2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

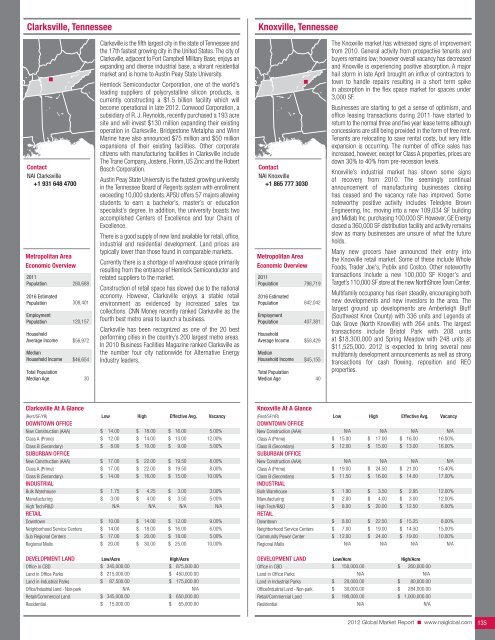

Clarksville, Tennessee<br />

Knoxville, Tennessee<br />

Contact<br />

<strong>NAI</strong> Clarksville<br />

+1 931 648 4700<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

280,688<br />

308,401<br />

120,157<br />

$56,972<br />

$46,654<br />

30<br />

Clarksville is the fifth largest city in the state of Tennessee and<br />

the 17th fastest growing city in the United States. The city of<br />

Clarksville, adjacent to Fort Campbell Military Base, enjoys an<br />

expanding and diverse industrial base, a vibrant residential<br />

market and is home to Austin Peay State University.<br />

Hemlock Semiconductor Corporation, one of the world’s<br />

leading suppliers of polycrystalline silicon products, is<br />

currently constructing a $1.5 billion facility which will<br />

become operational in late <strong>2012</strong>. Conwood Corporation, a<br />

subsidiary of R. J. Reynolds, recently purchased a 193 acre<br />

site and will invest $130 million expanding their existing<br />

operation in Clarksville. Bridgestone Metalpha and Winn<br />

Marine have also announced $75 million and $50 million<br />

expansions of their existing facilities. Other corporate<br />

citizens with manufacturing facilities in Clarksville include<br />

The Trane Company, Jostens, Florim, US Zinc and the Robert<br />

Bosch Corporation.<br />

Austin Peay State University is the fastest growing university<br />

in the Tennessee Board of Regents system with enrollment<br />

exceeding 10,000 students. APSU offers 57 majors allowing<br />

students to earn a bachelor’s, master’s or education<br />

specialist’s degree. In addition, the university boasts two<br />

accomplished Centers of Excellence and four Chairs of<br />

Excellence.<br />

There is a good supply of new land available for retail, office,<br />

industrial and residential development. Land prices are<br />

typically lower than those found in comparable markets.<br />

Currently there is a shortage of warehouse space primarily<br />

resulting from the entrance of Hemlock Semiconductor and<br />

related suppliers to the market.<br />

Construction of retail space has slowed due to the national<br />

economy. However, Clarksville enjoys a stable retail<br />

environment as evidenced by increased sales tax<br />

collections. CNN Money recently ranked Clarksville as the<br />

fourth best metro area to launch a business.<br />

Clarksville has been recognized as one of the 20 best<br />

performing cities in the country’s 200 largest metro areas.<br />

In 2010 Business Facilities Magazine ranked Clarksville as<br />

the number four city nationwide for Alternative Energy<br />

Industry leaders.<br />

Contact<br />

<strong>NAI</strong> Knoxville<br />

+1 865 777 3030<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

Total Population<br />

Median Age<br />

798,719<br />

842,042<br />

407,381<br />

$58,429<br />

$45,155<br />

40<br />

The Knoxville market has witnessed signs of improvement<br />

from 2010. General activity from prospective tenants and<br />

buyers remains low; however overall vacancy has decreased<br />

and Knoxville is experiencing positive absorption. A major<br />

hail storm in late April brought an influx of contractors to<br />

town to handle repairs resulting in a short term spike<br />

in absorption in the flex space market for spaces under<br />

3,000 SF.<br />

Businesses are starting to get a sense of optimism, and<br />

office leasing transactions during 2011 have started to<br />

return to the normal three and five year lease terms although<br />

concessions are still being provided in the form of free rent.<br />

Tenants are relocating to save rental costs, but very little<br />

expansion is occurring. The number of office sales has<br />

increased, however, except for Class A properties, prices are<br />

down 30% to 40% from pre-recession levels.<br />

Knoxville’s industrial market has shown some signs<br />

of recovery from 2010. The seemingly continual<br />

announcement of manufacturing businesses closing<br />

has ceased and the vacancy rate has improved. Some<br />

noteworthy positive activity includes Teledyne Brown<br />

Engineering, Inc. moving into a new 109,034 SF building<br />

and Midlab Inc. purchasing 100,000 SF. However, GE Energy<br />

closed a 360,000 SF distribution facility and activity remains<br />

slow as many businesses are unsure of what the future<br />

holds.<br />

Many new grocers have announced their entry into<br />

the Knoxville retail market. Some of these include Whole<br />

Foods, Trader Joe's, Publix and Costco. Other noteworthy<br />

transactions include a new 100,000 SF Kroger's and<br />

Target’s 110,000 SF store at the new NorthShore Town Center.<br />

Multifamily occupancy has risen steadily, encouraging both<br />

new developments and new investors to the area. The<br />

largest ground up developments are Amberleigh Bluff<br />

(Southwest Knox County) with 336 units and Legends at<br />

Oak Grove (North Knoxville) with 264 units. The largest<br />

transactions include Bristol Park with 208 units<br />

at $18,300,000 and Spring Meadow with 248 units at<br />

$11,525,000. <strong>2012</strong> is expected to bring several new<br />

multifamily development announcements as well as strong<br />

transactions for cash flowing, reposition and REO<br />

properties.<br />

Clarksville At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

$<br />

$<br />

14.00<br />

12.00<br />

$<br />

$<br />

18.00<br />

14.00<br />

$ 16.00<br />

$ 13.00<br />

5.00%<br />

12.00%<br />

Class B (Secondary)<br />

suburban offIce<br />

$ 8.00 $ 10.00 $ 9.00 5.00%<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

17.00<br />

17.00<br />

14.00<br />

$<br />

$<br />

$<br />

22.00<br />

22.00<br />

16.00<br />

$ 19.50<br />

$ 19.50<br />

$ 15.00<br />

8.00%<br />

8.00%<br />

10.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

1.75<br />

3.00<br />

N/A<br />

$<br />

$<br />

4.25<br />

4.00<br />

N/A<br />

$<br />

$<br />

3.00<br />

3.50<br />

N/A<br />

3.00%<br />

5.00%<br />

N/A<br />

Downtown<br />

Neighborhood Service Centers<br />

Sub Regional Centers<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

10.00<br />

14.00<br />

17.00<br />

20.00<br />

$<br />

$<br />

$<br />

$<br />

14.00<br />

18.00<br />

20.00<br />

30.00<br />

$ 12.00<br />

$ 16.00<br />

$ 18.00<br />

$ 25.00<br />

9.00%<br />

6.00%<br />

5.00%<br />

10.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

$<br />

$<br />

$<br />

$<br />

345,000.00<br />

215,000.00<br />

87,500.00<br />

N/A<br />

345,000.00<br />

$ 875,000.00<br />

$ 450,000.00<br />

$ 175,000.00<br />

N/A<br />

$ 650,000.00<br />

Residential<br />

$ 15,000.00 $ 55,000.00<br />

Knoxville At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

15.00<br />

12.00<br />

N/A<br />

19.00<br />

11.50<br />

$<br />

$<br />

$<br />

$<br />

N/A<br />

17.00<br />

15.00<br />

N/A<br />

24.50<br />

16.00<br />

N/A<br />

$ 16.00<br />

$ 13.00<br />

N/A<br />

$ 21.00<br />

$ 14.00<br />

N/A<br />

16.00%<br />

16.00%<br />

N/A<br />

15.40%<br />

17.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

$<br />

$<br />

1.90<br />

2.00<br />

$<br />

$<br />

3.50<br />

4.00<br />

$<br />

$<br />

2.95<br />

3.00<br />

12.00%<br />

12.00%<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

8.00<br />

8.00<br />

7.00<br />

12.00<br />

N/A<br />

$<br />

$<br />

$<br />

$<br />

20.00<br />

22.50<br />

19.00<br />

24.00<br />

N/A<br />

$ 12.50<br />

$ 15.25<br />

$ 14.50<br />

$ 19.00<br />

N/A<br />

6.00%<br />

8.00%<br />

15.00%<br />

10.00%<br />

N/A<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

$<br />

$<br />

$<br />

150,000.00<br />

N/A<br />

20,000.00<br />

30,000.00<br />

$<br />

$<br />

$<br />

260,000.00<br />

N/A<br />

80,000.00<br />

284,000.00<br />

Retail/Commercial Land<br />

Residential<br />

$ 190,000.00<br />

N/A<br />

$ 1,000,000.00<br />

N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 135