2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Sydney, Australia<br />

Beijing, China<br />

Contact<br />

<strong>NAI</strong> Harcourts Sydney<br />

+61 2 9380 8665<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

2,969,907<br />

3.5%<br />

$1,297.83<br />

$57,661.88<br />

3.0%<br />

5.1%<br />

4.8%<br />

22.508<br />

The Reserve Bank of Australia is expected to keep cash<br />

rates unchanged in the last quarter of 2011 and has<br />

indicated the cash rate may fall moving into <strong>2012</strong> due to<br />

the uncertainty in global markets having a knock on effect<br />

in Australia. The New South Wales local economy may<br />

provide some resilience to the downturn with the new state<br />

government attempting to stimulate the economy particularly<br />

in Sydney through infrastructure spending.<br />

Office leasing activity in the CBD and metropolitan areas has<br />

been stable throughout the year without being spectacular.<br />

With 160,000 SM of new space coming on to the market<br />

this year in the CBD, vacancies will probably increase but<br />

with little new supply next year this increase will be short<br />

lived. More concerning will be strength of demand on the<br />

back of the weakening in economic conditions. Unemployment<br />

has risen slightly during 2011 but most notably in the<br />

manufacturing sector. While job advertisement no’s are<br />

down universally with limited supply before 2014, the<br />

Sydney CBD office market is expected to see growing<br />

returns for inventors as a result of improving effective rents.<br />

Industrial markets continue to see reasonable levels of<br />

activity but again concerns stem from the immediate<br />

economic downturn more than other factors affecting the<br />

market. New supply in the west and south west will mean<br />

activity is likely to be centered there with a trend towards<br />

warehouse activity as manufacturing has significantly<br />

contracted, largely as a result of the high value of the Aussie<br />

currency. Activity is generally favored in leasing transactions,<br />

perhaps related to more generic requirements of warehousing<br />

versus manufacturing.<br />

Investment activity has remained steady, with the biggest<br />

impediment to investment and new construction still being<br />

the availability of credit. The Outlook remains steady<br />

however with the NSW government focusing $66.5 billion<br />

dollars on infrastructure spending which will enhance<br />

transport links for better movement around the metropolitan<br />

areas for private and business users alike.<br />

Retail leasing markets continue to struggle on the back of<br />

weaker economic conditions; this trend is likely to continue<br />

into <strong>2012</strong> with the expected continued economic slowing<br />

down. 2011 has seen households focus on mortgage<br />

repayments and savings over retail spending. On a positive<br />

note, unemployment remains at low levels, the economy is<br />

still predicted to grow and interest rates cuts will deliver<br />

more discretional spending capacity.<br />

Contact<br />

<strong>NAI</strong> Curzon<br />

+852 2180 6308<br />

Country Data<br />

Area (Sq Mi)<br />

GDP Growth<br />

GDP 2011 (US$ B)<br />

GDP/Capita (US$)<br />

Inflation Rate<br />

Unemployment Rate<br />

Interest Rate<br />

Population (Millions)<br />

2,969,907<br />

3.5%<br />

$1,297.83<br />

$57,661.88<br />

3.0%<br />

5.1%<br />

4.8%<br />

22.508<br />

Beijing’s real estate investment increased by 14.5% yearon-year<br />

in the first eight months of 2011 to RMB 188.17<br />

billion (US $29.40 billion). With strong investment and<br />

speculative demand from institutional investors, the capital<br />

value of office and retail properties recorded double-digit<br />

growth in 2011. However, with a number of cooling measures<br />

imposed by the government on both the commercial and<br />

residential property market, it is expected momentum in the<br />

property sales market may be subdued in <strong>2012</strong>.<br />

The commercial leasing market was strong in Beijing in<br />

2011, triggered by office expansion from international<br />

corporations. During Q3 2011, new office space was quickly<br />

absorbed by companies with aggressive expansion plans in<br />

Beijing. Class A office prices increased by 11% in Q3 2011,<br />

quarter-on-quarter, to RMB 330/SM per month (US $51.6).<br />

Sale prices of Class A office space increased 7% to RMB<br />

46,951/SM (US $7,340) during the same period. Vacancy<br />

rates are expected to remain level between 5% and 10% in<br />

<strong>2012</strong>. Available office space is mainly in high-end properties,<br />

which is a driving force to increase the average asking rental<br />

rate. Lack of affordable office space is expected to continue<br />

until 2013, increasing further throughout <strong>2012</strong>.<br />

To stimulate consumers to spend money, market intelligence<br />

believes the government is planning to reduce tariffs for luxury<br />

products in China up to 15%. Demand for retail space remained<br />

sustainable. From January to August 2011, sales of consumer<br />

goods amounted to RMB 437.48 billion (US $ 69.5), an increase<br />

of 11.1% year-on-year. At the end of Q3 2011, the overall<br />

shopping center inventory provided up to 5.4 million SM of retail<br />

space to the market. The overall average vacancy reached 11%<br />

in Q3 2011, dropping 2.3% quarter-on-quarter. Continued<br />

growing demand from retailers and international brands drove<br />

the asking rental rate to between RMB 600 and RMB 1,200/SM<br />

per month (US $93.8 to $187.5) as of September 2011.<br />

In the residential market, tightening of government control<br />

is expected to continue for the long run, particularly in highend<br />

residential markets. The average rental rate for residential<br />

properties reached RMB 160/SM per month (US $25) in Q3<br />

2011, representing a decrease of 4.3% quarter-on-quarter.<br />

The vacancy rate declined from Q1 2011 to 8.4% in Q3<br />

2011, representing a decrease of 4.2% quarter-on-quarter.<br />

The average price of luxury residential properties was at<br />

RMB 41,700/SM (US $6,520) as of Q3 2011. In <strong>2012</strong>, both<br />

the rental and capital value of luxurious residential properties<br />

is expected to maintain at a steady level.<br />

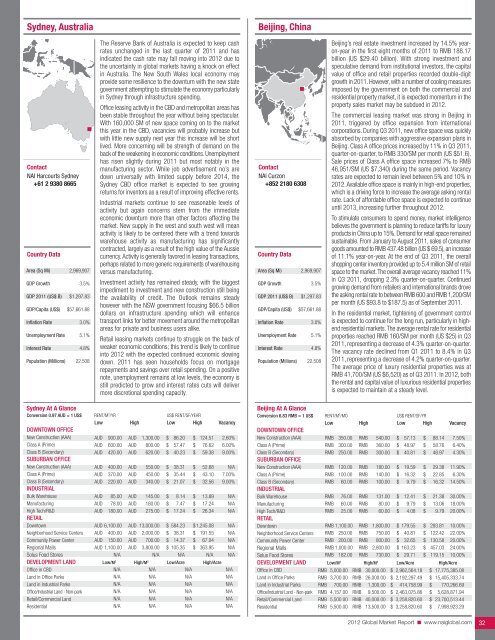

Sydney At A Glance<br />

conversion 0.97 aud = 1 us$ RENT/M 2 /YR US$ RENT/SF/YEAR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

900.00<br />

600.00<br />

420.00<br />

400.00<br />

370.00<br />

220.00<br />

85.00<br />

78.00<br />

180.00<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

AUD<br />

1,300.00<br />

800.00<br />

620.00<br />

550.00<br />

450.00<br />

340.00<br />

145.00<br />

180.00<br />

275.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

86.20<br />

57.47<br />

40.23<br />

38.31<br />

35.44<br />

21.07<br />

8.14<br />

7.47<br />

17.24<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

124.51<br />

76.62<br />

59.38<br />

52.68<br />

43.10<br />

32.56<br />

13.89<br />

17.24<br />

26.34<br />

2.60%<br />

6.00%<br />

9.00%<br />

N/A<br />

7.00%<br />

9.00%<br />

N/A<br />

N/A<br />

N/A<br />

Downtown<br />

AUD 6,100.00 AUD 13,000.00 $ 584.23 $ 1,245.08 N/A<br />

Neighborhood Service Centers AUD 400.00 AUD 2,000.00 $ 38.31 $ 191.55 N/A<br />

Community Power Center AUD150.00 AUD 700.00 $ 14.37 $ 67.04 N/A<br />

Regional Malls<br />

Solus Food Stores<br />

AUD 1,100.00<br />

N/A<br />

AUD 3,800.00<br />

N/A<br />

$ 105.35<br />

N/A<br />

$ 363.95<br />

N/A<br />

N/A<br />

N/A<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

N/A N/A N/A N/A<br />

Beijing At A Glance<br />

conversion 6.83 rmb = 1 us$ RENT/M 2 /MO US$ RENT/SF/YR<br />

low High low High Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA) RMB 350.00 RMB 540.00 $ 57.13 $ 88.14 7.50%<br />

Class A (Prime)<br />

RMB 300.00 RMB 360.00 $ 48.97 $ 58.76 6.40%<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

RMB 250.00<br />

RMB 120.00<br />

RMB 100.00<br />

RMB<br />

RMB<br />

RMB<br />

300.00<br />

180.00<br />

140.00<br />

$<br />

$<br />

$<br />

40.81<br />

19.59<br />

16.32<br />

$<br />

$<br />

$<br />

48.97<br />

29.38<br />

22.85<br />

4.30%<br />

11.90%<br />

6.30%<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

RMB<br />

RMB<br />

RMB<br />

RMB<br />

60.00<br />

76.00<br />

60.00<br />

25.00<br />

RMB<br />

RMB<br />

RMB<br />

RMB<br />

100.00<br />

131.00<br />

80.00<br />

60.00<br />

$<br />

$<br />

$<br />

$<br />

9.79<br />

12.41<br />

9.79<br />

4.08<br />

$<br />

$<br />

$<br />

$<br />

16.32<br />

21.38<br />

13.06<br />

9.79<br />

14.50%<br />

30.00%<br />

18.00%<br />

20.00%<br />

Downtown<br />

RMB 1,100.00 RMB 1,800.00 $ 179.55 $ 293.81 10.00%<br />

Neighborhood Service Centers RMB 250.00 RMB 750.00 $ 40.81 $ 122.42 22.00%<br />

Community Power Center RMB 200.00 RMB 800.00 $ 32.65 $ 130.58 20.00%<br />

Regional Malls<br />

RMB 1,000.00 RMB 2,800.00 $ 163.23 $ 457.03 24.00%<br />

Solus Food Stores<br />

RMB 182.00 RMB 730.00 $ 29.71 $ 119.15 10.00%<br />

deVeloPment land low/m 2 High/m 2 low/acre High/acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

RMB 5,000.00 RMB 30,000.00 $ 2,962,564.18 $ 17,775,385.08<br />

RMB 3,700.00 RMB 26,000.00 $ 2,192,297.49 $ 15,405,333.74<br />

RMB 700.00 RMB 1,300.00 $ 414,758.99 $ 770,266.69<br />

RMB 4,157.00 RMB 9,500.00 $ 2,463,075.86 $ 5,628,871.94<br />

RMB 5,500.00 RMB 40,000.00 $ 3,258,820.60 $ 23,700,513.44<br />

RMB 5,500.00 RMB 13,500.00 $ 3,258,820.60 $ 7,998,923.29<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 32