Derfshaw Limited Retirement Benefits Scheme - The Pensions ...

Derfshaw Limited Retirement Benefits Scheme - The Pensions ...

Derfshaw Limited Retirement Benefits Scheme - The Pensions ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DETERMINATION NOTICE<br />

under section 96(2)(d) of the<br />

<strong>Pensions</strong> Act 2004 (“the Act”)<br />

<strong>The</strong><br />

<strong>Pensions</strong><br />

Regulator<br />

case ref:<br />

372/04<br />

To:<br />

Of:<br />

To:<br />

To:<br />

To:<br />

Of:<br />

<strong>Scheme</strong>: <strong>Derfshaw</strong> <strong>Limited</strong> <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong><br />

Mr F H Shaw<br />

Trustee, <strong>Derfshaw</strong> Ltd <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong><br />

<strong>Derfshaw</strong> <strong>Limited</strong><br />

Bredgar Road<br />

Gillingham<br />

Kent ME8 6PN<br />

Mr J E Simpson<br />

Trustee, <strong>Derfshaw</strong> Ltd <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong><br />

XXXXXXXXXX<br />

XXXXXXXX<br />

XXXXXX<br />

Mr R Benyon<br />

Trustee, <strong>Derfshaw</strong> Ltd <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong><br />

XXXXXXXXXX<br />

XXXX<br />

XXXXXXXXXX<br />

Thomas Eggar Trust Corporation <strong>Limited</strong><br />

Belmont House<br />

Station Way<br />

Crawley<br />

West Sussex RH10 1JA<br />

Date: 22 December 2005<br />

TAKE NOTICE that the <strong>Pensions</strong> Regulator of Napier House, Trafalgar Place,<br />

Brighton BN1 4DW (“<strong>The</strong> Regulator”) has made a determination on<br />

13 December 2005.<br />

1. Determination<br />

1.1 An application by <strong>The</strong> <strong>Pensions</strong> Regulator to appoint an independent trustee to<br />

this scheme.<br />

1.2<br />

<strong>The</strong> application was granted.<br />

DM No: 523964 1

2. Procedure Followed: Standard<br />

2.1 By its Warning Notice dated 28 July 2005 (“the Warning Notice”) the <strong>Pensions</strong><br />

Regulator gave notice that it proposed to take the above action pursuant to the<br />

application of the Regulator.<br />

2.2 <strong>The</strong> Regulator determined that the following parties are directly affected by this<br />

determination:<br />

1. Mr F H Shaw in his role as a trustee of the scheme<br />

2. Mr J E Simpson in his role as a trustee of the scheme<br />

3. Mr R Benyon in his role as a trustee of the scheme<br />

(collectively referred to as “the directly affected parties”)<br />

<strong>The</strong>se directly affected parties were entitled to make representations to the<br />

<strong>Pensions</strong> Regulator about the determination.<br />

2.3 Following the issue of the Warning Notice Mr F H Shaw, Mr J E Simpson and<br />

Mr R Benyon exercised their right to make representations to the <strong>Pensions</strong><br />

Regulator, and having been granted an oral hearing, attended before the<br />

Determinations Panel on 13 December 2005 together with their legal adviser<br />

Mr M A Shepherd and their witness, Mr G W Mansell.<br />

2.4 <strong>The</strong> <strong>Pensions</strong> Regulator has taken both the written and oral representations of the<br />

directly affected parties into account and has considered those materials carefully<br />

but has nevertheless determined to take the action as detailed in 7 below for the<br />

reasons set out below.<br />

3<br />

Relevant Statutory Provisions/Legislation<br />

<strong>Pensions</strong> Act 1995<br />

Section 7 as amended by section 35 of the <strong>Pensions</strong> Act 2004 and in particular:<br />

sections 7(3)(a), 7(5)(b), 7(5)(c), 8(1)(b), 8(2) and 8(4)(b)<br />

<strong>The</strong> <strong>Pensions</strong> Regulator may grant an application for the appointment of an<br />

independent trustee if it is satisfied that it is necessary to do so in order to secure<br />

that the trustees as a whole have, or exercise, the necessary knowledge and skill<br />

for the proper administration of the scheme pursuant to section 7(3)(a) of the<br />

<strong>Pensions</strong> Act 1995.<br />

Sections 36, 73, 75 and 91 of the <strong>Pensions</strong> Act 1995.<br />

Section 97(4) of the <strong>Pensions</strong> Act 2004.<br />

Regulation 4A of the Occupational Pension <strong>Scheme</strong>s (Winding Up) Regulations<br />

1996.<br />

DM No: 523964 2

4. Relevant Guidance<br />

4.1 In relation to the point raised in UM/52 by the trustees, the regulatory lawyer<br />

advised that the Determinations Panel did have the jurisdiction to appoint an<br />

independent trustee to this scheme and referred them to the whole of section 7 of<br />

the <strong>Pensions</strong> Act 1995 and in particular sub-section 7(3) where it states: ‘<strong>The</strong><br />

authority may also by order appoint a trustee of a trust scheme where they are<br />

satisfied that it is necessary to do so in order-‘. <strong>The</strong> regulatory lawyer submitted<br />

that there was no requirement at sub-section 3 for there to be any application from<br />

the trustees or members of a scheme to give power to make such an appointment.<br />

<strong>The</strong> <strong>Pensions</strong> Regulator can make an application where it considers it is<br />

necessary to do so and this is the trigger for the authority to do so. <strong>The</strong><br />

independent legal adviser was asked what his view on this point was and he<br />

stated that he was firmly of the view that what the regulatory lawyer had said was<br />

correct. <strong>The</strong> Determinations Panel agreed with the views of the regulatory lawyer<br />

and their independent legal adviser and decided to proceed with the hearing.<br />

5. Background to the Application<br />

1. By an Interim Trust Deed dated 27 April 1983, the principal employer<br />

established the scheme with effect from 1 May 1983. Regular contributions to<br />

the scheme stopped in September 1999 and the scheme commenced winding<br />

up on 30 September 1999. A further payment of £275,000 was made by the<br />

principal employer into the scheme in December 1999. <strong>The</strong>re are three<br />

trustees of the scheme all of whom are members.<br />

2. <strong>The</strong> principal employer for the scheme is <strong>Derfshaw</strong> <strong>Limited</strong>. <strong>The</strong>re are three<br />

participating employers: Kestner Engineering Company <strong>Limited</strong>, Lennox<br />

Foundry Company <strong>Limited</strong> and DJM Pollution Control Ltd (in liquidation). Mr<br />

F H Shaw, chairman of the trustees, is managing director of the principal<br />

employer and a director of both participating employers. Mr J E Simpson, a<br />

trustee, was a director of both the participating employers until his resignation<br />

as a director on 30 June 1999.<br />

3. <strong>The</strong> trustees did not obtain a statutory determination and calculation of the<br />

debt due from the employers in accordance with Section 75 of the <strong>Pensions</strong><br />

Act 1995. However, an actuarial valuation of the scheme, as at 1 January<br />

2001, disclosed a Minimum Funding Requirement (MFR) deficit of £558,000.<br />

4. Minutes of a trustees’ meeting held on 16 May 2003 stated that Mr Shaw<br />

advised the meeting that Mr K Mitchell of AXA had resigned as scheme<br />

actuary as of 21 March 2003 and that AXA had proposed that Mr M Meredith<br />

be appointed in his place. <strong>The</strong> trustees agreed to this proposal. Mr Meredith<br />

is the current scheme actuary.<br />

5. This scheme was brought to the attention of Opra on 5 February 2004 when<br />

the scheme actuary, Mr Meredith, wrote making a section 48(1) report under<br />

the <strong>Pensions</strong> Act 1995. He wrote: “I wish to report that the trustees, acting on<br />

DM No: 523964 3

advice from their solicitor, have instructed me to allocate the available assets<br />

of the scheme in a way that, in my opinion, is not permissible under Section<br />

73 of the <strong>Pensions</strong> Act 1995 and Regulation 4A of the Occupational <strong>Pensions</strong><br />

<strong>Scheme</strong>s (Winding Up) Regulations 1996.”<br />

6. In his letter the actuary also advised that: “<strong>The</strong> assets of the scheme are two<br />

insurance policies with AXA. One of these policies was set up in 1983 when<br />

some of the members transferred from another scheme. Although this policy<br />

is not earmarked under the trust deed and rules, the trustees’ solicitor has<br />

advised the trustees that they have an obligation, as a result of<br />

correspondence with the relevant members in 1983, to use this policy for the<br />

benefit of those members alone.<br />

<strong>The</strong> trustees and employer have finalised a compromise agreement, similar to<br />

the Bradstock case. In the agreement, the employer has agreed to make a<br />

final contribution of £100,000.<br />

In addition, the Managing Director of the Company, who is also a trustee, has<br />

agreed to waive 25% of his entitlement to benefits. I understand that his wife,<br />

who is his only dependant, has agreed to this.<br />

<strong>The</strong> trustees have suspended the issue of transfer value quotations. I am not<br />

aware that they have received any requests for such quotations.<br />

<strong>The</strong> trustees wish to secure GMPs [Guaranteed Minimum <strong>Pensions</strong>] for the<br />

members. In September 2003 the position with regard to this was as set out<br />

in the attached appendix 2. In summary:<br />

Value of assets<br />

= £1.51m<br />

Value of MFR liabilities = £1.84 m<br />

Cost of securing GMPs by non profit deferred annuities with AXA = £1.22m<br />

Thus, on the face of it, there were sufficient assets to secure full GMPs.<br />

However the cost of doing so, for the members highlighted on appendix 2,<br />

would be more than the MFR value of their liabilities.<br />

I have advised the trustees that, in my opinion, they are not allowed to secure<br />

full GMPs in these circumstances. <strong>The</strong> trustees’ solicitor disagrees with this.”<br />

7. On 10 February 2004 Mr Shaw, on behalf of the trustees, wrote to Opra and<br />

referred to the actuary’s letter. Mr Shaw stated that, in fact, both of the<br />

policies were set up in 1983: one at the inception of the scheme and the<br />

second when the monies were received from the APV 1974 Pension <strong>Scheme</strong>.<br />

In his letter Mr Shaw also wrote: “For our part, the trustees would be pleased<br />

to receive your advice [Opra’s] as to how to complete the winding-up as<br />

expeditiously as possible. Whilst we do not question the Actuary’s good faith<br />

and best intentions, we have considered proceeding with a formal complaint<br />

about AXA/Sun Life’s delays and the losses sustained by the <strong>Scheme</strong><br />

thereby.”<br />

8. In a letter dated 26 January 2004 to the trustees the actuary wrote that in his<br />

DM No: 523964 4

opinion one of two things should happen to complete the winding-up:<br />

• that the Inland Revenue acceded to their request to allow deemed<br />

buyback even though the company was not insolvent;<br />

• that the DWP formally assured both the insurer and the trustees that they<br />

would be discharged from liability to provide any GMP above a partial<br />

GMP secured by a buy out contract.<br />

In the same letter the scheme actuary advised the trustees that because of a<br />

substantial rise in the cost of deferred annuities offered by AXA the assets<br />

available to the scheme now fell £620,000 short in aggregate of the cost of<br />

purchasing full GMPs.<br />

9. On 7 June 2004 the scheme actuary telephoned OPRA to advise that the<br />

trustees had requested AXA to pay 100% GMPs for three members who had<br />

passed normal retirement age and that AXA would be complying with this<br />

request. This was despite the fund being underfunded. One of the members<br />

was a trustee of the scheme.<br />

10. During 2004 the trustees, together with their professional advisers, sought<br />

alternative ways of securing member benefits with the remaining scheme<br />

assets. “Deemed buy-back” was explored but rejected by the Inland Revenue<br />

as the Principal Employer was not insolvent.<br />

11. As at 3 March 2005 Opra wrote to the trustees to the effect that no policy<br />

documentation so far supplied contained any reference which suggested that<br />

the managed fund policy was “earmarked”, that is, to be used to benefit only<br />

certain of the scheme members.<br />

12. On 11 January 2005 Opra wrote requesting certain information and<br />

clarification and stating that there appeared to be a conflict of interest in Mr<br />

Shaw’s role as a trustee of the scheme and as a director of the holding<br />

company, <strong>Derfshaw</strong> <strong>Limited</strong>, and as a director of other companies of the<br />

employer. This letter also advised the trustees that in such circumstances the<br />

Board of Opra had the power to appoint an independent trustee to the<br />

scheme.<br />

13. <strong>The</strong> trustees have been inconsistent in regard to saying whether they obtained<br />

legal advice regarding the compromise agreement. <strong>The</strong>ir letter to Opra dated<br />

5 May 2004 stated at numbered paragraph 4: “<strong>The</strong> trustees have not received<br />

separate advice over the level of the compromise agreement.” However, in<br />

their letter to Opra dated 8 March 2005 they state: “we confirm the trustees<br />

did obtain legal advice and, separately, actuarial advice, in connection with the<br />

compromise”.<br />

14. <strong>The</strong> minutes of the trustees’ meetings show that they agreed to the<br />

compromise on the terms proposed by Mr. Shaw at the trustees’ meeting on<br />

16 May 2003 (UM/3a). <strong>The</strong>y broached the question of increasing the level of<br />

the compromise at their meeting on 14 October 2003 (UM/3a) but agreed to<br />

DM No: 523964 5

leave the level unchanged after Mr. Shaw had stated that “such a contribution<br />

was impossible, bearing in mind the employer’s financial situation and cash<br />

flow.”<br />

15. <strong>The</strong> Directors’ Report and Accounts of <strong>Derfshaw</strong> <strong>Limited</strong> for the year ended<br />

31 December 2003 (UM /11a) show that even after a dividend of £400,000<br />

had been taken retained profits carried forward to 2004 totalled £1,391,752.<br />

In a letter to the Regulator dated 24 August 2005 Mr. Shaw states that the<br />

dividend was shared between three shareholders (of whom he was one).<br />

16. On 19 April 2005 the scheme actuary wrote to Opra stating: “With regard to<br />

the managed fund policy, AXA’s documentation department has previously<br />

commented to the trustees that:<br />

‘<strong>The</strong> scheme consists of a common trust fund and there is no earmarking of<br />

entitlements. <strong>The</strong>re are no provisions in the scheme rules that segregate or<br />

protect the money transferred into the managed fund policy.’<br />

Notwithstanding the above, I understand that the trustees were advised by<br />

their solicitor that they were able to earmark the managed fund policy for the<br />

benefit of the members who transferred from the APV scheme on the grounds<br />

that this was always their intention. As far as I am aware, the managed fund<br />

policy has indeed only been used for the benefit of these members.”<br />

17. <strong>The</strong> trustees have made no written statement of the principles governing their<br />

decisions about investments, as required by Section 35(1) of the <strong>Pensions</strong> Act<br />

1995. In reply to Opra’s letter of 11 January 2005, asking the trustees to<br />

supply copies of investment advice obtained since wind up, the trustees in<br />

their reply of 8 March 2005 referred Opra to the scheme actuary. <strong>The</strong> latter in<br />

his letter of 19 April 2005 said that “no-one at AXA has given the trustees<br />

investment advice since the scheme started to wind up.”<br />

18. <strong>Scheme</strong> accounts have not been provided within seven months of the scheme<br />

years ended 31 December 2002, 2003 and 2004. Despite numerous requests<br />

from the Regulator copies of the audited accounts for 2003 and 2004 have not<br />

been received.<br />

19. In view of all of the above the Regulator considered that an application should<br />

be made to the Determinations Panel of the Regulator to consider the<br />

appointment of an independent trustee to this scheme to secure that the<br />

trustees as a whole have, or exercise, the necessary knowledge and skill for<br />

the proper administration of the scheme. <strong>The</strong> Regulator noted in particular<br />

that the conflict of interest in Mr Shaw’s role as a trustee and managing<br />

director of the holding company, which is also the sponsoring employer,<br />

provided grounds sufficient to justify the application.<br />

Oral Hearing<br />

In a telephone conversation on 19 August 2005 between Mr Shaw and the<br />

Regulator, Mr Shaw asked if the trustees would be allowed to be present at the<br />

DM No: 523964 6

Determinations Panel meeting and was told that they could not. It was<br />

subsequently agreed by the Determinations Panel that the trustees should be<br />

given the opportunity to attend the hearing if they so wished. All three trustees<br />

said that they wished to attend and details of the attendees are given in 2.3 above.<br />

<strong>The</strong> Panel heard the submissions in relation to this case on behalf of the Regulator<br />

and then the trustees of the <strong>Derfshaw</strong> Ltd <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong>. Both<br />

sides were given the opportunity to question each other and the Panel put<br />

questions to both sides. All three trustees were questioned as was their witness<br />

Mr Mansell.<br />

<strong>The</strong> Panel retired to make their decision.<br />

On returning, and before informing all those present of the Panel’s decision, the<br />

chairman spoke to the trustees and stated that the Panel did fully understand that<br />

winding up a pension scheme in these circumstances was extremely difficult. It<br />

was almost impossible to meet the expectations of all members and it appeared to<br />

the Panel that the trustees had a high moral commitment to do what they thought<br />

was right by the ex APV scheme members. It was evident from the papers that<br />

that thread of commitment to honour the promises the trustees had made, orally<br />

and in writing, had clearly driven all their actions and thoughts over the years. It<br />

was also very clear that Mr Simpson and Mr Benyon in particular had carried a<br />

heavy workload during this time.<br />

6. Facts and Matters Relied Upon<br />

1. <strong>The</strong> Determinations Panel is satisfied that it is necessary to appoint a trustee to<br />

the scheme trust in order to secure that the trustees as a whole have, or exercise<br />

the necessary knowledge and skills for the proper administration of the scheme<br />

on the following grounds:-<br />

• the trustees’ lack of understanding of, and in some cases lack of willingness to<br />

comply with, the relevant statutory, regulatory and fiduciary requirements<br />

which they should have complied with in carrying out their duties as trustees;<br />

• the failure of the trustees on a number of occasions to take appropriate<br />

independent professional advice on their duties in winding up the scheme;<br />

• the trustees’ failure to properly manage the problems caused by the inherent<br />

conflict between Mr. Shaw’s interests as the managing director and<br />

shareholder of the principal employer and his responsibility as a trustee to the<br />

scheme members. As a consequence, the trustees did not adequately carry<br />

out their fiduciary duty to seek to recover as much as possible of the statutory<br />

debt owing from the employer to the scheme.<br />

<strong>The</strong> facts and matters relied on by the Determinations Panel in reaching these<br />

conclusions are set out in more detail in the following paragraphs.<br />

Understanding and Compliance<br />

2. <strong>The</strong> trustees did not understand, or were not willing to accept, a duty to comply<br />

with Section 73 of the <strong>Pensions</strong> Act by allocating all the available assets of the<br />

DM No: 523964 7

scheme in accordance with the statutory order of priorities shown in that section.<br />

<strong>The</strong> trustees persisted in their intention to disregard these statutory requirements<br />

despite frequent advice to the contrary from the scheme actuary and after being<br />

informed by Opra in its letter of 3 March 2005 (UM/24) that it concurred with views<br />

of the scheme actuary. <strong>The</strong> trustees did not seek independent professional advice<br />

from a third party, (as suggested by Opra in its letter of 3 March 2005) in order to<br />

resolve the disagreement between the scheme actuary and their own legal<br />

adviser on this matter.<br />

3. <strong>The</strong> trustees did not understand, or were not willing to accept, that the managed<br />

fund (copy of the policy located at page 345 between UM/41 and 42) was an<br />

asset of the scheme as a whole, despite clear indications in the policy itself that<br />

this was the case, and accordingly, under Section 73, had to be used for the<br />

benefit of all the members once wind-up had commenced, despite clear advice<br />

from the scheme actuary on this point. <strong>The</strong> trustees again failed to take<br />

independent professional advice to resolve the disagreement between the<br />

scheme actuary and their legal adviser on this point<br />

4. <strong>The</strong> Trustees were aware of, but did not comply with the requirement in section<br />

75(5) that a determination and calculation of the employer’s statutory debt must<br />

be obtained from the scheme actuary. In May 2003 Mr. Shaw on behalf of the<br />

employer put forward a proposal for a Supplementary Compromise and Waiver<br />

(UM/3d), which was subsequently agreed by the trustees at their meeting of 16<br />

September 2003 and confirmed at their meeting of 14 October (UM/3a). Mr.<br />

Shaw appears to have been unaware that the waiver of a quarter of his and his<br />

wife’s pension rights contained in this proposal was in breach of Section 91(1) of<br />

the <strong>Pensions</strong> Act 1995 and therefore unenforceable. <strong>The</strong> Determinations Panel<br />

noted the view of the regulatory lawyer at the oral hearing that this may have<br />

rendered the entire compromise invalid.<br />

5. <strong>The</strong> trustees showed a lack of willingness to comply with the statutory<br />

requirements on them to produce audited trust accounts (Section 41 of the<br />

<strong>Pensions</strong> Act 1995 and Regulation 2(1)(a) of the Occupational Pension <strong>Scheme</strong>s<br />

(Requirement to obtain Audited Accounts and a Statement from the Auditor)<br />

Regulations 1996 (SI 1996/1975)) within seven months of the end of the financial<br />

year to which they relate. In particular, the trustees assumed, without taking any<br />

advice, that they would not have to produce scheme accounts after the scheme<br />

went into wind up in 1999. This led to a significant delay in the production of the<br />

scheme accounts in respect of that year. <strong>The</strong> trustees have so far failed to have<br />

the scheme accounts for 2003 and 2004 audited.<br />

Seeking and Taking Advice<br />

6. <strong>The</strong> trustees did not consider whether they needed to review the continuing<br />

suitability of the scheme’s investments when the scheme went into wind-up, as<br />

required by Section 36(4) of the <strong>Pensions</strong> Act 1995. In answer to Opra’s<br />

enquiries on this point (letter dated 11 January 2005 in UM/20) the trustees<br />

referred Opra to AXA. In the trustees’ replies to the Warning Notice (p224 at UM/<br />

40) the trustees stated that they ‘expected investment advice to be offered by the<br />

scheme actuary’ but in AXA’s letter to OPRA dated 19 April 2005 the scheme<br />

actuary said that “no-one at AXA has given the trustees investment advice since<br />

the scheme started to wind up.”<br />

DM No: 523964 8

7. In particular, the trustees confirmed during the oral hearing that (i) they had taken<br />

no professional advice before deciding to invest the £275,000 top-up contribution<br />

provided by the employer in December 1999, in the existing insured policy DA 77<br />

(second document exhibited at UM/14) and (ii) they had not understood the<br />

detrimental impact of the scheme’s entry into wind-up on the value of this policy.<br />

Managing Conflicts of Interest<br />

8. In agreeing to Mr. Shaw’s proposal at their meeting in September 2003 and in<br />

the subsequent discussion of it at their meeting on 14 October 2003, the trustees<br />

collectively failed to deal adequately with the conflict of interest in Mr. Shaw’s<br />

position. Specifically, Mr. Simpson and Mr. Benyon took no independent financial<br />

advice, either on the resources available to the company, or on the level of<br />

settlement for which they should aim. (During the oral hearing the Determinations<br />

Panel heard that the two trustees had rejected their legal adviser’s suggestion<br />

that they should seek independent financial advice). <strong>The</strong> two trustees thereby<br />

failed to test Mr. Shaw’s assertion, which he explicitly made in his capacity as<br />

managing director of the employer, that “such a contribution [to increase the level<br />

of the settlement] was impossible, bearing in mind the employer’s financial<br />

situation and cash flow”.<br />

9. As a consequence, the trustees collectively did not comply with their fiduciary<br />

duty to seek to recover as much as possible of the statutory debt due from the<br />

employer to the scheme. Mr. Shaw individually failed adequately to manage the<br />

conflict between his duty as a trustee to seek the best possible settlement for the<br />

scheme members and his personal interests as a shareholder. <strong>The</strong> panel noted<br />

that after refusing any increase in the settlement at the 14 October meeting, Mr<br />

Shaw participated, as a director, in a decision to pay a dividend to shareholders<br />

of £400,000 out of the company’s retained profits at the end of 2003 (UM/11a).<br />

10. Following the confirmation of the agreement on the compromise on 14 October<br />

2003, Mr. Shaw failed to comply with the binding undertaking on the employer in<br />

paragraph 3.1 of the Supplemental Deed of Compromise and Waiver (UM3d) to<br />

pay £100,000 to the scheme “forthwith” and did not make the payment until<br />

March 2005.<br />

In considering their decision the Determinations Panel noted that in the course of the<br />

oral hearing the trustees expressed their willingness to take independent advice on<br />

the allocation of the assets of the scheme among the members and to comply with<br />

the statutory requirement to have their accounts audited. While regarding this offer<br />

as helpful, the Determinations Panel considered that these undertakings did not<br />

excuse the failings described in paragraphs 1 to 10 above and did not affect its<br />

overall judgement that it was necessary to appoint an additional trustee with<br />

exclusive powers. <strong>The</strong> panel expressed the hope that all the trustees would work with<br />

the appointed independent trustee in order to facilitate the winding-up of the scheme.<br />

DM No: 523964 9

7. Conclusion: Details of Determination<br />

1. Thomas Eggar Trust Corporation <strong>Limited</strong> of Belmont House, Station Way,<br />

Crawley, West Sussex RH10 1JA is hereby appointed as trustee of the<br />

<strong>Derfshaw</strong> <strong>Limited</strong> <strong>Retirement</strong> <strong>Benefits</strong> <strong>Scheme</strong> with effect on and from 13<br />

December 2005.<br />

2. This order is made because the <strong>Pensions</strong> Regulator is satisfied that it is<br />

necessary to do so in order to secure that the trustees as a whole have, or<br />

exercise, the necessary knowledge and skill for the proper administration of<br />

the scheme pursuant to section 7(3)(a) of the <strong>Pensions</strong> Act 1995.<br />

3. <strong>The</strong> powers and duties exercisable by Thomas Eggar Trust Corporation<br />

<strong>Limited</strong> shall be to the exclusion of all other trustees of the scheme pursuant<br />

to section 8(4)(b) of the <strong>Pensions</strong> Act 1995.<br />

4. <strong>The</strong> appointed trustee’s fees and expenses shall be wholly paid out of the<br />

scheme’s resources pursuant to section 7(5)(b) of the <strong>Pensions</strong> Act 1995 as<br />

amended by section 35 of the <strong>Pensions</strong> Act 2004, and those fees and<br />

expenses shall be deemed to be a debt due from the employer to the trustee<br />

pursuant to sections 8(1)(b) and 8(2) of the <strong>Pensions</strong> Act 1995 as amended<br />

by section 35 of the <strong>Pensions</strong> Act 2004.<br />

5. This order:<br />

a. will take immediate effect on the date of this order<br />

b. may be terminated at the expiration of 28 days notice from the <strong>Pensions</strong><br />

Regulator to the trustees, pursuant to section 7(5)(c) of the <strong>Pensions</strong> Act<br />

1995.<br />

8. Decision Maker<br />

<strong>The</strong> determination which gave rise to the obligation to give this Determination<br />

Notice was made by the Determinations Panel.<br />

9. <strong>Scheme</strong> details<br />

Type of scheme<br />

Defined benefit<br />

Status of scheme Winding up with effect from 30 September 1999<br />

Membership 56 as at March 2004<br />

Size of fund £1,259,918 as at 31 December 2002<br />

Contracted in/out<br />

Contracted out<br />

10. <strong>Scheme</strong> trustees<br />

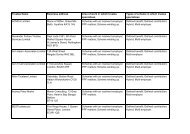

Name Period of office Status of trustee<br />

DM No: 523964 10

10. <strong>Scheme</strong> trustees<br />

1. Mr F H Shaw 27 April 1983 to date Individual (Managing Director and Company<br />

Secretary of the Principal Employer and a<br />

director of subsidiary companies and all<br />

participating employers).<br />

2. Mr J E Simpson 27 April 1983 to date Individual (Pensioner and former director of<br />

Kestner Engineering Co. Ltd and Lennox<br />

Foundry Co. Ltd, participating employers).<br />

3. Mr R Benyon 27 April 1983 to date Individual (Employee of a participating<br />

employer).<br />

11. <strong>Scheme</strong> advisers<br />

Type Name Period of office Company<br />

1. <strong>Scheme</strong> actuary Mr M Meredith from date unknown to date AXA Sun Life<br />

Services plc, Bristol<br />

BS99 5SN<br />

2. <strong>Scheme</strong> auditor Spokes & Company from date unknown to date Spokes &<br />

Company,<br />

Hildenborough,<br />

Kent<br />

3. <strong>Scheme</strong> insurer from date unknown to date AXA Sun Life<br />

Services plc, Bristol<br />

BS99 5SN<br />

4. Legal adviser Mr M Shepherd 27 November 2002 to date M A Shepherd &<br />

Co, Lyndhurst,<br />

London N3 1TA<br />

12. Employer<br />

Name<br />

Address<br />

Nature of business<br />

Number of employees<br />

<strong>Derfshaw</strong> <strong>Limited</strong><br />

Bredgar Road, Gillingham, Kent, ME8 9NG<br />

Manufacture metal structures & parts<br />

Unknown<br />

13. Important Notices<br />

This Determination Notice is given to you under sections 96(2)(d) of the Act. <strong>The</strong><br />

following statutory rights are important.<br />

14. Referral to the <strong>Pensions</strong> Regulator Tribunal<br />

14.1 You have the right to refer the matter to which this Determination Notice relates to<br />

the <strong>Pensions</strong> Regulator Tribunal (“the Tribunal”). Under section 103(1)(b) of the<br />

Act you have 28 days from the date this Determination Notice is given to you to<br />

refer the matter to the Tribunal or such other period as specified in the Tribunal<br />

rules or as the Tribunal may allow. A reference to the Tribunal is made by way of<br />

DM No: 523964 11

a written notice signed by you and filed with a copy of this Determination Notice.<br />

<strong>The</strong> Tribunal’s address is: 15-19 Bedford Avenue, London WC1B 3AS (tel: 020<br />

7612 9700). <strong>The</strong> detailed procedures for making a reference to the Tribunal are<br />

contained in section 103 of the Act and the Tribunal Rules.<br />

14.2<br />

You should note that the Tribunal rules provide that at the same time as filing a<br />

reference notice with the Tribunal, you must send a copy of the reference notice to<br />

<strong>The</strong> <strong>Pensions</strong> Regulator. Any copy reference notice should be sent to<br />

Determinations Support at <strong>The</strong> <strong>Pensions</strong> Regulator, Napier House, Trafalgar<br />

Place, Brighton BN1 4DW.<br />

Signed:<br />

Olivia Dickson..................................................................................................<br />

Chairman:<br />

Olivia Dickson................................................................................................<br />

Date: 22/12/05.....................................................................................................................<br />

DM No: 523964 12