2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

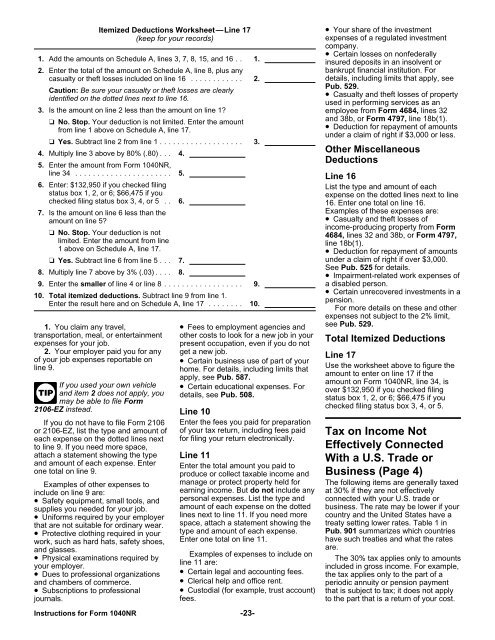

Itemized Deductions Worksheet—Line 17<br />

• Your share of the investment<br />

(keep <strong>for</strong> your records)<br />

expenses of a regulated investment<br />

company.<br />

• Certain losses on nonfederally<br />

1. Add the amounts on Schedule A, lines 3, 7, 8, 15, and 16 . . 1.<br />

insured deposits in an insolvent or<br />

2. Enter the total of the amount on Schedule A, line 8, plus any<br />

bankrupt financial institution. For<br />

casualty or theft losses included on line 16 ............ 2.<br />

details, including limits that apply, see<br />

Pub. 529.<br />

Caution: Be sure your casualty or theft losses are clearly<br />

• Casualty and theft losses of property<br />

identified on the dotted lines next to line 16.<br />

used in per<strong>for</strong>ming services as an<br />

3. Is the amount on line 2 less than the amount on line 1? employee from <strong>Form</strong> 4684, lines 32<br />

❏ No. Stop. Your deduction is not limited. Enter the amount<br />

and 38b, or <strong>Form</strong> 4797, line 18b(1).<br />

from line 1 above on Schedule A, line 17.<br />

• Deduction <strong>for</strong> repayment of amounts<br />

under a claim of right if $3,000 or less.<br />

❏ Yes. Subtract line 2 from line 1 ................... 3.<br />

4. Multiply line 3 above by 80% (.80) . . . 4.<br />

Other Miscellaneous<br />

Deductions<br />

5. Enter the amount from <strong>Form</strong> <strong>1040NR</strong>,<br />

line 34 ...................... 5. Line 16<br />

6. Enter: $132,950 if you checked filing List the type and amount of each<br />

status box 1, 2, or 6; $66,475 if you<br />

expense on the dotted lines next to line<br />

checked filing status box 3, 4, or 5 . . 6. 16. Enter one total on line 16.<br />

7. Is the amount on line 6 less than the<br />

Examples of these expenses are:<br />

amount on line 5?<br />

• Casualty and theft losses of<br />

income-producing property from <strong>Form</strong><br />

❏ No. Stop. Your deduction is not 4684, lines 32 and 38b, or <strong>Form</strong> 4797,<br />

limited. Enter the amount from line<br />

line 18b(1).<br />

1 above on Schedule A, line 17. • Deduction <strong>for</strong> repayment of amounts<br />

❏ Yes. Subtract line 6 from line 5 . . . 7.<br />

under a claim of right if over $3,000.<br />

See Pub. 525 <strong>for</strong> details.<br />

8. Multiply line 7 above by 3% (.03) . . . . 8.<br />

• Impairment-related work expenses of<br />

9. Enter the smaller of line 4 or line 8 .................. 9.<br />

a disabled person.<br />

10. Total itemized deductions. Subtract line 9 from line 1.<br />

Enter the result here and on Schedule A, line 17 ........ 10.<br />

• Certain unrecovered investments in a<br />

pension.<br />

For more details on these and other<br />

expenses not subject to the 2% limit,<br />

see Pub. 529.<br />

1. You claim any travel, • Fees to employment agencies and<br />

transportation, meal, or entertainment other costs to look <strong>for</strong> a new job in your<br />

Total Itemized Deductions<br />

expenses <strong>for</strong> your job.<br />

present occupation, even if you do not<br />

2. Your employer paid you <strong>for</strong> any get a new job.<br />

Line 17<br />

of your job expenses reportable on • Certain business use of part of your<br />

line 9.<br />

home. For details, including limits that<br />

Use the worksheet above to figure the<br />

apply, see Pub. 587.<br />

amount to enter on line 17 if the<br />

If you used your own vehicle<br />

amount on <strong>Form</strong> <strong>1040NR</strong>, line 34, is<br />

• Certain educational expenses. For<br />

TIP and item 2 does not apply, you<br />

over $132,950 if you checked filing<br />

details, see Pub. 508.<br />

may be able to file <strong>Form</strong><br />

status box 1, 2, or 6; $66,475 if you<br />

2106-EZ instead.<br />

checked filing status box 3, 4, or 5.<br />

Line 10<br />

If you do not have to file <strong>Form</strong> 2106 Enter the fees you paid <strong>for</strong> preparation<br />

or 2106-EZ, list the type and amount of of your tax return, including fees paid Tax on Income Not<br />

each expense on the dotted lines next <strong>for</strong> filing your return electronically.<br />

to line 9. If you need more space,<br />

Effectively Connected<br />

attach a statement showing the type Line 11 With a U.S. Trade or<br />

and amount of each expense. Enter Enter the total amount you paid to<br />

one total on line 9. Business (Page 4)<br />

Examples of other expenses to<br />

include on line 9 are:<br />

• Safety equipment, small tools, and<br />

supplies you needed <strong>for</strong> your job.<br />

• Uni<strong>for</strong>ms required by your employer<br />

that are not suitable <strong>for</strong> ordinary wear.<br />

• Protective clothing required in your<br />

work, such as hard hats, safety shoes,<br />

and glasses.<br />

• Physical examinations required by<br />

your employer.<br />

• Dues to professional organizations<br />

and chambers of commerce.<br />

• Subscriptions to professional<br />

journals.<br />

<strong>Instructions</strong> <strong>for</strong> <strong>Form</strong> <strong>1040NR</strong><br />

produce or collect taxable income and<br />

manage or protect property held <strong>for</strong><br />

earning income. But do not include any<br />

personal expenses. List the type and<br />

amount of each expense on the dotted<br />

lines next to line 11. If you need more<br />

space, attach a statement showing the<br />

type and amount of each expense.<br />

Enter one total on line 11.<br />

Examples of expenses to include on<br />

line 11 are:<br />

• Certain legal and accounting fees.<br />

• Clerical help and office rent.<br />

• Custodial (<strong>for</strong> example, trust account)<br />

fees.<br />

-23-<br />

The following items are generally taxed<br />

at 30% if they are not effectively<br />

connected with your U.S. trade or<br />

business. The rate may be lower if your<br />

country and the United States have a<br />

treaty setting lower rates. Table 1 in<br />

Pub. 901 summarizes which countries<br />

have such treaties and what the rates<br />

are.<br />

The 30% tax applies only to amounts<br />

included in gross income. For example,<br />

the tax applies only to the part of a<br />

periodic annuity or pension payment<br />

that is subject to tax; it does not apply<br />

to the part that is a return of your cost.