CLAIMS HANDBOOK - Department of Human Services

CLAIMS HANDBOOK - Department of Human Services

CLAIMS HANDBOOK - Department of Human Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

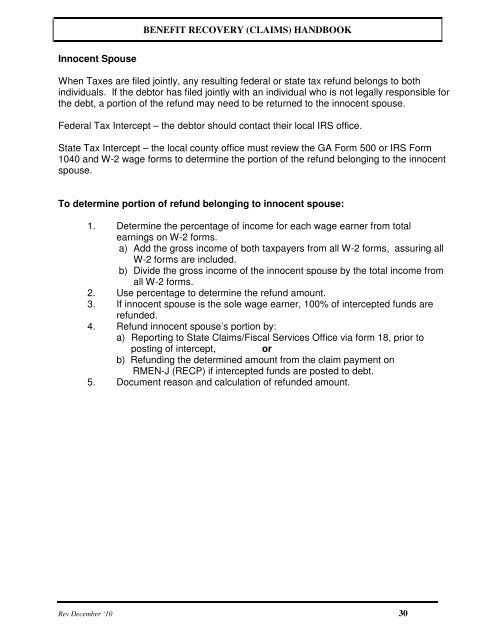

BENEFIT RECOVERY (<strong>CLAIMS</strong>) <strong>HANDBOOK</strong><br />

Innocent Spouse<br />

When Taxes are filed jointly, any resulting federal or state tax refund belongs to both<br />

individuals. If the debtor has filed jointly with an individual who is not legally responsible for<br />

the debt, a portion <strong>of</strong> the refund may need to be returned to the innocent spouse.<br />

Federal Tax Intercept – the debtor should contact their local IRS <strong>of</strong>fice.<br />

State Tax Intercept – the local county <strong>of</strong>fice must review the GA Form 500 or IRS Form<br />

1040 and W-2 wage forms to determine the portion <strong>of</strong> the refund belonging to the innocent<br />

spouse.<br />

To determine portion <strong>of</strong> refund belonging to innocent spouse:<br />

1. Determine the percentage <strong>of</strong> income for each wage earner from total<br />

earnings on W-2 forms.<br />

a) Add the gross income <strong>of</strong> both taxpayers from all W-2 forms, assuring all<br />

W-2 forms are included.<br />

b) Divide the gross income <strong>of</strong> the innocent spouse by the total income from<br />

all W-2 forms.<br />

2. Use percentage to determine the refund amount.<br />

3. If innocent spouse is the sole wage earner, 100% <strong>of</strong> intercepted funds are<br />

refunded.<br />

4. Refund innocent spouse’s portion by:<br />

a) Reporting to State Claims/Fiscal <strong>Services</strong> Office via form 18, prior to<br />

posting <strong>of</strong> intercept, or<br />

b) Refunding the determined amount from the claim payment on<br />

RMEN-J (RECP) if intercepted funds are posted to debt.<br />

5. Document reason and calculation <strong>of</strong> refunded amount.<br />

Rev December ‘10 30