Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

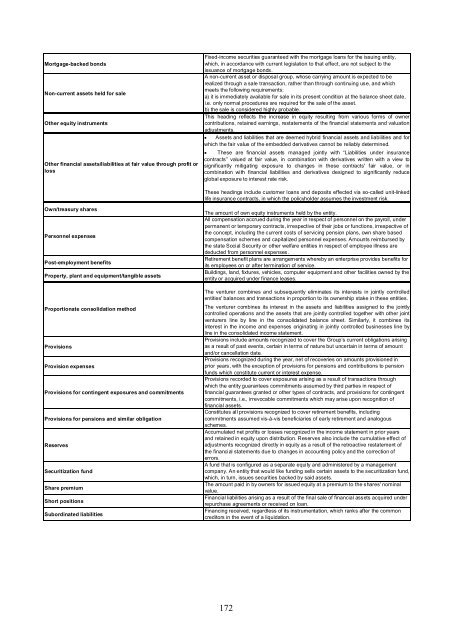

Mortgage-backed bonds<br />

Non-current assets held for sale<br />

Other equity instruments<br />

Other financial assets/liabilities <strong>at</strong> fair value through pr<strong>of</strong>it or<br />

loss<br />

Fixed-income securities guaranteed with the mortgage loans for the issuing entity,<br />

which, in accordance with current legisl<strong>at</strong>ion to th<strong>at</strong> effect, are not subject to the<br />

issuance <strong>of</strong> mortgage bonds.<br />

A non-current asset or disposal group, whose carrying amount is expected to be<br />

realized through a sale transaction, r<strong>at</strong>her than through continuing use, and which<br />

meets the following requirements:<br />

a) it is immedi<strong>at</strong>ely available for sale in its present condition <strong>at</strong> the balance sheet d<strong>at</strong>e,<br />

i.e. only normal procedures are required for the sale <strong>of</strong> the asset.<br />

b) the sale is considered highly probable.<br />

This heading reflects the increase in equity resulting from various forms <strong>of</strong> owner<br />

contributions, retained earnings, rest<strong>at</strong>ements <strong>of</strong> the financial st<strong>at</strong>ements and valu<strong>at</strong>ion<br />

adjustments.<br />

• Assets and liabilities th<strong>at</strong> are deemed hybrid financial assets and liabilities and for<br />

which the fair value <strong>of</strong> the embedded deriv<strong>at</strong>ives cannot be reliably determined.<br />

• These are financial assets managed jointly with “Liabilities under insurance<br />

contracts” valued <strong>at</strong> fair value, in combin<strong>at</strong>ion with deriv<strong>at</strong>ives written with a view to<br />

significantly mitig<strong>at</strong>ing exposure to changes in these contracts' fair value, or in<br />

combin<strong>at</strong>ion with financial liabilities and deriv<strong>at</strong>ives designed to significantly reduce<br />

global exposure to interest r<strong>at</strong>e risk.<br />

These headings include customer loans and deposits effected via so-called unit-linked<br />

life insurance contracts, in which the policyholder assumes the investment risk.<br />

Own/treasury shares<br />

Personnel expenses<br />

Post-employment benefits<br />

Property, plant and equipment/tangible assets<br />

Proportion<strong>at</strong>e consolid<strong>at</strong>ion method<br />

Provisions<br />

Provision expenses<br />

Provisions for contingent exposures and commitments<br />

Provisions for pensions and similar oblig<strong>at</strong>ion<br />

Reserves<br />

Securitiz<strong>at</strong>ion fund<br />

Share premium<br />

Short positions<br />

Subordin<strong>at</strong>ed liabilities<br />

The amount <strong>of</strong> own equity instruments held by the entity.<br />

All compens<strong>at</strong>ion accrued during the year in respect <strong>of</strong> personnel on the payroll, under<br />

permanent or temporary contracts, irrespective <strong>of</strong> their jobs or functions, irrespective <strong>of</strong><br />

the concept, including the current costs <strong>of</strong> servicing pension plans, own share based<br />

compens<strong>at</strong>ion schemes and capitalized personnel expenses. Amounts reimbursed by<br />

the st<strong>at</strong>e Social Security or other welfare entities in respect <strong>of</strong> employee illness are<br />

deducted from personnel expenses.<br />

Retirement benefit plans are arrangements whereby an enterprise provides benefits for<br />

its employees on or after termin<strong>at</strong>ion <strong>of</strong> service.<br />

Buildings, land, fixtures, vehicles, computer equipment and other facilities owned by the<br />

entity or acquired under finance leases.<br />

The venturer combines and subsequently elimin<strong>at</strong>es its interests in jointly controlled<br />

entities' balances and transactions in proportion to its ownership stake in these entities.<br />

The venturer combines its interest in the assets and liabilities assigned to the jointly<br />

controlled oper<strong>at</strong>ions and the assets th<strong>at</strong> are jointly controlled together with other joint<br />

venturers line by line in the consolid<strong>at</strong>ed balance sheet. Similarly, it combines its<br />

interest in the income and expenses origin<strong>at</strong>ing in jointly controlled businesses line by<br />

line in the consolid<strong>at</strong>ed income st<strong>at</strong>ement.<br />

Provisions include amounts recognized to cover the Group’s current oblig<strong>at</strong>ions arising<br />

as a result <strong>of</strong> past events, certain in terms <strong>of</strong> n<strong>at</strong>ure but uncertain in terms <strong>of</strong> amount<br />

and/or cancell<strong>at</strong>ion d<strong>at</strong>e.<br />

Provisions recognized during the year, net <strong>of</strong> recoveries on amounts provisioned in<br />

prior years, with the exception <strong>of</strong> provisions for pensions and contributions to pension<br />

funds which constitute current or interest expense.<br />

Provisions recorded to cover exposures arising as a result <strong>of</strong> transactions through<br />

which the entity guarantees commitments assumed by third parties in respect <strong>of</strong><br />

financial guarantees granted or other types <strong>of</strong> contracts, and provisions for contingent<br />

commitments, i.e., irrevocable commitments which may arise upon recognition <strong>of</strong><br />

financial assets.<br />

Constitutes all provisions recognized to cover retirement benefits, including<br />

commitments assumed vis-à-vis beneficiaries <strong>of</strong> early retirement and analogous<br />

schemes.<br />

Accumul<strong>at</strong>ed net pr<strong>of</strong>its or losses recognized in the income st<strong>at</strong>ement in prior years<br />

and retained in equity upon distribution. Reserves also include the cumul<strong>at</strong>ive effect <strong>of</strong><br />

adjustments recognized directly in equity as a result <strong>of</strong> the retroactive rest<strong>at</strong>ement <strong>of</strong><br />

the financial st<strong>at</strong>ements due to changes in accounting policy and the correction <strong>of</strong><br />

errors.<br />

A fund th<strong>at</strong> is configured as a separ<strong>at</strong>e equity and administered by a management<br />

company. An entity th<strong>at</strong> would like funding sells certain assets to the securitiz<strong>at</strong>ion fund,<br />

which, in turn, issues securities backed by said assets.<br />

The amount paid in by owners for issued equity <strong>at</strong> a premium to the shares' nominal<br />

value.<br />

Financial liabilities arising as a result <strong>of</strong> the final sale <strong>of</strong> financial assets acquired under<br />

repurchase agreements or received on loan.<br />

Financing received, regardless <strong>of</strong> its instrument<strong>at</strong>ion, which ranks after the common<br />

creditors in the event <strong>of</strong> a liquid<strong>at</strong>ion.<br />

172