Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

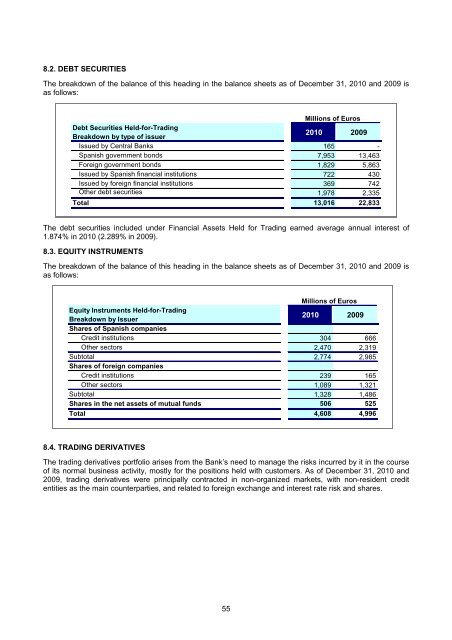

8.2. DEBT SECURITIES<br />

The breakdown <strong>of</strong> the balance <strong>of</strong> this heading in the balance sheets as <strong>of</strong> <strong>December</strong> <strong>31</strong>, <strong>2010</strong> and 2009 is<br />

as follows:<br />

Millions <strong>of</strong> Euros<br />

Debt Securities Held-for-Trading<br />

Breakdown by type <strong>of</strong> issuer<br />

<strong>2010</strong> 2009<br />

Issued by Central Banks 165 -<br />

Spanish government bonds 7,953 13,463<br />

Foreign government bonds 1,829 5,863<br />

Issued by Spanish financial institutions 722 430<br />

Issued by foreign financial institutions 369 742<br />

Other debt securities 1,978 2,335<br />

Total 13,016 22,833<br />

The debt securities included under Financial Assets Held for Trading earned average annual interest <strong>of</strong><br />

1.874% in <strong>2010</strong> (2.289% in 2009).<br />

8.3. EQUITY INSTRUMENTS<br />

The breakdown <strong>of</strong> the balance <strong>of</strong> this heading in the balance sheets as <strong>of</strong> <strong>December</strong> <strong>31</strong>, <strong>2010</strong> and 2009 is<br />

as follows:<br />

Millions <strong>of</strong> Euros<br />

Equity Instruments Held-for-Trading<br />

Breakdown by Issuer<br />

<strong>2010</strong> 2009<br />

Shares <strong>of</strong> Spanish companies<br />

Credit institutions 304 666<br />

Other sectors 2,470 2,<strong>31</strong>9<br />

Subtotal 2,774 2,985<br />

Shares <strong>of</strong> foreign companies<br />

Credit institutions 239 165<br />

Other sectors 1,089 1,321<br />

Subtotal 1,328 1,486<br />

Shares in the net assets <strong>of</strong> mutual funds 506 525<br />

Total 4,608 4,996<br />

8.4. TRADING DERIVATIVES<br />

The trading deriv<strong>at</strong>ives portfolio arises from the Bank’s need to manage the risks incurred by it in the course<br />

<strong>of</strong> its normal business activity, mostly for the positions held with customers. As <strong>of</strong> <strong>December</strong> <strong>31</strong>, <strong>2010</strong> and<br />

2009, trading deriv<strong>at</strong>ives were principally contracted in non-organized markets, with non-resident credit<br />

entities as the main counterparties, and rel<strong>at</strong>ed to foreign exchange and interest r<strong>at</strong>e risk and shares.<br />

55