Stakeholder Update Summer 2013 - The Pensions Regulator

Stakeholder Update Summer 2013 - The Pensions Regulator

Stakeholder Update Summer 2013 - The Pensions Regulator

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Keeping<br />

you informed<br />

Welcome to the summer <strong>Stakeholder</strong> update. As you<br />

will all now probably be aware, in March I announced my<br />

intention to leave the regulator at the end of June to take<br />

up a new role as group chief executive of the Universities<br />

Superannuation Scheme Ltd (USS).<br />

Leaving the regulator will be very hard. I leave behind a hugely committed<br />

team, which has a clear vision on how to support this vital industry. It has<br />

been a privilege to represent their work to the outside world. I wish them<br />

all very well. We advertised for my replacement in May and the chairman<br />

expects to recruit my successor in July. It has been a pleasure working with<br />

so many of you over the past 5 years.<br />

<strong>Update</strong><br />

<strong>Stakeholder</strong><br />

<strong>Summer</strong> <strong>2013</strong><br />

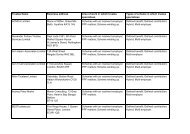

In this issue...<br />

Pension liberation fraud update<br />

What’s happened so far<br />

Maintaining contributions<br />

Draft codes of practice and guidance laid<br />

Making a statement<br />

Our DB funding statement<br />

Latest developments<br />

<strong>Update</strong>s from across the organisation<br />

Coming soon<br />

New publications on the horizon<br />

Bill Galvin<br />

Chief executive, <strong>The</strong> <strong>Pensions</strong> <strong>Regulator</strong><br />

For further details of the items mentioned in this<br />

newsletter, please see our website: www.tpr.gov.uk

Latest<br />

developments...<br />

Our<br />

member<br />

information<br />

leaflet<br />

‘We need to<br />

make sure that<br />

the action we<br />

take is joinedup,<br />

as decisive<br />

as possible, and<br />

that we limit the<br />

risks of new forms<br />

of pensions scam<br />

emerging’.<br />

Pension liberation<br />

fraud update<br />

<strong>The</strong> industry has an important role to play in<br />

disrupting this activity, and there has been<br />

an overwhelmingly positive response to our<br />

‘scorpion’ awareness campaign.<br />

We’ve had more than 4,000 visitors to our website<br />

landing page – with frequent downloads of our action<br />

pack, transfer insert and member information leaflet, as<br />

well as a ‘bite-sized’ e-learning module for trustees<br />

and administrators.<br />

We cannot tackle this issue without the help of others and<br />

we work with a cross-government task force looking at<br />

this issue, called Project Bloom. This involves, amongst<br />

others, the new National Crime Agency, the Serious<br />

Fraud Office, the Serious and Organised Crime Agency,<br />

the Financial Conduct Authority, HM Revenue and<br />

Customs, the City of London Police and the <strong>Pensions</strong><br />

Advisory Service.<br />

You will probably be aware of the recent raids undertaken<br />

by the City of London Police, supported by staff from<br />

the regulator and other agencies. If you have any<br />

information about pension liberation fraud, please help<br />

us assemble the intelligence picture by reporting your<br />

suspicions to Action Fraud – the central intelligence hub<br />

for Project Bloom.<br />

<strong>The</strong> pension liberation<br />

landing page on our website<br />

We are also looking carefully at a range of further<br />

options to tackle this issue, but there is no simple<br />

answer or single quick fix. We need to make sure that<br />

the action we take is joined-up, as decisive as possible,<br />

and that we limit the risks of new forms of pensions<br />

scams emerging. <strong>The</strong>se are issues we will take forward<br />

with our Government and Project Bloom partners, and<br />

with the industry.<br />

Go to: www.tpr.gov.uk/professionals/pensionliberation-fraud-professionals.aspx<br />

to find out more<br />

<strong>Stakeholder</strong> <strong>Update</strong> <strong>Summer</strong> <strong>2013</strong><br />

2

Draft<br />

codes and<br />

guidance<br />

published<br />

‘<strong>The</strong>y build on<br />

current good<br />

practice and<br />

existing legal<br />

duties, as well<br />

as focusing on<br />

establishing clear<br />

accountabilities<br />

for achieving<br />

good outcomes<br />

for members.’<br />

Maintaining<br />

contributions<br />

On 7 June, we published revised codes and<br />

guidance to support automatic enrolment by<br />

helping to ensure that members of workplace<br />

pensions receive the pension contributions<br />

they are due, setting out:<br />

• guidance for employers who have primary<br />

responsibility for ensuring the correct level of<br />

contribution is paid to schemes on time. This explains<br />

how employers can meet their duty to calculate the<br />

correct pension contribution<br />

• codes and supporting guidance for trustees and<br />

pension providers setting out how they should<br />

meet their obligations to monitor the payment of<br />

contributions due to be paid, provide information to<br />

members, and report material payment failures to both<br />

the regulator and scheme members.<br />

<strong>The</strong>y build on current good practice and existing<br />

legal duties, as well as focusing on establishing clear<br />

accountabilities for achieving good outcomes for<br />

members. We also published a quick guide for employers,<br />

providing clear information to employers on paying<br />

contributions, including information on how to calculate,<br />

deduct and pay contributions.<br />

<strong>The</strong> codes of practice and<br />

supporting guidance address<br />

comments made in response to<br />

the consultation. For example, clarification of the<br />

duty on trustees and managers to monitor<br />

contributions due to the scheme and in particular,<br />

that an effective monitoring system should be<br />

proportionate and risk-based.<br />

<strong>The</strong> draft codes of practice have been laid before<br />

Parliament and the Northern Ireland Assembly. After<br />

the process is completed, these codes are expected to<br />

come into force in autumn <strong>2013</strong>.<br />

To see the consultation response and draft codes<br />

of practice, visit our website: www.tpr.gov.uk/<br />

doc-library/maintaining-contributions.aspx<br />

To see the quick guide for employers, go to:<br />

www.tpr.gov.uk/employers/<br />

contributions-funding-tax.aspx<br />

<strong>Stakeholder</strong> <strong>Update</strong> <strong>Summer</strong> <strong>2013</strong><br />

3

Latest<br />

developments...<br />

‘Our statement<br />

makes it clear that<br />

legislation requires<br />

the discount rate<br />

to calculate future<br />

liabilities (known<br />

as ‘technical<br />

provisions’), to be<br />

chosen prudently’<br />

Annual DB<br />

funding statement<br />

In May we published our annual funding<br />

statement primarily aimed at helping<br />

pension scheme trustees and sponsoring<br />

employers undertaking valuations with<br />

effective dates between 22 September 2012<br />

and 21 September <strong>2013</strong>.<br />

Our statement makes it clear that legislation requires<br />

the discount rate to calculate future liabilities (known as<br />

‘technical provisions’), to be chosen prudently, taking into<br />

account the yield held by assets of the scheme and/or<br />

the yield on Government or high-quality bonds. Trustees<br />

can use the flexibility available in setting discount rates to<br />

adopt an approach to best fit their circumstances.<br />

Trustees are also reminded that they should take into<br />

account what is reasonably affordable to the employer<br />

when agreeing contribution levels and should consider<br />

whether the current level of contributions can be<br />

maintained. For some employers it may be reasonable to<br />

make increases while others may find that they are unable<br />

to do so.<br />

To view the annual DB funding statement, visit our website:<br />

www.tpr.gov.uk/doc-library/statements.aspx#s8142<br />

Trustees are also encouraged to produce plans that<br />

take an integrated approach to managing the risks<br />

to their scheme, including funding levels, investment<br />

performance and the employer covenant.<br />

Finally, we also set out that we continue to evolve<br />

our suite of risk indicators as part of our filter<br />

mechanism for assessing recovery plans and that we<br />

would continue with our programme of proactive<br />

engagement with a selection of schemes undergoing<br />

<strong>2013</strong> valuations.<br />

Looking forward<br />

• DC code and response<br />

to the consultation<br />

• DC regulatory approach<br />

• DC compliance and<br />

enforcement strategy<br />

• Employer, IFA and accountant guides<br />

to choosing a quality DC scheme<br />

• <strong>Update</strong>d management committee guidance<br />

Continuing this busy year, we also expect to issue<br />

consultations on revisions to our defined benefit code<br />

and regulatory approach, record-keeping, public service<br />

pensions and trustee knowledge and understanding.<br />

<strong>Stakeholder</strong> <strong>Update</strong> <strong>Summer</strong> <strong>2013</strong> 4

Latest<br />

developments...<br />

‘<strong>The</strong>re is a lot<br />

going on, and<br />

we are all working<br />

together to<br />

build confidence<br />

in workplace<br />

pensions’.<br />

Corporate plan <strong>2013</strong>-<br />

2016 published<br />

In May, we published our Corporate plan<br />

for <strong>2013</strong>-2016, setting out our strategic<br />

approach to regulating defined benefit (DB)<br />

and defined contribution (DC) schemes and<br />

maximising employer compliance with new<br />

automatic enrolment duties.<br />

We held our annual stakeholder conference on the same<br />

day and set out for you our priorities, as well as hearing<br />

from some of you on what challenges there are facing the<br />

industry. <strong>The</strong> key message for the day was that there is<br />

a lot going on, and we are all working together to build<br />

confidence in workplace pensions.<br />

Thanks to those of you who attended, and also to the<br />

presenters, Tim Thomas from EEF, Craig Berry from TUC<br />

and Roger Mattingly from SPC.<br />

Trustee updates<br />

Trustee toolkit<br />

<strong>Update</strong>s to ‘Funding your DB scheme’, ‘DB recovery<br />

plans’, ‘Contributions and funding principles’ and<br />

‘How DB schemes work’ have been made to reflect<br />

the challenges that DB trustees face in the current<br />

economic environment. For those trustees who have<br />

already completed these modules and the toolkit,<br />

we recommend they go and have a look and refresh<br />

their knowledge. For those who are in the process<br />

of completing the toolkit, we recommend that they<br />

complete the new versions of the modules.<br />

Guide for new trustees<br />

Aimed at people new to the role of trustee and also<br />

to those who may be considering becoming a trustee,<br />

it sets out roles, responsibilities and our expectations,<br />

and promotes the resources we can provide to help<br />

them gain a deeper understanding of the role. We’ll<br />

be emailing a link to this to chairs of pension schemes,<br />

so that they can pass this on to new trustees or anyone<br />

thinking of becoming a trustee.<br />

Read the Corporate plan<br />

here: www.tpr.gov.uk/about-us/<br />

corporate-plans.aspx<br />

To see the DB modules, visit our Trustee toolkit:<br />

https://trusteetoolkit.thepensionsregulator.gov.uk/<br />

arena/index.cfm<br />

<strong>Stakeholder</strong> <strong>Update</strong> <strong>Summer</strong> <strong>2013</strong> 5

Latest<br />

developments...<br />

Automatic enrolment<br />

monthly reports<br />

Beginning in April, we have begun to publish monthly<br />

information on automatic enrolment, derived from<br />

information submitted by employers when they register,<br />

supplemented by annual reports including additional<br />

analysis and commentary. This report shows, on a<br />

cumulative basis, the number of employers who have<br />

registered with the regulator on completion of their<br />

automatic enrolment duties.<br />

By the end of May, over 600 employers had registered<br />

with us. You can read the latest figures here:<br />

www.tpr.gov.uk/doc-library/research-analysis.aspx#s5188<br />

Feedback<br />

We hope you find this update useful. Please do get in<br />

contact if you have any feedback via the stakeholder<br />

team at: stakeholder@thepensionsregulator.gov.uk<br />

<strong>Stakeholder</strong> <strong>Update</strong><br />

© <strong>The</strong> <strong>Pensions</strong> <strong>Regulator</strong><br />

<strong>Summer</strong> <strong>2013</strong><br />

You can reproduce the<br />

text in this publication<br />

as long as you quote<br />

<strong>The</strong> <strong>Pensions</strong> <strong>Regulator</strong>’s<br />

name and title of the<br />

publication. Please<br />

contact us if you have<br />

any questions about<br />

this publication. We can<br />

produce it in Braille, large<br />

print or on audio tape.<br />

We can also produce it in<br />

other languages.<br />

How to contact us<br />

Napier House<br />

Trafalgar Place<br />

Brighton<br />

BN1 4DW<br />

T 0845 600 0707<br />

F 0870 241 1144<br />

E stakeholder@thepensionsregulator.gov.uk<br />

www.thepensionsregulator.gov.uk<br />

www.trusteetoolkit.com