Fact sheet - Tax-Exempt Portfolio - DWS Investments

Fact sheet - Tax-Exempt Portfolio - DWS Investments

Fact sheet - Tax-Exempt Portfolio - DWS Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Money Market<br />

<strong>Tax</strong>-<strong>Exempt</strong> <strong>Portfolio</strong><br />

Share class: <strong>DWS</strong> <strong>Tax</strong>-Free Money Fund-S I 147539639 I DTCXX <strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong> Money Fund I 147539647 I DTBXX 4th quarter 2013<br />

Objective<br />

The portfolio seeks to provide maximum<br />

current income that is exempt from federal<br />

income taxes to the extent consistent with<br />

stability of capital.<br />

Strategy<br />

The portfolio pursues its objective by<br />

investing in high quality, short-term<br />

municipal obligations, is managed in<br />

accordance with Rule 2a-7 under the<br />

Investment Company Act of 1940 (as<br />

amended), and follows policies designed to<br />

maintain a stable share price:<br />

• <strong>Portfolio</strong> securities are denominated in<br />

U.S. dollars and have remaining maturities<br />

of 397 days (about 13 months) or less at<br />

the time of purchase. The portfolio may<br />

invest in securities that have certain<br />

maturity shortening features (such as<br />

interest rate resets and demand features)<br />

that have the effect of reducing their<br />

maturities to 397 days or less at the time of<br />

purchase.<br />

• The portfolio maintains a dollar-weighted<br />

average maturity of (i) 60 days or less and<br />

(ii) 120 days or less determined without<br />

regard to interest rate resets.<br />

• The portfolio buys short-term municipal<br />

obligations that the Advisor determines<br />

present minimal credit risks<br />

Features<br />

A group of investment professionals is<br />

responsible for the day-to-day management<br />

of the fund. These investment professionals<br />

have a broad range of experience in<br />

managing money market funds.<br />

• Experienced team of portfolio managers,<br />

credit analysts and client investment<br />

specialists<br />

• Managing liquidity strategies for more<br />

than 25 years<br />

• Diverse line-up of products and services<br />

• Same-day liquidity<br />

• Competitive yields<br />

• Global liquidity management resources<br />

• Rigorous risk management and<br />

compliance controls<br />

• Convenient on-line account access<br />

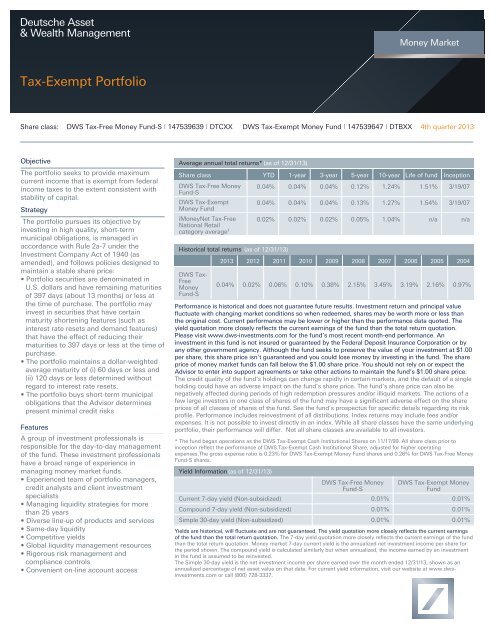

Average annual total returns* (as of 12/31/13)<br />

Share class<br />

<strong>DWS</strong> <strong>Tax</strong>-Free Money<br />

Fund-S<br />

<strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong><br />

Money Fund<br />

iMoneyNet <strong>Tax</strong>-Free<br />

National Retail<br />

category average 1<br />

YTD<br />

0.04%<br />

0.04%<br />

0.02%<br />

Historical total returns (as of 12/31/13)<br />

<strong>DWS</strong> <strong>Tax</strong>-<br />

Free<br />

Money<br />

Fund-S<br />

2013<br />

0.04%<br />

2012<br />

0.02%<br />

2011<br />

0.06%<br />

1-year<br />

0.04%<br />

0.04%<br />

0.02%<br />

2010<br />

0.10%<br />

3-year<br />

0.04%<br />

0.04%<br />

0.02%<br />

2009<br />

0.38%<br />

5-year<br />

0.12%<br />

0.13%<br />

0.05%<br />

2008<br />

2.15%<br />

10-year<br />

1.24%<br />

1.27%<br />

1.04%<br />

2007<br />

3.45%<br />

Life of fund<br />

2006<br />

3.19%<br />

1.51%<br />

1.54%<br />

n/a<br />

2005<br />

2.16%<br />

Inception<br />

3/19/07<br />

3/19/07<br />

n/a<br />

2004<br />

0.97%<br />

Performance is historical and does not guarantee future results. Investment return and principal value<br />

fluctuate with changing market conditions so when redeemed, shares may be worth more or less than<br />

the original cost. Current performance may be lower or higher than the performance data quoted. The<br />

yield quotation more closely reflects the current earnings of the fund than the total return quotation.<br />

Please visit www.dws-investments.com for the fund’s most recent month-end performance. An<br />

investment in this fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or by<br />

any other government agency. Although the fund seeks to preserve the value of your investment at $1.00<br />

per share, this share price isn't guaranteed and you could lose money by investing in the fund. The share<br />

price of money market funds can fall below the $1.00 share price. You should not rely on or expect the<br />

Advisor to enter into support agreements or take other actions to maintain the fund’s $1.00 share price.<br />

The credit quality of the fund’s holdings can change rapidly in certain markets, and the default of a single<br />

holding could have an adverse impact on the fund’s share price. The fund’s share price can also be<br />

negatively affected during periods of high redemption pressures and/or illiquid markets. The actions of a<br />

few large investors in one class of shares of the fund may have a significant adverse effect on the share<br />

prices of all classes of shares of the fund. See the fund’s prospectus for specific details regarding its risk<br />

profile. Performance includes reinvestment of all distributions. Index returns may include fees and/or<br />

expenses. It is not possible to invest directly in an index. While all share classes have the same underlying<br />

portfolio, their performance will differ. Not all share classes are available to all investors.<br />

* The fund began operations as the <strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong> Cash Institutional Shares on 11/17/99. All share class prior to<br />

inception reflect the performance of <strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong> Cash Institutional Share, adjusted for higher operating<br />

expenses.The gross expense ratio is 0.23% for <strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong> Money Fund shares and 0.26% for <strong>DWS</strong> <strong>Tax</strong>-Free Money<br />

Fund-S shares.<br />

Yield Information (as of 12/31/13)<br />

Current 7-day yield (Non-subsidized)<br />

Compound 7-day yield (Non-subsidized)<br />

Simple 30-day yield (Non-subsidized)<br />

<strong>DWS</strong> <strong>Tax</strong>-Free Money<br />

Fund-S<br />

0.01%<br />

0.01%<br />

0.01%<br />

<strong>DWS</strong> <strong>Tax</strong>-<strong>Exempt</strong> Money<br />

Fund<br />

0.01%<br />

0.01%<br />

0.01%<br />

Yields are historical, will fluctuate and are not guaranteed. The yield quotation more closely reflects the current earnings<br />

of the fund than the total return quotation. The 7-day yield quotation more closely reflects the current earnings of the fund<br />

than the total return quotation. Money market 7-day current yield is the annualized net investment income per share for<br />

the period shown. The compound yield is calculated similarly but when annualized, the income earned by an investment<br />

in the fund is assumed to be reinvested.<br />

The Simple 30-day yield is the net investment income per share earned over the month ended 12/31/13, shown as an<br />

annualized percentage of net asset value on that date. For current yield information, visit our website at www.dwsinvestments.com<br />

or call (800) 728-3337.

<strong>Tax</strong>-<strong>Exempt</strong> <strong>Portfolio</strong><br />

Money Market<br />

<strong>Portfolio</strong> and risk statistics 2 (12/31/13)<br />

Number of holdings<br />

134<br />

Total net assets<br />

$2.10 billion<br />

Growth of a $1 million investment in Class INST shares from 12/31/03 to 12/31/13<br />

(in thousands)<br />

$1,200<br />

$900<br />

$600<br />

$300<br />

$1,137,526<br />

Top 10 holdings (12/31/13)<br />

Puerto Rico 4.50%<br />

Tennessee 3.80%<br />

Idaho<br />

3.60%<br />

Clark County, NV 2.90%<br />

District of 2.70%<br />

Columbia<br />

New York 2.60%<br />

Nuveen Premier 2.50%<br />

Income<br />

Municipal Fund<br />

2, Inc.<br />

Puerto Rico 2.00%<br />

San Bernardino 2.00%<br />

County, CA<br />

RBC Municipal 1.90%<br />

Products, Inc.<br />

Other<br />

71.50%<br />

12/03 12/05<br />

12/07<br />

12/09<br />

12/11<br />

12/13<br />

Source: Deutsche Asset & Wealth Management.<br />

A minimum investment of $1 million is required to open an account for Institutional shares.<br />

Performance is historical and does not guarantee future results.<br />

Security type (12/31/13)<br />

Variable rate demand<br />

notes<br />

Municipal bonds<br />

<strong>Tax</strong>-exempt<br />

commercial paper<br />

CP mode bonds<br />

3%<br />

Municipal put bonds 1%<br />

14%<br />

9%<br />

72%<br />

1<br />

The iMoneyNet <strong>Tax</strong>-Free National Retail category includes all retail national and state tax-free and municipal money funds. <strong>Portfolio</strong> holdings of tax-free funds include rated and<br />

unrated demand notes, rated and unrated general market notes, commercial paper, put bonds - 6 months & less, put bonds - over 6 months, alternative minimum tax paper and other<br />

tax-free holdings. Consists of all funds in the National <strong>Tax</strong>-Free Retail and State-Specific Retail categories.<br />

2<br />

Total Net Assets refers to total net assets of all securities in the portfolio, including cash and equivalents.<br />

This information must be preceded or accompanied by a summay prospectus, if available, or prospectus. We advise you to carefully<br />

consider the product’s objectives, risks, charges and expenses before investing. The summary prospectus and prospectus contains this<br />

and other important information about the investment product. Please read the prospectus carefully before you invest. For more<br />

information, please call (800) 728-3337.<br />

Investment products: No bank guarantee I Not FDIC insured I May lose value<br />

Deutsche Asset & Wealth Management represents the asset management and wealth management activities conducted by Deutsche Bank AG or any of its<br />

subsidiaries. Clients will be provided Deutsche Asset & Wealth Management products or services by one or more legal entities that will be identified to clients<br />

pursuant to the contracts, agreements, offering materials or other documentation relevant to such products or services.<br />

<strong>DWS</strong> <strong>Investments</strong> Distributors, Inc.<br />

222 South Riverside Plaza, Chicago, IL 60606-5808 I www.dws-investments.com I service@dws.com I Tel (800) 621-1148<br />

© 2014 Deutsche Bank AG. All rights reserved. (1/14) R-2985-10 CAT-FACT