Record-keeping: a consultation document - The Pensions Regulator

Record-keeping: a consultation document - The Pensions Regulator

Record-keeping: a consultation document - The Pensions Regulator

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2.17 <strong>The</strong> <strong>Pensions</strong> Advisory Service reports that in its experience poor<br />

administration is a major concern for members, and good record<strong>keeping</strong><br />

is essential if this situation is to improve.<br />

Question 2: Have we correctly identified the costs of poor record-<strong>keeping</strong><br />

and the benefits of good record-<strong>keeping</strong>?<br />

<strong>Record</strong>-<strong>keeping</strong> requirements of different scheme types<br />

2.18 A typical DC scheme (and GPP or AVC arrangements) requires at least<br />

12 administrative transactions a year for each active scheme member,<br />

while a typical DB scheme may only require one or two. <strong>The</strong> scope for<br />

record-<strong>keeping</strong> errors in DC schemes is therefore greatly increased.<br />

2.19 As well as recording and reconciling contributions and investments at<br />

member level, it is essential that there is a regular reconciliation of the<br />

number of units held by the investment manager against the number of<br />

units held by each member and the trustees. Ideally this should be<br />

performed following each investment or disinvestment transaction.<br />

2.20 Data for many DB schemes, on the other hand, is normally collected<br />

annually, at the scheme's renewal date, when it will be loaded to the<br />

members' records. Some schemes may, however, collect and record<br />

this information more frequently.<br />

Provision of pension scheme administration<br />

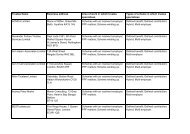

2.21 Our Governance Survey 2008 indicated that approximately four fifths<br />

(79 per cent) of trust-based schemes rely on a third party administrator<br />

(TPA) as their main provider of administration services and this has<br />

increased from two thirds (66 per cent) since 2006 as indicated in the<br />

following table:<br />

Chart 1 Administration arrangements of trust-based pension schemes 2006 -2008<br />

TPAs<br />

In-house admin<br />

Insurer<br />

12%<br />

18%<br />

6%<br />

17%<br />

10%<br />

14%<br />

66%<br />

69%<br />

79%<br />

2006<br />

2007<br />

2008<br />

2.22 Data on contract-based arrangements is more difficult to obtain.<br />

However, a 2007 estimate by a leading insurance company suggested<br />

that about two thirds of the members of contract-based schemes are in<br />

‘bundled’ arrangements, although the administration of those schemes<br />

may have been outsourced by the insurer.<br />

<strong>The</strong> <strong>Pensions</strong> <strong>Regulator</strong>: <strong>Record</strong>-<strong>keeping</strong> <strong>consultation</strong> <strong>document</strong><br />

9