EBC Asset Management Pension and Life Assurance Trust (PDF ...

EBC Asset Management Pension and Life Assurance Trust (PDF ...

EBC Asset Management Pension and Life Assurance Trust (PDF ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DETERMINATION NOTICE<br />

under section 96(2)(d) of the<br />

<strong>Pension</strong>s Act 2004 (“the Act”)<br />

The<br />

<strong>Pension</strong>s<br />

Regulator<br />

case ref:<br />

1773/05<br />

To:<br />

Scheme: <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong><br />

Mr Vipul Malde<br />

Of:<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

XXXXXXXXXXXX<br />

XXXXX<br />

XXXXXXXXXXX<br />

Mr Rainer Christian Kahrmann<br />

<strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited<br />

East India House<br />

109-117 Middlesex Street<br />

London E1 7JF<br />

Mr Paul Rudolph Bastin<br />

<strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited<br />

East India House<br />

109-117 Middlesex Street<br />

London E1 7JF<br />

Thomas Eggar <strong>Trust</strong> Corporation Limited<br />

Belmont House<br />

Station Way<br />

Crawley<br />

West Sussex RH10 1JA<br />

Date: 25 April 2006<br />

TAKE NOTICE that the <strong>Pension</strong>s Regulator of Napier House, Trafalgar Place,<br />

Brighton BN1 4DW (“The Regulator”) has made a determination on<br />

19 April 2006<br />

1. Determination<br />

1.1 The <strong>Pension</strong>s Regulator is to determine whether an independent trustee should be<br />

appointed to this scheme to secure the proper use or application of the assets of<br />

the scheme.<br />

1.2<br />

The application was granted.<br />

1<br />

DM No: 524262

2. Procedure Followed: St<strong>and</strong>ard<br />

2.1 By its Warning Notice dated 4 April 2006 (“the Warning Notice”) the <strong>Pension</strong>s<br />

Regulator gave notice that it proposed to take the above action pursuant to the<br />

application of the Regulator.<br />

2.2 The Regulator determined that the following parties are directly affected by this<br />

determination:<br />

1. Mr Vipul Malde In his role as a trustee of the <strong>EBC</strong> <strong>Asset</strong><br />

<strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong><br />

2. Mr Rainer Christian<br />

Kahrmann<br />

3. Mr Paul Rudolph<br />

Bastin<br />

In his role as a trustee of the <strong>EBC</strong> <strong>Asset</strong><br />

<strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong><br />

<strong>and</strong> sole direction of <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong><br />

Limited, the principal employer of the scheme<br />

In his role as a trustee of the RBC <strong>Asset</strong><br />

<strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong><br />

(collectively referred to as “the directly affected parties”)<br />

These directly affected parties were entitled to make representations to the<br />

<strong>Pension</strong>s Regulator about the determination.<br />

2.3 Following the issue of the Warning Notice WgS Solicitors, on behalf of the trustees<br />

exercised their right to make representations to the <strong>Pension</strong>s Regulator.<br />

2.4 The <strong>Pension</strong>s Regulator has taken those representations into account <strong>and</strong> has<br />

considered those materials carefully but has nevertheless determined to take the<br />

action as detailed in 6 below for the reasons set out below:<br />

3 Relevant Statutory Provisions/Legislation<br />

Section 7(3)(c) of the <strong>Pension</strong>s Act 1995 – Appointment of trustees<br />

7(3)(c)<br />

The Authority may by order appoint a trustee of a trust scheme where they are<br />

satisfied that it is necessary to do so in orderto<br />

secure the proper use or application of the assets of the scheme.<br />

8 Appointment of trustees: consequences<br />

(1) An order under section 7 appointing a trustee may provide for any fees <strong>and</strong><br />

expenses of trustees appointed under the order to be paid-<br />

(a) by the employer,<br />

(b) out of the resources of the scheme, or<br />

(c) partly by the employer <strong>and</strong> partly out of those resources.<br />

DM No: 524262<br />

2

(2) Such an order may also provide that an amount equal to the amount (if any)<br />

paid out of the resources of the scheme by virtue of subsection (1)(b) or (c) is<br />

to be treated for all purposes as a debt due from the employer to the trustees<br />

of the scheme.<br />

(3) Such an order may make provision-<br />

(a) For restricting the powers or duties of a trustee so appointed,<br />

(b) For powers or duties to be exercisable by a trustee so appointed to the<br />

exclusion of other trustees.<br />

Section 100 - Duty to have regard to interests of members etc<br />

(1) The Regulator must have regard to the matters mentioned in subsection (2) –<br />

(a) when determining whether to exercise a regulatory function –<br />

(i) in a case where the requirements of the st<strong>and</strong>ard or special<br />

procedure apply, or<br />

(ii) on a review under section 99, <strong>and</strong><br />

(b) when exercising the regulatory function in question.<br />

(2) Those matters are –<br />

(a) the interests of the generality of the members of the scheme to which<br />

the exercise of the function relates, <strong>and</strong><br />

(b) the interests of such persons as appear to the Regulator to be directly<br />

affected by the exercise.<br />

4. Relevant Guidance<br />

Power to be used<br />

The Regulator may appoint an independent trustee to the scheme under section<br />

7(3)(c) of the <strong>Pension</strong>s Act 1995 where they are satisfied that it is necessary to do<br />

so in order to secure the proper use or application of the scheme assets of the<br />

scheme. An order under section 7 appointing a trustee may provide that any fees<br />

or expenses of the trustees appointed under the order are to be paid (a) by the<br />

employer, (b) out of resources of the scheme <strong>and</strong> (c) partly by the employer <strong>and</strong><br />

partly out of those resources, it may also provide that an amount which has been<br />

paid out of the resources of the scheme can be treated as a debt on the employer.<br />

Further, the order can provide that the powers or duties of the appointed trustee<br />

are to be exercisable by that trustee to the exclusion of other trustees.<br />

5. Background to the Application<br />

1. The <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong> was<br />

established on 1 June 1990 by way of an interim trust deed.<br />

2. As at 4 April 2006 there were three scheme trustees all holding senior<br />

positions in the employer company. They were:<br />

DM No: 524262<br />

3

• Mr Rainer Christian Kahrmann, Chairman <strong>and</strong> sole director of <strong>EBC</strong> <strong>Asset</strong><br />

<strong>Management</strong> Limited<br />

• Mr Paul Bastin, Chief Executive of <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited<br />

• Mr Vipul Malde, Chief Accountant, Company Secretary <strong>and</strong> Personnel<br />

Manager of <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited<br />

3. Mr Karhrmann is the largest single beneficiary of the scheme. He is also the<br />

majority shareholder of the employer company (51%).<br />

4. XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX<br />

XXXXXXXXXXXXXXXXXXXXXXXXXX.<br />

5. On 4 July 2005 Mr Vipul Malde, trustee of the scheme, wrote to the <strong>Pension</strong>s<br />

Regulator stating that under the schedule of contributions in respect of the<br />

scheme year to 31 May 2005, <strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited (<strong>EBC</strong>), was<br />

required to pay £108,000 to the Scheme <strong>and</strong> <strong>EBC</strong> but had not paid the full<br />

amount required <strong>and</strong> that £78,000 remained outst<strong>and</strong>ing as at 31 May 2005.<br />

(£30,000 was in fact repaid to the scheme by <strong>EBC</strong> on 20 June 2005.)<br />

6. Mr Malde explained in this letter that on 20 June 2005, Mr Kahrmann in his<br />

capacity as the Director of the principal employer had affirmed that <strong>EBC</strong> would<br />

make good the shortfall in 3 instalments: £25,000 by 30 June 2005; £25,000<br />

by mid July <strong>and</strong> the balance of £28,000 by end July 2005. These payments<br />

were not made.<br />

7. Mr Malde was advised by the scheme actuary that the non payment of these<br />

contributions was not reportable until they had been outst<strong>and</strong>ing for 90 days<br />

after the due date (29 August 2005) unless Mr Malde believed that the non<br />

payment was symptomatic of a more serious or widespread problem relating<br />

to the company, for instance if the employer was delaying payment to alleviate<br />

cash flow problems.<br />

8. Under the heading ‘<strong>EBC</strong>’s recent position’ Mr Malde, in the same letter, stated<br />

“in my opinion the non-payment is symptomatic of a wider problem” <strong>and</strong><br />

gave a history of <strong>EBC</strong>’s financial circumstances <strong>and</strong> highlighted financial<br />

problems within the company.<br />

9. On 22 August 2005 Mr Malde informed the <strong>Pension</strong>s Regulator that the:<br />

i. principal employer had paid a further £7,500 to the Scheme on 12 July<br />

2005, leaving a shortfall of £70,500 outst<strong>and</strong>ing in respect of year ended 31<br />

May 2005;<br />

ii. total assets of the Scheme stood at £2,939,000 <strong>and</strong> that the Scheme<br />

actuary as at 1 March 2005 had calculated that the approximate buyout<br />

costs of securing all members’ benefits was £5,376,000, based on a wind<br />

up position should the employer cease to sponsor the scheme, giving an<br />

estimated deficit on buy out basis of £2,437,000;<br />

iii. a transfer value for Mr XXXXXXXX had been quoted <strong>and</strong> the member had<br />

accepted the quotation on 17 August 2005. The amount of the transfer<br />

value was £486,937 <strong>and</strong> represented approximately 16% of the scheme<br />

assets. The guarantee date was 17 May 2005 <strong>and</strong> payment was due to<br />

DM No: 524262<br />

4

DM No: 524262<br />

made by 17 November 2005.<br />

9. On 7 October 2005 Mr Malde stated to the Regulator by telephone that he<br />

was no longer attending work as he had not been paid his full wages for 2<br />

months.<br />

10. On 10 October 2005 the <strong>Pension</strong>s Regulator wrote to Mr Malde as<br />

representatives of the trustees stating that in light of the principal employer’s<br />

financial position; the outst<strong>and</strong>ing contributions due to the Scheme <strong>and</strong> the<br />

deficit within the Scheme, the <strong>Pension</strong>s Regulator did not feel that it would be<br />

in all the members’ best interests to allow the full transfer value of<br />

£486,937.99 to be paid out. The <strong>Pension</strong>s Regulator was of the opinion that<br />

to pay out 16% of the total scheme assets to one member when the financial<br />

position of the principal employer was in doubt could be detrimental to the<br />

remaining members <strong>and</strong> that the trustees should consider applying to the<br />

Regulator for an extension of time, permitted for payment of the cash<br />

equivalent transfer value, whilst investigations took place into <strong>EBC</strong>’s financial<br />

position.<br />

11. On 11 October 2005 Mr Malde telephoned the Regulator stating that<br />

Mr Kahrmann was issuing post dated cheques for national insurance due from<br />

<strong>EBC</strong> <strong>and</strong> that wages were not being paid in full.<br />

12. On 14 December 2005 a letter was issued to Mr Kahrmann at <strong>EBC</strong> from the<br />

Regulator, requesting confirmation of when outst<strong>and</strong>ing contributions to the<br />

scheme would be paid; what action was being taken to deal with his conflict<br />

of interests as trustee of the Scheme <strong>and</strong> director of <strong>EBC</strong> in light of the money<br />

owed to the Scheme; details of <strong>EBC</strong>’s financial position <strong>and</strong> what action was<br />

being taken by <strong>EBC</strong> to meaningfully support the Scheme going forward. A<br />

deadline of 29 December 2005 was set for a response to be received. No<br />

response was received by that date.<br />

13. On 3 January 2006 a reminder was sent to Mr Kahrmann requesting a<br />

response to the <strong>Pension</strong> Regulator’s letter of 14 December 2005.<br />

14. On 5 January 2006 Mr Kahrmann wrote to the <strong>Pension</strong>s Regulator stating that<br />

<strong>EBC</strong> owes £72,560 to the Scheme <strong>and</strong> that a sale of an <strong>EBC</strong> asset had fallen<br />

through but that he was confident that the money could be found within the<br />

next 21 days <strong>and</strong> requested an extension until 27 January 2006 to respond to<br />

the <strong>Pension</strong>s Regulator’s letter dated 14 December 2005.<br />

15. On 16 January 2006, the <strong>Pension</strong>s Regulator wrote to Mr Karhmann stating<br />

that a full response would be required no later than 31 January 2006 or further<br />

action might be considered.<br />

16. On 30 January 2006 Mr Kahrmann responded to the <strong>Pension</strong>s Regulator <strong>and</strong><br />

confirmed that the outst<strong>and</strong>ing contributions of £72,560 would be paid to the<br />

scheme on 31 January 2006.<br />

17. On 6 March 2006 the <strong>Pension</strong>s Regulator made enquiries with the trustee of<br />

the scheme Mr V Malde to confirm that the outst<strong>and</strong>ing contributions had been<br />

received into the scheme. Mr Malde confirmed that the outst<strong>and</strong>ing<br />

contributions had not been received into the scheme on 31 January 2006 <strong>and</strong><br />

that as far as he was aware they remained outst<strong>and</strong>ing as at 6 March 2006.<br />

5

18. On 10 April 2006 a letter was received from WgS Solicitors in response to the<br />

Warning Notice issued stating that they are acting on behalf of the <strong>Trust</strong> <strong>and</strong><br />

requesting an extension to the response deadline to 19 April 2006. The letter<br />

stated that they were aware that the matter related to a potential deficit at the<br />

<strong>Trust</strong> which they anticipated being able to demonstrate would be rectified<br />

promptly.<br />

19. On 11 April 2006 an email was sent to WgS Solicitors stating that no<br />

extension to 19 April 2006 would be given for further comment as the Panel<br />

was due to meet on that date <strong>and</strong> needed time to consider the facts of the<br />

case <strong>and</strong> any responses. It was explained that the <strong>Pension</strong>s Regulator felt<br />

that it would be detrimental to the scheme to delay matters any further <strong>and</strong><br />

that it was essential that the case was heard on the 19 th April. It was<br />

explained that matters regarding the deficit <strong>and</strong> it being rectified promptly<br />

would not materially affect the facts of the case as there were other issues<br />

that the Panel were being asked to consider <strong>and</strong> the <strong>Pension</strong>s Regulator<br />

would not consider withdrawing the application if it could be demonstrated that<br />

the deficit could be cleared promptly. These issues supported the decision<br />

not to allow an extension to the 19 th April requested by WgS Solicitors. The<br />

Solicitor was advised of the opportunity to make a reference to the <strong>Pension</strong>s<br />

Regulator’s Tribunal should the decision taken by the Panel not be agreed<br />

with.<br />

20. On 11 April 2006 a fax was received from Vipal Malde on behalf of the<br />

trustees of the scheme confirming that a sum of £72,560 had been received<br />

into the scheme with 11 April 2006 value date.<br />

21. On 11 April 2006, the <strong>Pension</strong>s Regulator agreed to allow WgS solicitors until<br />

Tuesday 18 April to provide further comments to the Warning Notice.<br />

22. A response was received from WgS Solicitors on the afternoon of Tuesday 18<br />

April <strong>and</strong> this was duly considered by the Determinations Panel.<br />

6. Facts <strong>and</strong> Matters Relied Upon<br />

A preliminary point was addressed in relation to the comment from WgS that the<br />

time limit imposed by the Regulator for a response to the Warning Notice was<br />

unreasonable. The panel considered that there had been no failure by the<br />

Regulator to comply with either statutory timescale requirements or any set down<br />

in their own procedures <strong>and</strong> that given the additional time allowed to the solicitors<br />

for a response, the requirement was not unreasonable.<br />

6.1 All 3 trustees hold senior positions within <strong>EBC</strong> <strong>and</strong> they therefore suffer from a<br />

potential conflict of interests. In particular, Mr Kahrmann is trustee of the<br />

scheme, sole director of <strong>EBC</strong> <strong>and</strong> owns 51% of the shares of <strong>EBC</strong>. He is the<br />

sole revenue generator for <strong>EBC</strong> <strong>and</strong> has sole discretion over how such<br />

revenues are applied.<br />

6.2 The panel considered that, on the evidence, the employer’s covenant was<br />

weak, particularly taking into account the information given by one of the<br />

trustees – Mr V Malde. If the employer covenant is weak <strong>and</strong> its ability to<br />

DM No: 524262<br />

6

support the scheme is in doubt, then consideration needed to be given as to<br />

whether it is in the interests of the generality of the members to wind up the<br />

scheme to ensure the fairest division of assets.<br />

6.3 The Panel did not consider that the response from WgS had provided<br />

sufficient detailed <strong>and</strong> specific evidence to satisfy them that the company<br />

covenant would improve.<br />

6.4 An independent trustee would be better able to assess the financial position of<br />

<strong>EBC</strong> <strong>and</strong> the future of the scheme, whether it ought to be wound up <strong>and</strong> how<br />

that might be achieved, <strong>and</strong> in order to pursue the outst<strong>and</strong>ing contributions<br />

currently owed to the scheme by <strong>EBC</strong>.<br />

7. Conclusion: Details of Determination<br />

1. Thomas Eggar <strong>Trust</strong> Corporation Limited of Belmont House, Station Way,<br />

Crawley, West Sussex RH10 1JA is hereby appointed as trustee of the <strong>EBC</strong><br />

<strong>Asset</strong> <strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong> with effect on <strong>and</strong> from<br />

19 April 2006.<br />

2. This order is made because the <strong>Pension</strong>s Regulator is satisfied that it is<br />

necessary to do so in order to secure the proper use or application of the<br />

assets of the scheme pursuant to section 7(3)(c) of the <strong>Pension</strong>s Act 1995.<br />

3. The powers <strong>and</strong> duties exercisable by Thomas Eggar <strong>Trust</strong> Corporation<br />

Limited shall be to the exclusion of all other trustees of the scheme pursuant<br />

to section 8(4)(b) of the <strong>Pension</strong>s Act 1995.<br />

4. The appointed trustee’s fees <strong>and</strong> expenses shall be paid by the employer<br />

pursuant to section 8(1)(a) of the <strong>Pension</strong>s Act 1995 as amended by section<br />

35 of the <strong>Pension</strong>s Act 2004, <strong>and</strong> those fees <strong>and</strong> expenses shall be deemed<br />

to be a debt due from the employer to the trustee pursuant to sections 8(1)(b)<br />

<strong>and</strong> 8(2) of the <strong>Pension</strong>s Act 1995 as amended by section 35 of the <strong>Pension</strong>s<br />

Act 2004.<br />

5. This order:<br />

a. will take immediate effect on the date of this order<br />

b. may be terminated at the expiration of 28 days notice from the <strong>Pension</strong>s<br />

Regulator to the trustees, pursuant to section 7(5)(c) of the <strong>Pension</strong>s Act<br />

1995.<br />

8. Decision Maker<br />

The determination which gave rise to the obligation to give this Determination<br />

Notice was made by the Determinations Panel.<br />

9. Scheme details<br />

Name of scheme<br />

Type of scheme<br />

Status of scheme<br />

<strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> <strong>Pension</strong> <strong>and</strong> <strong>Life</strong> <strong>Assurance</strong> <strong>Trust</strong><br />

Defined benefit<br />

Open<br />

7<br />

DM No: 524262

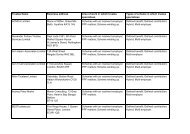

9. Scheme details<br />

Membership<br />

8 active members<br />

Size of fund £2,939,00 as at 1 March 2005<br />

Contracted in/out<br />

Contracted out<br />

10. Scheme trustees<br />

Name Period of office Status of trustee<br />

1. Vipul Malde 1.06.90 – present date individual<br />

2. Rainer Christian Kahrmann 20.05.92 – present date individual<br />

3. Paul Rudolph Bastin 18.10.93 – present date individual<br />

11. Scheme advisers<br />

Type Name Period of office Company<br />

1. Scheme actuary David Watson unknown Scottish Widows plc<br />

12. Employer details<br />

Name<br />

Address<br />

<strong>EBC</strong> <strong>Asset</strong> <strong>Management</strong> Limited<br />

East India House<br />

109-117 Middlesex Street<br />

London E1 7JF<br />

Nature of business<br />

Financial<br />

Number of employees 6<br />

Company Registered<br />

Number<br />

Current Status<br />

If dissolved enter date<br />

of dissolution<br />

01971681<br />

active<br />

Not applicable<br />

13. Important Notices<br />

This Determination Notice is given to you under sections 96(2)(d) of the Act. The<br />

following statutory rights are important.<br />

14. Referral to the <strong>Pension</strong>s Regulator Tribunal<br />

14.1 You have the right to refer the matter to which this Determination Notice relates to<br />

the <strong>Pension</strong>s Regulator Tribunal (“the Tribunal”). Under section 103(1)(b) of the<br />

Act you have 28 days from the date this Determination Notice is sent to you to<br />

refer the matter to the Tribunal or such other period as specified in the Tribunal<br />

rules or as the Tribunal may allow. A reference to the Tribunal is made by way of<br />

a written notice signed by you <strong>and</strong> filed with a copy of this Determination Notice.<br />

DM No: 524262<br />

8

The Tribunal’s address is: 15-19 Bedford Avenue, London WC1B 3AS (tel: 020<br />

7612 9649). The detailed procedures for making a reference to the Tribunal are<br />

contained in section 103 of the Act <strong>and</strong> the Tribunal Rules.<br />

14.2<br />

You should note that the Tribunal rules provide that at the same time as filing a<br />

reference notice with the Tribunal, you must send a copy of the reference notice to<br />

The <strong>Pension</strong>s Regulator. Any copy reference notice should be sent to<br />

Determinations Support at The <strong>Pension</strong>s Regulator, Napier House, Trafalgar<br />

Place, Brighton BN1 4DW.<br />

Signed: John Scampion .........................<br />

Chairman: John Scampion ...........................<br />

Date: 25 April 2006.................................<br />

DM No: 524262<br />

9