Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

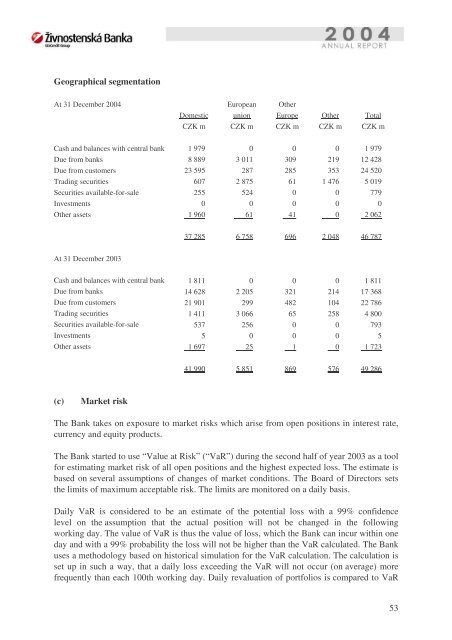

Geographical segmentation<br />

At 31 December <strong>2004</strong><br />

European Other<br />

Domestic union Europe Other Total<br />

CZK m CZK m CZK m CZK m CZK m<br />

Cash and balances with central bank 1 979 0 0 0 1 979<br />

Due from banks 8 889 3 011 309 219 12 428<br />

Due from customers 23 595 287 285 353 24 520<br />

Trading securities 607 2 875 61 1 476 5 019<br />

Securities available-for-sale 255 524 0 0 779<br />

Investments 0 0 0 0 0<br />

Other assets 1 960 61 41 0 2 062<br />

37 285 6 758 696 2 048 46 787<br />

At 31 December 2003<br />

Cash and balances with central bank 1 811 0 0 0 1 811<br />

Due from banks 14 628 2 205 321 214 17 368<br />

Due from customers 21 901 299 482 104 22 786<br />

Trading securities 1 411 3 066 65 258 4 800<br />

Securities available-for-sale 537 256 0 0 793<br />

Investments 5 0 0 0 5<br />

Other assets 1 697 25 1 0 1 723<br />

41 990 5 851 869 576 49 286<br />

(c)<br />

Market risk<br />

The <strong>Bank</strong> takes on exposure to market risks which arise from open positions in interest rate,<br />

currency and equity products.<br />

The <strong>Bank</strong> started to use “Value at Risk” (“VaR”) during the second half of year 2003 as a tool<br />

for estimating market risk of all open positions and the highest expected loss. The estimate is<br />

based on several assumptions of changes of market conditions. The Board of Directors sets<br />

the limits of maximum acceptable risk. The limits are monitored on a daily basis.<br />

Daily VaR is considered to be an estimate of the potential loss with a 99% confidence<br />

level on the assumption that the actual position will not be changed in the following<br />

working day. The value of VaR is thus the value of loss, which the <strong>Bank</strong> can incur within one<br />

day and with a 99% probability the loss will not be higher than the VaR calculated. The <strong>Bank</strong><br />

uses a methodology based on historical simulation for the VaR calculation. The calculation is<br />

set up in such a way, that a daily loss exceeding the VaR will not occur (on average) more<br />

frequently than each 100th working day. Daily revaluation of portfolios is compared to VaR<br />

53