Tradeflow Study - UNDP Black Sea Trade and Investment Promotion ...

Tradeflow Study - UNDP Black Sea Trade and Investment Promotion ...

Tradeflow Study - UNDP Black Sea Trade and Investment Promotion ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Both small scale <strong>and</strong> large scale privatisation has been undertaken in many countries of the<br />

BSEC, presenting significant opportunities for investment <strong>and</strong> a more competitive trading<br />

environment. Nevertheless, Azerbaijan, Serbia, Albania, Russia <strong>and</strong> Ukraine have significant<br />

reforms still pending in this area. The restructuring of enterprises in most BSEC countries<br />

remains quite weak, particularly in the cases of Azerbaijan, Moldova, Montenegro <strong>and</strong><br />

Ukraine. Competition policy remains weakly implemented by countries that even have a<br />

competition office. Montenegro, Serbia, Azerbaijan, Georgia <strong>and</strong> Moldova have particularly<br />

weak legislation in this regard.<br />

In terms of price liberalisation, all countries have made significant strides to undertake<br />

reforms <strong>and</strong> price liberalisation is considered to be extremely advanced across BSEC. The<br />

foreign exchange rate has been fully liberalised <strong>and</strong> made convertible in all countries except<br />

in Montenegro, Russia, Serbia <strong>and</strong> Ukraine where restrictions still apply.<br />

Overall, the institutional <strong>and</strong> legal framework governing economic, trade <strong>and</strong> competition<br />

policy has dramatically improved <strong>and</strong> has created a more enabling environment for<br />

investment. In particular, Albania, Bulgaria, Greece, Moldova, Romania, <strong>and</strong> Turkey have<br />

implemented a number of reforms which make these countries particularly interesting<br />

environments in which to invest.<br />

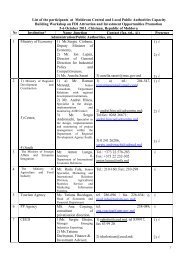

Table 20. Transition Indicators<br />

Large scale<br />

privatisation<br />

Small scale<br />

privatisation<br />

Enterprise<br />

restructuring<br />

Price<br />

liberalisation<br />

<strong>Trade</strong> &<br />

Forex<br />

system<br />

Competition<br />

Policy<br />

Albania 3.00 4.00 2.33 4.33 4.33 2.00<br />

Armenia 3.67 4.00 2.33 4.33 4.33 2.33<br />

Azerbaijan 2.00 3.67 2.00 4.00 4.00 2.00<br />

Bulgaria 4.00 4.00 2.67 4.33 4.33 2.67<br />

Georgia 3.67 4.00 2.33 4.33 4.33 2.00<br />

Moldova 3.00 3.67 2.00 4.00 4.33 2.00<br />

Montenegro 3.33 3.00 2.00 4.00 3.33 1.00<br />

Romania 3.67 3.67 2.67 4.33 4.33 2.67<br />

Russia 3.00 4.00 2.33 4.00 3.33 2.33<br />

Serbia 2.67 3.67 2.33 4.00 3.33 1.67<br />

Ukraine 3.00 4.00 2.00 4.00 3.67 2.33<br />

Note: Scores range from 1 to 4+, where 1 denotes weak market economic environment or lack of legislation <strong>and</strong> 4<br />

denoting performance commensurate with a typical advanced industrialised economy. See Annex 3 for more<br />

explanations on the methodology<br />

Source: EBRD Transition Report 2006<br />

63/135