2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board 2001 Instructions for Form 1040NR - Uncle Fed's Tax*Board

Student Loan Interest Deduction Worksheet—Line 25 (keep for your records) Before you begin: • Complete Form 1040NR, lines 26 through 31, if they apply to you. • Figure any amount to be entered on the dotted line next to line 32 (see the instructions for line 32 on this page). • See the instructions for line 25 on page 13. Pub. 560 or, if you were a minister, Pub. 517. Line 30—Penalty on Early Withdrawal of Savings. The Form 1099-INT or Form 1099-OID you received will show the amount of any penalty you were charged. Line 31—Scholarship and Fellowship Grants Excluded. If you 1. Enter the total interest you paid in 2001 on qualified student loans received a scholarship or fellowship (defined on page 13). Do not include interest that was required to be grant and were a degree candidate, paid after the first 60 months ............................. 1. enter amounts used for tuition and 2. Enter the smaller of line 1 or $2,500 ....................... 2. course-related expenses (fees, books, supplies, and equipment), but only to 3. Enter the amount from Form 1040NR, line 23 ...... 3. the extent the amounts are included on 4. Enter the total of the amounts from Form 1040NR, line 12. See the examples in the line 24, lines 26 through 31, plus any amount you entered on the dotted line next to line 32 ......... 4. instructions for line 12 on page 10. Line 32. Include in the total on line 32 5. Subtract line 4 from line 3 .................... 5. any of the following adjustments that are related to your effectively 6. Is line 5 more than $40,000? connected income. To find out if you ❏ No. Skip lines 6 and 7, enter -0- on line 8, and go can take the deduction, see the form or to line 9. publication indicated. On the dotted line ❏ Yes. Subtract $40,000 from line 5 ............ 6. next to line 32, enter the amount of your deduction and identify it as 7. Divide line 6 by $15,000. Enter the result as a decimal (rounded to at indicated. least three places). Do not enter more than “1.000” ............ 7. . • Performing-arts-related expenses 8. Multiply line 2 by line 7 ................................. 8. (see Form 2106 or Form 2106-EZ). 9. Student loan interest deduction. Subtract line 8 from line 2. Enter Identify as “QPA.” the result here and on Form 1040NR, line 25. Do not include this • Reforestation amortization (see Pub. amount in figuring any other deduction on your return (such as on 535). Identify as “RFST.” Schedule A (Form 1040NR), Schedule C (Form 1040), Schedule E • Repayment of supplemental (Form 1040), etc.) .................................... 9. unemployment benefits under the Trade Act of 1974 (see Pub. 525). Identify as “Sub-Pay TRA.” Form 3903 to figure the amount to • You had more than one source of • Contributions to section 501(c)(18) enter on this line. income subject to self-employment tax. pension plans (see Pub. 525). Identify Line 28—Self-Employed Health • You are using amounts paid for as “501(c)(18).” Insurance Deduction. If you were qualified long-term care insurance to • Contributions by certain chaplains to self-employed and had a net profit for figure the deduction. section 403(b) plans (see Pub. 517). the year, you may be able to deduct Line 29—Self-Employed SEP, Identify as “403(b).” part of the amount paid for health SIMPLE, and Qualified Plans. If you • Deduction for clean-fuel vehicles insurance for yourself, your spouse, were self-employed or a partner, you (see Pub. 535). Identify as and dependents. The insurance plan may be able to take this deduction. See “Clean-Fuel.” must be established under your business. But if you were also eligible Self-Employed Health Insurance Deduction Worksheet—Line 28 to participate in any subsidized health plan maintained by your or your (keep for your records) spouse’s employer for any month or Before you begin: part of a month in 2001, amounts paid • Complete Form 1040NR, line 29, if it applies to you. for health insurance coverage for that month cannot be used to figure the • Be sure you have read the Exception on this page to see if you can use this deduction. For example, if you were worksheet instead of Pub. 535 to figure your deduction. eligible to participate in a subsidized health plan maintained by your 1. Enter the total amount paid in 2001 for health insurance coverage spouse’s employer from September 30 established under your business for 2001 for you, your spouse, through December 31, you cannot use and dependents. But do not include amounts for any month you amounts paid for health insurance were eligible to participate in an employer-sponsored health plan . . 1. coverage for September through 2. Multiply line 1 by 60% (.60) ............................. 2. December to figure your deduction. For more details, see Pub. 535. 3. Enter your net profit and any other earned income* from the business under which the insurance plan is established, minus any If you qualify to take the deduction, deduction you claim on Form 1040NR, line 29 ............... 3. use the worksheet on this page to figure the amount you can deduct. Exception. Use Pub. 535 instead of the worksheet on this page to find out how to figure your deduction if either of the following applies. 4. Self-employed health insurance deduction. Enter the smaller of line 2 or line 3 here and on Form 1040NR, line 28 ............ 4. *Earned income includes net earnings and gains from the sale, transfer, or licensing of property you created. It does not include capital gain income. -14- Instructions for Form 1040NR

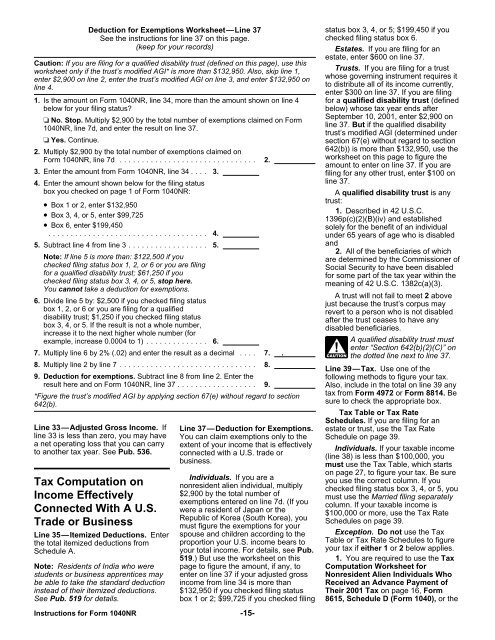

Deduction for Exemptions Worksheet—Line 37 status box 3, 4, or 5; $199,450 if you See the instructions for line 37 on this page. checked filing status box 6. (keep for your records) Estates. If you are filing for an estate, enter $600 on line 37. Caution: If you are filing for a qualified disability trust (defined on this page), use this worksheet only if the trust’s modified AGI* is more than $132,950. Also, skip line 1, Trusts. If you are filing for a trust enter $2,900 on line 2, enter the trust’s modified AGI on line 3, and enter $132,950 on whose governing instrument requires it line 4. to distribute all of its income currently, enter $300 on line 37. If you are filing 1. Is the amount on Form 1040NR, line 34, more than the amount shown on line 4 for a qualified disability trust (defined below for your filing status? below) whose tax year ends after ❏ No. Stop. Multiply $2,900 by the total number of exemptions claimed on Form September 10, 2001, enter $2,900 on 1040NR, line 7d, and enter the result on line 37. line 37. But if the qualified disability trust’s modified AGI (determined under ❏ Yes. Continue. section 67(e) without regard to section 2. Multiply $2,900 by the total number of exemptions claimed on 642(b)) is more than $132,950, use the Form 1040NR, line 7d ............................... 2. worksheet on this page to figure the amount to enter on line 37. If you are 3. Enter the amount from Form 1040NR, line 34 . . . . 3. filing for any other trust, enter $100 on 4. Enter the amount shown below for the filing status line 37. box you checked on page 1 of Form 1040NR: A qualified disability trust is any trust: • Box 1 or 2, enter $132,950 1. Described in 42 U.S.C. • Box 3, 4, or 5, enter $99,725 1396p(c)(2)(B)(iv) and established • Box 6, enter $199,450 solely for the benefit of an individual .................................... 4. under 65 years of age who is disabled 5. Subtract line 4 from line 3 .................. 5. and 2. All of the beneficiaries of which Note: If line 5 is more than: $122,500 if you are determined by the Commissioner of checked filing status box 1, 2, or 6 or you are filing Social Security to have been disabled for a qualified disability trust; $61,250 if you for some part of the tax year within the checked filing status box 3, 4, or 5, stop here. meaning of 42 U.S.C. 1382c(a)(3). You cannot take a deduction for exemptions. A trust will not fail to meet 2 above 6. Divide line 5 by: $2,500 if you checked filing status just because the trust’s corpus may box 1, 2, or 6 or you are filing for a qualified revert to a person who is not disabled disability trust; $1,250 if you checked filing status after the trust ceases to have any box 3, 4, or 5. If the result is not a whole number, disabled beneficiaries. increase it to the next higher whole number (for example, increase 0.0004 to 1) .............. 6. A qualified disability trust must enter “Section 642(b)(2)(C)” on 7. Multiply line 6 by 2% (.02) and enter the result as a decimal . . . . 7. . ! CAUTION the dotted line next to line 37. 8. Multiply line 2 by line 7 ............................... 8. Line 39—Tax. Use one of the 9. Deduction for exemptions. Subtract line 8 from line 2. Enter the following methods to figure your tax. result here and on Form 1040NR, line 37 .................. 9. Also, include in the total on line 39 any *Figure the trust’s modified AGI by applying section 67(e) without regard to section tax from Form 4972 or Form 8814. Be 642(b). sure to check the appropriate box. Tax Table or Tax Rate Schedules. If you are filing for an Line 33—Adjusted Gross Income. If Line 37—Deduction for Exemptions. estate or trust, use the Tax Rate line 33 is less than zero, you may have You can claim exemptions only to the Schedule on page 39. a net operating loss that you can carry extent of your income that is effectively to another tax year. See Pub. 536. Individuals. If your taxable income connected with a U.S. trade or (line 38) is less than $100,000, you business. must use the Tax Table, which starts on page 27, to figure your tax. Be sure Individuals. If you are a Tax Computation on you use the correct column. If you nonresident alien individual, multiply checked filing status box 3, 4, or 5, you Income Effectively $2,900 by the total number of must use the Married filing separately exemptions entered on line 7d. (If you column. If your taxable income is Connected With A U.S. were a resident of Japan or the $100,000 or more, use the Tax Rate Republic of Korea (South Korea), you Trade or Business Schedules on page 39. must figure the exemptions for your Line 35—Itemized Deductions. Enter spouse and children according to the Exception. Do not use the Tax the total itemized deductions from proportion your U.S. income bears to Table or Tax Rate Schedules to figure Schedule A. your total income. For details, see Pub. your tax if either 1 or 2 below applies. 519.) But use the worksheet on this 1. You are required to use the Tax Note: Residents of India who were page to figure the amount, if any, to Computation Worksheet for students or business apprentices may enter on line 37 if your adjusted gross Nonresident Alien Individuals Who be able to take the standard deduction income from line 34 is more than Received an Advance Payment of instead of their itemized deductions. $132,950 if you checked filing status Their 2001 Tax on page 16, Form See Pub. 519 for details. box 1 or 2; $99,725 if you checked filing 8615, Schedule D (Form 1040), or the Instructions for Form 1040NR -15-

- Page 1 and 2: 2001 Instructions for Form 1040NR U

- Page 3 and 4: • You were not engaged in a trade

- Page 5 and 6: Special rules apply for exemptions

- Page 7 and 8: Inflation-Adjusted Amounts for Expa

- Page 9 and 10: • Is a U.S. citizen or resident a

- Page 11 and 12: 2e of Forms 1099-DIV or substitute

- Page 13: You may be able to pay less tax Wer

- Page 17 and 18: Capital Gain Tax Worksheet—Line 3

- Page 19 and 20: the country of which you are a resi

- Page 21 and 22: 2001 must have been made on time

- Page 23 and 24: Itemized Deductions Worksheet—Lin

- Page 25 and 26: periodic income ordinarily subject

- Page 27 and 28: 2001 Tax Table For persons with tax

- Page 29 and 30: 2001 Tax Table—Continued Caution:

- Page 31 and 32: 2001 Tax Table—Continued Caution:

- Page 33 and 34: 2001 Tax Table—Continued Caution:

- Page 35 and 36: 2001 Tax Table—Continued Caution:

- Page 37 and 38: 2001 Tax Table—Continued Caution:

- Page 39 and 40: 2001 Tax Rate Schedules These tax r

Deduction <strong>for</strong> Exemptions Worksheet—Line 37<br />

status box 3, 4, or 5; $199,450 if you<br />

See the instructions <strong>for</strong> line 37 on this page.<br />

checked filing status box 6.<br />

(keep <strong>for</strong> your records)<br />

Estates. If you are filing <strong>for</strong> an<br />

estate, enter $600 on line 37.<br />

Caution: If you are filing <strong>for</strong> a qualified disability trust (defined on this page), use this<br />

worksheet only if the trust’s modified AGI* is more than $132,950. Also, skip line 1,<br />

Trusts. If you are filing <strong>for</strong> a trust<br />

enter $2,900 on line 2, enter the trust’s modified AGI on line 3, and enter $132,950 on<br />

whose governing instrument requires it<br />

line 4.<br />

to distribute all of its income currently,<br />

enter $300 on line 37. If you are filing<br />

1. Is the amount on <strong>Form</strong> <strong>1040NR</strong>, line 34, more than the amount shown on line 4 <strong>for</strong> a qualified disability trust (defined<br />

below <strong>for</strong> your filing status?<br />

below) whose tax year ends after<br />

❏ No. Stop. Multiply $2,900 by the total number of exemptions claimed on <strong>Form</strong><br />

September 10, <strong>2001</strong>, enter $2,900 on<br />

<strong>1040NR</strong>, line 7d, and enter the result on line 37.<br />

line 37. But if the qualified disability<br />

trust’s modified AGI (determined under<br />

❏ Yes. Continue.<br />

section 67(e) without regard to section<br />

2. Multiply $2,900 by the total number of exemptions claimed on<br />

642(b)) is more than $132,950, use the<br />

<strong>Form</strong> <strong>1040NR</strong>, line 7d ............................... 2.<br />

worksheet on this page to figure the<br />

amount to enter on line 37. If you are<br />

3. Enter the amount from <strong>Form</strong> <strong>1040NR</strong>, line 34 . . . . 3. filing <strong>for</strong> any other trust, enter $100 on<br />

4. Enter the amount shown below <strong>for</strong> the filing status<br />

line 37.<br />

box you checked on page 1 of <strong>Form</strong> <strong>1040NR</strong>:<br />

A qualified disability trust is any<br />

trust:<br />

• Box 1 or 2, enter $132,950<br />

1. Described in 42 U.S.C.<br />

• Box 3, 4, or 5, enter $99,725<br />

1396p(c)(2)(B)(iv) and established<br />

• Box 6, enter $199,450<br />

solely <strong>for</strong> the benefit of an individual<br />

.................................... 4. under 65 years of age who is disabled<br />

5. Subtract line 4 from line 3 .................. 5.<br />

and<br />

2. All of the beneficiaries of which<br />

Note: If line 5 is more than: $122,500 if you<br />

are determined by the Commissioner of<br />

checked filing status box 1, 2, or 6 or you are filing<br />

Social Security to have been disabled<br />

<strong>for</strong> a qualified disability trust; $61,250 if you<br />

<strong>for</strong> some part of the tax year within the<br />

checked filing status box 3, 4, or 5, stop here.<br />

meaning of 42 U.S.C. 1382c(a)(3).<br />

You cannot take a deduction <strong>for</strong> exemptions.<br />

A trust will not fail to meet 2 above<br />

6. Divide line 5 by: $2,500 if you checked filing status<br />

just because the trust’s corpus may<br />

box 1, 2, or 6 or you are filing <strong>for</strong> a qualified<br />

revert to a person who is not disabled<br />

disability trust; $1,250 if you checked filing status<br />

after the trust ceases to have any<br />

box 3, 4, or 5. If the result is not a whole number,<br />

disabled beneficiaries.<br />

increase it to the next higher whole number (<strong>for</strong><br />

example, increase 0.0004 to 1) .............. 6.<br />

A qualified disability trust must<br />

enter “Section 642(b)(2)(C)” on<br />

7. Multiply line 6 by 2% (.02) and enter the result as a decimal . . . . 7. .<br />

!<br />

CAUTION the dotted line next to line 37.<br />

8. Multiply line 2 by line 7 ............................... 8.<br />

Line 39—Tax. Use one of the<br />

9. Deduction <strong>for</strong> exemptions. Subtract line 8 from line 2. Enter the following methods to figure your tax.<br />

result here and on <strong>Form</strong> <strong>1040NR</strong>, line 37 .................. 9. Also, include in the total on line 39 any<br />

*Figure the trust’s modified AGI by applying section 67(e) without regard to section<br />

tax from <strong>Form</strong> 4972 or <strong>Form</strong> 8814. Be<br />

642(b).<br />

sure to check the appropriate box.<br />

Tax Table or Tax Rate<br />

Schedules. If you are filing <strong>for</strong> an<br />

Line 33—Adjusted Gross Income. If Line 37—Deduction <strong>for</strong> Exemptions. estate or trust, use the Tax Rate<br />

line 33 is less than zero, you may have You can claim exemptions only to the Schedule on page 39.<br />

a net operating loss that you can carry extent of your income that is effectively<br />

to another tax year. See Pub. 536.<br />

Individuals. If your taxable income<br />

connected with a U.S. trade or<br />

(line 38) is less than $100,000, you<br />

business.<br />

must use the Tax Table, which starts<br />

on page 27, to figure your tax. Be sure<br />

Individuals. If you are a<br />

Tax Computation on<br />

you use the correct column. If you<br />

nonresident alien individual, multiply<br />

checked filing status box 3, 4, or 5, you<br />

Income Effectively<br />

$2,900 by the total number of<br />

must use the Married filing separately<br />

exemptions entered on line 7d. (If you<br />

column. If your taxable income is<br />

Connected With A U.S. were a resident of Japan or the<br />

$100,000 or more, use the Tax Rate<br />

Republic of Korea (South Korea), you<br />

Trade or Business<br />

Schedules on page 39.<br />

must figure the exemptions <strong>for</strong> your<br />

Line 35—Itemized Deductions. Enter spouse and children according to the Exception. Do not use the Tax<br />

the total itemized deductions from proportion your U.S. income bears to Table or Tax Rate Schedules to figure<br />

Schedule A.<br />

your total income. For details, see Pub. your tax if either 1 or 2 below applies.<br />

519.) But use the worksheet on this 1. You are required to use the Tax<br />

Note: Residents of India who were page to figure the amount, if any, to Computation Worksheet <strong>for</strong><br />

students or business apprentices may enter on line 37 if your adjusted gross Nonresident Alien Individuals Who<br />

be able to take the standard deduction income from line 34 is more than Received an Advance Payment of<br />

instead of their itemized deductions. $132,950 if you checked filing status Their <strong>2001</strong> Tax on page 16, <strong>Form</strong><br />

See Pub. 519 <strong>for</strong> details. box 1 or 2; $99,725 if you checked filing 8615, Schedule D (<strong>Form</strong> 1040), or the<br />

<strong>Instructions</strong> <strong>for</strong> <strong>Form</strong> <strong>1040NR</strong><br />

-15-