Record of Decision (ROD) was<br />

announced in September of 2010 to proceed with the<br />

relocations plans, political indecisiveness by the Japanese<br />

government has stalled the process making it difficult for<br />

stakeholders to decide on employment and building supply<br />

deployments. The future of Guam’s military build-up was<br />

further clouded with the announcement of cutbacks in<br />

military expenditures by the US Congress as part of its<br />

austerity programs. Until the US military build-up and the<br />

correlating construction start dates are ascertained, the<br />

economic growth scenario for Guam ranges from flat to<br />

modest growth. If however, the newly elected Japan Prime<br />

Minister Noda is successful in his attempts to garner support<br />

in Okinawa for the military relocation plans, Guam is clearly<br />

positioned to see a boom period unlike any it has witnessed<br />

in the past.<br />

Xi’an At A Glance<br />

conversion 6.83 rmb = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

RMB<br />

RMB<br />

100.00 RMB<br />

110.00 RMB<br />

120.00 $ 16.32<br />

150.00 $ 17.95<br />

$ 19.59<br />

$ 24.48<br />

11.00%<br />

8.00%<br />

Class B (Secondary)<br />

suburban offIce<br />

RMB 60.00 RMB 80.00 $ 9.79 $ 13.06 12.00%<br />

New Construction (AAA)<br />

RMB 75.00 RMB 90.00 $ 12.24 $ 14.69 20.00%<br />

Class A (Prime)<br />

RMB 50.00 RMB 90.00 $ 8.16 $ 14.69 10.00%<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

RMB<br />

RMB<br />

RMB<br />

RMB<br />

15.00 RMB<br />

10.00 RMB<br />

8.00 RMB<br />

3.00 RMB<br />

40.00 $<br />

20.00 $<br />

18.00 $<br />

10.00 $<br />

2.45<br />

1.63<br />

1.31<br />

0.49<br />

$<br />

$<br />

$<br />

$<br />

6.53<br />

3.26<br />

2.94<br />

1.63<br />

8.00%<br />

15.00%<br />

18.00%<br />

23.00%<br />

Downtown<br />

RMB 1,300.00 RMB 1,700.00 $ 212.19 $277.48 10.00%<br />

Neighborhood Service Centers<br />

Community Power Center<br />

RMB<br />

RMB<br />

175.00 RMB<br />

150.00 RMB<br />

400.00 $ 28.56<br />

500.00 $ 24.48<br />

$ 65.29<br />

$ 81.61<br />

16.00%<br />

13.00%<br />

Regional Malls<br />

RMB 800.00 RMB 1,250.00 $ 130.58 $204.03 8.00%<br />

Solus Food Stores<br />

RMB 70.00 RMB 800.00 $ 11.43 $130.58 9.00%<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

RMB 2,800.00 RMB 5,000.00 $ 1,659,035.94 $ 2,962,564.18<br />

RMB 900.00 RMB 4,000.00 $ 533,261.55 $ 2,370,051.34<br />

RMB 400.00 RMB 2,000.00 $ 237,005.13 $ 1,185,025.67<br />

RMB 1,000.00 RMB 3,500.00 $ 592,512.84 $ 2,073,794.93<br />

RMB 1,500.00 RMB 7,000.00 $ 888,769.25 $ 4,147,589.85<br />

RMB 1,200.00 RMB 6,500.00 $ 711,015.40 $ 3,851,333.43<br />

Guam At A Glance<br />

US$ RENT/SF/YR low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

$<br />

N/A<br />

N/A<br />

26.50<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$ 42.80<br />

N/A<br />

N/A<br />

$<br />

N/A<br />

N/A<br />

34.65<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

14.00%<br />

N/A<br />

N/A<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

$<br />

15.12<br />

8.42<br />

8.42<br />

N/A<br />

$ 38.88<br />

$ 19.44<br />

$ 19.44<br />

N/A<br />

$ 34.56<br />

$ 18.14<br />

$ 18.14<br />

N/A<br />

18.00%<br />

9.00%<br />

11.00%<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

Solus Food Stores<br />

$<br />

$<br />

$<br />

$<br />

35.64<br />

14.04<br />

10.36<br />

38.88<br />

N/A<br />

$ 116.64<br />

$ 64.80<br />

$ 16.20<br />

$ 77.76<br />

N/A<br />

$<br />

$<br />

$<br />

$<br />

93.96<br />

46.44<br />

18.46<br />

77.76<br />

N/A<br />

14.00%<br />

12.00%<br />

11.00%<br />

7.00%<br />

N/A<br />

deVeloPment land<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

Low/Acre<br />

High/Acre<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

$ 815,000.00 $ 1,163,200.00<br />

$ 815,000.00 $ 1,163,200.00<br />

$ 1,285,000.00 $ 2,480,000.00<br />

$ 116,640.00 $ 734,400.00<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 35