2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

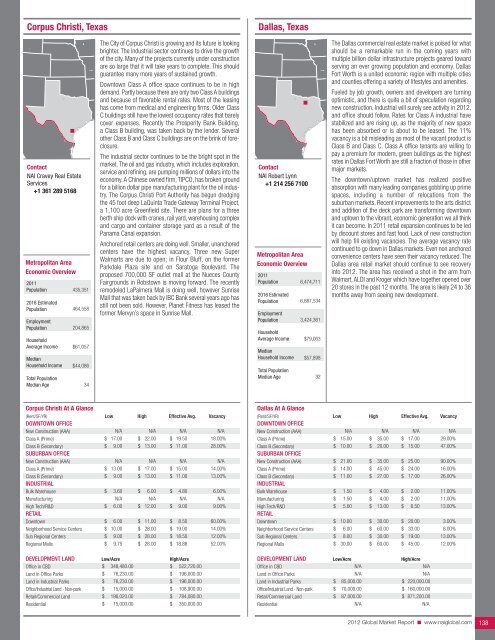

Corpus Christi, Texas<br />

Dallas, Texas<br />

Contact<br />

<strong>NAI</strong> Cravey Real Estate<br />

Services<br />

+1 361 289 5168<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

435,351<br />

464,558<br />

204,865<br />

$61,057<br />

$44,086<br />

34<br />

The City of Corpus Christi is growing and its future is looking<br />

brighter. The industrial sector continues to drive the growth<br />

of the city. Many of the projects currently under construction<br />

are so large that it will take years to complete. This should<br />

guarantee many more years of sustained growth.<br />

Downtown Class A office space continues to be in high<br />

demand. Partly because there are only two Class A buildings<br />

and because of favorable rental rates. Most of the leasing<br />

has come from medical and engineering firms. Older Class<br />

C buildings still have the lowest occupancy rates that barely<br />

cover expenses. Recently the Prosperity Bank Building,<br />

a Class B building, was taken back by the lender. Several<br />

other Class B and Class C buildings are on the brink of foreclosure.<br />

The industrial sector continues to be the bright spot in the<br />

market. The oil and gas industry, which includes exploration,<br />

service and refining, are pumping millions of dollars into the<br />

economy. A Chinese owned firm, TIPCO, has broken ground<br />

for a billion dollar pipe manufacturing plant for the oil industry.<br />

The Corpus Christi Port Authority has begun dredging<br />

the 45 foot deep LaQuinta Trade Gateway Terminal Project,<br />

a 1,100 acre Greenfield site. There are plans for a three<br />

berth ship dock with cranes, rail yard, warehousing complex<br />

and cargo and container storage yard as a result of the<br />

Panama Canal expansion.<br />

Anchored retail centers are doing well. Smaller, unanchored<br />

centers have the highest vacancy. Three new Super<br />

Walmarts are due to open; in Flour Bluff, on the former<br />

Parkdale Plaza site and on Saratoga Boulevard. The<br />

proposed 700,000 SF outlet mall at the Nueces County<br />

Fairgrounds in Robstown is moving forward. The recently<br />

remodeled LaPalmera Mall is doing well, however Sunrise<br />

Mall that was taken back by IBC Bank several years ago has<br />

still not been sold. However, Planet Fitness has leased the<br />

former Mervyn’s space in Sunrise Mall.<br />

Contact<br />

<strong>NAI</strong> Robert Lynn<br />

+1 214 256 7100<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

6,474,711<br />

6,887,534<br />

3,424,361<br />

$79,063<br />

$57,898<br />

32<br />

The Dallas commercial real estate market is poised for what<br />

should be a remarkable run in the coming years with<br />

multiple billion dollar infrastructure projects geared toward<br />

serving an ever growing population and economy. Dallas<br />

Fort Worth is a united economic region with multiple cities<br />

and counties offering a variety of lifestyles and amenities.<br />

Fueled by job growth, owners and developers are turning<br />

optimistic, and there is quite a bit of speculation regarding<br />

new construction. Industrial will surely see activity in <strong>2012</strong>,<br />

and office should follow. Rates for Class A industrial have<br />

stabilized and are rising up, as the majority of new space<br />

has been absorbed or is about to be leased. The 11%<br />

vacancy is a bit misleading as most of the vacant product is<br />

Class B and Class C. Class A office tenants are willing to<br />

pay a premium for modern, green buildings as the highest<br />

rates in Dallas Fort Worth are still a fraction of those in other<br />

major markets.<br />

The downtown/uptown market has realized positive<br />

absorption with many leading companies gobbling up prime<br />

spaces, including a number of relocations from the<br />

suburban markets. Recent improvements to the arts district<br />

and addition of the deck park are transforming downtown<br />

and uptown to the vibrant, economic generation we all think<br />

it can become. In 2011 retail expansion continues to be led<br />

by discount stores and fast food. Lack of new construction<br />

will help fill existing vacancies. The average vacancy rate<br />

continued to go down in Dallas markets. Even non anchored<br />

convenience centers have seen their vacancy reduced. The<br />

Dallas area retail market should continue to see recovery<br />

into <strong>2012</strong>. The area has received a shot in the arm from<br />

Walmart, ALDI and Kroger which have together opened over<br />

20 stores in the past 12 months. The area is likely 24 to 36<br />

months away from seeing new development.<br />

Corpus Christi At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

N/A<br />

$ 17.00<br />

N/A<br />

$ 22.00<br />

N/A<br />

$ 19.50<br />

N/A<br />

18.00%<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

$ 9.00<br />

N/A<br />

$ 13.00<br />

N/A<br />

$ 11.00<br />

N/A<br />

28.00%<br />

N/A<br />

Class A (Prime)<br />

$ 13.00 $ 17.00 $ 15.00 14.00%<br />

Class B (Secondary)<br />

IndustrIal<br />

$ 9.00 $ 13.00 $ 11.00 13.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

$ 3.60<br />

N/A<br />

$ 6.00<br />

N/A<br />

$ 4.80<br />

N/A<br />

6.00%<br />

N/A<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

$<br />

$<br />

6.00<br />

6.00<br />

$ 12.00<br />

$ 11.00<br />

$<br />

$<br />

9.00<br />

8.50<br />

9.00%<br />

60.00%<br />

Neighborhood Service Centers $ 10.00 $ 28.00 $ 19.00 14.00%<br />

Sub Regional Centers<br />

Regional Malls<br />

$<br />

$<br />

9.00<br />

9.75<br />

$ 28.00<br />

$ 28.00<br />

$ 18.50<br />

$ 18.88<br />

12.00%<br />

52.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

348,480.00<br />

76,230.00<br />

76,230.00<br />

15,000.00<br />

196,020.00<br />

15,000.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

522,720.00<br />

196,000.00<br />

196,000.00<br />

108,900.00<br />

784,080.00<br />

350,000.00<br />

Dallas At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

N/A<br />

$ 15.00<br />

$ 10.00<br />

$ 21.00<br />

$ 14.00<br />

$ 11.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

35.00<br />

20.00<br />

35.00<br />

45.00<br />

27.00<br />

N/A<br />

$ 17.00<br />

$ 15.00<br />

$ 25.00<br />

$ 24.00<br />

$ 17.00<br />

N/A<br />

29.00%<br />

47.00%<br />

90.00%<br />

16.00%<br />

26.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

$<br />

1.50<br />

1.50<br />

5.00<br />

$<br />

$<br />

$<br />

4.00<br />

4.00<br />

13.00<br />

$<br />

$<br />

$<br />

2.00<br />

2.00<br />

6.50<br />

11.00%<br />

11.00%<br />

13.00%<br />

Downtown<br />

$ 10.00 $ 30.00 $ 20.00 3.00%<br />

Neighborhood Service Centers<br />

Sub Regional Centers<br />

$<br />

$<br />

6.00<br />

8.00<br />

$<br />

$<br />

60.00<br />

30.00<br />

$ 33.00<br />

$ 19.00<br />

8.00%<br />

13.00%<br />

Regional Malls<br />

$ 30.00 $ 60.00 $ 45.00 12.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

$<br />

N/A<br />

N/A<br />

85,000.00<br />

70,000.00<br />

87,000.00<br />

N/A<br />

N/A<br />

N/A<br />

$ 220,000.00<br />

$ 160,000.00<br />

$ 871,200.00<br />

N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 138