Business Plan for UJVNL - UJVN Limited Dehradun...

Business Plan for UJVNL - UJVN Limited Dehradun...

Business Plan for UJVNL - UJVN Limited Dehradun...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

<strong>Business</strong> <strong>Plan</strong> <strong>for</strong> the Control Period<br />

(April 1, 2013 to March 31, 2016)<br />

BEFORE THE<br />

HON’BLE UTTARAKHAND ELECTRICITY REGULATORY COMMISSION<br />

DEHRADUN, UTTARAKHAND<br />

<strong>UJVN</strong> <strong>Limited</strong><br />

1

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

TABLE OF CONTENTS<br />

1 INTRODUCTION .................................................................................................................................... 16<br />

1.1 COMPANY OVERVIEW .................................................................................................................................. 17<br />

1.2 VISION AND MISSION ................................................................................................................................... 19<br />

1.3 EXISTING INSTALLED CAPACITY ....................................................................................................................... 20<br />

1.4 UPCOMING GENERATION CAPACITY: ............................................................................................................... 23<br />

2 CAPITAL EXPENDITURE PLAN – UPCOMING PROJECTS .......................................................................... 31<br />

2.1 VYASI HYDROELECTRIC PROJECT (120 MW) .................................................................................................... 32<br />

2.2 LAKHWAR MULTIPURPOSE PROJECT (300 MW) ............................................................................................... 38<br />

2.3 KISHAU MULTIPURPOSE PROJECT (660 MW) .................................................................................................. 44<br />

2.4 SIRKARI BHYOL RUPSIABAGAR HYDROELECTRIC PROJECT (210 MW) .................................................................... 49<br />

2.5 BOWALA NAND PRAYAG HYDROELECTRIC PROJECT (300 MW) ........................................................................... 53<br />

2.6 NAND PRAYAG LANGASU HYDROELECTRIC PROJECT (100 MW) .......................................................................... 58<br />

2.7 TAMAK LATA HYDROELECTRIC PROJECT (250 MW)........................................................................................... 63<br />

2.8 PALA MANERI HYDROELECTRIC PROJECT (480 MW) ......................................................................................... 67<br />

2.9 BHAIRONGHATI HYDROELECTRIC PROJECT (381 MW) ....................................................................................... 68<br />

3 CAPITAL EXPENDITURE PLAN – EXISTING PROJECTS ............................................................................. 69<br />

3.1 CHIBRO POWER STATION (240 MW) ............................................................................................................. 70<br />

3.2 KHODRI POWER STATION (120 MW) ............................................................................................................. 76<br />

3.3 DHAKRANI POWER STATION (33.75 MW) ...................................................................................................... 82<br />

3.4 DHALIPUR POWER STATION (51 MW) ............................................................................................................ 88<br />

3.5 KULHAL POWER STATION (30 MW) ............................................................................................................... 94<br />

3.6 TILOTH POWER STATION (90 MW) .............................................................................................................. 100<br />

3.7 CHILLA POWER STATION (144 MW) ............................................................................................................ 106<br />

3.8 KHATIMA POWER STATION (41.40 MW) ...................................................................................................... 112<br />

3.9 RAMGANGA POWER STATION (198 MW) ..................................................................................................... 118<br />

3.10 MANERI BHALI - II HYDROELECTRIC PROJECT (304 MW) ............................................................................ 124<br />

3.11 REFURBISHMENT OF ASAN BARRAGE, AT DHALIPUR (DEHRADUN).................................................................. 128<br />

3.12 REFURBISHING OF ICHARI DAM, AT ICHARI, KOTI (DEHRADUN)...................................................................... 130<br />

3.13 REHABILITATION WORK OF VIRBHADRA BARRAGE, PASHULOK, RISHIKESH ....................................................... 132<br />

3.14 REFURBISHMENT OF DAKPATHAR BARRAGE, AT DAKPATHAR (DEHRADUN) ...................................................... 134<br />

3.15 REFURBISHMENT OF MANERI DAM AT MANERI, UTTRAKASHI ....................................................................... 136<br />

2

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

3.16 SPECIAL CLOSURE WORKS OF CIVIL & HYDRO MECHANICAL STRUCTURES FOR YAMUNA HYDEL SCHEME STAGE–I<br />

(PART-I&II) & STAGE-IV ..................................................................................................................................... 138<br />

3.17 CLOSURE OF CHILLA HEP FOR SPECIAL REPAIR OF POWER CHANNEL, SUBMERGED PARTS OF STRUCTURES & HYDRO-<br />

MECHANICAL COMPONENTS OF VIRBHADRA BARRAGE, PASHULOK, RISHIKESH ............................................................... 140<br />

4 MAJOR SHUTDOWN PLAN OF POWER STATIONS................................................................................ 143<br />

4.1 MAJOR SHUTDOWN PLAN OF POWER STATIONS ............................................................................................. 144<br />

5 SUMMARY .......................................................................................................................................... 146<br />

5.1 CAPITAL EXPENDITURE & CAPITALIZATION...................................................................................................... 147<br />

6 TECHNICAL REPORT OF EXISTING POWER STATIONS .......................................................................... 149<br />

6.1 OBJECTIVE OF THE TECHNICAL REPORT .......................................................................................................... 150<br />

6.2 TECHNICAL REPORT OF TILOTH POWER STATION ................................................................................. 151<br />

6.3 TECHNICAL REPORT OF CHIBRO POWER STATION ................................................................................ 166<br />

6.4 TECHNICAL REPORT OF DHAKRANI POWER STATION ........................................................................... 179<br />

6.5 TECHNICAL REPORT OF DHALIPUR POWER STATION ............................................................................ 192<br />

6.6 TECHNICAL REPORT OF KHODRI POWER STATION ............................................................................... 205<br />

6.7 TECHNICAL REPORT OF KULHAL POWER STATION ............................................................................... 218<br />

6.8 TECHNICAL REPORT OF CHILLA POWER STATION ................................................................................. 231<br />

6.9 TECHNICAL REPORT OF KHATIMA POWER STATION ............................................................................. 244<br />

6.10 TECHNICAL REPORT OF RAMGANGA POWER STATION ................................................................... 256<br />

6.11 TECHNICAL REPORT OF MANERI BHALI – II HYDROELECTRIC PROJECT ............................................ 271<br />

7 ANNEXURES ........................................................................................................................................ 278<br />

7.1 ANNEXURE 1: 10 DAILY DISCHARGE TILOTH POWER STATION............................................................................ 279<br />

7.2 ANNEXURE 2: 10 DAILY DISCHARGE CHIBRO POWER STATION ........................................................................... 280<br />

7.3 ANNEXURE 3: 10 DAILY DISCHARGE DHAKRANI POWER STATION ....................................................................... 281<br />

7.4 ANNEXURE 4: 10 DAILY DISCHARGE DHALIPUR POWER STATION ....................................................................... 282<br />

7.5 ANNEXURE 5: 10 DAILY DISCHARGE KHODRIPOWER STATION ........................................................................... 283<br />

7.6 ANNEXURE 6: 10 DAILY DISCHARGE KULHAL POWER STATION ........................................................................... 284<br />

7.7 ANNEXURE 7: 10 DAILY DISCHARGE CHILLA POWER STATION ............................................................................ 285<br />

7.8 ANNEXURE 8: 10 DAILY DISCHARGE KHATIMA POWER STATION ........................................................................ 286<br />

7.9 ANNEXURE 9: 10 DAILY DISCHARGE MANERI BHALI – II HYDROELECTRIC PROJECT ................................................ 287<br />

7.10 ANNEXURE 10: BREAKUP OF COST FOR BALANCE WORKS AS PER ORIGINAL DPR AS APPROVED BY CEA AND PROPOSED<br />

NEW WORKS FOR MANERI BHALI –II HEP................................................................................................................ 288<br />

7.11 ANNEXURE 11: NATURE OF ENVIRONMENTAL IMPACTS CAUSED BY RMU AND SUGGESTED MITIGATION MEASURES 302<br />

3

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

7.12 ANNEXURE 12: FINANCING OF RMU OF SIX HYDRO ELECTRIC PROJECTS THROUGH KFW .................................. 307<br />

ANNEXURE 13: LETTER OF CEA FOR LAKHWAR POWER STATION ................................................................................. 314<br />

7.13 ANNEXURE 14: LOAN AGREEMENT OF PFC FOR RMU OF KHATIMA POWER STATION ....................................... 315<br />

7.14 Annexure 15: Note on Small Hydroelectric Projects........................................................... ............<br />

..3156<br />

7.15 Annexure 16 : Note on Manpower <strong>Plan</strong>ning of <strong>UJVN</strong> Ltd. during the Control Period......................317<br />

4

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

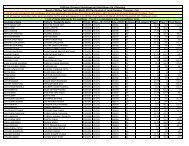

List of Tables<br />

Table 1: Brief History of Formation of <strong>UJVN</strong> <strong>Limited</strong> ............................................................... 19<br />

Table 2: Salient Features of the Existing Power Stations ........................................................ 20<br />

Table 3: Generation of Hydro Projects in <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> last 5 years ................................. 22<br />

Table 4: <strong>Plan</strong>ned Capacity Addition by <strong>UJVN</strong> <strong>Limited</strong> .............................................................. 24<br />

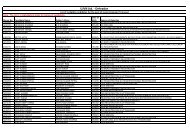

Table 5: Capital Expenditure during Control Period – Vyasi Project ....................................... 33<br />

Table 6: Capital Cost – Vyasi Project ........................................................................................ 34<br />

Table 7: Funding Pattern during the Control Period – Vyasi Project ....................................... 36<br />

Table 8: Capex & Capitalization during the Control Period – Vyasi Project ............................ 37<br />

Table 9: Capital Expenditure during the Control Period – Lakhwar Project ............................ 39<br />

Table 10: Capital Cost – Lakhwar Project ................................................................................ 40<br />

Table 11: Funding Pattern during the Control Period – Lakhwar Project ............................... 43<br />

Table 12: Capex & Capitalization during the Control Period – Lakhwar Project ..................... 43<br />

Table 13: Capital Expenditure during the Control Period – Kishau Project ............................. 45<br />

Table 14: Capital Cost – Kishau Project ................................................................................... 46<br />

Table 15: Funding Pattern during the Control Period – Kishau Project .................................. 48<br />

Table 16: Capex & Capitalization during the Control Period – Kishau Project ........................ 48<br />

Table 17: Capital Expenditure during the Control Period – Sirkari Bhyol Rupsiabagar Project<br />

.................................................................................................................................................. 49<br />

Table 18: Capital Cost – Sirkari Bhyol Rupsiabagar Project ..................................................... 50<br />

Table 19: Funding Pattern during the Control Period – Sirkari Bhyol Rupsiabagar Project .... 52<br />

Table 20: Capex & Capitalization during the Control Period –Sirkari Bhyol Rupsiabagar<br />

Project ...................................................................................................................................... 52<br />

Table 21: Capital Expenditure during the Control Period – Bowala Nand Prayag Project ...... 53<br />

Table 22: Capital Cost – Bowala Nand Prayag Project ............................................................. 54<br />

Table 23: Funding Pattern during the Control Period – Bowla Nand Prayag Project .............. 57<br />

5

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 24: Capex & Capitalization during the Control Period – Bowla Nand Prayag Project ... 57<br />

Table 25: Capital Expenditure during the Control Period – Nand Prayag Langasu Project ..... 58<br />

Table 26: Capital Cost – Nand Prayag Langasu Project ........................................................... 59<br />

Table 27: Funding Pattern during the Control Period – Nand Prayag Langasu Project .......... 61<br />

Table 28: Capex & Capitalization during the Control Period – Nand Prayag Langasu Project 62<br />

Table 29: Capital Expenditure during the Control Period – Tamak Lata Project ..................... 63<br />

Table 30: Capital Cost – Tamak Lata Project ............................................................................ 64<br />

Table 31: Funding Pattern during the Control Period – Tamak Lata Project ........................... 66<br />

Table 32: Capex & Capitalization during the Control Period – Tamak Lata Project ................ 66<br />

Table 33: Capital Expenditure during the Control Period – Chibro Project ............................. 70<br />

Table 34: Capital Cost – Chibro Project ................................................................................... 72<br />

Table 35: Funding Pattern during the Control Period – Chibro Project .................................. 75<br />

Table 36: Capex & Capitalization during the Control Period – Chibro Project ........................ 75<br />

Table 37: Capital Expenditure during Control Period – Khodri Project ................................... 76<br />

Table 38: Capital Cost – Khodri Project ................................................................................... 78<br />

Table 39: Funding Pattern during the Control Period – Khodri Project .................................. 81<br />

Table 40: Capex & Capitalization during the Control Period – Khodri Project ........................ 81<br />

Table 41: Capital Expenditure during the Control Period – Dhakrani Project ......................... 82<br />

Table 42: Capital Cost – Dhakrani Project................................................................................ 84<br />

Table 43: Funding Pattern during the Control Period – Dhakrani Project............................... 87<br />

Table 44: Capex & Capitalization during the Control Period – Dhakrani Project .................... 87<br />

Table 45: Capital Expenditure during the Control Period – Dhalipur Project ......................... 88<br />

Table 46: Capital Cost – Dhalipur Project ................................................................................ 90<br />

Table 47: Funding Pattern during Control Period – Dhalipur Project ...................................... 93<br />

Table 48: Capex & Capitalization during the Control Period – Dhalipur Project ..................... 93<br />

Table 49: Capital Expenditure during the Control Period – Kulhal Project ............................. 94<br />

6

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 50: Capital Cost – Kulhal Project .................................................................................... 96<br />

Table 51: Funding Pattern during the Control Period – Kulhal Project ................................... 99<br />

Table 52: Capex & Capitalization during the Control Period – Kulhal Project ......................... 99<br />

Table 53: Capital Expenditure during the Control Period – Tiloth Project ............................ 101<br />

Table 54: Capital Cost – Tiloth Project ................................................................................... 102<br />

Table 55: Funding Pattern during the Control Period – Tiloth Project .................................. 105<br />

Table 56: Capex & Capitalization during the Control Period – Tiloth Project ....................... 105<br />

Table 57: Capital Expenditure during the Control Period – Chilla Project ............................ 106<br />

Table 58: Capital Cost – Chilla Project ................................................................................... 108<br />

Table 59: Funding Pattern during the Control Period – Chilla Project .................................. 111<br />

Table 60: Capex & Capitalization during the Control Period – Chilla Project ........................ 111<br />

Table 61: Capital Expenditure during the Control Period – Khatima Project ........................ 112<br />

Table 62: Capital Cost – Khatima Project ............................................................................... 114<br />

Table 63: Funding Pattern during the Control Period – Khatima Project .............................. 117<br />

Table 64: Capex & Capitalization during the Control Period – Khatima Project ................... 117<br />

Table 65: Capital Expenditure during the Control Period – Ramganga Project .................... 119<br />

Table 66: Capital Cost – Ramganga Project ........................................................................... 120<br />

Table 67: Funding Pattern during the Control Period – Ramganga Project .......................... 122<br />

Table 68: Capex & Capitalization during the Control Period – Ramganga Project ................ 123<br />

Table 69: Capital Expenditure during the Control Period – Maneri Bhali - II Project ............ 125<br />

Table 70: Capital Cost – Maneri Bhali - II Project .................................................................. 126<br />

Table 71: Funding Pattern during the Control Period – Maneri Bhali - II Project ................. 127<br />

Table 72: Capex & Capitalization during the Control Period – Maneri Bhali - II Project ....... 127<br />

Table 73 : Summary of expenses proposed under DRIP Scheme and Closure Works<br />

(in Rs. Lakh) ............................................................................................................................ 141<br />

Table 74 : Outage <strong>Plan</strong> during the Control Period <strong>for</strong> <strong>UJVN</strong> <strong>Limited</strong>..................................... 145<br />

7

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 75: Capex & Capitalization during the control period - <strong>UJVN</strong> <strong>Limited</strong> ......................... 147<br />

Table 76: Debt & Equity <strong>for</strong> Capital Expenditure during the control period - <strong>UJVN</strong> <strong>Limited</strong> 148<br />

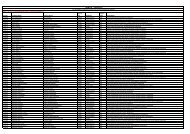

Table 77: 90% dependable year – Tiloth Power Station ........................................................ 152<br />

Table 78: Discharge & Generation Data – Tiloth Power Station ........................................... 154<br />

Table 79: Design Energy: Tiloth Power Station ...................................................................... 155<br />

Table 80: Uncontrollable Losses – Tiloth Power Station ....................................................... 155<br />

Table 81: Year wise Maximum Possible Generation (MU) – Tiloth Power Station ............... 157<br />

Table 82: Design Energy – Tiloth Power Station .................................................................... 157<br />

Table 83: <strong>Plan</strong>t Availability during FY 2000 - 12 – Tiloth Power Station................................ 158<br />

Table 84: % Generation Loss on account of various Factors – Tiloth Power Station ............ 160<br />

Table 85: Auxiliary and Trans<strong>for</strong>mation Losses – Tiloth Power Station ................................ 161<br />

Table 86: 90% Dependable year – Chibro Power Station ...................................................... 167<br />

Table 87: Discharge & Generation Data – Chibro Power Station .......................................... 169<br />

Table 88: Design Energy- Chibro Power Station .................................................................... 170<br />

Table 89: Uncontrollable Losses – Chibro Power Station ...................................................... 170<br />

Table 90: Year wise Maximum Possible Generation (MU) – Chibro Power Station .............. 171<br />

Table 91: Design Energy – Chibro Power Station .................................................................. 172<br />

Table 92: <strong>Plan</strong>t Availability during FY 2000 - 12 – Chibro Power Station .............................. 172<br />

Table 93: % Generation Loss on account of various Factors – Chibro Power Station ........... 174<br />

Table 94: Auxiliary and Trans<strong>for</strong>mation Losses – Chibro Power Station ............................... 174<br />

Table 95: 90% Dependable Year– Dhakrani Power Station ................................................... 180<br />

Table 96: Discharge & Generation Data – Dhakrani Power Station ...................................... 182<br />

Table 97- Design Energy: Dhakrani Power Station ................................................................ 183<br />

Table 98: Uncontrollable Losses – Dhakrani Power Station .................................................. 183<br />

Table 99: Year wise Maximum Possible Generation (MU) – Dhakrani Power Station .......... 184<br />

Table 100: Design Energy – Dhakrani Power Station ............................................................ 185<br />

8

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 101: <strong>Plan</strong>t Availability during FY 2000 - 12 – Dhakrani Power Station ........................ 185<br />

Table 102: % Generation Loss on account of various Factors – Dhakrani Power Station ..... 187<br />

Table 103: Auxiliary and Trans<strong>for</strong>mation Losses – Dhakrani Power Station ......................... 188<br />

Table 104: 90% Dependable year – Dhalipur Power Station ................................................. 193<br />

Table 105: Discharge & Generation Data – Dhalipur Power Station ..................................... 195<br />

Table 106: Design Energy- Dhalipur Power Station ............................................................... 196<br />

Table 107: Uncontrollable Losses – Dhalipur Power Station ................................................. 196<br />

Table 108: Year wise Maximum Possible Generation (MU) – Dhalipur Power Station ......... 197<br />

Table 109: Design Energy – Dhalipur Power Station ............................................................. 198<br />

Table 110: <strong>Plan</strong>t Availability during FY 2001- 12 – Dhalipur Power Station .......................... 198<br />

Table 111: % Generation Loss on account of various Factors – Dhalipur Power Station ...... 200<br />

Table 112: Auxiliary and Trans<strong>for</strong>mation Losses – Dhalipur Power Station .......................... 201<br />

Table 113: 90% Dependable year – Khodri Power Station .................................................... 207<br />

Table 114: Discharge & Generation Data – Power Station .................................................... 208<br />

Table 115: Design Energy-Khodri Power Station ................................................................... 209<br />

Table 116: Uncontrollable Losses – Khodri Power Station .................................................... 209<br />

Table 117: Year wise Maximum Possible Generation (MU) – Khodri Power Station ............ 210<br />

Table 118: Design Energy – Khodri Power Station ................................................................ 211<br />

Table 119: <strong>Plan</strong>t Availability during FY 2000 - 12 – Khodri Power Station ............................ 211<br />

Table 120: % Generation Loss on account of various Factors – Khodri Power Station ......... 213<br />

Table 121: Auxiliary and Trans<strong>for</strong>mation Losses – Khodri Power Station ............................. 214<br />

Table 122: 90% dependable year – Kulhal Power Station ..................................................... 219<br />

Table 123: Discharge & Generation Data – Kulhal Power Station ......................................... 221<br />

Table 124: Design Energy-Kulhal Power Station .................................................................... 222<br />

Table 125: Uncontrollable Losses – Kulhal Power Station .................................................... 222<br />

Table 126: Year wise Maximum Possible Generation (MU) – Kulhal Power Station ............ 223<br />

9

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 127: Design Energy – Kulhal Power Station ................................................................. 224<br />

Table 128: <strong>Plan</strong>t Availability during FY 2001- 12 – Kulhal Power Station .............................. 224<br />

Table 129: % Generation Loss on account of various Factors – Kulhal Power Station ......... 225<br />

Table 130: Auxiliary and Trans<strong>for</strong>mation Losses – Kulhal Power Station ............................. 226<br />

Table 131: 90% dependable year – Chilla Power Station ...................................................... 232<br />

Table 132: Discharge & Generation Data – Chilla Power Station .......................................... 234<br />

Table 133: Design Energy: Chilla Power Station .................................................................... 235<br />

Table 134: Uncontrollable Losses – Chilla Power Station ...................................................... 235<br />

Table 135: Year wise Maximum Possible Generation (MU) – Chilla Power Station .............. 236<br />

Table 136: Design Energy – Chilla Power Station .................................................................. 237<br />

Table 137: <strong>Plan</strong>t Availability during FY 2002- 12 – Chilla Power Station ............................... 237<br />

Table 138: % Generation Loss on account of various Factors – Chilla Power Station ........... 239<br />

Table 139: Auxiliary and Trans<strong>for</strong>mation Losses – Chilla Power Station ............................... 240<br />

Table 140: 90% dependable year – Khatima Power Station ................................................. 246<br />

Table 141: Discharge & Generation Data – Khatima Power Station ..................................... 247<br />

Table 142: Design Energy- Khatima Power Station ............................................................... 248<br />

Table 143: Uncontrollable Losses – Khatima Power Station ................................................. 248<br />

Table 144: Year wise Maximum Possible Generation (MU) – Khatima Power Station ......... 249<br />

Table 145: Design Energy – Khatima Power Station .............................................................. 250<br />

Table 146: <strong>Plan</strong>t Availability during FY 2000 - 12 – Khatima Power Station ......................... 250<br />

Table 147: % Generation Loss on account of various Factors – Khatima Power Station ...... 251<br />

Table 148: Auxiliary and Trans<strong>for</strong>mation Losses – Khatima Power Station .......................... 252<br />

Table 149: Annual Discharge ................................................................................................. 260<br />

Table 150: 90% Dependable year .......................................................................................... 261<br />

Table 151: Energy Generation potential <strong>for</strong> the dependable year on 10 daily discharge basis<br />

................................................................................................................................................ 262<br />

10

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 152: <strong>Plan</strong>t availability based on Peaking Capability ..................................................... 265<br />

Table 153: <strong>Plan</strong>t Availability during 2007-12 ......................................................................... 266<br />

Table 154: Auxiliary and Trans<strong>for</strong>mation losses .................................................................... 267<br />

Table 155: <strong>Plan</strong>t Availability during FY 2008-12 – Maneri Bhali - II Hydroelectric Project.... 272<br />

Table 156: % Generation Loss on account of various Factors – Maneri Bhali - II Hydroelectric<br />

Project .................................................................................................................................... 274<br />

Table 157: Auxiliary and Trans<strong>for</strong>mation Losses – Maneri Bhali - II Hydroelectric Project .. 275<br />

11

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

BEFORE THE HON’BLE UTTARAKHAND ELECTRICITY REGULATORY COMMISSION<br />

DEHRADUN, UTTARAKHAND<br />

IN THE MATTER OF:<br />

The <strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> FY 2013-14 to FY 2015-2016 under Section 62 and 86<br />

of the Electricity Act, 2003 read with the relevant regulations and guidelines of the Hon’ble<br />

Commission.<br />

And<br />

IN THE MATTER OF THE APPLICANT:<br />

<strong>UJVN</strong> <strong>Limited</strong>, a Company incorporated under the provisions of the Companies Act, 1956<br />

and having its registered office at UJJWAL, Maharani Bagh, GMS Road, <strong>Dehradun</strong> –<br />

Petitioner<br />

12

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

A. Specific Legal Provisions under which the Petition is being filed<br />

The Hon’ble Commission has notified the Uttarakhand Electricity Regulatory<br />

Commission (Terms and Conditions <strong>for</strong> Determination of Tariff) Regulations, 2011,<br />

on 19 th December 2011. In accordance with Regulation 9 of these regulations states<br />

that Applicant is to submit a <strong>Business</strong> <strong>Plan</strong> <strong>for</strong> the entire control period. Regulation<br />

9(1) states:<br />

“An Applicant shall submit, under affidavit and as per the UERC (Conduct of <strong>Business</strong>)<br />

Regulations, 2004, a <strong>Business</strong> <strong>Plan</strong> by May 31, 2012, <strong>for</strong> the Control Period of three<br />

(3) financial years from April 1, 2013 to March 31, 2016,<br />

a) The <strong>Business</strong> <strong>Plan</strong> <strong>for</strong> the Generating Company shall be <strong>for</strong> the entire control<br />

period and shall, interalia, contain-<br />

(i) Capital investment plan, which shall include details of the<br />

investments planned by the Generating Company <strong>for</strong> existing<br />

stations, yearly phasing of capital expenditure along with the<br />

source of funding, financing plan and corresponding capitalisation<br />

schedule. This plan shall be commensurate with R&M schemes and<br />

proposed efficiency improvements <strong>for</strong> various plants of the<br />

company.<br />

(ii) The capital investment plan shall show separately, on-going<br />

projects that will spill over into the years under review, and new<br />

projects (along with justification) that will commence in the years<br />

under review but may be completed within or beyond the tariff<br />

period.<br />

(iii) The Generating Company shall submit plant-wise details of the<br />

capital structure and cost of financing (interest on debt and return<br />

on equity), after considering the existing market conditions, terms<br />

of the existing loan agreements, risks associated in generation<br />

business and creditworthiness;<br />

(iv) Details related to major shut down of machines, if any<br />

13

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

(v) Trajectory of per<strong>for</strong>mance parameters”<br />

In compliance with this Regulation, the <strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> has been<br />

submitted through this petition.<br />

B. Facts of the Case<br />

1. The Petitioner, <strong>UJVN</strong> <strong>Limited</strong>, is a company incorporated under the provisions of the<br />

Companies Act, 1956, having its registered office at UJJWAL, Maharani Bagh, GMS<br />

Road, <strong>Dehradun</strong>.<br />

2. It is submitted that Government of India (GoI) vide order dated November 5, 2001<br />

transferred all hydropower assets of Uttar Pradesh Jal Vidyut Nigam <strong>Limited</strong><br />

(UPJVNL) located in the State of Uttarakhand to <strong>UJVN</strong> <strong>Limited</strong> with effect from<br />

November 09, 2001. In compliance to the said order, administrative and financial<br />

control of all hydro Power Stations of UPJVNL in operation or under construction in<br />

the State of Uttarakhand was taken over by <strong>UJVN</strong> <strong>Limited</strong> with effect from<br />

November 09, 2001. GOI order also defines the basis of division of assets and<br />

liabilities between UPJVNL and <strong>UJVN</strong> <strong>Limited</strong>.<br />

3. Though administrative and financial control was transferred to <strong>UJVN</strong> <strong>Limited</strong> on<br />

November 09, 2001, <strong>UJVN</strong> <strong>Limited</strong> initiated discussions with UPJVNL <strong>for</strong> <strong>for</strong>mulation<br />

of transfer scheme as per the said GOI order on mutually agreed terms.<br />

4. Government of Uttarakhand (GoU) has notified the provisional transfer scheme vide<br />

its notification no. 70/AS (E)/I/2008-04 (3)/22/08 dated 07/03/08.<br />

C. Prayer to Hon’ble Commission<br />

Further, <strong>UJVN</strong> <strong>Limited</strong> prays the following be<strong>for</strong>e the Hon’ble Commission:<br />

1) Approve the <strong>Business</strong> <strong>Plan</strong> <strong>for</strong> <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> the Control Period (FY 2013-<br />

14 to FY 2015-16) in accordance with Regulation 9 of Uttarakhand Electricity<br />

14

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Regulatory Commission (Terms and Conditions <strong>for</strong> Determination of Tariff)<br />

Regulations, 2011.<br />

2) Approve planned outages of Power Stations and also grant permission <strong>for</strong><br />

change in the schedule.<br />

3) Approve Methodology adopted <strong>for</strong> calculation of NAPAF and other technical<br />

parameters.<br />

4) Condone any inadvertent omission/ errors/ shortcomings and permit <strong>UJVN</strong><br />

<strong>Limited</strong> to add/ change/ modify/ alter this filing and make further<br />

submissions as may be required at a future date.<br />

5) Any other relief that the Hon’ble Commission may deem fit.<br />

15

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

1 INTRODUCTION<br />

16

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

1.1 Company Overview<br />

1.1.1 <strong>UJVN</strong> <strong>Limited</strong> is a wholly owned Corporation of the Government of Uttarakhand. The<br />

main objects to be pursued by the company are as under:<br />

To establish takeover, operate and maintain power generating stations<br />

harnessing the conventional, non-conventional, nuclear and other sources of<br />

energy by what so ever name called that include sub-stations, transmission lines,<br />

other ancillaries and activities that are essential <strong>for</strong> generation, transmission,<br />

distribution and trading of power.<br />

To carry on its activities within the State of Uttarakhand or elsewhere as may be<br />

found feasible.<br />

To make arrangements with any Company, Authority, Government or other<br />

persons or institutions <strong>for</strong> the operation and maintenance of any generating<br />

station owned by it (including transmission lines and other works connected<br />

therewith) on such terms and conditions as may be agreed upon between it and<br />

the Company.<br />

To take such measures as in the opinion of the Company, are calculated to<br />

advance the development of water power in the State of Uttarakhand and may<br />

carry out power and Hydro –metric survey work and cause to be made such<br />

maps, plans, sections and estimate as are necessary <strong>for</strong> any of the said purpose.<br />

To carry out investigation and to prepare one or more schemes relating to the<br />

establishment or acquisition of generating stations, tie-lines, sub-stations and<br />

transmission lines <strong>for</strong> promoting the use of electricity within the State of<br />

Uttarakhand.<br />

To operate and maintain in the most efficient and economical manner the<br />

generating stations, tie-lines, sub-stations and main transmission lines, owned by<br />

the Company.<br />

To enter into agreement with any licensee licensed under the Indian Electricity<br />

Act, 1910 or any other Act, Law of Regulation in <strong>for</strong>ce <strong>for</strong> the time being, or as<br />

17

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

modified from time to time or with any person <strong>for</strong> use of any transmission line,<br />

distribution line or main transmission line of that licensee or person <strong>for</strong> such time<br />

and upon such terms as may be agreed.<br />

To enter into arrangement on such terms as may be agreed upon, <strong>for</strong> the sale of<br />

electricity generated by it to the State Electricity Company constituted <strong>for</strong><br />

Uttarakhand or <strong>for</strong> the sale of electricity generated by it to any other state, body,<br />

person by itself with the consent of such person or persons duly authorized or<br />

licensed under prevalent Laws and Regulations or on its own account.<br />

To avail such rights, exercise such powers and functions and to per<strong>for</strong>m such<br />

duties as are conferred upon or expected of the company under the provisions of<br />

such Laws, legislation and regulations as are in <strong>for</strong>ce from time to time.<br />

To do such other acts and things as are authorized to be done under the<br />

Electricity (Supply) Act, 1948, or any other Act, Laws or regulations in <strong>for</strong>ce or<br />

amended from time to time.<br />

To do such other acts and things as are authorized to be done under Indian<br />

Electricity Act, 1910, as amended from time to time.<br />

1.1.2 The erstwhile Uttar Pradesh State Electricity Board was trifurcated pursuant to<br />

enactment of U.P. Electricity Re<strong>for</strong>ms Act, 1999. U.P. State Electricity Re<strong>for</strong>ms<br />

Transfer Scheme, 2000 was promulgated <strong>for</strong> execution of the trifurcation of<br />

erstwhile UPSEB into U.P. Power Corporation Ltd. (In short UPPCL), U.P. Jal Vidyut<br />

Nigam Ltd. (In short UPJVNL) and U.P. Rajya Vidyut Utpadan Nigam <strong>Limited</strong><br />

(UPRVUNL). By operation of the a<strong>for</strong>esaid Scheme all the Hydro Electric Projects<br />

earlier owned and operated by UPSEB were transferred to UPJVNL (a Govt. Company<br />

existing prior to the said trifurcation) in addition to other projects owned and<br />

operated by the UPJVNL previously.<br />

1.1.3 Uttar Pradesh was bifurcated by en<strong>for</strong>cement of U.P. Reorganization Act, 2000 as a<br />

result thereof the State of Uttarakhand came into existence. The Government of<br />

18

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

India issued an order dated 05-11-01 u/s 63(4)(a) of the Reorganization Act whereby<br />

assets and liabilities between UPJVNL and <strong>UJVN</strong> <strong>Limited</strong> were divided. By operation<br />

of this order all the Hydro Power Assets of UPJVNL located in the State of<br />

Uttarakhand were transferred to <strong>UJVN</strong> <strong>Limited</strong>. In compliance to the said order,<br />

administrative and financial control of all hydro power plants of UPJVNL in operation<br />

or under construction was taken over by <strong>UJVN</strong> <strong>Limited</strong> with effect from November<br />

09, 2001.<br />

1.1.4 The brief history of <strong>for</strong>mation of <strong>UJVN</strong> <strong>Limited</strong> is presented in Table 1.<br />

Table 1: Brief History of Formation of <strong>UJVN</strong> <strong>Limited</strong><br />

Milestone<br />

Date<br />

UPSEB Unbundled under UPSEB Transfer Scheme 14-01-2000<br />

Uttarakhand State Created under UP Reorganisation Act 09-11-2000<br />

<strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong>med under Companies Act, 1956 12-02-2001<br />

<strong>UJVN</strong> <strong>Limited</strong> Commenced Operations 09-11-2001<br />

<strong>UJVN</strong> <strong>Limited</strong> Took Possession of Assets 09-11-2001<br />

1.1.5 Presently, <strong>UJVN</strong> <strong>Limited</strong> operates Hydro Power Stations ranging in capacity from 0.2<br />

MW to 304 MW, totaling around 1310.25 MW. Though the State was more or less<br />

sufficient in energy generation to meet its own requirements at the time of its<br />

<strong>for</strong>mation, it is falling short of power at present. As such efficient operation of<br />

exiting hydro power projects <strong>for</strong> economic well-being and growth of the State and its<br />

people has become relevant and essential.<br />

1.2 Vision and Mission<br />

1.2.1 The vision of <strong>UJVN</strong> <strong>Limited</strong> is to be a significant player in the National Power Sector<br />

and best corporate in Uttarakhand. It aims to be an excellent & efficient organization<br />

19

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

on the strength of its human resources and induce adjacent infrastructure business<br />

that provides opportunities <strong>for</strong> growth.<br />

1.2.2 The Mission of the Nigam is to contribute to improvement in the quality of life in<br />

Uttarakhand. To achieve this, <strong>UJVN</strong> <strong>Limited</strong> has adopted a value based approach and<br />

its values include:<br />

Creation of value <strong>for</strong> all stakeholder<br />

Result oriented with professional work culture<br />

Earn trust through fair business practices with all<br />

Growth balanced with environmental protection & enrichment<br />

Law abiding<br />

1.3 Existing Installed Capacity<br />

1.3.1 Currently, <strong>UJVN</strong> <strong>Limited</strong> has an installed capacity of 1310.25 MW with installed<br />

capacity of Power Stations ranging from 0.2 MW to 304 MW. The salient features of<br />

these existing Power Stations are summarized in Table 2.<br />

Table 2: Salient Features of the Existing Power Stations<br />

S.<br />

N<br />

Power<br />

Station<br />

Installed<br />

Capacity<br />

(MW)<br />

Year of<br />

Commiss<br />

ioning<br />

Type<br />

of<br />

Scheme<br />

River<br />

Design<br />

Head<br />

(m)<br />

Design<br />

Discharge<br />

(m3/s)<br />

1 MB-II 304.00 2008 ROR Bhagirathi 247.60 142.00<br />

2 Khodri 120.00 1984 ROR Tons 57.90 200.00<br />

3 Tiloth 90.00 1984 ROR Bhagirathi 147.50 71.40<br />

4 Chilla 144.00 1980 ROR Ganga 32.50 565.00<br />

5 Chibro 240.00 1975 ROR Tons 110 200.00<br />

6 Kulhal 30.00 1975 ROR Yamuna 18.00 198.00<br />

7 Ramganga 198.00 1975 Reservoir Ramganga 84.40 235.60<br />

20

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

S.<br />

N<br />

Power<br />

Station<br />

Installed<br />

Capacity<br />

(MW)<br />

Year of<br />

Commiss<br />

ioning<br />

Type<br />

of<br />

Scheme<br />

River<br />

Design<br />

Head<br />

(m)<br />

Design<br />

Discharge<br />

(m3/s)<br />

8 Dhakrani 33.75 1965 ROR Yamuna 19.80 199.20<br />

9 Dhalipur 51.00 1965 ROR Yamuna 30.48 199.20<br />

10 Khatima 41.40 1956 ROR Sharda 17.98 269.00<br />

11 Pathri 20.40 1955 ROR Ganga 9.75 253.00<br />

12 M. Pur 9.30 1952 ROR Ganga 5.70 255.00<br />

13 Galogi 3.00 1907 ROR Bhatta 285.00 1.36<br />

14 Urgam 3.00 1998 ROR Kalpganga 196.00 1.86<br />

15 Tharali 0.40 1989 ROR Pranmati 79.77 0.67<br />

16 Badrinath–II 1.25 2004 ROR Rishiganga 75.45 2.07<br />

17 Pandukesh<br />

war<br />

0.75 2004 ROR Laxman<br />

ganga<br />

113.00 0.94<br />

18 Jumma 1.20 2005 ROR Jumma<br />

gad<br />

19 Tapovan 0.80 2005 ROR Dak<br />

Gadera<br />

143.50 1.07<br />

274.00 0.41<br />

20 Sonprayag 0.50 2002 ROR Sone 46.70 1.36<br />

21 Sapteshwar 0.30 1994 ROR Koiralgad 82.30 0.48<br />

22 Kanchauti 2.00 1993 ROR Kanchauti<br />

gad<br />

400.00 0.62<br />

23 Chhirkila 1.50 1997 ROR Dukugad 275.00 0.68<br />

24 Relagad 3.00 2004 ROR Relagad 264.83 1.42<br />

25 Kulagad 1.20 1995 ROR Kulagad 200.00 0.79<br />

26 Pilangad 2.25 2004 ROR Pilangad 102.00 2.75<br />

27 Harsil 0.20 2000 ROR Bhagirathi 114.00 0.26<br />

28 Kaliganga 4.00 2012 ROR Kaliganga 166.00 3.00<br />

29 Suringad 0.80 1986 ROR Sureingad 151.00 0.76<br />

21

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

S.<br />

N<br />

Power<br />

Station<br />

Installed<br />

Capacity<br />

(MW)<br />

Year of<br />

Commiss<br />

ioning<br />

Type<br />

of<br />

Scheme<br />

River<br />

Design<br />

Head<br />

(m)<br />

Design<br />

Discharge<br />

(m3/s)<br />

30 Taleshwar 0.60 2000 ROR Kaliganga 189.00 0.59<br />

31 Barar 0.75 1997 ROR Ramganga 99.48 0.96<br />

32 Chharandeo 0.40 2000 ROR Kaliganga 229.74 0.19<br />

33 Garaon 0.30 2001 ROR Ramganga 119.50 0.24<br />

34 Kotabagh 0.20 1990 ROR Dabaka 29.33 0.94<br />

Total 1310.25<br />

1.3.2 Most of the Power Stations were commissioned by the early 1980’s and the oldest<br />

Galogi Power Station was commissioned way back in 1907. The latest hydro station<br />

to be commissioned is Kaliganga-I SHP with an installed capacity of 4 MW in the year<br />

2012. Thus, it can be said that about more than 3 quarters of the capacity has been<br />

in operation <strong>for</strong> nearly 30 to 60 years and is, almost at the end of the life.<br />

1.3.3 All the <strong>UJVN</strong> <strong>Limited</strong> Power Stations except Ramganga are run of the river stations<br />

and thus are highly dependent on water availability and monsoon <strong>for</strong> electricity<br />

generation. Table 3 summarizes generation of hydro projects in the last 5 years.<br />

Table 3: Generation of Hydro Projects in <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> last 5 years<br />

Year Unit 2007-08 2008-09 2009-10 2010-11 2011-12<br />

Chibro Gen. (MU) 755.08 837.68 587.89 795.69 848.97<br />

Khodri Gen. (MU) 354.66 379.98 275.89 361.77 382.87<br />

Dhakrani Gen. (MU) 148.93 146.53 105.09 143.02 152.76<br />

Dhalipur Gen. (MU) 210.70 224.44 160.15 210.84 229.58<br />

Kulhal Gen. (MU) 149.76 143.68 112.62 142.53 157.83<br />

22

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Year Unit 2007-08 2008-09 2009-10 2010-11 2011-12<br />

Tiloth Gen. (MU) 466.14 403.80 449.08 504.41 516.11<br />

MB-II Gen. (MU) 77.02 1044.95 1198.04 1335.96 1351.15<br />

Chilla Gen. (MU) 825.97 776.59 739.49 775.15 910.09<br />

Ramganga Gen. (MU) 279.06 325.48 174.29 325.62 416.42<br />

Khatima Gen. (MU) 155.43 140.65 151.01 155.94 164.00<br />

LHPs Gen. (MU) 3422.75 4423.78 3953.55 4750.93 5129.78<br />

SHPS Gen. (MU) 180.43 189.45 173.00 155.34 132.03<br />

Total Gen. (MU) 3603.18 4613.23 4126.54 4906.26 5261.82<br />

1.3.4 Three Power Stations, namely, MB-II, Chilla and Chibro account <strong>for</strong> nearly 60% of the<br />

generation but Chilla & Chibro are now more than 30 years old. The generation of<br />

<strong>UJVN</strong> <strong>Limited</strong> increased by 28% between FY 2007-08 and FY 2008-09 on account of<br />

commissioning of MB-II, in FY 2007-08. There was a dip in generation between FY<br />

2008-09 and FY 2009-10 due to low hydrology.<br />

1.4 Upcoming Generation Capacity:<br />

1.4.1 <strong>UJVN</strong> <strong>Limited</strong> plans to expand its current capacity base and has about 3276 MW of<br />

Generating <strong>Plan</strong>ts in different stages of planning and implementation. The details of<br />

the projects planned and currently being implemented by <strong>UJVN</strong> <strong>Limited</strong> in the<br />

coming years are presented in the Table 4 below.<br />

23

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 4: <strong>Plan</strong>ned Capacity Addition by <strong>UJVN</strong> <strong>Limited</strong><br />

S.No.<br />

Name of<br />

Estimated<br />

District<br />

River/<br />

Expected<br />

Project<br />

Potential<br />

Tributary<br />

Commissioning<br />

(MW)<br />

Year<br />

1 Vyasi 120 <strong>Dehradun</strong> Yamuna 2016<br />

2 Lakhwar 300 <strong>Dehradun</strong> Yamuna 2018<br />

3 Bowla<br />

Nandprayag<br />

300 Chamoli Alaknanda 2019<br />

4 Tamak lata 250 Chamoli Dhauliganga 2019<br />

5 Nand Pyayag<br />

Langasu<br />

6 Sirkari Bhyol<br />

Rupsiabagar<br />

100 Chamoli Alaknanda 2020<br />

210 Pithoragarh Goriganga 2021<br />

7 Sela Urthing 230 Pithoragarh Dhauliganga 2023<br />

8 Kishau 660 <strong>Dehradun</strong> Tons 2024<br />

9 Pala Maneri 480 Uttarkashi Bhagirathi On hold<br />

10 Bhairon Ghati 381 Uttarkashi Bhagirathi On hold<br />

11 Taluka Sankri 140 Uttarkashi Tons 2026*<br />

12 Rishiganga I 70 Chamoli Rishiganga 2026*<br />

13 Rishiganga – II 35 Chamoli Rishiganga 2026*<br />

Total 3276<br />

*Subject to clearance of Wildlife Board and MoEF.<br />

1.4.2 It will be important to consider some of these Projects in this business plan as some<br />

capital expenditure related to these projects shall also be done during the current<br />

24

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

control period. Two hydro projects namely Pala Maneri and Bhairon Ghati on the<br />

Bhagirathi River are currently on hold due to environmental issues. Taluka Sankri,<br />

Rishiganga – I , Rishigana – II and Sela Urthing are still under planning phase and<br />

hence no capital expenditure will be incurred during the control period. Sela Urthing<br />

is expected to be commissioned in 2023 and no capital expenditure is expected to be<br />

incurred during the control period.<br />

In addition to these Large Hydroelectric Projects, quite a number of Small<br />

Hydroelectric Projects are in operation as well as in various stages of implementation<br />

requiring substantial capital investments during the Control Period 2013-14 to<br />

2015-16. These have been appended as Annexure-15.<br />

Ef<strong>for</strong>t towards Diversification of Generation Base<br />

1.4.3 Electricity demand in the state has grown exponentially due to rapid industrialization<br />

as a result of industry friendly policies and special package granted to the State by<br />

the Union Government. The demand <strong>for</strong> electricity has been growing at the rate of<br />

about 14% per annum during the last 8 years and the demand-supply gap is<br />

increasing. At present power generation in the state is wholly dependent on<br />

Hydro projects and allocation of power from central pool is not sufficient to meet<br />

the requirement of the State. The power deficit becomes acute during winter season<br />

as freezing temperatures causes low river discharges leading to lower generation<br />

whereas demand goes up significantly.<br />

Bottlenecks in development of Hydro projects<br />

1.4.4 The state could not harness the full potential of Hydro power due to various reasons,<br />

notably among them are the inordinate delay in various clearances <strong>for</strong> the upcoming<br />

hydro projects, suspension / closure of 480 MW Pala Maneri & 381 MW<br />

Bhairoghati projects of State PSU (<strong>UJVN</strong> <strong>Limited</strong>), 600 MW Lohari Nag Pala project of<br />

25

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

NTPC Ltd. by Govt. of India and cancellation of already issued environment clearance<br />

to some Hydroelectric projects. Because of these factors the development of hydro<br />

power projects in the state is not taking place at desired pace. It is pertinent to<br />

mention that due to various environmental, social and religious issues, the<br />

development of hydro power in Uttarakhand state has been greatly hampered.<br />

Several religious agitations against developments of hydro power projects have<br />

resulted in the closure of three a<strong>for</strong>esaid hydro projects in the state and there is a<br />

strong demand <strong>for</strong> closure of other up-coming projects.<br />

Alternate Resources: Development of Gas based thermal power plant<br />

1.4.5 For the reasons listed in the previous section, the State Government is exploring<br />

alternatives to hydro power. In this regard Gas Based Power Projects have been<br />

initiated by the State Government (<strong>UJVN</strong> Ltd, A Govt. Uttarakhand Undertaking) in<br />

joint venture with GAIL (India) Ltd. at Haridwar & Kashipur in Uttarakhand, but<br />

Government of India has in<strong>for</strong>med that they do not have adequate Gas supply and<br />

have expressed its inability to allocate gas to the state <strong>for</strong> generation in near future.<br />

Development of Coal based Power <strong>Plan</strong>t and allocation of Coal Block<br />

1.4.6 Uttarakhand state does not have any coal reserve and no coal block has been<br />

allocated to the state since its <strong>for</strong>mation. Govt. of India has notified a new coal policy<br />

“The Auction by Competitive Bidding of Coal Mines Rules, 2012” on 02-02-2012. As<br />

per the in<strong>for</strong>mation available on different websites, 54 Coal Blocks with total<br />

geological reserves of about 18.22 Billion Tonnes have been identified <strong>for</strong> allocation.<br />

Out of which 16 Blocks with 7.27 BT have been reserved <strong>for</strong> Government owned<br />

companies, 16 Coal Blocks with 8.16 BT <strong>for</strong> power sector companies selected<br />

through tariff based bidding and 22 Blocks with 7.29 BT <strong>for</strong> companies selected<br />

through auction have been earmarked <strong>for</strong> allocation. Allocation of above coal blocks<br />

will start soon.<br />

26

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

1.4.7 In this reference a meeting was held on 11 th May 2012 under the Chairmanship of<br />

Secretary (Coal), GoI to finalize the terms and conditions <strong>for</strong> allocation of Coal Blocks<br />

to Government owned companies through auction by competitive bidding.<br />

Secretary (Coal), GoI has in<strong>for</strong>med that coal blocks <strong>for</strong> Power Sector will be allotted<br />

only through competitive bidding.<br />

Steps Taken For Allocation of Coal Block<br />

1.4.8 Growing demand – supply gap of power is of utmost concern <strong>for</strong> the Government of<br />

Uttarakhand. To bridge the gap, a 2000 MW Coal Based Power Project is required.<br />

1.4.9 In this context a request <strong>for</strong> allocation of coal block <strong>for</strong> 2000 MW Coal Based Power<br />

Project has been made by the Chief Minister of Uttarakhand vide his office letter No.<br />

763/I(2)/2010-05/33/2007, dated 21.04.2010 to the Government of India.<br />

1.4.10 In continuation to above Chief Secretary of Uttarakhand vide letter no.<br />

760/I2/09/2012 dated 10 th May, 2012 has further requested Secretary Coal, GoI <strong>for</strong><br />

allocation of Coal Block <strong>for</strong> setting-up a 2000 MW thermal power plant at pit head<br />

on priority basis.<br />

1.4.11 For development of Coal based Power <strong>Plan</strong>t with Uttar Pradesh (UPPCL), Managing<br />

Director, <strong>UJVN</strong> Ltd. requested vide letter no. 1728/<strong><strong>UJVN</strong>L</strong>/MD/Coal dated<br />

26.04.2012 Chairman and Managing director, UPPCL <strong>for</strong> development of Thermal<br />

Power <strong>Plan</strong>t under joint venture route. In this regard Nigam Official met and<br />

appraised the matter to CMD, UPPCL.. CMD, UPPCL has in<strong>for</strong>med that there is no<br />

coal block left <strong>for</strong> link/tie-up <strong>for</strong> development of Coal based Thermal power plant.<br />

1.4.12 In the Month of February 2012, Managing Director <strong>UJVN</strong> Ltd. discussed the power<br />

scenario of Uttarakhand with Chairman, Jharkhand Electricity Board (JSEB) and<br />

27

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

requested <strong>for</strong> development of a Coal based power plant at pit in Jharkhand.<br />

Chairman, JSEB vide letter no. 60/Ch. Dated 21-03-2012 invited <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong><br />

setting up a coal based thermal power plant in Jharkhand and hydro power project in<br />

the territory of Uttarakhand through joint venture route <strong>for</strong> the mutual benefit of<br />

both states.<br />

1.4.13 JSEB and <strong><strong>UJVN</strong>L</strong> have decided to <strong>for</strong>m a joint working group to go into details of the<br />

modality <strong>for</strong> <strong>for</strong>mation of SPV/ Joint Venture as well as to develop a concept report<br />

on the proposed thermal and hydro power plant. The report of the working group<br />

shall be reviewed by JSEB/<strong><strong>UJVN</strong>L</strong> and shall be put up to their respective Boards/<br />

Government of the states <strong>for</strong> their approval.<br />

1.4.14 <strong>UJVN</strong> Ltd. is also exploring other options <strong>for</strong> allocation of new Coal Blocks as per GoI<br />

Coal Block allotment policy. It is seeking consultancy services <strong>for</strong> “Identification,<br />

Application <strong>for</strong> Allocation and Bidding on behalf of <strong>UJVN</strong> Ltd. <strong>for</strong> coal block as per the<br />

final Terms & Conditions of the Ministry of Coal <strong>for</strong> allotment of Coal Blocks to Govt.<br />

Companies under Auction by Competitive Bidding of Coal Mines Rules 2012 <strong>for</strong> a<br />

2000 MW Pit head coal based power project”. Various options (including case 2 PPP<br />

option) to establish the thermal plant will be explored and evaluated by <strong>UJVN</strong><br />

<strong>Limited</strong> once the coal block is allocated to the state.<br />

Initiative <strong>for</strong> increasing the Power availability <strong>for</strong> state of Uttarakhand<br />

1.4.15 The Government of Uttaranchal has taken initiative to increase the base load power<br />

availability within the state. Consequent to persuasion by GoU the MoP, GoI has<br />

allocated a share of 200 MW in the Ultra Mega Power Project (UMPP) to be<br />

established in the state of Orissa. In this regard <strong><strong>UJVN</strong>L</strong> has paid Rs. 35. 93 Crores to<br />

PFC towards its share of cost of land to be procured <strong>for</strong> the thermal plant. Once the<br />

UMPPP is awarded to the successful bidder this cost will be reimbursed by the<br />

selected bidder.<br />

28

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Alternate Resources: Development of Solar Power <strong>Plan</strong>ts<br />

1.4.16 The Renewable purchase obligation (RPO <strong>for</strong> solar) <strong>for</strong> Uttarakhand as stated in<br />

Uttarakhand Electricity Regulatory Commission (Renewable Purchase Obligation, its<br />

compliance & implementation of REC framework), Regulations 2010 is 0.025% <strong>for</strong><br />

FY2010-11, FY2011-12 & FY2012-13 while <strong>for</strong> the control period i.e. FY2013-14,<br />

FY2014-15 & FY2015-16 the RPO would be 0.050%. For the compliance of this<br />

requirement <strong>UJVN</strong> limited has taken several initiatives.<br />

1.4.17 Order <strong>for</strong> installation of 100 kWp Solar Photo Voltaic (SPV) Power <strong>Plan</strong>t at Ujjwal,<br />

<strong>Dehradun</strong> has been placed with M/s Central Electronics <strong>Limited</strong>, a Public Sector<br />

Enterprise under DSIR of Ministry of Science & Technology, Government of India, on<br />

23.12.2011. Total cost of installation of 100 kWp Solar Photo Voltaic (SPV) Power<br />

<strong>Plan</strong>t at Ujjwal is Rs. 2.73 Crores. For project development Central Financial<br />

Assistance (CFA) of Rs. 2.43 Crores has been sanctioned by MNRE and Rs. 1.20 Crores<br />

has been released by MNRE directly to M/s Central Electronics <strong>Limited</strong> on<br />

02.02.2012. Remaining expenditure will be borne by <strong>UJVN</strong> <strong>Limited</strong>. Solar Photo<br />

Voltaic (SPV) of 100 kWp capacity Power <strong>Plan</strong>t at “ Ujjwal”, <strong>Dehradun</strong> has been<br />

commissioned in the month of December, 2012.<br />

1.4.18 DPRs <strong>for</strong> installation of 50 kWp and 80 kWp Solar Photo Voltaic (SPV) Power <strong>Plan</strong>ts at<br />

Ganga Bhawan and Yamuna Bhawan have been submitted to MNRE <strong>for</strong> Central<br />

Finance Assistance (CFA) <strong>for</strong> funding these projects.<br />

1.4.19 <strong>UJVN</strong> Ltd. also propose to install Solar Photo Voltaic (SPV) Power <strong>Plan</strong>ts in the long<br />

run at various Hydro Electric Projects and their Power Channels. Initial studies have<br />

been made by <strong>UJVN</strong> Ltd. about the possibilities of installation of 0.2 MWp to 5.26<br />

MWp Solar PV Power <strong>Plan</strong>ts at existing Power Stations and capacities ranging from<br />

29

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

1.07 MWp to much higher capacities over canal banks (subject to Forest &<br />

Environment and UPID clearances) have been studied. Installation of Power <strong>Plan</strong>ts<br />

at some of these locations are proposed to be firmed up after seeing the efficacy of<br />

100 kWp Solar Photo Voltaic (SPV) Power <strong>Plan</strong>t commissioned at “Ujjwal" which has<br />

already been taken up is established.<br />

1.4.20 <strong>UJVN</strong> Ltd. as indicated in the above sections is looking at various sources of<br />

generation to augment its existing generation. In the above sections the endeavor of<br />

<strong>UJVN</strong> Ltd. has been to apprise the Commission the status of its initiatives in this<br />

regard. <strong>UJVN</strong> Ltd. shall file be<strong>for</strong>e the Commission the initiatives planned by it as<br />

soon as they take some concrete shape. At that stage <strong><strong>UJVN</strong>L</strong> shall file be<strong>for</strong>e the<br />

Commission technical, financial and commercial details of the project <strong>for</strong> its<br />

approval.<br />

1.4.21 Note on Manpower <strong>Plan</strong>ning of <strong>UJVN</strong> Ltd. during the Control Period is enclosed as<br />

Annexure-16.<br />

30

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

2 CAPITAL EXPENDITURE PLAN –<br />

UPCOMING PROJECTS<br />

31

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

2.1 Vyasi Hydroelectric Project (120 MW)<br />

2.1.1 Background:<br />

2.1.1.1 Vyasi HE Project of 120 MW is located downstream of Lakhwar dam scheme in the<br />

district of <strong>Dehradun</strong> in Uttarakhand. The project is planned to be constructed on<br />

the river Yamuna. The work site is connected with rest of the country through<br />

railways, airport at <strong>Dehradun</strong> and road network.<br />

2.1.1.2 Initially this project was started in 1979 by the State Govt. of Uttar Pradesh. Partial<br />

work on various components of the project such as abutment stripping of Vyasi<br />

dam, excavation of surface powerhouse at Hathiari, HRT and surge shaft had been<br />

carried out. The major civil works on this project was started in 1987 and which<br />

progressed till 1992 but thereafter, all works on this project have been stopped.<br />

2.1.1.3 Later on erstwhile UPSEB prepared a DPR revising the project cost at March 96<br />

price level and submitted to CWC/CEA <strong>for</strong> approval. MOU was signed between<br />

Uttarakhand Government authorities and NHPC on 1 st November 2003 <strong>for</strong><br />

execution of the remaining work. Later on GoU entrusted the implementation of<br />

Lakhwar & Vyasi HE project (420 MW) to <strong>UJVN</strong> <strong>Limited</strong> vide letter No. 1596/ l(2)/<br />

2008-04(8)/ 77/ 2003 dated 23.06.08. <strong>UJVN</strong> <strong>Limited</strong> initiated the process of taking<br />

over the project but NHPC requested GOI and GoU <strong>for</strong> reconsideration of the<br />

decision to take over the project . GoU again vide Letter No. 3326/ I(2)/ 2004-04(8)-<br />

17/ 2008 dated 30.12.08 in<strong>for</strong>med Secretary (Power), GoI of its decision that <strong>UJVN</strong><br />

<strong>Limited</strong> will complete the remaining work of the project and the request of NHPC<br />

<strong>for</strong> reconsideration of this decision may not be considered. The GoU decided to<br />

start construction work at the project immediately.<br />

2.1.2 Capital Expenditure:<br />

32

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

2.1.2.1 The estimated cost of the project at February 2010 price level is Rs. 936.23 Crores<br />

including IDC of 72.51 Crores and Rs. 6.55 Crores of Financing Charges. The project<br />

is estimated to get completed by December 2016. Capital expenditure of Rs. 500<br />

Crores is projected to be incurred during the control period. The year wise phasing<br />

of the capital expenditure during the control period is shown in the table below:<br />

Table 5: Capital Expenditure during Control Period – Vyasi Project<br />

upto<br />

31.03.2013<br />

FY 2013-<br />

14<br />

FY 2014-<br />

15<br />

FY 2015-<br />

16<br />

Rs.Crores<br />

after<br />

31.03.2016 Total<br />

Capital<br />

Expenditure 104.00 100.00 200.00 200.00 332.23 936.23<br />

2.1.2.2 Details of the project cost are provided in the table on next page :<br />

33

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Table 6: Capital Cost – Vyasi Project<br />

VYASI H. E. PROJECT (120 MW), UTTARAKHAND<br />

ABSTRACT OF COST (February 2010)<br />

S. No Description Amount (Rs. in<br />

Crores)<br />

A CIVIL WORKS<br />

1 DIRECT CHARGES<br />

I - Works<br />

A - Preliminary 28.36<br />

B - Land 32.52<br />

C - Works 317.79<br />

J - Power <strong>Plan</strong>t Civil Works 172.57<br />

K - Buildings 19.66<br />

M - <strong>Plan</strong>tation 1.00<br />

O - Miscellaneous 16.61<br />

P - Maintenance During Construction 5.44<br />

Q - Special Tools and <strong>Plan</strong>ts 1.27<br />

R - Communication 34.06<br />

X - Environment and Ecology 23.34<br />

Y - Losses on Stock 1.36<br />

TOTAL OF I - WORKS 653.97<br />

II - Establishment 49.72<br />

III - Tools and <strong>Plan</strong>ts 1.00<br />

IV - Suspense -<br />

V- Receipt & Recoveries -0.94<br />

TOTAL DIRECT CHARGES 703.74<br />

2 INDIRECT CHARGES<br />

I - Capitalised Value of Abatement of Land Revenue 0.36<br />

II - Audit & Accounts Charges 3.27<br />

TOTAL INDIRECT CHARGES 3.63<br />

TOTAL CIVIL WORKS 707.38<br />

B ELECTRICAL WORKS 149.79<br />

TOTAL COST (CIVIL + ELECTRICAL) 857.17<br />

INTEREST DURING CONSTRUCTION 72.51<br />

FINANCING CHARGES 6.55<br />

TOTAL COST INCLUDING IDC & FINANCING CHARGES 936.23<br />

Total 936.23<br />

34

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

2.1.2.3 Economic Analysis<br />

The energy generation from the project with an installed capacity of 120 MW in<br />

stand-alone operation mode is estimated at 375.24 MU in a 90% dependable year<br />

with 95% machine availability and considering aquatic release of 2 cumec<br />

continuously.<br />

Interest rate of 12%, financing charges of 1% of loan amount, RoE of 14%,<br />

depreciation is considered same as repayment schedule and O&M charges of<br />

1.5% of capital cost is assumed. Based on the above assumptions, Levellised tariff<br />

in this mode from the project works out as Rs. 4.19 per unit (with 10.74%<br />

discounting factor).<br />

The detailed working of the economic analysis is provided in Detailed Project<br />

Report.<br />

2.1.2.4 Status Update of Capital Expenditure:<br />

Environment clearance received <strong>for</strong> Vyasi Power Station has been transferred<br />

in favour of <strong>UJVN</strong> <strong>Limited</strong> by MOEF on 22.04.2010 after NHPC conveyed its<br />

NOC <strong>for</strong> the same.<br />

The case <strong>for</strong> transfer of Forest land in favour of <strong>UJVN</strong> <strong>Limited</strong> from Irrigation<br />

Department has since been processed and recommended at State level on<br />

05.06.2012 <strong>for</strong> sending the proposal to MoEF, GOI <strong>for</strong> according final<br />

approval. The case has been submitted in MoEF on 14.06.2012. The proposal<br />

was discussed in the meeting of Forest Advisory Committee held on<br />

17.08.2012. FAC has recommended the transfer of land in favour of <strong>UJVN</strong><br />

<strong>Limited</strong> from Irrigation Department with certain conditions.<br />

The case <strong>for</strong> preparing Forest Proposal <strong>for</strong> diversion of additional Forest land<br />

in River bed area and area above underground works has been started.<br />

35

<strong>Business</strong> <strong>Plan</strong> of <strong>UJVN</strong> <strong>Limited</strong> <strong>for</strong> Control Period<br />

Earlier an R&R package was decided by GoU <strong>for</strong> Lakhwar Vyasi Project and<br />

provided to NHPC in August, 2004. Later in May, 2008 an R&R proposal <strong>for</strong><br />

projects of <strong>UJVN</strong> <strong>Limited</strong> was submitted to GoU <strong>for</strong> approval. Based on the<br />

above R&R package <strong>for</strong> Vyasi Project is to be finalised by the GoU.<br />

The supplementary agreement was <strong>for</strong>mally executed between UJVL <strong>Limited</strong><br />

and M/s NPCC <strong>Limited</strong> on 06.03.2012.<br />

The prequalification of contractors <strong>for</strong> Dam & associated structures has been<br />