USAA Brokerage Services Cost Basis Form - USAA.com

USAA Brokerage Services Cost Basis Form - USAA.com

USAA Brokerage Services Cost Basis Form - USAA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

P.O. Box 659453<br />

San Antonio, Texas 78265-9825<br />

<strong>USAA</strong> <strong>Brokerage</strong><br />

<strong>Cost</strong> <strong>Basis</strong> <strong>Form</strong><br />

What is the purpose of this form?<br />

If you do not have access to usaa.<strong>com</strong>, you may use this form to update cost basis information for your <strong>USAA</strong> <strong>Brokerage</strong> Account.<br />

<strong>Cost</strong> basis information may be provided for equities, fixed in<strong>com</strong>e securities, mutual funds, options and other investment types.<br />

<strong>USAA</strong> Investment Management Company (<strong>USAA</strong>) is not responsible for the accuracy of cost basis information that a customer<br />

provides using this update form. However,<br />

<strong>USAA</strong> will be held responsible for basis related information for securities acquired after the effective date(s) of the regulation that<br />

mandates cost basis reporting for financial institutions. As a result, this form cannot be used to update cost basis on securities<br />

acquired after the following effective dates*:<br />

Security Types<br />

Effective Date<br />

Individual stocks January 1, 2011<br />

Mutual funds January 1, 2012<br />

All other security types, including Bonds and Options January 1, 2013<br />

What information can I use to help me determine my cost basis?<br />

The most <strong>com</strong>plete and accurate information should be located on your trade confirmation and on your brokerage account<br />

statement.<br />

Is my cost basis the original purchase information?<br />

<strong>Cost</strong> basis is generally defined as the original purchase price of a security, adjusted for fees, corporate actions, wash sales, return<br />

of capital distributions, and other tax related adjustments. If you acquired the security by gift, inheritance, as a distribution from a<br />

retirement account or a trust, then your basis determination will be more <strong>com</strong>plex and you should consult with your tax advisor for<br />

your specific situation.<br />

How do I update cost basis for mutual fund shares?<br />

If you are providing mutual fund cost basis you may enter each lot individually or you may <strong>com</strong>bine your long-term lots into one<br />

lot. Entering short-term lots individually is necessary in order to retain accuracy in calculations of short-term and long-term capital<br />

gains. Average cost basis tracking for mutual funds will take into account short-term and long-term lots, when applying average<br />

costing rules.<br />

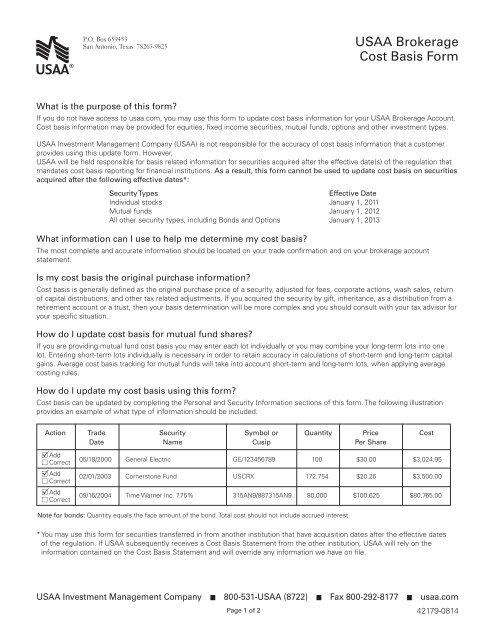

How do I update my cost basis using this form?<br />

<strong>Cost</strong> basis can be updated by <strong>com</strong>pleting the Personal and Security Information sections of this form. The following illustration<br />

provides an example of what type of information should be included.<br />

Action Trade Security Symbol or Quantity Price <strong>Cost</strong><br />

Date Name Cusip Per Share<br />

P<br />

Add<br />

Correct<br />

P<br />

Add<br />

Correct<br />

P<br />

Add<br />

Correct<br />

05/18/2000 General Electric GE/123456789 100 $30.00 $3,024.95<br />

02/01/2003 Cornerstone Fund USCRX 172.754 $20.26 $3,500.00<br />

09/16/2004 Time Warner Inc. 7.75% 315AN9/887315AN9 80,000 $100.625 $80,765.00<br />

Note for bonds: Quantity equals the face amount of the bond. Total cost should not include accrued interest.<br />

* You may use this form for securities transferred in from another institution that have acquisition dates after the effective dates<br />

of the regulation. If <strong>USAA</strong> subsequently receives a <strong>Cost</strong> <strong>Basis</strong> Statement from the other institution, <strong>USAA</strong> will rely on the<br />

information contained on the <strong>Cost</strong> <strong>Basis</strong> Statement and will override any information we have on file.<br />

<strong>USAA</strong> Investment Management Company m 800-531-<strong>USAA</strong> (8722) m Fax 800-292-8177 m usaa.<strong>com</strong><br />

Page 1 of 2 42179-0814

Personal Information<br />

Registered Owner(s) as printed on statement<br />

<strong>USAA</strong> Number<br />

Residence Phone Number (include area code) Business Phone Number (include area code) <strong>Brokerage</strong> Account Number<br />

Security Information<br />

Please check the appropriate Action box.<br />

Add new cost basis information OR Correct existing cost basis information<br />

Action Trade Security Symbol or Quantity Price <strong>Cost</strong><br />

Date Name Cusip Per Share<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

Add<br />

Correct<br />

The signatures of ALL registered owners/authorized agents are required.<br />

x<br />

Registered Owner/Authorized Agent<br />

Date (mm/dd/yy)<br />

x<br />

Registered Owner/Authorized Agent<br />

Date (mm/dd/yy)<br />

The cost basis figures you provided are for informational purposes only and will not be reported to the IRS. We have<br />

not independently verified this information; therefore, the accuracy of the basis information provided to you cannot<br />

be guaranteed. Consult your tax advisor regarding your specific situation prior to using information for your tax<br />

reporting purposes.<br />

For more details about cost basis and your securities, please refer to IRS publication 550 Investment In<strong>com</strong>e and Expenses<br />

(Including Capital Gains and Losses) and IRS publication 551 <strong>Basis</strong> of Assets at www.irs.gov.<br />

Page 2 of 2