ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SNTGN “TRANSGAZ” SA Medias Annual Management Report for 2007<br />

CH. 3. THE MARKET <strong>OF</strong> THE SECURITIES ISSUED BY TRANSGAZ<br />

Transgaz is the second state-owned company of the utility sector. In order to achieve<br />

the strategic objectives specified in the governmental programme “A Strong Market” –<br />

“Capital Market Development”, Transgaz promoted a primary initial public offering<br />

for sales of stock, i.e. 10% of the increased share capital, as provided by GD<br />

no.1329/2004 on the proxy of the involved public institution and on the approval of<br />

the public offering privatization strategy of companies included in the portfolio of the<br />

Ministry of Economy and Commerce, amended by GD no. 708/2005.<br />

In the context of the capital market development, the listing of the sole Romanian gas<br />

transmission operator on the Bucharest Stock Exchange proved to be a strategic<br />

decision, of great importance both for the company’s prospects and for stock exchange<br />

capitalization increase.<br />

The company’s being traded on the regulated market managed by the Bucharest Stock<br />

Exchange is an acknowledgement of its efficiency, significance and role played in the<br />

domestic and international business environment and also an additional safe sorce for<br />

the financing of the investment programmes and for the company’s development.<br />

The IPO developed during November 26 th , 2007 - December 7 th , 2007 was endorsed<br />

by the Romanian National Securities Commission under Decision no. 2199/14.11.2007<br />

and Decision no. 2266/21.12.2007 and was executed pursuant to the capital market<br />

legislation.<br />

The IPO turned into a great success for the Romanian capital market from the<br />

following points of view:<br />

IPO with the highest value of the offering exposed for sale;<br />

IPO with the heaviest stock demand of Romania;<br />

The first IPO in Romania, with a new financial instrument attached thereto, i.e. the<br />

so-called “allocation rights”.<br />

3.1. Features and growth of the securities issued by Transgaz on the regulated<br />

market managed by the Bucharest Stock Exchange<br />

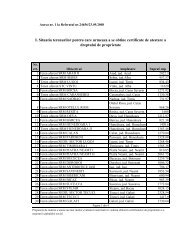

Given the fact that such event has set a record in the company’s history, the IPO<br />

balance sheet illustrates data and information related to the securities issued by the<br />

company, as follows:<br />

• Transgaz’ IPO was the first IPO in the history of Bucharest Stock Exchange to<br />

trade allocation rights, thus allowing investors to trade such rights prior to the start<br />

of the actual share transactions, the conversion ratio being 1 right to 1 share;<br />

• The number of shares exposed for sale through Public Offering was of 1,177,384<br />

shares, standing for 10% of the increased share capital;<br />

• Price of shares: lei 191.92 /share;<br />

• Total value of the shares exposed for sale: lei 225,963,537.28 ~ Є 65 million;<br />

• Subscription period: November 26 th , 2007 – December 7 th , 2007;<br />

• Subscription tranches: high subscription tranch - 60% of the offering- any<br />

subscription of over lei 500,000 and low subscription tranch - 40% of the<br />

Page 30 of 54