Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

Balance Sheet at 31 December 2010 of BBVA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

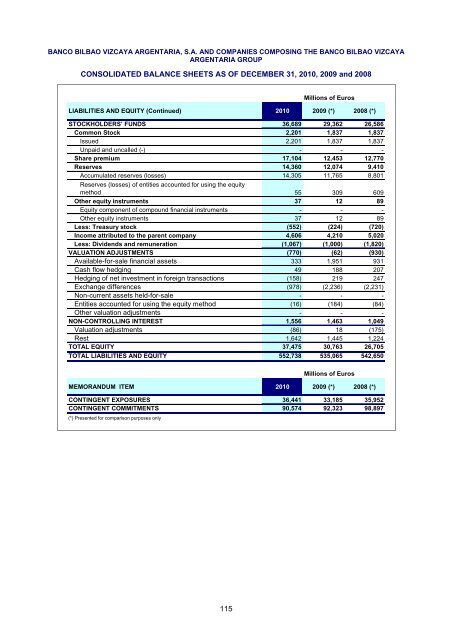

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. AND COMPANIES COMPOSING THE BANCO BILBAO VIZCAYA<br />

ARGENTARIA GROUP<br />

CONSOLIDATED BALANCE SHEETS AS OF DECEMBER <strong>31</strong>, <strong>2010</strong>, 2009 and 2008<br />

Millions <strong>of</strong> Euros<br />

LIABILITIES AND EQUITY (Continued) <strong>2010</strong> 2009 (*) 2008 (*)<br />

STOCKHOLDERS’ FUNDS 36,689 29,362 26,586<br />

Common Stock 2,201 1,837 1,837<br />

Issued 2,201 1,837 1,837<br />

Unpaid and uncalled (-) - - -<br />

Share premium 17,104 12,453 12,770<br />

Reserves 14,360 12,074 9,410<br />

Accumul<strong>at</strong>ed reserves (losses) 14,305 11,765 8,801<br />

Reserves (losses) <strong>of</strong> entities accounted for using the equity<br />

method 55 309 609<br />

Other equity instruments 37 12 89<br />

Equity component <strong>of</strong> compound financial instruments - - -<br />

Other equity instruments 37 12 89<br />

Less: Treasury stock (552) (224) (720)<br />

Income <strong>at</strong>tributed to the parent company 4,606 4,210 5,020<br />

Less: Dividends and remuner<strong>at</strong>ion (1,067) (1,000) (1,820)<br />

VALUATION ADJUSTMENTS (770) (62) (930)<br />

Available-for-sale financial assets 333 1,951 9<strong>31</strong><br />

Cash flow hedging 49 188 207<br />

Hedging <strong>of</strong> net investment in foreign transactions (158) 219 247<br />

Exchange differences (978) (2,236) (2,2<strong>31</strong>)<br />

Non-current assets held-for-sale - - -<br />

Entities accounted for using the equity method (16) (184) (84)<br />

Other valu<strong>at</strong>ion adjustments - - -<br />

NON-CONTROLLING INTEREST 1,556 1,463 1,049<br />

Valu<strong>at</strong>ion adjustments (86) 18 (175)<br />

Rest 1,642 1,445 1,224<br />

TOTAL EQUITY 37,475 30,763 26,705<br />

TOTAL LIABILITIES AND EQUITY 552,738 535,065 542,650<br />

Millions <strong>of</strong> Euros<br />

MEMORANDUM ITEM <strong>2010</strong> 2009 (*) 2008 (*)<br />

CONTINGENT EXPOSURES 36,441 33,185 35,952<br />

CONTINGENT COMMITMENTS 90,574 92,323 98,897<br />

(*) Presented for comparison purposes only<br />

115