ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SNTGN “TRANSGAZ” SA Medias Annual Management Report for 2007<br />

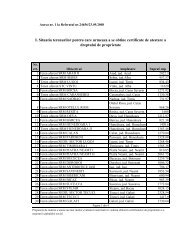

5.1.3. Cash-flow<br />

The cash flow during 2005-2006 is rendered below:<br />

Ratio<br />

Financial year ended on December 31 st<br />

2005 2006 2007<br />

Operational activities:<br />

Net profit 138,447,085 237,912,527 224,006,454<br />

Depreciation expense 62,650,342 71,278,807 73,448,093<br />

Expense/ (revenues) for floating assets provisions 5,975,614 -13,202,598 3,266,022<br />

Loss on receivables of various debtors 0 0 143,015<br />

Adjustment on risk and expense provisions 3,887,872 -11,004,095 9,581,049<br />

Penalties on dividends in arrears for 2000 – 2003 and<br />

45,483,318 6,234,233 0<br />

2006<br />

Interest revenues -2,605,662 -1,703,052 -4,879,452<br />

Interest expenses 16,330,276 14,717,567 12,196,687<br />

Profit/loss from sales of tangible fixed assets 2,020,757 -18,761,597 93,250<br />

Other expenses/ financial revenues 0 -832,931 -451,993<br />

Tax on profit 36,610,652 48,377,640 45,323,764<br />

Increase in cash from operation before floating<br />

capital amendments<br />

308,800,254 359,421,697 362,726,889<br />

Decrease in the balance of stocks 336,242 4,711,468 3,963,644<br />

(increase) / decrease in balances of commercial<br />

receivables and other receivables<br />

-20,913,033 -194,193,492 -163,688,924<br />

Increase in balances of commercial liabilities 48,030,224 160,312,593 163,559,425<br />

Net cash-flow from operational activities 336,253,687 330,252,266 366,566,034<br />

Cashed interest 2,381,565 2,024,387 4,881,043<br />

Paid interests -16,194,649 -8,696,715 -5,192,094<br />

Payments related to the employees’ share in profit -3,887,872 -4,350,025 -4,862,190<br />

Tax on paid profit -54,592,171 -35,628,007 -48,070,130<br />

Cash flow from operating activities 263,960,560 283,601,907 313,322,663<br />

Cashed dividends 32,140 0 0<br />

Sales of financial fixed assets 0 627,736 -758,851<br />

Receipts from loans granted 0 832,931 451,993<br />

Receipts from sales of fixed tangible assets 0 20,271,750 563,403<br />

Fixed asset acquisition -246,940,568 -189,022,637 -202,840,254<br />

Cash flow used for investment activities -246,908,158 -167,290,220 -202,583,701<br />

Loan reimbursement 5,646,457 -41,884,419 -18,981,205<br />

Loan withdrawals -14,499,667 25,889,683 52,950,000<br />

Paid dividends 0 -71,388,676 -121,384,642<br />

Capital increase 13,849,560<br />

Issuance premium 251,933,300<br />

Cash flow used for financing activities -8,853,210 -87,383,912 178,367,003<br />

Total cash-flow 8,199,192 28,927,775 289,105,965<br />

Variation in cash and cash equivalents<br />

Cash and cash equivalents at the beginning of the<br />

period<br />

24,846,071 33,045,263 61,973,038<br />

Variation in cash and cash equivalents 8,199,192 28,927,775 289,105,965<br />

Cash and cash equivalents at the end of the period 33,045,263 61,973,038 351,079,003<br />

5.2. Financial risk management<br />

By the nature of business, our company is subject to various risks including: credit<br />

risks, currency risks, interest rate risks, liquidity risks and capital market risks. The<br />

Page 45 of 54