CLAIMS HANDBOOK - Department of Human Services

CLAIMS HANDBOOK - Department of Human Services

CLAIMS HANDBOOK - Department of Human Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

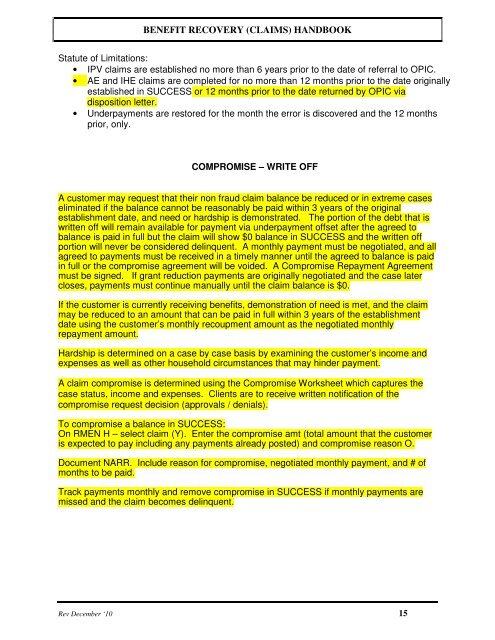

BENEFIT RECOVERY (<strong>CLAIMS</strong>) <strong>HANDBOOK</strong><br />

Statute <strong>of</strong> Limitations:<br />

• IPV claims are established no more than 6 years prior to the date <strong>of</strong> referral to OPIC.<br />

• AE and IHE claims are completed for no more than 12 months prior to the date originally<br />

established in SUCCESS or 12 months prior to the date returned by OPIC via<br />

disposition letter.<br />

• Underpayments are restored for the month the error is discovered and the 12 months<br />

prior, only.<br />

COMPROMISE – WRITE OFF<br />

A customer may request that their non fraud claim balance be reduced or in extreme cases<br />

eliminated if the balance cannot be reasonably be paid within 3 years <strong>of</strong> the original<br />

establishment date, and need or hardship is demonstrated. The portion <strong>of</strong> the debt that is<br />

written <strong>of</strong>f will remain available for payment via underpayment <strong>of</strong>fset after the agreed to<br />

balance is paid in full but the claim will show $0 balance in SUCCESS and the written <strong>of</strong>f<br />

portion will never be considered delinquent. A monthly payment must be negotiated, and all<br />

agreed to payments must be received in a timely manner until the agreed to balance is paid<br />

in full or the compromise agreement will be voided. A Compromise Repayment Agreement<br />

must be signed. If grant reduction payments are originally negotiated and the case later<br />

closes, payments must continue manually until the claim balance is $0.<br />

If the customer is currently receiving benefits, demonstration <strong>of</strong> need is met, and the claim<br />

may be reduced to an amount that can be paid in full within 3 years <strong>of</strong> the establishment<br />

date using the customer’s monthly recoupment amount as the negotiated monthly<br />

repayment amount.<br />

Hardship is determined on a case by case basis by examining the customer’s income and<br />

expenses as well as other household circumstances that may hinder payment.<br />

A claim compromise is determined using the Compromise Worksheet which captures the<br />

case status, income and expenses. Clients are to receive written notification <strong>of</strong> the<br />

compromise request decision (approvals / denials).<br />

To compromise a balance in SUCCESS:<br />

On RMEN H – select claim (Y). Enter the compromise amt (total amount that the customer<br />

is expected to pay including any payments already posted) and compromise reason O.<br />

Document NARR. Include reason for compromise, negotiated monthly payment, and # <strong>of</strong><br />

months to be paid.<br />

Track payments monthly and remove compromise in SUCCESS if monthly payments are<br />

missed and the claim becomes delinquent.<br />

Rev December ‘10 15