Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

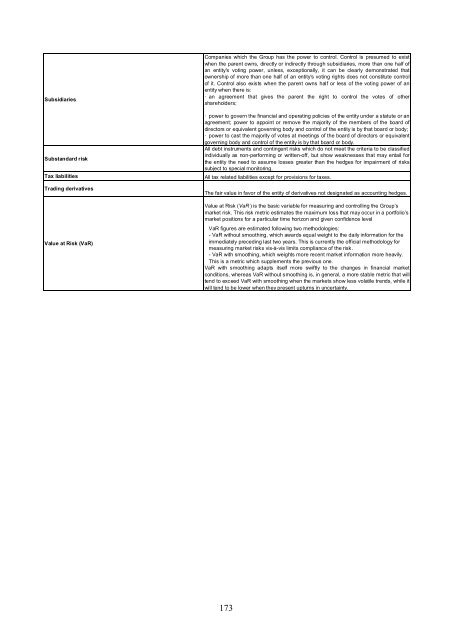

Subsidiaries<br />

Substandard risk<br />

Tax liabilities<br />

Trading deriv<strong>at</strong>ives<br />

Value <strong>at</strong> Risk (VaR)<br />

Companies which the Group has the power to control. Control is presumed to exist<br />

when the parent owns, directly or indirectly through subsidiaries, more than one half <strong>of</strong><br />

an entity's voting power, unless, exceptionally, it can be clearly demonstr<strong>at</strong>ed th<strong>at</strong><br />

ownership <strong>of</strong> more than one half <strong>of</strong> an entity's voting rights does not constitute control<br />

<strong>of</strong> it. Control also exists when the parent owns half or less <strong>of</strong> the voting power <strong>of</strong> an<br />

entity when there is:<br />

· an agreement th<strong>at</strong> gives the parent the right to control the votes <strong>of</strong> other<br />

shareholders;<br />

· power to govern the financial and oper<strong>at</strong>ing policies <strong>of</strong> the entity under a st<strong>at</strong>ute or an<br />

agreement; power to appoint or remove the majority <strong>of</strong> the members <strong>of</strong> the board <strong>of</strong><br />

directors or equivalent governing body and control <strong>of</strong> the entity is by th<strong>at</strong> board or body;<br />

· power to cast the majority <strong>of</strong> votes <strong>at</strong> meetings <strong>of</strong> the board <strong>of</strong> directors or equivalent<br />

governing body and control <strong>of</strong> the entity is by th<strong>at</strong> board or body.<br />

All debt instruments and contingent risks which do not meet the criteria to be classified<br />

individually as non-performing or written-<strong>of</strong>f, but show weaknesses th<strong>at</strong> may entail for<br />

the entity the need to assume losses gre<strong>at</strong>er than the hedges for impairment <strong>of</strong> risks<br />

subject to special monitoring.<br />

All tax rel<strong>at</strong>ed liabilities except for provisions for taxes.<br />

The fair value in favor <strong>of</strong> the entity <strong>of</strong> deriv<strong>at</strong>ives not design<strong>at</strong>ed as accounting hedges.<br />

Value <strong>at</strong> Risk (VaR ) is the basic variable for measuring and controlling the Group’s<br />

market risk. This risk metric estim<strong>at</strong>es the maximum loss th<strong>at</strong> may occur in a portfolio’s<br />

market positions for a particular time horizon and given confidence level<br />

VaR figures are estim<strong>at</strong>ed following two methodologies:<br />

- VaR without smoothing, which awards equal weight to the daily inform<strong>at</strong>ion for the<br />

immedi<strong>at</strong>ely preceding last two years. This is currently the <strong>of</strong>ficial methodology for<br />

measuring market risks vis-à-vis limits compliance <strong>of</strong> the risk.<br />

- VaR with smoothing, which weights more recent market inform<strong>at</strong>ion more heavily.<br />

This is a metric which supplements the previous one.<br />

VaR with smoothing adapts itself more swiftly to the changes in financial market<br />

conditions, whereas VaR without smoothing is, in general, a more stable metric th<strong>at</strong> will<br />

tend to exceed VaR with smoothing when the markets show less vol<strong>at</strong>ile trends, while it<br />

will tend to be lower when they present upturns in uncertainty.<br />

173