2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

2012 Global Market report - NAI Global

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

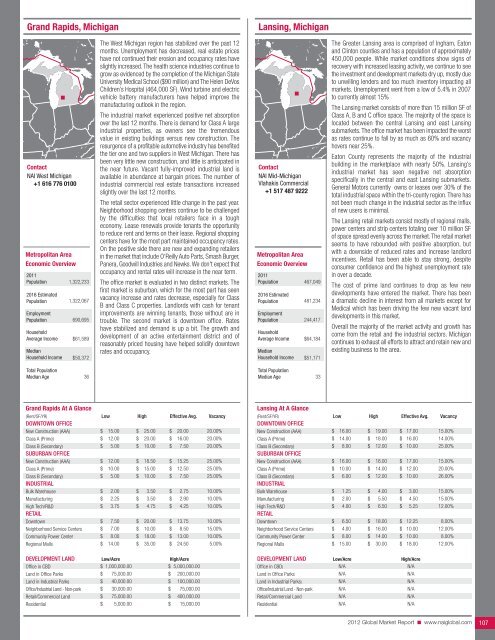

Grand Rapids, Michigan<br />

Lansing, Michigan<br />

Contact<br />

<strong>NAI</strong> West Michigan<br />

+1 616 776 0100<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

1,322,233<br />

1,322,067<br />

690,695<br />

$61,589<br />

$50,372<br />

The West Michigan region has stabilized over the past 12<br />

months. Unemployment has decreased, real estate prices<br />

have not continued their erosion and occupancy rates have<br />

slightly increased. The health science industries continue to<br />

grow as evidenced by the completion of the Michigan State<br />

University Medical School ($90 million) and The Helen DeVos<br />

Children’s Hospital (464,000 SF). Wind turbine and electric<br />

vehicle battery manufacturers have helped improve the<br />

manufacturing outlook in the region.<br />

The industrial market experienced positive net absorption<br />

over the last 12 months. There is demand for Class A large<br />

industrial properties, as owners see the tremendous<br />

value in existing buildings versus new construction. The<br />

resurgence of a profitable automotive industry has benefited<br />

the tier one and two suppliers in West Michigan. There has<br />

been very little new construction, and little is anticipated in<br />

the near future. Vacant fully-improved industrial land is<br />

available in abundance at bargain prices. The number of<br />

industrial commercial real estate transactions increased<br />

slightly over the last 12 months.<br />

The retail sector experienced little change in the past year.<br />

Neighborhood shopping centers continue to be challenged<br />

by the difficulties that local retailers face in a tough<br />

economy. Lease renewals provide tenants the opportunity<br />

to reduce rent and terms on their lease. Regional shopping<br />

centers have for the most part maintained occupancy rates.<br />

On the positive side there are new and expanding retailers<br />

in the market that include O'Reilly Auto Parts, Smash Burger,<br />

Panera, Goodwill Industries and Newks. We don't expect that<br />

occupancy and rental rates will increase in the near term.<br />

The office market is evaluated in two distinct markets. The<br />

first market is suburban, which for the most part has seen<br />

vacancy increase and rates decrease, especially for Class<br />

B and Class C properties. Landlords with cash for tenant<br />

improvements are winning tenants, those without are in<br />

trouble. The second market is downtown office. Rates<br />

have stabilized and demand is up a bit. The growth and<br />

development of an active entertainment district and of<br />

reasonably priced housing have helped solidify downtown<br />

rates and occupancy.<br />

Contact<br />

<strong>NAI</strong> Mid-Michigan<br />

Vlahakis Commercial<br />

+1 517 487 9222<br />

Metropolitan Area<br />

Economic Overview<br />

2011<br />

Population<br />

2016 Estimated<br />

Population<br />

Employment<br />

Population<br />

Household<br />

Average Income<br />

Median<br />

Household Income<br />

467,049<br />

481,234<br />

244,417<br />

$64,184<br />

$51,171<br />

The Greater Lansing area is comprised of Ingham, Eaton<br />

and Clinton counties and has a population of approximately<br />

450,000 people. While market conditions show signs of<br />

recovery with increased leasing activity, we continue to see<br />

the investment and development markets dry up, mostly due<br />

to unwilling lenders and too much inventory impacting all<br />

markets. Unemployment went from a low of 5.4% in 2007<br />

to currently almost 15%<br />

The Lansing market consists of more than 15 million SF of<br />

Class A, B and C office space. The majority of the space is<br />

located between the central Lansing and east Lansing<br />

submarkets. The office market has been impacted the worst<br />

as rates continue to fall by as much as 60% and vacancy<br />

hovers near 25%.<br />

Eaton County represents the majority of the industrial<br />

building in the marketplace with nearly 50%. Lansing’s<br />

industrial market has seen negative net absorption<br />

specifically in the central and east Lansing submarkets.<br />

General Motors currently owns or leases over 30% of the<br />

total industrial space within the tri-county region. There has<br />

not been much change in the industrial sector as the influx<br />

of new users is minimal.<br />

The Lansing retail markets consist mostly of regional malls,<br />

power centers and strip centers totaling over 10 million SF<br />

of space spread evenly across the market. The retail market<br />

seems to have rebounded with positive absorption, but<br />

with a downside of reduced rates and increase landlord<br />

incentives. Retail has been able to stay strong, despite<br />

consumer confidence and the highest unemployment rate<br />

in over a decade.<br />

The cost of prime land continues to drop as few new<br />

developments have entered the market. There has been<br />

a dramatic decline in interest from all markets except for<br />

Medical which has been driving the few new vacant land<br />

developments in this market.<br />

Overall the majority of the market activity and growth has<br />

come from the retail and the industrial sectors. Michigan<br />

continues to exhaust all efforts to attract and retain new and<br />

existing business to the area.<br />

Total Population<br />

Median Age<br />

36<br />

Total Population<br />

Median Age<br />

33<br />

Grand Rapids At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

$ 15.00 $ 25.00 $ 20.00 20.00%<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

12.00<br />

5.00<br />

12.00<br />

10.00<br />

5.00<br />

2.00<br />

2.25<br />

3.75<br />

7.50<br />

7.00<br />

8.00<br />

14.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

20.00<br />

10.00<br />

18.50<br />

15.00<br />

10.00<br />

3.50<br />

3.50<br />

4.75<br />

20.00<br />

10.00<br />

18.00<br />

35.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

16.00<br />

7.50<br />

15.25<br />

12.50<br />

7.50<br />

2.75<br />

2.90<br />

4.25<br />

13.75<br />

8.50<br />

13.00<br />

24.50<br />

20.00%<br />

20.00%<br />

25.00%<br />

25.00%<br />

25.00%<br />

10.00%<br />

10.00%<br />

10.00%<br />

10.00%<br />

15.00%<br />

10.00%<br />

5.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD<br />

$ 1,000,000.00 $ 5,000,000.00<br />

Land in Office Parks<br />

Land in Industrial Parks<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

$<br />

$<br />

$<br />

$<br />

$<br />

75,000.00<br />

40,000.00<br />

30,000.00<br />

75,000.00<br />

5,000.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

200,000.00<br />

100,000.00<br />

75,000.00<br />

400,000.00<br />

15,000.00<br />

Lansing At A Glance<br />

(Rent/SF/YR) low High effective avg. Vacancy<br />

doWntoWn offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

suburban offIce<br />

New Construction (AAA)<br />

Class A (Prime)<br />

Class B (Secondary)<br />

IndustrIal<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

16.00<br />

14.00<br />

8.00<br />

16.00<br />

10.00<br />

6.00<br />

$<br />

$<br />

$<br />

$<br />

$<br />

$<br />

19.00<br />

18.00<br />

12.00<br />

18.00<br />

14.00<br />

12.00<br />

$ 17.00<br />

$ 16.00<br />

$ 10.00<br />

$ 17.00<br />

$ 12.00<br />

$ 10.00<br />

15.00%<br />

14.00%<br />

25.00%<br />

15.00%<br />

20.00%<br />

26.00%<br />

Bulk Warehouse<br />

Manufacturing<br />

High Tech/R&D<br />

retaIl<br />

$<br />

$<br />

$<br />

1.25<br />

2.00<br />

4.00<br />

$<br />

$<br />

$<br />

4.00<br />

5.50<br />

6.50<br />

$<br />

$<br />

$<br />

3.00<br />

4.50<br />

5.25<br />

15.00%<br />

15.00%<br />

12.00%<br />

Downtown<br />

Neighborhood Service Centers<br />

Community Power Center<br />

Regional Malls<br />

$<br />

$<br />

$<br />

$<br />

6.50<br />

4.00<br />

8.00<br />

15.00<br />

$<br />

$<br />

$<br />

$<br />

18.00<br />

16.00<br />

14.00<br />

30.00<br />

$ 12.25<br />

$ 10.00<br />

$ 10.00<br />

$ 18.00<br />

8.00%<br />

12.00%<br />

8.00%<br />

12.00%<br />

deVeloPment land Low/Acre High/Acre<br />

Office in CBD)<br />

Land in Office Parks<br />

Land in Industrial Parks)<br />

Office/Industrial Land - Non-park<br />

Retail/Commercial Land<br />

Residential<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

<strong>2012</strong> <strong>Global</strong> <strong>Market</strong> Report n www.naiglobal.com 107