J O Walker & Company plc Pension & Life Assurance Scheme (PDF

J O Walker & Company plc Pension & Life Assurance Scheme (PDF

J O Walker & Company plc Pension & Life Assurance Scheme (PDF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DETERMINATION NOTICE<br />

under section 96(2)(d) of the<br />

<strong>Pension</strong>s Act 2004 (“the Act”)<br />

The <strong>Pension</strong>s<br />

Regulator<br />

case ref:<br />

1365/05<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

To:<br />

Of:<br />

<strong>Scheme</strong>: J O <strong>Walker</strong> & <strong>Company</strong> <strong>plc</strong> <strong>Pension</strong> & <strong>Life</strong> <strong>Assurance</strong> <strong>Scheme</strong><br />

The Trustee Corporation Limited<br />

Trinity Court<br />

16 John Dalton Street<br />

Manchester<br />

M60 8HS<br />

Ian Best<br />

Ernst & Young LLP<br />

No 1 Colmore Square<br />

Birmingham<br />

B4 6HQ<br />

Alan Lovatt<br />

Ernst & Young LLP<br />

No 1 Colmore Square<br />

Birmingham<br />

B4 6HQ<br />

Simon Allport<br />

Ernst & Young LLP<br />

No 1 Colmore Square<br />

Birmingham<br />

B4 6HQ<br />

Springwood <strong>plc</strong><br />

Swithland Hall<br />

Swithland<br />

Leicestershire<br />

LE12 8TD<br />

Date: 20 March 2006<br />

TAKE NOTICE that the <strong>Pension</strong>s Regulator of Napier House, Trafalgar Place,<br />

Brighton BN1 4DW (“The Regulator”) has made a determination on<br />

15 March 2006<br />

1. Determination<br />

1.1 The <strong>Pension</strong>s Regulator is to determine whether an order should be<br />

made authorising the J O <strong>Walker</strong> & <strong>Company</strong> <strong>plc</strong> <strong>Pension</strong> & <strong>Life</strong><br />

<strong>Assurance</strong> <strong>Scheme</strong> to be put into wind up<br />

DM No: 524218<br />

1

1.2 The application was granted<br />

2. Procedure Followed: Standard<br />

2.1 By its Warning Notice dated 26 January 2006 (“the Warning Notice”) the<br />

<strong>Pension</strong>s Regulator gave notice that it proposed to take the above action<br />

pursuant to the application of the Independent Trustee, The Trustee<br />

Corporation Limited.<br />

2.2 The Regulator determined that the following parties are directly affected by<br />

this determination:<br />

1. The Trustee In its role as trustee of the scheme<br />

Corporation Limited<br />

2. Ian Best of Ernst & In his role as administrative receiver<br />

Young LLP<br />

3. Alan Lovatt of Ernst In his role as administrative receiver<br />

& Young LLP<br />

4. Simon Allport of In his role as administrative receiver<br />

Ernst & Young LLP<br />

5. Springwood <strong>plc</strong> In its role as principal employer<br />

(collectively referred to as “the directly affected parties”)<br />

These directly affected parties were entitled to make representations to the<br />

<strong>Pension</strong>s Regulator about the determination.<br />

2.3 Following the issue of the Warning Notice none of the directly affected parties<br />

exercised their right to make representations to the <strong>Pension</strong>s Regulator.<br />

3.<br />

Relevant Statutory Provisions/Legislation<br />

Section 11 of the <strong>Pension</strong>s Act 1995 as amended by the <strong>Pension</strong>s Act 2004.<br />

11 Powers to wind up schemes<br />

(1) Subject to the following provisions of this section, the Authority may by<br />

order direct or authorise an occupational pension scheme to be wound<br />

up if they are satisfied that –<br />

(a) the scheme, or part of it, ought to be replaced by a different scheme,<br />

(b) the scheme is no longer required, or<br />

(c) it is necessary in order to protect the interests of the generality of the<br />

members of the scheme that it be wound up.<br />

(2) The Authority may not make an order under this section on either of<br />

the grounds referred to in subsection (1)(a) or (b) unless they are<br />

satisfied that the winding up of the scheme -<br />

(a) cannot be achieved otherwise than by means of such an order, or<br />

DM No: 524218<br />

2

(b) can only be achieved in accordance with a procedure which:<br />

(i) is liable to be unduly complex or protracted, or<br />

(ii) involves the obtaining of consents which cannot be obtained, or<br />

can only be obtained with undue delay or difficulty,<br />

and that it is reasonable in all the circumstances to make the order.<br />

(4) An order under this section authorising a scheme to be wound up must<br />

include such directions with respect to the manner and timing of the<br />

winding up as the Authority think appropriate having regard to the<br />

purposes of the order.<br />

(5)The winding up of a scheme in pursuance of an order of the Authority<br />

under this section is as effective in law as if it had been made under powers<br />

conferred by or under the scheme.<br />

(6)An order under this section may be made and complied with in relation to<br />

a scheme -<br />

(a) in spite of any enactment or rule of law, or any rule of the scheme,<br />

which would otherwise operate to prevent the winding up, or<br />

(b) except for the purpose of the Authority determining whether or not they<br />

are satisfied as mentioned in subsection (2), without regard to any such<br />

enactment, rule of law or rule of the scheme as would otherwise require, or<br />

might otherwise be taken to require, the implementation of any procedure<br />

or the obtaining of any consent, with a view to the winding up.<br />

(6A)Subsection (6) does not have effect to authorise the Authority to make an<br />

order as mentioned in paragraph (a) or (b) of that subsection, if their doing so<br />

would be unlawful as a result of section 6(1) of the Human Rights Act 1998<br />

(unlawful for public authority to act in contravention of a Convention right).<br />

Section 100 of <strong>Pension</strong>s Act 2004 – Duty to have regard to the interests<br />

of members etc<br />

(1) The Regulator must have regard to the matters mentioned in subsection<br />

(2) –<br />

(a) when determining whether to exercise a regulatory function –<br />

(i) in a case where the requirements of the standard or special<br />

procedure apply, or<br />

(ii) on a review under section 99, and<br />

(b) when exercising the regulatory function in question.<br />

(2) Those matters are –<br />

(a) the interests of the generality of the members of the scheme to which<br />

the exercise of the function relates, and<br />

(b) the interests of such persons as appear to the Regulator to be directly<br />

affected by the exercise.<br />

DM No: 524218<br />

3

4. Background to the Application / Case<br />

The independent trustee to this scheme, the Trustee Corporation Limited,<br />

was statutorily appointed under section 23(1)(b) of the <strong>Pension</strong>s Act 1995 on<br />

12 March 2004 by the administrative receivers to the employer, Ian Best,<br />

Alan Lovatt and Simon Allport of Ernst & Young LLP. The administrative<br />

receivers were appointed on 19 February 2004.<br />

The independent trustee originally applied to Opra for a winding up order on<br />

1 September 2004.<br />

The <strong>Scheme</strong> Rules, Rule 23 Discontinuance or partial discontinuance of the<br />

scheme, provides as follows:<br />

The Principal Employer may at any time decide that all contributions to the<br />

<strong>Scheme</strong> shall cease and shall give at least three months notice of such<br />

cessation to the Administrator who shall notify the members in writing. At the<br />

date of the cessation unless previously terminated cover in respect of the<br />

benefits payable on death-in-service before Normal Retiring Date shall cease<br />

(except for the refund of contributions under (Rule 9(1)(ii) and the <strong>Scheme</strong><br />

shall be wound up in accordance with sub-Rule(2) of this Rule unless within<br />

one month of its decision to terminate payment of contributions the Principal<br />

Employer shall request and the Insurance <strong>Company</strong> shall agree that the<br />

<strong>Scheme</strong> be treated as a frozen scheme in which event the provisions of sub-<br />

Rule (1) of this Rule shall apply.<br />

In the event of the Principal Employer being wound up or if the Principal<br />

Employer is not a limited company its business being sold the <strong>Scheme</strong> shall<br />

be wound-up in accordance with sub-Rule (2) of this Rule.<br />

(1) Frozen <strong>Scheme</strong><br />

On the <strong>Scheme</strong> being frozen the following shall apply:-<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

the <strong>Scheme</strong> shall be closed to new entrants<br />

all contributions to the <strong>Scheme</strong> shall cease and members<br />

shall have no entitlement to further benefits<br />

the Policy shall continue to be held on trust by the body or<br />

persons in whom it is vested for the members of the scheme<br />

the Rules (other than those relating to the eligibility of new<br />

entrants or to contributions) shall continue to apply in all<br />

respects.<br />

The trustee advised that none of the conditions which would trigger wind up<br />

under the scheme rules, i.e. 3 months notice by the employer to the trustee<br />

that it had decided to cease contributions, the limited company employer<br />

being wound up or the business of a non incorporated employer being sold,<br />

applied in this case. The trustee could find no evidence that the employer<br />

served the appropriate notice on the trustee and the employer, which is a<br />

public limited company, although in administrative receivership, has yet to be<br />

wound up.<br />

DM No: 524218<br />

4

Under Rule 21 of the <strong>Scheme</strong> Rules it states that the Deed and Rules may<br />

be amended only by the employer. In light of this the independent trustee<br />

was of the view that it could not make amendment to the scheme itself.<br />

The trustee stated that it considered that the wind up was necessary in order<br />

to protect the interests of members because:<br />

• The fund was being eroded by the costs of the advisers<br />

• The fund was exposed to investment risk<br />

The independent trustee advised Opra that the scheme might have been put<br />

into wind up some years earlier but no documentary evidence had been<br />

located to show that the employer had given the requisite notice to the<br />

trustee and none of the other conditions existed to trigger wind up. Prior to<br />

the statutory appointment of the independent trustee the employer was also<br />

the trustee to this scheme.<br />

The trustee requested the administrative receivers to provide the required<br />

notice in respect of the termination of all contributions but they declined to do<br />

so stating that their legal advisers indicated that they could not sign any such<br />

notice because they only acted as agents of the company. The trustee<br />

considered that it would be an expensive and protracted exercise to pursue<br />

this avenue further.<br />

In December 2004 the independent trustees withdrew their application on the<br />

basis that it had subsequently located a document that indicated that wind up<br />

had been triggered.<br />

The independent trustee subsequently made a further application to the<br />

Regulator to re-open their previous application for an order authorising the<br />

winding up of the scheme under section 11 of the <strong>Pension</strong>s Act 1995 by way<br />

of a letter dated 8 July 2005. The application was made on the same basis<br />

that it had previously been made.<br />

The trustee’s investigations into the effect of the documents they located<br />

revealed that the scheme was made paid up in 1996 but that there was no<br />

unequivocal evidence that the scheme was actually put into wind up. Other<br />

documents located by the trustee indicated that in 1998 there was some<br />

intention to re-open the scheme in order to allow certain employees to join<br />

the pension scheme.<br />

The trustee advised that it continued to be of the opinion that it had no power<br />

to trigger wind up under the rules of the scheme and that none of the<br />

particular circumstances which would trigger wind up currently existed.<br />

It is noted that as this scheme is currently assumed not to be in wind up and<br />

it is possible for the employer to suffer a second qualifying insolvency event<br />

(in particular the employer company may be wound up) the scheme may<br />

possibly fulfil the eligibility criteria for the <strong>Pension</strong> Protection Fund. However<br />

information relating to the scheme funding position had been obtained by the<br />

DM No: 524218<br />

5

Regulator including a statement from the scheme actuary, advising that in his<br />

opinion, the scheme would not need assistance from the <strong>Pension</strong> Protection<br />

Fund. The actuary indicated that buy out quotations had been obtained<br />

which would provide close to 100% of members’ benefits, provided the<br />

scheme was wound up quickly. The trustees had supplied information<br />

detailing the tasks remaining to wind up the scheme.<br />

The determinations panel considered whether the exercise of their reserved<br />

regulatory power was appropriate and then considered all the facts of the<br />

case, paying particular attention to section 100 of the <strong>Pension</strong>s Act 2004.<br />

5. Facts and Matters Relied Upon<br />

1. The Panel considered that the scheme was not in wind up status,<br />

accepting<br />

the evidence of the applicant<br />

2. The panel accepted the evidence of the scheme actuary that the buy-out<br />

quotation was for a valuation close to 100% of members benefits and that<br />

no advantage to members would be achieved by delaying a wind up<br />

which would allow buy-out to proceed<br />

3. The Panel considered therefore that it was necessary to wind up the<br />

scheme in order to protect the interests of the generality of the members<br />

of the scheme pursuant to section 11(1)(c) of the <strong>Pension</strong>s Act 1995<br />

4. The Panel considered that whilst the scheme was in non wind up status<br />

the fund could be eroded by the costs of the advisers<br />

5. The Panel considered that whilst the scheme was in non wind up status<br />

the fund was exposed to investment risk<br />

6. Conclusion: Details of Determination<br />

1. The <strong>Pension</strong>s Regulator hereby directs that J O <strong>Walker</strong> & <strong>Company</strong> <strong>plc</strong><br />

<strong>Pension</strong> & <strong>Life</strong> <strong>Assurance</strong> <strong>Scheme</strong> commence wind up proceedings with<br />

effect on and from 28 days following the date of this order, that is 17 April<br />

2006, in accordance with section 96(5)(a) of the <strong>Pension</strong>s Act 2004.<br />

2. This Order is made because the <strong>Pension</strong>s Regulator is satisfied that it is<br />

necessary to wind up the scheme in order to protect the interests of the<br />

generality of the members of the scheme pursuant to section 11(1)(c) of<br />

the <strong>Pension</strong>s Act 1995<br />

3. The <strong>Scheme</strong> be wound up in accordance with the provisions of sections<br />

73-75 of the <strong>Pension</strong>s Act 1995 (as modified by the Occupational<br />

<strong>Pension</strong> <strong>Scheme</strong>s (Winding Up) Regulations 1996 and any relevant<br />

provisions of those regulations, or such other statutory provisions and<br />

regulations as may be in force from time to time and may be applicable to<br />

the winding up of the scheme.<br />

DM No: 524218<br />

6

7. Decision Maker<br />

The determination which gave rise to the obligation to give this Determination<br />

Notice was made by the Determinations Panel.<br />

8. <strong>Scheme</strong> details<br />

Type of scheme<br />

Status of scheme<br />

Defined Benefit<br />

Closed<br />

Membership 120<br />

Size of fund £3.69m t 31 December 2002<br />

Contracted in/out<br />

Contracted out<br />

9. <strong>Scheme</strong> trustees<br />

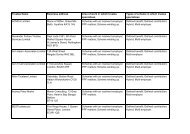

Name Period of office Status of trustee<br />

1. The Trustee<br />

Corporation<br />

Limited<br />

From 12 March 2004 to present Statutory independent trustee<br />

appointed by the insolvency<br />

practitioner<br />

10. <strong>Scheme</strong> advisers<br />

Type Name Period of office <strong>Company</strong><br />

1. <strong>Scheme</strong> Actuary Graham Cooper From January 2004 to<br />

present<br />

2. <strong>Scheme</strong> Actuary Mr N Mitchell From 30 November 2000 to<br />

January 2004<br />

3. <strong>Scheme</strong> Actuary Mr R Chadwick From 1 July 2000 to 25 July<br />

2000<br />

Harsant Services<br />

Limited<br />

Harsant Services<br />

Limited<br />

Harsant Services<br />

Limited<br />

4. <strong>Scheme</strong> Actuary Mr J D Harsant From unknown to 1 July 2000 Harsant Services<br />

Limited<br />

5. <strong>Scheme</strong> Actuary Mr A Soni From unknown to April 1999 Commercial Union<br />

6. Insurer Dates unknown Commercial Union,<br />

now Norwich Union<br />

7. <strong>Scheme</strong> Auditor From unknown to present Grant Thornton<br />

8. Administrator From April 2000 to present Harsant Services<br />

Limited<br />

9. Administrator From unknown to April 2000 Bland Bankart<br />

Financial Services<br />

Limited<br />

11. Employer details<br />

Name<br />

Address<br />

Springwood Plc (in administrative receivership)<br />

Ernst & Young LLP<br />

No 1 Colmore Row<br />

DM No: 524218<br />

7

11. Employer details<br />

Nature of<br />

business<br />

Number of<br />

employees<br />

Birmingham<br />

B3 2DB<br />

Other entertainment activities<br />

Unknown<br />

12. Important Notices<br />

This Determination Notice is given to you under sections 96(2)(d) of the Act.<br />

The following statutory rights are important.<br />

13. Referral to the <strong>Pension</strong>s Regulator Tribunal<br />

13.1 You have the right to refer the matter to which this Determination Notice<br />

relates to the <strong>Pension</strong>s Regulator Tribunal (“the tribunal”). Under section<br />

103(1)(b) of the Act you have 28 days from the date this Determination<br />

Notice is given to you to refer the matter to the Tribunal or such other period<br />

as specified in the Tribunal rules or as the Tribunal may allow. A reference to<br />

the Tribunal is made by way of a written notice signed by you and filed with a<br />

copy of this Determination Notice. The Tribunal’s address is: 15-19 Bedford<br />

Avenue, London WC1B 3AS (tel: 020 7612 9649). The detailed procedures<br />

for making a reference to the Tribunal are contained in section 103 of the Act<br />

and the Tribunal Rules.<br />

13.2<br />

You should note that the Tribunal rules provide that at the same time as filing<br />

a reference notice with the tribunal, you must send a copy of the reference<br />

notice to The <strong>Pension</strong>s Regulator. Any copy reference notice should be sent<br />

to Determinations Support at The <strong>Pension</strong>s Regulator, Napier House,<br />

Trafalgar Place, Brighton BN1 4DW.<br />

Signed: John Scampion .........................<br />

Chairman: John Scampion .............................<br />

Date: 20 March 2006 ..............................<br />

DM No: 524218<br />

8