Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

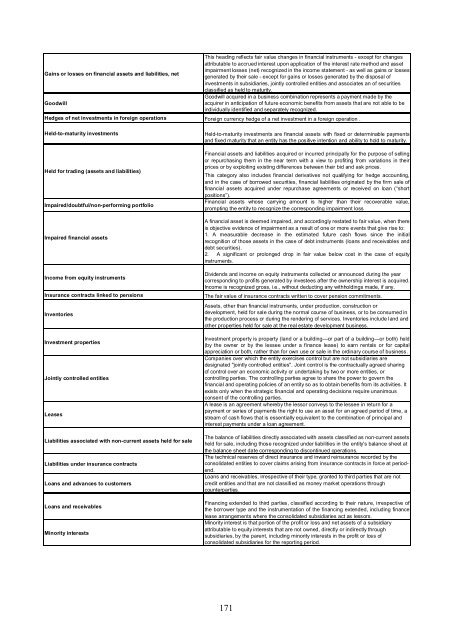

This heading reflects fair value changes in financial instruments - except for changes<br />

<strong>at</strong>tributable to accrued interest upon applic<strong>at</strong>ion <strong>of</strong> the interest r<strong>at</strong>e method and asset<br />

impairment losses (net) recognized in the income st<strong>at</strong>ement - as well as gains or losses<br />

Gains or losses on financial assets and liabilities, net<br />

gener<strong>at</strong>ed by their sale - except for gains or losses gener<strong>at</strong>ed by the disposal <strong>of</strong><br />

investments in subsidiaries, jointly controlled entities and associ<strong>at</strong>es an <strong>of</strong> securities<br />

classified as held to m<strong>at</strong>urity.<br />

Goodwill acquired in a business combin<strong>at</strong>ion represents a payment made by the<br />

Goodwill<br />

acquirer in anticip<strong>at</strong>ion <strong>of</strong> future economic benefits from assets th<strong>at</strong> are not able to be<br />

individually identified and separ<strong>at</strong>ely recognized.<br />

Hedges <strong>of</strong> net investments in foreign oper<strong>at</strong>ions Foreign currency hedge <strong>of</strong> a net investment in a foreign oper<strong>at</strong>ion .<br />

Held-to-m<strong>at</strong>urity investments<br />

Held for trading (assets and liabilities)<br />

Impaired/doubtful/non-performing portfolio<br />

Impaired financial assets<br />

Income from equity instruments<br />

Insurance contracts linked to pensions<br />

Inventories<br />

Investment properties<br />

Jointly controlled entities<br />

Leases<br />

Liabilities associ<strong>at</strong>ed with non-current assets held for sale<br />

Liabilities under insurance contracts<br />

Loans and advances to customers<br />

Loans and receivables<br />

Minority interests<br />

Held-to-m<strong>at</strong>urity investments are financial assets with fixed or determinable payments<br />

and fixed m<strong>at</strong>urity th<strong>at</strong> an entity has the positive intention and ability to hold to m<strong>at</strong>urity.<br />

Financial assets and liabilities acquired or incurred principally for the purpose <strong>of</strong> selling<br />

or repurchasing them in the near term with a view to pr<strong>of</strong>iting from vari<strong>at</strong>ions in their<br />

prices or by exploiting existing differences between their bid and ask prices.<br />

This c<strong>at</strong>egory also includes financial deriv<strong>at</strong>ives not qualifying for hedge accounting,<br />

and in the case <strong>of</strong> borrowed securities, financial liabilities origin<strong>at</strong>ed by the firm sale <strong>of</strong><br />

financial assets acquired under repurchase agreements or received on loan (“short<br />

positions”).<br />

Financial assets whose carrying amount is higher than their recoverable value,<br />

prompting the entity to recognize the corresponding impairment loss<br />

A financial asset is deemed impaired, and accordingly rest<strong>at</strong>ed to fair value, when there<br />

is objective evidence <strong>of</strong> impairment as a result <strong>of</strong> one or more events th<strong>at</strong> give rise to:<br />

1. A measurable decrease in the estim<strong>at</strong>ed future cash flows since the initial<br />

recognition <strong>of</strong> those assets in the case <strong>of</strong> debt instruments (loans and receivables and<br />

debt securities).<br />

2. A significant or prolonged drop in fair value below cost in the case <strong>of</strong> equity<br />

instruments.<br />

Dividends and income on equity instruments collected or announced during the year<br />

corresponding to pr<strong>of</strong>its gener<strong>at</strong>ed by investees after the ownership interest is acquired.<br />

Income is recognized gross, i.e., without deducting any withholdings made, if any.<br />

The fair value <strong>of</strong> insurance contracts written to cover pension commitments.<br />

Assets, other than financial instruments, under production, construction or<br />

development, held for sale during the normal course <strong>of</strong> business, or to be consumed in<br />

the production process or during the rendering <strong>of</strong> services. Inventories include land and<br />

other properties held for sale <strong>at</strong> the real est<strong>at</strong>e development business.<br />

Investment property is property (land or a building—or part <strong>of</strong> a building—or both) held<br />

(by the owner or by the lessee under a finance lease) to earn rentals or for capital<br />

appreci<strong>at</strong>ion or both, r<strong>at</strong>her than for own use or sale in the ordinary course <strong>of</strong> business.<br />

Companies over which the entity exercises control but are not subsidiaries are<br />

design<strong>at</strong>ed "jointly controlled entities". Joint control is the contractually agreed sharing<br />

<strong>of</strong> control over an economic activity or undertaking by two or more entities, or<br />

controlling parties. The controlling parties agree to share the power to govern the<br />

financial and oper<strong>at</strong>ing policies <strong>of</strong> an entity so as to obtain benefits from its activities. It<br />

exists only when the str<strong>at</strong>egic financial and oper<strong>at</strong>ing decisions require unanimous<br />

consent <strong>of</strong> the controlling parties.<br />

A lease is an agreement whereby the lessor conveys to the lessee in return for a<br />

payment or series <strong>of</strong> payments the right to use an asset for an agreed period <strong>of</strong> time, a<br />

stream <strong>of</strong> cash flows th<strong>at</strong> is essentially equivalent to the combin<strong>at</strong>ion <strong>of</strong> principal and<br />

interest payments under a loan agreement.<br />

The balance <strong>of</strong> liabilities directly associ<strong>at</strong>ed with assets classified as non-current assets<br />

held for sale, including those recognized under liabilities in the entity's balance sheet <strong>at</strong><br />

the balance sheet d<strong>at</strong>e corresponding to discontinued oper<strong>at</strong>ions.<br />

The technical reserves <strong>of</strong> direct insurance and inward reinsurance recorded by the<br />

consolid<strong>at</strong>ed entities to cover claims arising from insurance contracts in force <strong>at</strong> periodend.<br />

Loans and receivables, irrespective <strong>of</strong> their type, granted to third parties th<strong>at</strong> are not<br />

credit entities and th<strong>at</strong> are not classified as money market oper<strong>at</strong>ions through<br />

counterparties.<br />

Financing extended to third parties, classified according to their n<strong>at</strong>ure, irrespective <strong>of</strong><br />

the borrower type and the instrument<strong>at</strong>ion <strong>of</strong> the financing extended, including finance<br />

lease arrangements where the consolid<strong>at</strong>ed subsidiaries act as lessors.<br />

Minority interest is th<strong>at</strong> portion <strong>of</strong> the pr<strong>of</strong>it or loss and net assets <strong>of</strong> a subsidiary<br />

<strong>at</strong>tributable to equity interests th<strong>at</strong> are not owned, directly or indirectly through<br />

subsidiaries, by the parent, including minority interests in the pr<strong>of</strong>it or loss <strong>of</strong><br />

consolid<strong>at</strong>ed subsidiaries for the reporting period.<br />

171