Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

Annual report 2004 (PDF, 4141 kB) - Unicredit Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

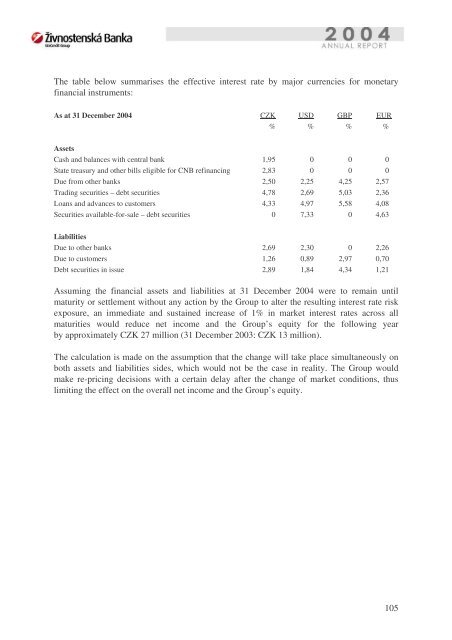

The table below summarises the effective interest rate by major currencies for monetary<br />

financial instruments:<br />

As at 31 December <strong>2004</strong><br />

CZK<br />

%<br />

USD<br />

%<br />

GBP<br />

%<br />

EUR<br />

%<br />

Assets<br />

Cash and balances with central bank 1,95 0 0 0<br />

State treasury and other bills eligible for CNB refinancing 2,83 0 0 0<br />

Due from other banks 2,50 2,25 4,25 2,57<br />

Trading securities – debt securities 4,78 2,69 5,03 2,36<br />

Loans and advances to customers 4,33 4,97 5,58 4,08<br />

Securities available-for-sale – debt securities 0 7,33 0 4,63<br />

Liabilities<br />

Due to other banks 2,69 2,30 0 2,26<br />

Due to customers 1,26 0,89 2,97 0,70<br />

Debt securities in issue 2,89 1,84 4,34 1,21<br />

Assuming the financial assets and liabilities at 31 December <strong>2004</strong> were to remain until<br />

maturity or settlement without any action by the Group to alter the resulting interest rate risk<br />

exposure, an immediate and sustained increase of 1% in market interest rates across all<br />

maturities would reduce net income and the Group’s equity for the following year<br />

by approximately CZK 27 million (31 December 2003: CZK 13 million).<br />

The calculation is made on the assumption that the change will take place simultaneously on<br />

both assets and liabilities sides, which would not be the case in reality. The Group would<br />

make re-pricing decisions with a certain delay after the change of market conditions, thus<br />

limiting the effect on the overall net income and the Group’s equity.<br />

105