Bidder's Statement - Peabody Energy

Bidder's Statement - Peabody Energy Bidder's Statement - Peabody Energy

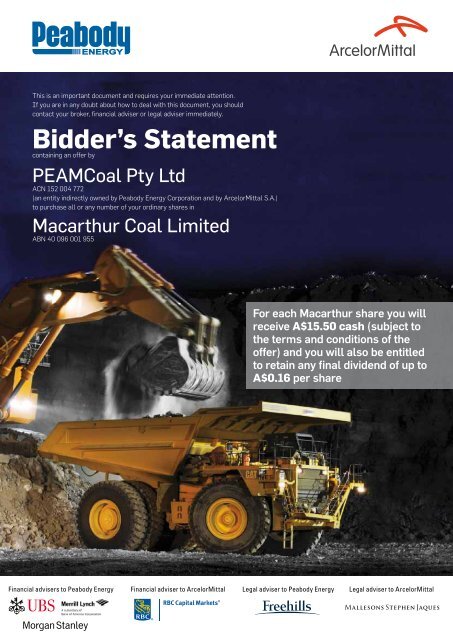

This is an important document and requires your immediate attention. If you are in any doubt about how to deal with this document, you should contact your broker, financial adviser or legal adviser immediately. Bidder’s Statement containing an offer by PEAMCoal Pty Ltd ACN 152 004 772 (an entity indirectly owned by Peabody Energy Corporation and by ArcelorMittal S.A.) to purchase all or any number of your ordinary shares in Macarthur Coal Limited ABN 40 096 001 955 For each Macarthur share you will receive A$15.50 cash (subject to the terms and conditions of the offer) and you will also be entitled to retain any final dividend of up to A$0.16 per share Financial advisers to Peabody Energy Financial adviser to ArcelorMittal Legal adviser to Peabody Energy Legal adviser to ArcelorMittal

- Page 2 and 3: important notices Nature of this do

- Page 4 and 5: Table of contents 1 Why you should

- Page 7 and 8: 1 Why you should accept the Offer 1

- Page 9 and 10: In contrast, if you accept the Offe

- Page 11 and 12: 1.4 You will still receive value fo

- Page 13 and 14: 3 Information on PEAMCoal 3.1 Overv

- Page 15 and 16: 4 Information on Peabody Energy 4.1

- Page 17 and 18: The table below presents informatio

- Page 19 and 20: William C. Rusnack, Independent Dir

- Page 21 and 22: Six months ended 30 June 2011 (US$

- Page 23 and 24: The map below displays ArcelorMitta

- Page 25 and 26: ecame Vice President for Finance te

- Page 27 and 28: Consolidated 6 months ended 30 June

- Page 29 and 30: 6 Information on Macarthur 6.1 Impo

- Page 31 and 32: 7 Sources of consideration 7.1 Maxi

- Page 33 and 34: 8 Intentions in relation to Macarth

- Page 35 and 36: ArcelorMittal nominees on the Macar

- Page 37 and 38: 10 Other material information 10.1

- Page 39 and 40: Group member will be entitled to pu

- Page 41 and 42: make any statement in this Bidder

- Page 43 and 44: eceived by PEAMCoal at the delivery

- Page 45 and 46: (e) Macarthur register of members (

- Page 47 and 48: (2) without limiting section 11.7(i

- Page 49 and 50: 12 Definitions and interpretation 1

- Page 51 and 52: Term Peabody Energy Peabody Energy

This is an important document and requires your immediate attention.<br />

If you are in any doubt about how to deal with this document, you should<br />

contact your broker, financial adviser or legal adviser immediately.<br />

Bidder’s <strong>Statement</strong><br />

containing an offer by<br />

PEAMCoal Pty Ltd<br />

ACN 152 004 772<br />

(an entity indirectly owned by <strong>Peabody</strong> <strong>Energy</strong> Corporation and by ArcelorMittal S.A.)<br />

to purchase all or any number of your ordinary shares in<br />

Macarthur Coal Limited<br />

ABN 40 096 001 955<br />

For each Macarthur share you will<br />

receive A$15.50 cash (subject to<br />

the terms and conditions of the<br />

offer) and you will also be entitled<br />

to retain any final dividend of up to<br />

A$0.16 per share<br />

Financial advisers to <strong>Peabody</strong> <strong>Energy</strong> Financial adviser to ArcelorMittal Legal adviser to <strong>Peabody</strong> <strong>Energy</strong> Legal adviser to ArcelorMittal

important notices<br />

Nature of this document<br />

This document is a replacement Bidder’s <strong>Statement</strong> and is issued<br />

by PEAMCoal Pty Ltd ACN 152 004 772 under Part 6.5 of the<br />

Corporations Act (as amended by ASIC Class Order 00/344).<br />

This replacement Bidder’s <strong>Statement</strong> is dated 15 August 2011 and<br />

a copy of this replacement Bidder’s <strong>Statement</strong> was lodged with ASIC<br />

on 15 August 2011. This replacement Bidder’s <strong>Statement</strong> replaces<br />

the original Bidder’s <strong>Statement</strong> lodged with ASIC on 4 August 2011.<br />

References in this document to ‘the date of this Bidder’s <strong>Statement</strong>’<br />

(or similar) should be read as references to 4 August 2011.<br />

Neither ASIC nor its officers take any responsibility for the content<br />

of this Bidder’s <strong>Statement</strong>.<br />

No account of your personal circumstances<br />

In preparing this Bidder’s <strong>Statement</strong>, none of PEAMCoal, PEAMCoal<br />

Holdings, <strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal have taken into account<br />

the individual objectives, financial situation or needs of individual<br />

Macarthur Shareholders. Accordingly, before making a decision<br />

whether or not to accept the Offer, you may wish to consult with your<br />

financial or other professional adviser.<br />

Disclaimer as to forward looking statements<br />

Some of the statements appearing in this Bidder’s <strong>Statement</strong> may<br />

be in the nature of forward looking statements. You should be aware<br />

that such statements are either statements of current expectations<br />

or predictions and are subject to inherent risks and uncertainties.<br />

Those risks and uncertainties include factors and risks specific to the<br />

industry in which the members of the Macarthur Group, the members<br />

of the <strong>Peabody</strong> Group and the members of the ArcelorMittal Group<br />

operate as well as general economic conditions, prevailing exchange<br />

rates and interest rates and conditions in financial markets. Actual<br />

events or results may differ materially from the events or results<br />

expressed or implied in any forward looking statement. None of<br />

PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal,<br />

the officers or employees of PEAMCoal, PEAMCoal Holdings,<br />

<strong>Peabody</strong> <strong>Energy</strong> or ArcelorMittal, any persons named in this<br />

Bidder’s <strong>Statement</strong> with their consent or any person involved in the<br />

preparation of this Bidder’s <strong>Statement</strong>, makes any representation<br />

or warranty (express or implied) as to the accuracy or likelihood of<br />

fulfilment of any forward looking statement, or any events or results<br />

expressed or implied in any forward looking statement, except to the<br />

extent required by law. You are cautioned not to place undue reliance<br />

on any forward looking statement. The forward looking statements in<br />

this Bidder’s <strong>Statement</strong> reflect views held only as at the date of this<br />

Bidder’s <strong>Statement</strong>.<br />

Disclaimer as to Macarthur information<br />

The information on Macarthur, Macarthur’s securities and the<br />

Macarthur Group contained in this Bidder’s <strong>Statement</strong> has been<br />

prepared by PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> and<br />

ArcelorMittal using publicly available information.<br />

Information in this Bidder’s <strong>Statement</strong> concerning Macarthur,<br />

Macarthur’s securities and the Macarthur Group and the assets<br />

and liabilities, financial position and performance, profits and losses<br />

and prospects of the Macarthur Group has not been independently<br />

verified by PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong> <strong>Energy</strong> and<br />

ArcelorMittal. Accordingly, PEAMCoal, PEAMCoal Holdings, <strong>Peabody</strong><br />

<strong>Energy</strong> and ArcelorMittal do not, subject to the Corporations Act,

Key dates<br />

Date original Bidder’s <strong>Statement</strong> was lodged with ASIC 4 August 2011<br />

Date replacement Bidder’s <strong>Statement</strong> was lodged with ASIC 15 August 2011<br />

Date of Offer and Offer opens 18 August 2011<br />

Date Offer closes (unless extended or withdrawn) 7.00pm (Brisbane time) on 20 September 2011<br />

Key Contacts<br />

Share registrar for the Offer<br />

Link Market Services Limited<br />

PEAMCoal Offer Information Line*<br />

• 1800 992 039 (for callers within Australia)<br />

• +61 2 8280 7692 (for callers outside Australia)<br />

* Calls to these numbers may be recorded<br />

make any representation or warranty, express or implied, as to the<br />

accuracy or completeness of such information.<br />

Further information relating to Macarthur’s business may be included<br />

in Macarthur’s target’s statement which Macarthur must provide to<br />

Macarthur’s Shareholders in response to this Bidder’s <strong>Statement</strong>.<br />

Foreign jurisdictions<br />

The distribution of this Bidder’s <strong>Statement</strong> in jurisdictions outside<br />

Australia may be restricted by law, and persons who come into<br />

possession of it should seek advice on and observe any such<br />

restrictions. Any failure to comply with such restrictions may<br />

constitute a violation of applicable securities laws. This Bidder’s<br />

<strong>Statement</strong> does not constitute an offer in any jurisdiction in which, or<br />

to any person to whom, it would not be lawful to make such an offer.<br />

Responsibility statement<br />

The information in this Bidder’s <strong>Statement</strong> has been prepared by<br />

PEAMCoal and is the responsibility of PEAMCoal, except for the<br />

ArcelorMittal Information, which has been prepared by ArcelorMittal<br />

and the <strong>Peabody</strong> <strong>Energy</strong> Information which has been prepared<br />

by <strong>Peabody</strong> <strong>Energy</strong>. ArcelorMittal takes sole responsibility for the<br />

ArcelorMittal Information. <strong>Peabody</strong> <strong>Energy</strong> takes sole responsibility for<br />

the <strong>Peabody</strong> <strong>Energy</strong> Information.<br />

No director, officer, employee or adviser of PEAMCoal, PEAMCoal<br />

Holdings or of any member of the <strong>Peabody</strong> Group, assumes any<br />

responsibility for the ArcelorMittal Information. No director, officer,<br />

employee or adviser of any member of the ArcelorMittal Group<br />

assumes any responsibility for any information other than the<br />

ArcelorMittal Information.<br />

No director, officer, employee or adviser of PEAMCoal, PEAMCoal<br />

Holdings or any member of the ArcelorMittal Group, assumes any<br />

responsibility for the <strong>Peabody</strong> <strong>Energy</strong> Information. No director, officer,<br />

employee or adviser of any member of the <strong>Peabody</strong> Group (other<br />

than PEAMCoal) assumes any responsibility for any information other<br />

than the <strong>Peabody</strong> <strong>Energy</strong> Information.<br />

Privacy<br />

PEAMCoal has collected your information from the Macarthur<br />

Register for the purpose of making this Offer and, if accepted,<br />

administering your holding of Shares and your acceptance of<br />

the Offer. The type of information PEAMCoal has collected about<br />

you includes your name, contact details and information on your<br />

shareholding in Macarthur. Without this information, PEAMCoal would<br />

be hindered in its ability to carry out the Offer. The Corporations<br />

Act requires the name and address of shareholders to be held in a<br />

public register. Your information may be disclosed on a confidential<br />

basis to PEAMCoal’s Related Bodies Corporate and external service<br />

providers, and may be required to be disclosed to regulators such as<br />

ASIC. The registered address of PEAMCoal is Level 13, BOQ Centre,<br />

259 Queen Street, Brisbane, Queensland 4000.<br />

Defined terms<br />

A number of defined terms are used in this Bidder’s <strong>Statement</strong>.<br />

Unless the contrary intention appears, the context requires otherwise<br />

or capitalised words are defined in section 12 of this Bidder’s<br />

<strong>Statement</strong>, words and phrases in this Bidder’s <strong>Statement</strong> have the<br />

same meaning and interpretation as in the Corporations Act.<br />

Maps and diagrams<br />

Any diagrams and maps appearing in this Bidder’s <strong>Statement</strong><br />

are illustrative only and may not be drawn to scale. Unless stated<br />

otherwise, all data contained in charts, maps, graphs and tables is<br />

based on information available at the date of this Bidder’s <strong>Statement</strong>.<br />

1

Table of<br />

contents<br />

1 Why you should accept the Offer 5<br />

2 Summary of the Offer 10<br />

3 Information on PEAMCoal 11<br />

4 Information on <strong>Peabody</strong> <strong>Energy</strong> 13<br />

5 Information on ArcelorMittal 20<br />

6 Information on Macarthur 27<br />

7 Sources of consideration 29<br />

8 Intentions in relation to Macarthur 31<br />

9 Tax considerations 34<br />

10 Other material information 35<br />

11 The terms and conditions of the Offer 40<br />

12 Definitions and interpretation 47<br />

13 Approval of Bidder’s <strong>Statement</strong> 51<br />

2

letter to<br />

shareholders<br />

4 August 2011<br />

Dear Macarthur shareholders<br />

Offer to acquire your shares in Macarthur Coal Limited<br />

On behalf of <strong>Peabody</strong> <strong>Energy</strong> and ArcelorMittal, we are pleased to enclose an offer from PEAMCoal to acquire all of your shares in<br />

Macarthur Coal. PEAMCoal is indirectly owned 60% by <strong>Peabody</strong> <strong>Energy</strong> and 40% by ArcelorMittal.<br />

If you accept our offer, which we announced on 1 August 2011, you will receive A$15.50 in cash for each share in Macarthur that you hold,<br />

subject to our offer becoming unconditional.<br />

As a Macarthur shareholder, you will also be entitled to retain any final dividend declared by Macarthur for the financial year ended<br />

30 June 2011, up to A$0.16 per share for holdings as at the dividend record date, without there being any reduction in the cash payment<br />

under our offer. 1<br />

We believe that our offer, which represents a total cash value of A$15.66 per share, is compelling and represents outstanding value for your<br />

shares. It fully recognises Macarthur’s existing operations as well as its growth prospects and offers you certainty, liquidity and a significant<br />

premium. Quite simply, we believe it offers you greater value than Macarthur has to date been able to deliver.<br />

Macarthur shares have substantially underperformed other Australian resource stocks, despite rising coal prices and record demand. Our offer<br />

provides you with a substantial premium over Macarthur’s relevant trading ranges not only in its recent history, but over an extended time frame.<br />

In fact, over the 12 months before our proposed offer was announced, Macarthur’s share price declined by more than 17% while the S&P/ASX<br />

200 Resources Index rose by nearly 13%, meaning Macarthur underperformed its resources peers by approximately 30%.<br />

The total cash value of A$15.66 per share, represents a:<br />

• 41% premium to the closing price of the Macarthur shares prior to the Initial Announcement on 11 July 2011; 2<br />

• 45% premium to the 1 month volume weighted average price of the Macarthur shares up to and including 11 July 2011;<br />

• 38% premium to the 3 month volume weighted average price of the Macarthur shares up to and including 11 July 2011; and<br />

• 30% premium to the 12 month volume weighted average price of the Macarthur shares up to and including 11 July 2011.<br />

You should also know that, as at the date of this Bidder’s <strong>Statement</strong>, PEAMCoal has a relevant interest in approximately 16.1% of the<br />

Macarthur shares as ArcelorMittal has agreed to accept the offer in respect of its entire holding of Macarthur shares. For this offer to meet the<br />

50.01% minimum acceptance condition, PEAMCoal only requires an additional 34% of the shares in Macarthur.<br />

The cash value of the offer should be considered against the risks and uncertainties currently borne by you as a shareholder. If you do not<br />

accept the offer, and it becomes unconditional, you may become a minority shareholder in Macarthur. This may have several implications<br />

for you, including reduced liquidity in the shares and a reduced ability for you to sell your shares. Moreover, in the absence of our offer, it is<br />

expected that the shares will trade below the offer price and closer to the trading levels prior to our proposal announcement on 11 July 2011.<br />

Details of our offer, including its terms and conditions, are set out in this Bidder’s <strong>Statement</strong>. We encourage you to read this document in its<br />

entirety, together with the target’s statement, and then to accept the offer as soon as possible. In order to be valid, your acceptance must be<br />

received before 7.00pm (Brisbane time) on 20 September 2011, which, unless extended, will be the closing date of the offer.<br />

To accept the offer, please follow the instructions on the accompanying Acceptance Form. If you require additional assistance, please call the<br />

PEAMCoal Offer Information Line on 1800 992 039 (for callers within Australia) or +61 2 8280 7692 (for callers outside Australia).<br />

We appreciate your consideration of our offer and look forward to the prospect of delivering significant shareholder value to you.<br />

Gregory H. Boyce<br />

Chairman and Chief Executive Officer<br />

<strong>Peabody</strong> <strong>Energy</strong> Corporation<br />

Aditya Mittal<br />

Chief Financial Officer and Member of the Group Management Board<br />

ArcelorMittal S.A.<br />

1 <br />

Persons who acquire Macarthur shares on-market on or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those shares even if they are on<br />

Macarthur’s register of members in respect of those shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each<br />

such share so acquired, subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of<br />

this dividend (if any). The actual amount of the dividend could be higher or lower than A$0.16 per share. If it is higher than A$0.16 per share the cash amount payable under our offer<br />

of A$15.50 per share will be reduced by the amount of the excess. If it is lower than A$0.16 per share, the A$15.66 per share amount mentioned in this letter will be reduced by the<br />

difference between A$0.16 and the actual amount of the dividend.<br />

2 <br />

The date of 11 July 2011 was the date on which Macarthur first announced the proposed takeover approach from <strong>Peabody</strong> <strong>Energy</strong> and ArcelorMittal. This page contains references to<br />

trading data prepared by IRESS Market Technology Limited (ACN 060 313 359) who has not consented to the use of references to that trading data in this Bidder’s <strong>Statement</strong>. The above<br />

values are based on the Offer Value of A$15.66, a closing price of Macarthur shares on the ASX on 11 July 2011 of A$11.08, a 1 month volume weighted average price of A$10.82 and a<br />

3 month volume weighted average price of A$11.32, and 12 month volume weighted average price of A$12.02.<br />

3

1 Why you should accept the Offer<br />

1<br />

THE<br />

2<br />

ACCEPTING<br />

3<br />

THE<br />

4<br />

YOU<br />

5<br />

MACARTHUR’S<br />

6<br />

THERE<br />

7<br />

THERE<br />

OFFER REPRESENTS A<br />

SIGNIFICANT PREMIUM TO BOTH<br />

RECENT TRADING PRICES OF THE<br />

SHARES AND TRADING RANGES<br />

OVER AN EXTENDED TIME FRAME.<br />

THE OFFER PROVIDES<br />

FULL CASH CONSIDERATION AND<br />

CERTAIN VALUE FOR YOUR SHARES.<br />

OFFER IS SUBSTANTIALLY<br />

HIGHER THAN EQUITY ANALYSTS’<br />

VALUATIONS OF THE SHARES. 3<br />

WILL STILL HAVE THE<br />

OPPORTUNITY TO RECEIVE AND<br />

RETAIN additional VALUE<br />

FOR ANY FINAL FY11 DIVIDEND<br />

DECLARED UP TO AN AMOUNT<br />

EQUAL TO A$0.16 PER SHARE.<br />

SHARE PRICE<br />

MAY FALL IF THE OFFER IS<br />

UNSUCCESSFUL.<br />

ARE RISKS ASSOCIATED<br />

WITH REMAINING As a MINORITY<br />

INVESTOR IN MACARTHUR.<br />

ARE NO COMPETING<br />

PROPOSALS AVAILABLE FOR YOUR<br />

SHARES AT THIS TIME.<br />

3<br />

See section 1.3.<br />

5

1 Why you should accept the Offer<br />

1.1 The Offer represents a significant premium to recent trading prices<br />

The all cash consideration being offered by PEAMCoal is a compelling offer and represents a substantial premium to the levels at which the<br />

Shares were trading prior to the Initial Announcement on 11 July 2011.<br />

The Offer Value of A$15.66 per Share (which comprises the Offer consideration of A$15.50 per Share plus an assumed final dividend from<br />

Macarthur for the financial year ended 30 June 2011 of A$0.16 per Share) represents a premium of:<br />

• 41% to A$11.08, the closing price of the Shares on the ASX on 11 July 2011 (being the date of the Initial Announcement);<br />

• 45% to A$10.82, the 1 month VWAP of the Shares on the ASX up to and including 11 July 2011;<br />

• 38% to A$11.32, the 3 month VWAP of the Shares on the ASX up to and including 11 July 2011;<br />

• 30% to A$12.02, the 12 month VWAP of the Shares on the ASX up to and including 11 July 2011; and<br />

• 36% to A$11.50, the per Share price at which Macarthur raised equity in August 2010. 4<br />

Figure 1: Offer premia relative to recent Macarthur trading prices<br />

16<br />

Offer Value = A$15.66/Share<br />

14<br />

12<br />

41% 45% 38%<br />

30% 36%<br />

A$/Share<br />

10<br />

8<br />

6<br />

11.08 10.82 11.32 12.02 11.50<br />

15.66<br />

A$15.50 Offer<br />

price + A$0.16<br />

dividend<br />

4<br />

2<br />

0<br />

Closing<br />

price 11<br />

July 2011 (1)<br />

1 month<br />

VWAP (2)<br />

3 month<br />

VWAP (3)<br />

12 month<br />

VWAP (4)<br />

August<br />

2010<br />

equity<br />

raising<br />

price<br />

Offer Value<br />

Source: IRESS. 5<br />

Notes:<br />

(1) Being the last trading day prior to the release of the Initial Announcement.<br />

(2) VWAP of Shares over 1 month prior to the release of the Initial Announcement (from 13 June 2011 to 11 July 2011).<br />

(3) VWAP of Shares over 3 months prior to the release of the Initial Announcement (from 12 April 2011 to 11 July 2011).<br />

(4) VWAP of Shares over 12 months prior to the release of the Initial Announcement (from 12 July 2010 to 11 July 2011).<br />

1.2 Full and certain cash consideratioN<br />

PEAMCoal believes that the Offer represents full and fair value for Your Shares.<br />

The certainty of receiving the Offer Value of A$15.66 cash per Share should be compared to the external and company specific risks and<br />

uncertainties which Macarthur may be subject to that could affect the trading price of the Shares.<br />

These risks and uncertainties include, but are not limited to:<br />

• coal price risk;<br />

• foreign exchange risk;<br />

• exploration, development and operational risk;<br />

• the uncertainties around the ability of Macarthur’s assets to generate anticipated cashflows and the related impact on dividends;<br />

• regulatory risk, including the introduction of the proposed minerals resource rent tax and the proposed carbon tax;<br />

• the uncertainties relating to the MDL 162 Litigation and the Monto Claims; and<br />

• equity market risk, including the uncertainty as to the prices at which Shares will trade in the absence of the Offer.<br />

4<br />

Noting the comments in footnote 1 of this Bidder’s <strong>Statement</strong>, the corresponding premia numbers based solely on the Offer consideration of A$15.50 per Share, are 40% to the closing<br />

price of the Shares on the ASX on 11 July 2011, 43% to the 1 month VWAP of the Shares on the ASX up to and including 11 July 2011, 37% to the 3 month VWAP of the Shares on<br />

the ASX up to and including 11 July 2011, 29% to the 12 month VWAP of the Shares on the ASX up to and including 11 July 2011 and 35% to A$11.50, the per Share price at which<br />

Macarthur raised equity in August 2010.<br />

5<br />

This section 1 contains various references to trading data prepared by IRESS Market Technology Limited (ACN 060 313 359) who has not consented to such use of references to that<br />

trading data.<br />

6

In contrast, if you accept the Offer, and the Offer becomes unconditional, you will receive assured value for your investment and you will transfer<br />

to PEAMCoal all the potential risks and uncertainties inherent in Macarthur and its assets.<br />

The risks and uncertainties you will avoid by accepting the Offer include:<br />

(a) Operational and marketing risk: Unexpected operational and marketing issues, such as adverse weather events (including the recent<br />

floods in Queensland) and a reduction in global demand for low volatile pulverised coal injection coal (LV PCI), have historically affected<br />

Macarthur’s operations due to their lack of geographical and product diversification. There is a risk that further such issues could impact<br />

Macarthur’s operations and earnings in the future.<br />

(b) Coal price and foreign exchange volatility: Macarthur’s coal sales are generally priced in US dollars. Macarthur is therefore exposed to<br />

fluctuations in coal prices and foreign exchange rates. Although quarterly LV PCI contracts have recently been agreed at historically high<br />

prices, coal prices remain volatile and there is no assurance they will remain at high levels.<br />

(c) Management performance risk: Macarthur management has not delivered on key targets over recent years, and there is a risk<br />

that continued setbacks will erode Shareholder value. Over the 12 months prior to the Initial Announcement, Macarthur substantially<br />

underperformed the broader Australian resources sector, as demonstrated in Figure 2 below. From 12 July 2010 to 11 July 2011, the<br />

Macarthur share price declined by 17.3% while the S&P/ASX 200 Resources Index rose by 12.8% meaning Macarthur underperformed its<br />

resources peers by more than 30%.<br />

Figure 2: Macarthur share price underperformed the S&P/ASX 200 Resources Index by approximately 30% over the past year (1)<br />

18<br />

16<br />

A$/Share<br />

14<br />

30% Macarthur<br />

underperformance<br />

+12.8%<br />

12<br />

–17.3%<br />

10<br />

Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

S&P/ASX 200 Resources (rebased)<br />

Macarthur<br />

Source: IRESS.<br />

Note:<br />

(1) Over 12 months prior to the making of the Initial Announcement, from 12 July 2010 to 11 July 2011.<br />

PEAMCoal believes that this share price underperformance has been driven by, amongst other things, Macarthur persistently falling short of<br />

earnings and growth targets. For example:<br />

• Macarthur has fallen short of its original production guidance for four of the past five years;<br />

• ongoing delays reaching first large scale production from Middlemount, which Macarthur originally planned for late 2009, 6 but is now<br />

expected in 2012;<br />

• downgrades to core earnings and production forecasts during FY11;<br />

• selection of the fourth mine (Codrilla) announced 5 months behind schedule in May 2011; and<br />

• failure to complete the acquisition of mining lease MDL162 as planned (refer to section 6.5(e) below).<br />

6<br />

Macarthur’s December 2007 Half Year Results Presentation dated 27-29 February 2008 as released to the ASX on 27 February 2008 and which is available at www.asx.com.au.<br />

7

As demonstrated in Figure 3, Macarthur management has continued to project production growth which has failed to materialise since 2006 –<br />

even after disregarding the impact of the severe weather on FY11 production.<br />

Figure 3: Macarthur saleable production since 2006<br />

Attributable production (Mt)<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

5.0<br />

2006 - 2010 CAGR = 0%<br />

3.6 3.5<br />

4.7<br />

5.0<br />

3.8<br />

0.0<br />

FY2006 FY2007 FY2008 FY2009 FY2010 FY2011<br />

Source: Macarthur ASX filings.<br />

(d) Development risk: While Macarthur has recently announced the selection of Codrilla as the fourth mine and has a portfolio of preproduction<br />

assets across Queensland, there are substantial uncertainties associated with greenfield mine development and there is no<br />

guarantee that Macarthur will be able to develop Codrilla, or any of the other projects, in the near future, if at all. If that development is<br />

delayed, Macarthur may face liabilities under its port and rail take-or-pay obligations.<br />

Furthermore, in August 2010, Macarthur announced its intention to acquire a controlling interest in MDL162, a pre-production project in the<br />

Bowen Basin, by providing a loan of approximately A$360 million which would be converted into equity in the company holding the licence.<br />

Macarthur has announced that it is now facing difficulty in converting this loan into equity. Accordingly, there is a risk that Macarthur will not<br />

be able to convert the loan into equity or receive full repayment of the loan. See section 6.5(e) for further details.<br />

(e) Funding risk: Development of Macarthur’s projects pipeline will require significant investment in exploration, feasibility studies and mine<br />

construction. This expenditure may exceed Macarthur’s cash reserves and operating cashflows, and therefore Macarthur could be required to<br />

seek debt funding or raise equity from existing or new shareholders. Macarthur’s ability to secure this funding is not guaranteed, which could<br />

cause the deferral of development projects and any future funding arrangements could potentially dilute existing Macarthur Shareholders.<br />

(f) Regulatory risk: The introduction of the proposed minerals resource rent tax and the proposed carbon tax could have a negative effect on<br />

Macarthur’s future earnings and impact the value of the Shares. 7<br />

(g) Litigation risk: Macarthur and two of its subsidiaries, Monto Coal Pty Ltd and Monto Coal 2 Pty Ltd, have been served with a statement of<br />

claim in relation to proceedings commenced in the Supreme Court of Queensland in 2007 by three joint venture participants in the Monto Coal<br />

joint venture. The claim is for damages of not less than A$1.19 billion for breach of contract plus interest and expenses. Whilst Macarthur has<br />

stated that it believes the claims to be unfounded, there is a risk that the outcome of the litigation could be unfavourable to Macarthur.<br />

1.3 The Offer is substantially higher than equity analysts’ valuations of Macarthur<br />

The Offer Value of A$15.66 per Share is 30% higher than the median equity analyst net asset value of Macarthur of A$12.05 per Share.<br />

The median equity analyst valuation of A$12.05 per Share was calculated using the valuations of 15 brokers, and the value in those brokers’<br />

reports range between A$10.50 and A$16.01 per Share. These valuations were published in reports that were released between 11 May 2011 and<br />

26 July 2011. To PEAMCoal’s knowledge, these are the most recent analyst valuations published before the date of this Bidder’s <strong>Statement</strong>.<br />

Figure 4: Premium to median analyst valuation<br />

15.00<br />

30% premium<br />

12.00<br />

A$/Share<br />

9.00<br />

6.00<br />

12.05<br />

15.66<br />

3.00<br />

0.00<br />

Median Equity Analyst Valuation<br />

Offer Value<br />

7<br />

Macarthur has included an estimate of the impact of the proposed carbon tax on page 11 of its June 2011 quarterly report, a copy of which was released to the ASX on 25 July 2011<br />

and which is available at www.asx.com.au. PEAMCoal notes that such forward looking statements are the sole responsibility of Macarthur and PEAMCoal makes no comment on their<br />

accuracy or otherwise.<br />

8

1.4 You will still receive value for any final dividend declared<br />

Macarthur Shareholders will be entitled to retain any final dividend declared by Macarthur in respect of the financial year ended 30 June 2011,<br />

up to an amount equal to A$0.16 per Share, in respect of the Shares of which they are the registered holder as at the record date for the<br />

dividend, without there being any reduction in the consideration payable under the Offer. 8<br />

1.5 Macarthur’s share price may fall if the Offer is not successful<br />

If the Offer does not proceed, and no other offers are made for the Shares, it is expected that Macarthur’s share price will fall below the Offer<br />

Value. Since May 2010, following the Macarthur Board’s rejection of <strong>Peabody</strong> <strong>Energy</strong>’s proposal, Macarthur shares traded persistently below<br />

the then proposed A$15.00 per Share cash price. As demonstrated in Figure 5 below, the Shares did not trade above A$15.00 between the<br />

date of withdrawal of <strong>Peabody</strong> <strong>Energy</strong>’s proposal and the date of the Initial Announcement.<br />

Figure 5: Macarthur 18 month Share price performance 9<br />

18<br />

16<br />

Previous <strong>Peabody</strong> <strong>Energy</strong><br />

proposal announced<br />

Offer Value = A$15.66/Share<br />

A$/Share<br />

14<br />

12<br />

10<br />

Macarthur Board rejection of<br />

previous <strong>Peabody</strong> <strong>Energy</strong> proposal<br />

8<br />

Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

Source: IRESS.<br />

1.6 Implications of remaining as a minority shareholder of Macarthur<br />

As PEAMCoal already has a Relevant Interest in 16.1% of the Shares as a result of the Pre-Bid Acceptance Deed, Shareholders holding only<br />

34% of the Shares are required to accept the Offer for the Offer to be successful and for PEAMCoal to become a majority shareholder in<br />

Macarthur. 10 If PEAMCoal becomes a majority shareholder in Macarthur, but Macarthur remains a listed company, the market for Your Shares<br />

may be less liquid or less active than at present. Therefore, if you do not accept the Offer, it could be more difficult for you to sell Your Shares<br />

at a later time. The smaller free float may also result in the removal of Macarthur from some S&P/ASX indices.<br />

If PEAMCoal becomes a majority shareholder in Macarthur, subject to the spread and number of remaining Macarthur Shareholders and the<br />

requirements in the Listing Rules, it intends to seek to remove Macarthur’s listing on the ASX.<br />

1.7 The only available offer for Your Shares<br />

PEAMCoal is not aware of any competing proposals for Your Shares as at the date of this Bidder’s <strong>Statement</strong>.<br />

8<br />

Persons who acquire Shares on-market or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those Shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the Offer of A$15.50 per Share will<br />

be reduced by the amount of the excess. . If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference<br />

between A$0.16 and the actual amount of the dividend.<br />

9<br />

From 12 January 2010 to 11 July 2011.<br />

10<br />

Subject to all other conditions in section 11.7 being fulfilled or freed.<br />

9

2 Summary of the Offer<br />

What PEAMCoal is<br />

offering to buy?<br />

Who is PEAMCoal?<br />

What you will receive if<br />

you accept the Offer?<br />

What is your entitlement<br />

to Macarthur’s FY11<br />

final dividend?<br />

When will you be paid?<br />

When does the Offer<br />

close?<br />

What are the conditions<br />

to the Offer?<br />

How do you accept the<br />

Offer?<br />

Where do you go for<br />

further information?<br />

Important notice<br />

PEAMCoal is offering to buy all of the Shares on the terms and conditions set out in this Bidder’s <strong>Statement</strong>.<br />

You may accept this Offer for all or any number of Your Shares.<br />

PEAMCoal is an entity that is indirectly owned 60% by <strong>Peabody</strong> <strong>Energy</strong> and 40% by ArcelorMittal.<br />

If you accept the Offer, subject to the conditions to the Offer being fulfilled or freed, you will receive A$15.50 cash<br />

for each of Your Shares accepted.<br />

In addition to the Offer price referred to above, you will also be entitled to retain any final dividend declared by<br />

Macarthur in respect of the financial year ended 30 June 2011, up to an amount equal to A$0.16 per Share,<br />

in respect of Shares of which you are the registered holder as at the record date for the dividend, without there<br />

being any reduction in the consideration payable under the Offer. 11<br />

Generally, PEAMCoal will pay the consideration due to you under the Offer on or before the earlier of:<br />

• one month after this Offer is accepted or one month after all of the conditions have been freed or fulfilled<br />

(whichever is the later); and<br />

• 21 days after the end of the Offer Period.<br />

Full details of when payments will be made are set out in section 11.6 of this Bidder’s <strong>Statement</strong>.<br />

The Offer closes at 7.00pm (Brisbane time) on 20 September 2011, unless it is extended or withdrawn<br />

under the Corporations Act.<br />

The Offer is subject to a number of conditions, including the following conditions:<br />

• PEAMCoal acquiring a Relevant Interest in excess of 50.01% of all Shares;<br />

• all required regulatory approvals being obtained;<br />

• no material adverse change occurring in relation to Macarthur;<br />

• no ‘prescribed occurrences’ occurring in relation to Macarthur; and<br />

• Macarthur not announcing a dividend, other than the Permitted FY11 Dividend or any Permitted Other<br />

Dividend.<br />

Full terms of the conditions of the Offer are set out in section 11.7 of this Bidder’s <strong>Statement</strong>.<br />

You may accept the Offer for all or any number of Your Shares.<br />

Issuer sponsored shareholders<br />

If Your Shares are held on Macarthur’s issuer sponsored subregister (such holdings will be evidenced by an<br />

‘I’ appearing next to your holder number on the enclosed Acceptance Form), to accept this Offer, you must<br />

complete and sign the Acceptance Form enclosed with this Bidder’s <strong>Statement</strong> and return it to the address<br />

indicated on the form so that it is received before the end of the Offer Period.<br />

CHESS sponsored shareholders<br />

If Your Shares are in a CHESS Holding (such holdings will be evidenced by an ‘X’ appearing next to your holder<br />

number on the enclosed Acceptance Form), you may accept the Offer by either:<br />

• completing and signing the enclosed Acceptance Form and returning it to the address indicated on the form<br />

so that it is received before the end of the Offer Period; or<br />

• instructing your Controlling Participant (for example, your broker) to accept the Offer on your behalf before<br />

the end of the Offer Period.<br />

Participants<br />

If you are a Participant, acceptance of this Offer must be initiated in accordance with Rule 14.14 of the ASX<br />

Settlement Operating Rules before the end of the Offer Period.<br />

Full details on how to accept the Offer are set out in section 11.3 of this Bidder’s <strong>Statement</strong>.<br />

For queries on how to accept the Offer, see the enclosed Acceptance Form. If you have any other queries in<br />

relation to the Offer, please contact the PEAMCoal Offer Information Line on 1800 992 039 (for callers within<br />

Australia) or +61 2 8280 7692 (for callers outside Australia).<br />

Please note that calls to the above numbers may be recorded. Inquiries in relation to the Offer will not be<br />

received on any other telephone numbers of PEAMCoal or its advisers.<br />

The information in this section 2 is a summary only of the Offer and is qualified by the detailed information set<br />

out elsewhere in this Bidder’s <strong>Statement</strong>.<br />

You should read the entire Bidder’s <strong>Statement</strong> and the target’s statement that Macarthur will shortly be sending<br />

to you, before deciding whether to accept the Offer.<br />

11<br />

Persons who acquire Shares on-market on or after the ‘ex-date’ for the dividend will not be entitled to be paid this dividend in respect of those Shares even if they are on the Macarthur<br />

Register in respect of those shares as at the record date for the dividend. In other words, those persons will only be entitled to receive A$15.50 in cash for each such Share so acquired,<br />

subject to our offer becoming unconditional. It should be noted that, as at the date of this Bidder’s <strong>Statement</strong>, Macarthur had not confirmed the amount of this dividend (if any). The<br />

actual amount of the dividend could be higher or lower than A$0.16 per Share. If it is higher than A$0.16 per Share the cash amount payable under the offer of A$15.50 per Share will be<br />

reduced by the amount of the excess. If it is lower than A$0.16 per Share, the A$15.66 per Share amount mentioned in this Bidder’s <strong>Statement</strong> will be reduced by the difference between<br />

A$0.16 and the actual amount of the dividend.<br />

10

3 Information on PEAMCoal<br />

3.1 Overview of PEAMCoal<br />

<strong>Peabody</strong> <strong>Energy</strong> indirectly owns 60% of PEAMCoal and ArcelorMittal<br />

indirectly owns 40% of PEAMCoal. The diagram in section 3.3<br />

illustrates the ownership structure of PEAMCoal.<br />

PEAMCoal’s sole purpose is to acquire Shares pursuant to the Offer.<br />

As at the date of this Bidder’s <strong>Statement</strong>, PEAMCoal was not carrying<br />

on business and had no assets or liabilities (other than pursuant to<br />

the Offer). PEAMCoal’s funding arrangements in relation to the Offer<br />

are set out in section 10.2(c).<br />

3.2 Directors<br />

As at the date of this Bidder’s <strong>Statement</strong>, the PEAMCoal<br />

Directors are:<br />

• Richard A. Navarre;<br />

• Eric Ford; and<br />

• Julian D. Thornton.<br />

Each of these individuals was appointed by <strong>Peabody</strong> <strong>Energy</strong>.<br />

Following the end of the Offer Period and pursuant to the terms of<br />

the Shareholders’ Deed, ArcelorMittal will be entitled to appoint two<br />

individuals as PEAMCoal Directors. For that purpose, ArcelorMittal<br />

has nominated the following individuals to be PEAMCoal Directors:<br />

• Peter Kukielski; and<br />

• Carole Whittall.<br />

Brief profiles of the existing and proposed PEAMCoal Directors are<br />

set out below.<br />

Richard A. Navarre<br />

Rick Navarre was named<br />

President and Chief Commercial<br />

Officer for <strong>Peabody</strong> in January<br />

2008. He has executive<br />

responsibility for global sales<br />

and trading, business<br />

development, international<br />

growth initiatives and business<br />

performance. He also is a<br />

frequent speaker on energy,<br />

industry and company trends<br />

and topics.<br />

With more than 25 years<br />

of financial and business<br />

experience, Rick served as<br />

<strong>Peabody</strong>’s Chief Financial<br />

Officer from 1999 through<br />

2008. He joined the<br />

company in 1993 and has held a series of financial and commercial<br />

positions, including executive responsibility for departments as<br />

diverse as Sales, Marketing, Trading and Transportation, Legal,<br />

Information Technology, Materials Management, Post-Mining<br />

Reclamation, Resource Management, and Investor Relations and<br />

Corporate Communications.<br />

Rick is a member of the Hall of Fame of the College of Business<br />

at Southern Illinois University Carbondale, a member of the<br />

Board of Advisors of the College of Business and Administration<br />

and the School of Accountancy of Southern Illinois University<br />

Carbondale; and a member of the Board of Directors of the Regional<br />

Chamber and Growth Association of St. Louis. He is a Director<br />

of the United Way of Greater St. Louis, Treasurer of the Missouri<br />

Historical Society, a member of Financial Executives International<br />

and the Civic Entrepreneurs Organization, a Fellow of the Foreign<br />

Policy Association and a former chairman of the Bituminous Coal<br />

Operators’ Association.<br />

Eric Ford<br />

Eric Ford is Executive Vice<br />

President and Chief Operating<br />

Officer of <strong>Peabody</strong> <strong>Energy</strong>. In<br />

his current role, he is<br />

responsible for all of the<br />

company’s global mining<br />

operations, along with areas of<br />

safety, operations, planning,<br />

and project development.<br />

Eric joined <strong>Peabody</strong> in<br />

January 2007 as Executive<br />

Vice President and Chief<br />

Operating Officer. Prior to<br />

joining <strong>Peabody</strong> <strong>Energy</strong>, he<br />

served six years with Anglo<br />

Coal Australia Pty Ltd. as Chief<br />

Executive Officer.<br />

Eric was Deputy Chairman and<br />

a member of the Executive Committee of the Coal Industry Advisory<br />

Board of the International <strong>Energy</strong> Agency and Vice Chairman and<br />

Director of the Minerals Council of Australia. He holds a Master of<br />

Management Sciences from Imperial College in London, England as<br />

well as a Bachelor of Science degree in Mining Engineering from the<br />

University of the Witwatersrand in Johannesburg, South Africa.<br />

Julian D. Thornton<br />

Julian Thornton is the Group<br />

Executive & Managing Director<br />

of <strong>Peabody</strong>’s Australian<br />

operations, being appointed in<br />

May 2008. Julian joined<br />

<strong>Peabody</strong> in March 2007 as<br />

Chief Operating Officer for the<br />

New South Wales operations<br />

and was then appointed to the<br />

newly created position of Chief<br />

Operating Officer for Australia in<br />

November 2007.<br />

Prior to joining <strong>Peabody</strong>, Julian<br />

was Chief Operating Officer for<br />

RPG Industries in the Czech<br />

Republic with responsibility<br />

for the operational aspects<br />

of the coal mines and coking<br />

operations of the company which were situated in the Eastern part<br />

of the country. Prior to that Julian worked for Anglo American’s<br />

Coal Division and performed a number of roles including a variety<br />

of operational roles on mines in South Africa and Colombia as well<br />

as joint venture management of operations in South America and<br />

project work.<br />

Julian holds a Bachelor of Science Degree and Doctorate in<br />

mining engineering from the University of Wales and a Higher<br />

Postgraduate Diploma in Computer Science from the University of<br />

the Witwatersrand in South Africa. Julian’s leadership roles currently<br />

include directorships of the New South Wales Minerals Council,<br />

Queensland Resources Council and the Australian Coal Association.<br />

11

Peter Kukielski<br />

Peter Kukielski is a member of<br />

the Group Management Board<br />

of ArcelorMittal and Chief<br />

Executive Mining. As part of this<br />

role, he has responsibility for<br />

ArcelorMittal’s mining business<br />

and for driving its development.<br />

Prior to joining ArcelorMittal,<br />

Peter was Executive<br />

Vice President and<br />

Chief Operating Officer at<br />

Teck Cominco Limited.<br />

Before that, he was<br />

Chief Operating Officer<br />

of Falconbridge Limited.<br />

He also has held senior<br />

engineering and project<br />

management positions with BHP Billiton and Fluor Corporation.<br />

Peter holds a Bachelor of Science degree in civil engineering from<br />

the University of Rhode Island and a Master of Science degree in<br />

civil engineering from Stanford University.<br />

Carole Whittall<br />

Carole Whittall is Vice President<br />

and Head of Mining M&A at<br />

ArcelorMittal where she is<br />

responsible for business<br />

development and transaction<br />

execution in the mining sector.<br />

She was previously with Rio<br />

Tinto where she held various<br />

commercial and business<br />

development roles. Her prior<br />

career was with JP Morgan and<br />

Standard Corporate and<br />

Merchant Bank (South Africa) in<br />

mergers and acquisitions and<br />

corporate finance.<br />

Carole holds a Bachelor of<br />

Science (Honours) degree in<br />

geology and geochemistry from the University of Cape Town and a<br />

Master of Business Administration from London Business School.<br />

3.3 Current Ownership structure and shareholder arrangements<br />

The following diagram shows PEAMCoal’s current ownership structure.<br />

<strong>Peabody</strong> <strong>Energy</strong> Corporation<br />

(<strong>Peabody</strong> <strong>Energy</strong>)<br />

ArcelorMittal S.A.<br />

(ArcelorMittal)<br />

100% (indirectly) 100% (indirectly)<br />

<strong>Peabody</strong> Acquisition Co. No. 2 Pty Ltd<br />

(PAC2)<br />

ArcelorMittal Mining Australasia B.V.<br />

(AM BV2)<br />

60% 40%<br />

PEAMCoal Holdings Pty Ltd<br />

(PEAMCoal Holdings)<br />

100%<br />

PEAMCoal Pty Ltd<br />

(PEAMCoal)<br />

Takeover Bid<br />

Macarthur Coal Ltd<br />

(Macarthur)<br />

12

4 Information on <strong>Peabody</strong> <strong>Energy</strong><br />

4.1 Overview of <strong>Peabody</strong> <strong>Energy</strong><br />

<strong>Peabody</strong> <strong>Energy</strong> is the world’s largest private sector coal company,<br />

with majority interests in 28 coal mining operations in the U.S. and<br />

Australia. In 2010, it produced 218.4 million Tons of coal and sold<br />

245.9 million Tons of coal.<br />

<strong>Peabody</strong> <strong>Energy</strong>, a public company existing under the laws of the<br />

United States and listed on the New York Stock Exchange, indirectly<br />

owns 60% of PEAMCoal Holdings.<br />

4.2 History, structure and ownership of<br />

<strong>Peabody</strong> <strong>Energy</strong><br />

(a) History<br />

<strong>Peabody</strong> <strong>Energy</strong> was incorporated in Delaware, U.S., in 2001 and<br />

its history in the coal mining business dates back to 1883. Over<br />

the past decade, <strong>Peabody</strong> <strong>Energy</strong> has continually adjusted its<br />

business to focus on the highest-growth regions in the U.S. and<br />

Asia-Pacific region. As part of this transformation, it has made<br />

strategic acquisitions and divestitures in Australia and the U.S.<br />

After re-entering the Australian market in 2002, <strong>Peabody</strong> <strong>Energy</strong><br />

expanded its presence there with acquisitions in 2004 and 2006.<br />

In 2007, <strong>Peabody</strong> <strong>Energy</strong> spun off portions of its former Eastern<br />

U.S. Mining segment through a dividend of all outstanding shares<br />

of Patriot Coal Corporation. It has also continued to expand its<br />

Trading and Brokerage operations and now has a global trading<br />

platform with offices in the U.S., Europe, Australia and Asia.<br />

(b) Structure<br />

<strong>Peabody</strong> <strong>Energy</strong> conducts it operations through a number<br />

of Subsidiaries, including <strong>Peabody</strong> <strong>Energy</strong> Australia Pty Ltd<br />

(<strong>Peabody</strong> <strong>Energy</strong> Australia) and joint ventures. <strong>Peabody</strong> <strong>Energy</strong><br />

Australia is currently the holding company for <strong>Peabody</strong> <strong>Energy</strong>’s<br />

Australian operations.<br />

(c) Ownership<br />

As at 2 August 2011, <strong>Peabody</strong> <strong>Energy</strong> understands that the<br />

following entities beneficially own more than 5% of <strong>Peabody</strong><br />

<strong>Energy</strong>’s issued share capital:<br />

Beneficial owner<br />

Percentage of issued<br />

share capital*<br />

Blackrock, Inc. 11.1%<br />

T. Rowe Price Associates 9.1%<br />

* Based on information filed with the SEC.<br />

4.3 Principal activities of <strong>Peabody</strong> <strong>Energy</strong><br />

<strong>Peabody</strong> <strong>Energy</strong> is actively pursuing growth plans in Australia with<br />

a view to being a long-term participant in the Australian coal industry.<br />

In addition to its mining operations, <strong>Peabody</strong> <strong>Energy</strong> markets, brokers<br />

and trades coal through its Trading and Brokerage segment.<br />

<strong>Peabody</strong> <strong>Energy</strong>’s other energy related commercial activities<br />

include participating in the development of mine-mouth coal-fueled<br />

generating plants and the development of Btu Conversion and clean<br />

coal technologies. <strong>Peabody</strong> <strong>Energy</strong>’s Btu Conversion projects are<br />

designed to expand the uses of coal through various technologies<br />

such as coal-to-liquids and coal gasification.<br />

<strong>Peabody</strong> <strong>Energy</strong> conducts business through four principal<br />

segments: Western U.S. Mining, Midwestern U.S. Mining, Australian<br />

Mining and Trading and Brokerage. The principal business of the<br />

Western and Midwestern U.S. Mining segments is the mining,<br />

preparation and sale of thermal coal, sold primarily to electric utilities.<br />

The Western U.S. Mining operations consist of <strong>Peabody</strong> <strong>Energy</strong>’s<br />

Powder River Basin, Southwest and Colorado operations. The<br />

Midwestern U.S. Mining operations consist of its Illinois and Indiana<br />

operations. The business of the Australian Mining Segment is the<br />

mining of various qualities of low-sulfur, high calorific value coal<br />

as well as thermal coal primarily sold to an international customer<br />

base with a portion sold to Australian steel producers and power<br />

generators. Metallurgical coal is produced primarily from five of<br />

<strong>Peabody</strong> <strong>Energy</strong>’s Australian mines.<br />

The Trading and Brokerage segment’s principal business is the<br />

brokering of coal sales of other producers, both as principal and<br />

agent, and the trading of coal, freight and freight-related contracts.<br />

It also provides transportation-related services in support of <strong>Peabody</strong><br />

<strong>Energy</strong>’s coal trading strategy, as well as hedging activities in support<br />

of its mining operations.<br />

A fifth segment, Corporate and Other, includes mining and<br />

export/transportation joint ventures, energy-related commercial<br />

activities, as well as the management of its coal reserve and real<br />

estate holdings.<br />

<strong>Peabody</strong> <strong>Energy</strong> continues to pursue Btu Conversion projects that<br />

expand the uses of coal through coal-to-liquids and coal-to-gas<br />

projects. <strong>Peabody</strong> <strong>Energy</strong>’s participation in generation development<br />

projects involves using its surface lands and coal reserves as the<br />

basis for mine-mouth plants. <strong>Peabody</strong> <strong>Energy</strong> is also advancing<br />

several initiatives associated with clean coal technologies, including<br />

carbon capture and storage.<br />

The maps below display <strong>Peabody</strong> <strong>Energy</strong> and <strong>Peabody</strong> <strong>Energy</strong><br />

Australia’s mine locations as of 31 December 2010. Also noted<br />

are the primary ports utilized in the U.S. and in Australia for its coal<br />

exports and its corporate headquarters.<br />

13

Map 1: U.S. mining Operations<br />

Map 2: Australian mining operations<br />

14

The table below presents information regarding each of <strong>Peabody</strong> <strong>Energy</strong>’s 28 mines, including mine location, type of mine, mining method, coal<br />

type, transportation method and Tons sold in 2010. The mines are sorted by Tons sold within each mining segment.<br />

Mine Location Mine Type Mining Method Coal Type<br />

Transport<br />

Method<br />

2010 Tons Sold<br />

(in millions)<br />

Western U.S. Mining<br />

North Antelope Rochelle Wright, WY S DL, T/S Thermal R 105.8<br />

Caballo Gillette, WY S D,T/S Thermal R 23.5<br />

Rawhide Gillette, WY S D, T/S Thermal R 11.3<br />

Twenty mile Oak Creek, CO U LW Thermal R, T 7.1<br />

Kayenta Kayenta, AZ S DL, T/S Thermal R 7.8<br />

El Segundo Grants, NM S T/S Thermal R 6.6<br />

Lee Ranch Grants, NM S DL, T/S Thermal R 1.7<br />

Midwestern U.S. Mining<br />

Somerville Central Oakland City, IN S DL, D, T/S Thermal R, T/R, T/B 3.3<br />

Viking - Corning Pit Cannelburg, IN S D, T/S Thermal T, T/R 3.2<br />

Gateway Coulterville, IL U CM Thermal T, R, R/B 3.0<br />

Willow Lake Equality, IL U CM Thermal T/B 2.9<br />

Bear Run Sullivan County, IN S DL, D, T/S Thermal T, R 2.8<br />

Francisco Underground Francisco, IN U CM Thermal R 2.7<br />

Cottage Grove Equality, IL S D, T/S Thermal T/B 2.1<br />

Somerville North (1) Oakland City, IN S D, T/S Thermal R, T/R, T/B 2.0<br />

Somerville South (1) Oakland City, IN S D, T/S Thermal R, T/R, T/B 1.7<br />

Air Quality Vincennes, IN U CM Thermal T, T/R, T/B 1.1<br />

Wildcat Hills Underground Eldorado, IL U CM Thermal T/B 0.7<br />

Wild Boar Lynville, IN S D, T/S Thermal T, R, R/B 0.1<br />

Other (2) – – – – – 4.1<br />

Australian Mining<br />

Wilpinjong* Wilpinjong, New South Wales S T/S Thermal R, EV 9.2<br />

North Wambo Underground (1) Warkworth, New South Wales U LW Thermal/Met** R, EV 3.6<br />

Wambo Open-Cut (1) * Warkworth, New South Wales S T/S Thermal R, EV 3.0<br />

Burton* (3) Glenden, Queensland S T/S Thermal/Met** R, EV 2.6<br />

North Goonyella Glenden, Queensland U LW Met** R, EV 2.5<br />

Wilkie Creek Macalister, Queensland S T/S Thermal R, EV 1.7<br />

Metropolitan Helensburgh, New South Wales U LW Met** R, EV 1.7<br />

Millennium* Moranbah, Queensland S T/S Met** R, EV 1.6<br />

Eagle field* Glenden, Queensland S T/S Met** R, EV 1.1<br />

Legend:<br />

S Surface Mine R Rail<br />

U Underground Mine T Truck<br />

DL Dragline R/B Rail and Barge<br />

D Dozer/Casting T/B Truck and Barge<br />

T/S Truck and Shovel T/R Truck and Rail<br />

LW Longwall EV Export Vessel<br />

CM Continuous Miner<br />

Thermal Thermal/Steam<br />

* Mine is operated by a contract miner Met Metallurgical<br />

** Metallurgical coals range from pulverized coal injection (PCI) to high quality hard coking coal on the heat value scale.<br />

Notes:<br />

(1) Represents mines that have non-controlling ownership interests.<br />

(2) “Other” in Midwestern U.S. Mining primarily consists of purchased coal used to satisfy certain coal supply agreements and shipments made from operations closed during 2010.<br />

(3) The Burton Mine is a 95% proportionally owned and consolidated mine.<br />

15

4.4 Directors of <strong>Peabody</strong> <strong>Energy</strong><br />

Brief profiles of the directors of <strong>Peabody</strong> <strong>Energy</strong> at the date of this<br />

Bidder’s <strong>Statement</strong> are set out below.<br />

Gregory H. Boyce, Chairman and Chief Executive Officer<br />

Gregory H. Boyce was elected Chairman of the board of directors<br />

of <strong>Peabody</strong> <strong>Energy</strong> on 10 October 2007 and has been a director<br />

of the company since March 2005. He was named Chief Executive<br />

Officer Elect in March 2005, and assumed the position of Chief<br />

Executive Officer in January 2006. Mr. Boyce served as President<br />

from October 2003 to December 2007 and as Chief Operating<br />

Officer from October 2003 to December 2005. He previously served<br />

as Chief Executive — <strong>Energy</strong> of Rio Tinto plc from 2000 to 2003.<br />

Other prior positions include President and Chief Executive Officer<br />

of Kennecott <strong>Energy</strong> Company from 1994 to 1999 and President of<br />

Kennecott Minerals Company from 1993 to 1994. He has extensive<br />

engineering and operating experience with Kennecott and also<br />

served as Executive Assistant to the Vice Chairman of Standard<br />

Oil of Ohio from 1983 to 1984. Mr. Boyce serves on the board of<br />

directors of Marathon Oil Corporation. He is Chairman of the National<br />

Mining Association and a member of the World Coal Association, the<br />

National Coal Council and the Coal Industry Advisory Board of the<br />

International <strong>Energy</strong> Agency. He is a Board member of the Business<br />

Roundtable and the American Coalition for Clean Coal Electricity.<br />

He is a member of the Business Council; Civic Progress in St. Louis;<br />

the Board of Trustees of St. Louis Children’s Hospital; the Board<br />

of Trustees of Washington University in St. Louis; and the Advisory<br />

Council of the University of Arizona’s Department of Mining and<br />

Geological Engineering.<br />

William A. Coley, Independent Director<br />

Mr. Coley has been a director of <strong>Peabody</strong> <strong>Energy</strong> since March<br />

2004. From March 2005 to July 2009, Mr. Coley served as<br />

Chief Executive Officer and Director of British <strong>Energy</strong> Group plc,<br />

the U.K.’s largest electricity producer. He was previously a nonexecutive<br />

director of British <strong>Energy</strong>. Mr. Coley served as President<br />

of Duke Power, the U.S.-based global energy company, from 1997<br />

until his retirement in February 2003. During his 37-year career at<br />

Duke Power, Mr. Coley held various officer level positions in the<br />

engineering, operations and senior management areas, including Vice<br />

President, Operations (1984-1986), Vice President, Central Division<br />

(1986-1988), Senior Vice President, Power Delivery (1988-1990),<br />

Senior Vice President, Customer Operations (1990-1991), Executive<br />

Vice President, Customer Group (1991-1994) and President,<br />

Associated Enterprises Group (1994-1997). Mr. Coley was elected<br />

to the board of Duke Power in 1990 and was named President<br />

following Duke Power’s acquisition of Pan<strong>Energy</strong> in 1997. Mr. Coley<br />

earned his B.S. in electrical engineering from Georgia Institute of<br />

Technology and is a registered professional engineer. He is also a<br />

director of E.R. Jahna Enterprises. Mr. Coley previously served as a<br />

director of British <strong>Energy</strong> Group plc, CT Communications, Inc. and<br />

SouthTrust Bank.<br />

William E. James, Independent Director<br />

Mr. James has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2001.<br />

Since July 2000, Mr. James has been co-founder and Managing<br />

General Partner of RockPort Capital Partners LLC, a venture capital<br />

fund specializing in energy and power, advanced materials, process<br />

and prevention technologies, transportation and green building<br />

technologies. Prior to joining RockPort, Mr. James co-founded<br />

and served as Chairman and Chief Executive Officer of Citizens<br />

Power LLC, the nation’s first and a leading power marketer. He also<br />

co-founded the non-profit Citizens <strong>Energy</strong> Corporation and served as<br />

the Chairman and Chief Executive Officer of Citizens Corporation, its<br />

for-profit holding company, from 1987 to 1996. Mr. James is also a<br />

director of Ener1, Inc.<br />

Robert B. Karn III, Independent Director<br />

Mr. Karn has been a director of <strong>Peabody</strong> <strong>Energy</strong> since January<br />

2003. Mr. Karn is a financial consultant and former managing<br />

partner in financial and economic consulting with Arthur Andersen<br />

LLP in St. Louis. Before retiring from Arthur Andersen in 1998,<br />

Mr. Karn served in a variety of accounting, audit and financial roles<br />

over a 33-year career, including Managing Partner in charge of<br />

the global coal mining practice from 1981 through 1998. He is a<br />

Certified Public Accountant and has served as a Panel Arbitrator<br />

with the American Arbitration Association. Mr. Karn is also a director<br />

of Natural Resource Partners L.P., a master limited partnership<br />

that is listed on the NYSE, Kennedy Capital Management, Inc.<br />

and numerous NYSE-listed closed-end mutual and exchange<br />

traded funds under the Guggenheim Financial Family of Funds. He<br />

previously served as a director of the Fiduciary/Claymore Dynamic<br />

Equity Fund.<br />

M. Frances Keeth, Independent Director<br />

Mrs. Keeth has been a director of <strong>Peabody</strong> <strong>Energy</strong> since March 2009.<br />

She was Executive Vice President of Royal Dutch Shell, plc, and Chief<br />

Executive Officer and President of Shell Chemicals Limited, a services<br />

company responsible for Royal Dutch Shell’s global petrochemical<br />

businesses, from January 2005 to December 2006. She served<br />

as Executive Vice President of Customer Fulfilment and Product<br />

Business Units for Shell Chemicals Limited from July 2001 to January<br />

2005 and was President and Chief Executive Officer of Shell Chemical<br />

LP, a U.S. petrochemical member of the Royal Dutch/Shell Group,<br />

from July 2001 to July 2006. Mrs. Keeth also serves as a director<br />

of Verizon Communications Inc. and Arrow Electronics Inc. She has<br />

been a member of the Advisory Board of the Bauer Business School,<br />

University of Houston, since 2002.<br />

Henry E. Lentz, Independent Director<br />

Mr. Lentz has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

February 1998. Mr. Lentz was a Managing Director of Lazard<br />

Frères & Co, an investment banking firm from June 2009 to<br />

May 2011. He was Managing Director of Barclays Capital, an<br />

investment banking firm and successor to Lehman Brothers Inc.,<br />

an investment banking firm, from September 2008 to June 2009.<br />

From January 2004 to September 2008 he was employed as<br />

an Advisory Director by Lehman Brothers. He joined Lehman<br />

Brothers Inc. in 1971 and became a Managing Director in 1976.<br />

He left the firm in 1988 to become Vice Chairman of Wasserstein<br />

Perella Group, Inc., an investment banking firm. In 1993, he<br />

returned to Lehman Brothers Inc. as a Managing Director and<br />

served as head of the firm’s worldwide energy practice. In 1996,<br />

he joined Lehman Brothers Inc.’s Merchant Banking Group as<br />

a Principal and in January 2003 became a consultant to the<br />

Merchant Banking Group. Mr. Lentz is also the non-executive<br />

Chairman of Rowan Companies, Inc. and a director of CARBO<br />

Ceramics, Inc.<br />

Robert A. Malone, Independent Director<br />

Mr. Malone has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2009.<br />

Mr. Malone was elected as President and Chief Executive Officer of<br />

the First National Bank of Sonora, Texas in October 2009. He is a<br />

retired Executive Vice President of BP plc and a retired Chairman of<br />

the Board and President of BP America Inc., at the time the largest<br />

producer of oil and natural gas and the second largest gasoline<br />

retailer in the United States. He served in that position from 2006<br />

to 2009. Mr. Malone previously served as Chief Executive Officer<br />

of BP Shipping Limited from 2002 to 2006, as Regional President<br />

Western United States, BP America Inc. from 2000 to 2002 and as<br />

President, Chief Executive Officer and Chief Operating Officer, Alyeska<br />

Pipeline Service Company from 1996 to 2000. He is also a director of<br />

Halliburton Company and the First National Bank of Sonora.<br />

16

William C. Rusnack, Independent Director<br />

Mr. Rusnack has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

January 2002. Mr. Rusnack is the former President and Chief<br />

Executive Officer of Premcor Inc., one of the largest independent oil<br />

refiners in the United States prior to its acquisition by Valero <strong>Energy</strong><br />

Corporation in 2005. He served as President, Chief Executive Officer<br />

and Director of Premcor from 1998 to February 2002. Prior to joining<br />

Premcor, Mr. Rusnack was President of ARCO Products Company,<br />

the refining and marketing division of Atlantic Richfield Company.<br />

During a 31-year career at ARCO, he was also President of ARCO<br />

Transportation Company and Vice President of Corporate Planning.<br />

He is also a director of Sempra <strong>Energy</strong>, Flowserve Corporation and<br />

Solutia Inc.<br />

John F. Turner, Independent Director<br />

Mr. Turner has been a director of <strong>Peabody</strong> <strong>Energy</strong> since July 2005.<br />

Mr. Turner served as Assistant Secretary of State for the Bureau of<br />

Oceans and International Environmental and Scientific Affairs from<br />

November 2001 to July 2005. Mr. Turner was previously President<br />

and Chief Executive Officer of The Conservation Fund, a national<br />

non-profit organization dedicated to public-private partnerships to<br />

protect land and water resources. He was director of the U.S. Fish<br />

and Wildlife Service from 1989 to 1993. Mr. Turner also served in<br />

the Wyoming state legislature for 19 years and is a past president<br />

of the Wyoming State Senate. He serves as a consultant to The<br />

Conservation Fund. Mr. Turner also serves as Chairman of the<br />

University of Wyoming, Ruckelshaus Institute of Environment and<br />

Natural Resources. He is also a director of International Paper<br />

Company, American Electric Power Company, Inc. and Ashland, Inc.<br />

Sandra A. Van Trease, Independent Director<br />

Ms. Van Trease has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

January 2003. Ms. Van Trease is Group President, BJC HealthCare,<br />

a position she has held since September 2004. BJC HealthCare<br />

is one of the nation’s largest non-profit healthcare organizations,<br />

delivering services to residents in the greater St. Louis, southern<br />

Illinois and mid-Missouri regions. Prior to joining BJC HealthCare,<br />

Ms. Van Trease served as President and Chief Executive Officer<br />

of UNICARE, an operating affiliate of WellPoint Health Networks<br />

Inc., from 2002 to September 2004. Ms. Van Trease also served<br />

as President, Chief Financial Officer and Chief Operating Officer<br />

of RightCHOICE Managed Care, Inc. from 2000 to 2002 and as<br />

Executive Vice President, Chief Financial Officer and Chief Operating<br />

Officer from 1997 to 2000. Prior to joining RightCHOICE in 1994,<br />

she was a Senior Audit Manager with Price Waterhouse LLP.<br />

She is a Certified Public Accountant and Certified Management<br />

Accountant. Ms. Van Trease is also a director of Enterprise Financial<br />

Services Corporation.<br />

Alan H. Washkowitz, Independent Director<br />

Mr. Washkowitz has been a director of <strong>Peabody</strong> <strong>Energy</strong> since<br />

May 1998. Until July 2005, Mr. Washkowitz was a Managing<br />

Director of Lehman Brothers Inc. and part of the firm’s Merchant<br />

Banking Group, responsible for oversight of Lehman Brothers Inc.’s<br />

Merchant Banking Partners. He joined Kuhn Loeb & Co. in 1968<br />

and became a general partner of Lehman Brothers Inc. in 1978<br />

when it acquired Kuhn Loeb & Co. Prior to joining the Merchant<br />

Banking Group, he headed Lehman Brothers Inc.’s Financial<br />

Restructuring Group. Mr. Washkowitz is also a director of L-3<br />

Communications Corporation.<br />

4.5 Historical financial information on<br />

<strong>Peabody</strong> <strong>Energy</strong><br />

(a) Basis of presentation<br />

The historical financial information presented below is a summary<br />

only and the full financial accounts for <strong>Peabody</strong> <strong>Energy</strong> for the<br />

financial periods described below, which include the notes to<br />

the accounts, can be found in <strong>Peabody</strong> <strong>Energy</strong>’s annual report<br />

on Form 10-K for the year ended 31 December 2010 as filed<br />

with the SEC and the current report on Form 8-K that set forth<br />

financial results of <strong>Peabody</strong> <strong>Energy</strong> for the three and six months<br />

ended 30 June 2011 as furnished to the SEC.<br />

(b) Condensed consolidated balance sheets<br />

The condensed consolidated balance sheets of <strong>Peabody</strong> <strong>Energy</strong><br />

as at 31 December 2010 and 31 December 2009 presented<br />

below have been extracted from the consolidated financial<br />

statements in <strong>Peabody</strong> <strong>Energy</strong>’s annual report on Form 10-K for<br />

the year ended 31 December 2010. The condensed consolidated<br />