Download presentation - UniCredit Group

Download presentation - UniCredit Group

Download presentation - UniCredit Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

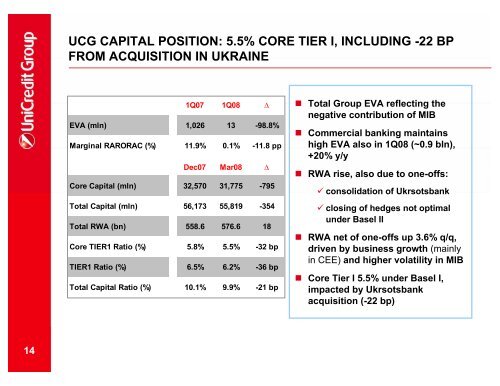

UCG CAPITAL POSITION: 5.5% CORE TIER I, INCLUDING -22 BP<br />

FROM ACQUISITION IN UKRAINE<br />

1Q07 1Q08 ∆<br />

EVA (mln) 1,026 13 -98.8%<br />

Marginal RARORAC (%) 11.9% 0.1% -11.8 pp<br />

Dec07 Mar08 ∆<br />

Core Capital (mln) 32,570 31,775 -795<br />

Total Capital (mln) 56,173 55,819 -354<br />

Total RWA (bn) 558.6 576.6 18<br />

Core TIER1 Ratio (%) 5.8% 5.5% -32 bp<br />

TIER1 Ratio (%) 6.5% 6.2% -36 bp<br />

Total Capital Ratio (%) 10.1% 9.9% -21 bp<br />

• Total <strong>Group</strong> EVA reflecting the<br />

negative contribution of MIB<br />

• Commercial banking maintains<br />

high EVA also in 1Q08 (~0.9 bln),<br />

+20% y/y<br />

• RWA rise, also due to one-offs:<br />

consolidation of Ukrsotsbank<br />

closing of hedges not optimal<br />

under Basel II<br />

• RWA net of one-offs up 3.6% q/q,<br />

driven by business growth (mainly<br />

in CEE) and higher volatility in MIB<br />

• Core Tier I 5.5% under Basel I,<br />

impacted by Ukrsotsbank<br />

acquisition (-22 bp)<br />

14