2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

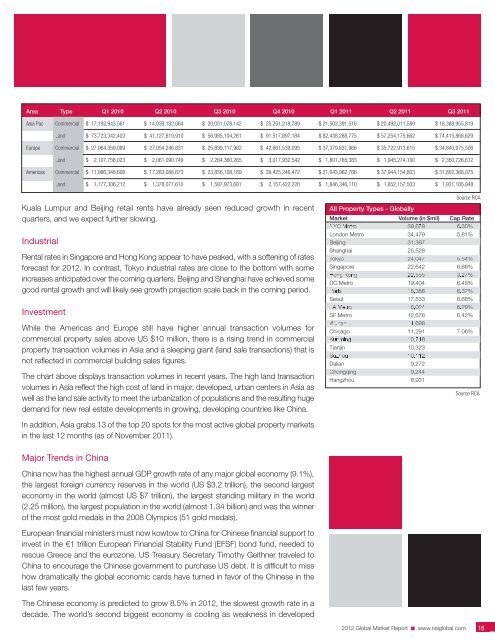

Area Type Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011<br />

Asia Pac Commercial $ 17,192,943,561 $ 14,039,182,064 $ 20,051,078,142 $ 25,251,218,789 $ 21,503,391,516 $ 20,492,011,589 $ 18,388,955,819<br />

Land $ 73,723,342,403 $ 41,127,619,910 $ 56,985,104,261 $ 91,517,897,184 $ 82,438,288,775 $ 57,254,175,662 $ 74,415,868,629<br />

Europe Commercial $ 27,064,359,069 $ 27,054,246,831 $ 25,839,117,962 $ 42,661,539,095 $ 37,379,631,966 $ 35,722,913,615 $ 34,843,975,506<br />

Land $ 2,107,758,023 $ 2,061,090,749 $ 2,264,360,265 $ 3,017,932,542 $ 1,801,765,383 $ 1,945,274,100 $ 2,350,726,612<br />

Americas Commercial $ 11,986,348,608 $ 17,283,088,673 $ 23,856,108,169 $ 39,425,246,472 $ 21,643,962,766 $ 37,944,154,803 $ 31,802,368,075<br />

Land $ 1,177,306,212 $ 1,378,077,610 $ 1,587,973,681 $ 2,157,422,220 $ 1,846,346,110 $ 1,852,157,503 $ 1,931,185,948<br />

Kuala Lumpur and Beijing retail rents have already seen reduced growth in recent<br />

quarters, and we expect further slowing.<br />

Industrial<br />

Rental rates in Singapore and Hong Kong appear to have peaked, with a softening of rates<br />

forecast for <strong>2012</strong>. In contrast, Tokyo industrial rates are close to the bottom with some<br />

increases anticipated over the coming quarters. Beijing and Shanghai have achieved some<br />

good rental growth and will likely see growth projection scale back in the coming period.<br />

Investment<br />

While the Americas and Europe still have higher annual transaction volumes for<br />

commercial property sales above US $10 million, there is a rising trend in commercial<br />

property transaction volumes in Asia and a sleeping giant (land sale transactions) that is<br />

not reflected in commercial building sales figures.<br />

The chart above displays transaction volumes in recent years. The high land transaction<br />

volumes in Asia reflect the high cost of land in major, developed, urban centers in Asia as<br />

well as the land sale activity to meet the urbanization of populations and the resulting huge<br />

demand for new real estate developments in growing, developing countries like China.<br />

Source RCA<br />

All Property Types - <strong>Global</strong>ly<br />

<strong>Market</strong> Volume (in $mil) Cap Rate<br />

NYC Metro 39,679 6.30%<br />

London Metro 34,479 5.81%<br />

Beijing 31,397<br />

Shanghai 25,528<br />

Tokyo 24,047 5.54%<br />

Singapore 22,642 6.68%<br />

Hong Kong 22,555 3.27%<br />

DC Metro 19,404 6.45%<br />

Paris 18,388 6.32%<br />

Seoul 17,533 6.68%<br />

LA Metro 16,024 6.29%<br />

SF Metro 12,678 6.42%<br />

Wuhan 11,698<br />

Chicago 11,291 7.06%<br />

Kunming 10,716<br />

Tianjin 10,323<br />

Suzhou 10,112<br />

Dalian 9,272<br />

Chongqing 9,244<br />

Hangzhou 8,931<br />

Source RCA<br />

In addition, Asia grabs 13 of the top 20 spots for the most active global property markets<br />

in the last 12 months (as of November 2011).<br />

Major Trends in China<br />

China now has the highest annual GDP growth rate of any major global economy (9.1%),<br />

the largest foreign currency reserves in the world (US $3.2 trillion), the second largest<br />

economy in the world (almost US $7 trillion), the largest standing military in the world<br />

(2.25 million), the largest population in the world (almost 1.34 billion) and was the winner<br />

of the most gold medals in the 2008 Olympics (51 gold medals).<br />

European financial ministers must now kowtow to China for Chinese financial support to<br />

invest in the €1 trillion European Financial Stability Fund (EFSF) bond fund, needed to<br />

rescue Greece and the eurozone. US Treasury Secretary Timothy Geithner traveled to<br />

China to encourage the Chinese government to purchase US debt. It is difficult to miss<br />

how dramatically the global economic cards have turned in favor of the Chinese in the<br />

last few years.<br />

The Chinese economy is predicted to grow 8.5% in <strong>2012</strong>, the slowest growth rate in a<br />

decade. The world’s second biggest economy is cooling as weakness in developed<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com<br />

16