2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

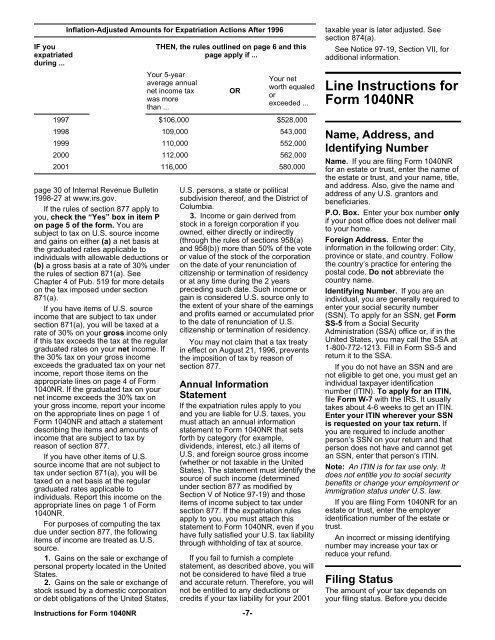

Inflation-Adjusted Amounts <strong>for</strong> Expatriation Actions After 1996<br />

taxable year is later adjusted. See<br />

section 874(a).<br />

IF you THEN, the rules outlined on page 6 and this See Notice 97-19, Section VII, <strong>for</strong><br />

expatriated page apply if ... additional in<strong>for</strong>mation.<br />

during ...<br />

Your 5-year<br />

average annual<br />

net income tax<br />

was more<br />

than ...<br />

OR<br />

Your net<br />

worth equaled<br />

or<br />

exceeded ...<br />

1997 $106,000 $528,000<br />

Line <strong>Instructions</strong> <strong>for</strong><br />

<strong>Form</strong> <strong>1040NR</strong><br />

1998 109,000 543,000<br />

Name, Address, and<br />

1999 110,000 552,000<br />

Identifying Number<br />

2000 112,000 562,000<br />

Name. If you are filing <strong>Form</strong> <strong>1040NR</strong><br />

<strong>2001</strong> 116,000 580,000 <strong>for</strong> an estate or trust, enter the name of<br />

the estate or trust, and your name, title,<br />

and address. Also, give the name and<br />

page 30 of Internal Revenue Bulletin U.S. persons, a state or political<br />

address of any U.S. grantors and<br />

1998-27 at www.irs.gov. subdivision thereof, and the District of<br />

beneficiaries.<br />

If the rules of section 877 apply to Columbia.<br />

3. Income or gain derived from<br />

P.O. Box. Enter your box number only<br />

you, check the “Yes” box in item P<br />

stock in a <strong>for</strong>eign corporation if you<br />

if your post office does not deliver mail<br />

on page 5 of the <strong>for</strong>m. You are<br />

owned, either directly or indirectly<br />

to your home.<br />

subject to tax on U.S. source income<br />

and gains on either (a) a net basis at (through the rules of sections 958(a) Foreign Address. Enter the<br />

the graduated rates applicable to and 958(b)) more than 50% of the vote in<strong>for</strong>mation in the following order: City,<br />

individuals with allowable deductions or or value of the stock of the corporation province or state, and country. Follow<br />

(b) a gross basis at a rate of 30% under on the date of your renunciation of the country’s practice <strong>for</strong> entering the<br />

the rules of section 871(a). See<br />

citizenship or termination of residency postal code. Do not abbreviate the<br />

Chapter 4 of Pub. 519 <strong>for</strong> more details or at any time during the 2 years country name.<br />

on the tax imposed under section preceding such date. Such income or Identifying Number. If you are an<br />

871(a).<br />

gain is considered U.S. source only to individual, you are generally required to<br />

If you have items of U.S. source<br />

the extent of your share of the earnings enter your social security number<br />

income that are subject to tax under and profits earned or accumulated prior (SSN). To apply <strong>for</strong> an SSN, get <strong>Form</strong><br />

section 871(a), you will be taxed at a to the date of renunciation of U.S. SS-5 from a Social Security<br />

rate of 30% on your gross income only citizenship or termination of residency. Administration (SSA) office or, if in the<br />

if this tax exceeds the tax at the regular You may not claim that a tax treaty United States, you may call the SSA at<br />

graduated rates on your net income. If in effect on August 21, 1996, prevents 1-800-772-1213. Fill in <strong>Form</strong> SS-5 and<br />

the 30% tax on your gross income the imposition of tax by reason of return it to the SSA.<br />

exceeds the graduated tax on your net section 877. If you do not have an SSN and are<br />

income, report those items on the<br />

not eligible to get one, you must get an<br />

appropriate lines on page 4 of <strong>Form</strong><br />

Annual In<strong>for</strong>mation<br />

individual taxpayer identification<br />

<strong>1040NR</strong>. If the graduated tax on your<br />

number (ITIN). To apply <strong>for</strong> an ITIN,<br />

net income exceeds the 30% tax on Statement<br />

file <strong>Form</strong> W-7 with the IRS. It usually<br />

your gross income, report your income If the expatriation rules apply to you takes about 4-6 weeks to get an ITIN.<br />

on the appropriate lines on page 1 of and you are liable <strong>for</strong> U.S. taxes, you Enter your ITIN wherever your SSN<br />

<strong>Form</strong> <strong>1040NR</strong> and attach a statement must attach an annual in<strong>for</strong>mation is requested on your tax return. If<br />

describing the items and amounts of statement to <strong>Form</strong> <strong>1040NR</strong> that sets you are required to include another<br />

income that are subject to tax by <strong>for</strong>th by category (<strong>for</strong> example, person’s SSN on your return and that<br />

reason of section 877. dividends, interest, etc.) all items of person does not have and cannot get<br />

If you have other items of U.S. U.S. and <strong>for</strong>eign source gross income an SSN, enter that person’s ITIN.<br />

source income that are not subject to (whether or not taxable in the United<br />

States). The statement must identify the<br />

Note: An ITIN is <strong>for</strong> tax use only. It<br />

tax under section 871(a), you will be<br />

source of such income (determined<br />

does not entitle you to social security<br />

taxed on a net basis at the regular<br />

under section 877 as modified by<br />

benefits or change your employment or<br />

graduated rates applicable to<br />

Section V of Notice 97-19) and those<br />

immigration status under U.S. law.<br />

individuals. Report this income on the<br />

appropriate lines on page 1 of <strong>Form</strong> items of income subject to tax under If you are filing <strong>Form</strong> <strong>1040NR</strong> <strong>for</strong> an<br />

<strong>1040NR</strong>.<br />

section 877. If the expatriation rules estate or trust, enter the employer<br />

apply to you, you must attach this identification number of the estate or<br />

For purposes of computing the tax statement to <strong>Form</strong> <strong>1040NR</strong>, even if you trust.<br />

due under section 877, the following have fully satisfied your U.S. tax liability<br />

items of income are treated as U.S. An incorrect or missing identifying<br />

through withholding of tax at source.<br />

source.<br />

number may increase your tax or<br />

reduce your refund.<br />

1. Gains on the sale or exchange of<br />

personal property located in the United<br />

States.<br />

2. Gains on the sale or exchange of<br />

stock issued by a domestic corporation<br />

or debt obligations of the United States,<br />

<strong>Instructions</strong> <strong>for</strong> <strong>Form</strong> <strong>1040NR</strong><br />

If you fail to furnish a complete<br />

statement, as described above, you will<br />

not be considered to have filed a true<br />

and accurate return. There<strong>for</strong>e, you will<br />

not be entitled to any deductions or<br />

credits if your tax liability <strong>for</strong> your <strong>2001</strong><br />

-7-<br />

Filing Status<br />

The amount of your tax depends on<br />

your filing status. Be<strong>for</strong>e you decide