Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Transl<strong>at</strong>ion <strong>of</strong> financial st<strong>at</strong>ements originally issued in Spanish and prepared in accordance with generally accounting principles Spain<br />

(See Note 1 and 54). In the event <strong>of</strong> a discrepancy, the Spanish-language version prevails.<br />

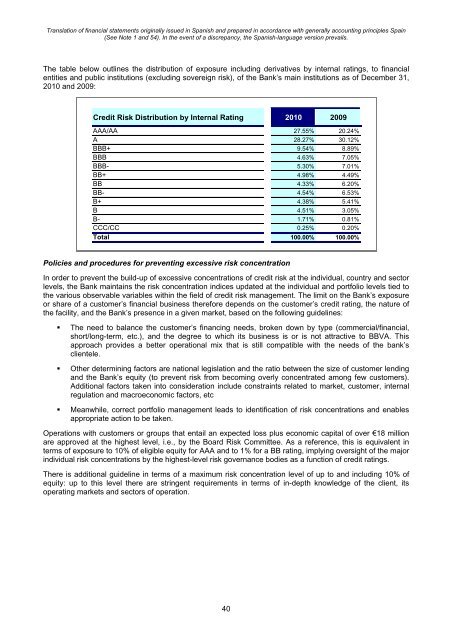

The table below outlines the distribution <strong>of</strong> exposure including deriv<strong>at</strong>ives by internal r<strong>at</strong>ings, to financial<br />

entities and public institutions (excluding sovereign risk), <strong>of</strong> the Bank’s main institutions as <strong>of</strong> <strong>December</strong> <strong>31</strong>,<br />

<strong>2010</strong> and 2009:<br />

Credit Risk Distribution by Internal R<strong>at</strong>ing <strong>2010</strong> 2009<br />

AAA/AA 27.55% 20.24%<br />

A 28.27% 30.12%<br />

BBB+ 9.54% 8.89%<br />

BBB 4.63% 7.05%<br />

BBB- 5.30% 7.01%<br />

BB+ 4.98% 4.49%<br />

BB 4.33% 6.20%<br />

BB- 4.54% 6.53%<br />

B+ 4.38% 5.41%<br />

B 4.51% 3.05%<br />

B- 1.71% 0.81%<br />

CCC/CC 0.25% 0.20%<br />

Total 100.00% 100.00%<br />

Policies and procedures for preventing excessive risk concentr<strong>at</strong>ion<br />

In order to prevent the build-up <strong>of</strong> excessive concentr<strong>at</strong>ions <strong>of</strong> credit risk <strong>at</strong> the individual, country and sector<br />

levels, the Bank maintains the risk concentr<strong>at</strong>ion indices upd<strong>at</strong>ed <strong>at</strong> the individual and portfolio levels tied to<br />

the various observable variables within the field <strong>of</strong> credit risk management. The limit on the Bank’s exposure<br />

or share <strong>of</strong> a customer’s financial business therefore depends on the customer’s credit r<strong>at</strong>ing, the n<strong>at</strong>ure <strong>of</strong><br />

the facility, and the Bank’s presence in a given market, based on the following guidelines:<br />

• The need to balance the customer’s financing needs, broken down by type (commercial/financial,<br />

short/long-term, etc.), and the degree to which its business is or is not <strong>at</strong>tractive to <strong>BBVA</strong>. This<br />

approach provides a better oper<strong>at</strong>ional mix th<strong>at</strong> is still comp<strong>at</strong>ible with the needs <strong>of</strong> the bank’s<br />

clientele.<br />

• Other determining factors are n<strong>at</strong>ional legisl<strong>at</strong>ion and the r<strong>at</strong>io between the size <strong>of</strong> customer lending<br />

and the Bank’s equity (to prevent risk from becoming overly concentr<strong>at</strong>ed among few customers).<br />

Additional factors taken into consider<strong>at</strong>ion include constraints rel<strong>at</strong>ed to market, customer, internal<br />

regul<strong>at</strong>ion and macroeconomic factors, etc<br />

• Meanwhile, correct portfolio management leads to identific<strong>at</strong>ion <strong>of</strong> risk concentr<strong>at</strong>ions and enables<br />

appropri<strong>at</strong>e action to be taken.<br />

Oper<strong>at</strong>ions with customers or groups th<strong>at</strong> entail an expected loss plus economic capital <strong>of</strong> over €18 million<br />

are approved <strong>at</strong> the highest level, i.e., by the Board Risk Committee. As a reference, this is equivalent in<br />

terms <strong>of</strong> exposure to 10% <strong>of</strong> eligible equity for AAA and to 1% for a BB r<strong>at</strong>ing, implying oversight <strong>of</strong> the major<br />

individual risk concentr<strong>at</strong>ions by the highest-level risk governance bodies as a function <strong>of</strong> credit r<strong>at</strong>ings.<br />

There is additional guideline in terms <strong>of</strong> a maximum risk concentr<strong>at</strong>ion level <strong>of</strong> up to and including 10% <strong>of</strong><br />

equity: up to this level there are stringent requirements in terms <strong>of</strong> in-depth knowledge <strong>of</strong> the client, its<br />

oper<strong>at</strong>ing markets and sectors <strong>of</strong> oper<strong>at</strong>ion.<br />

40