ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ... ANNUAL REPORT OF âTRANSGAZâ MANAGEMENT INDIVIDUAL ...

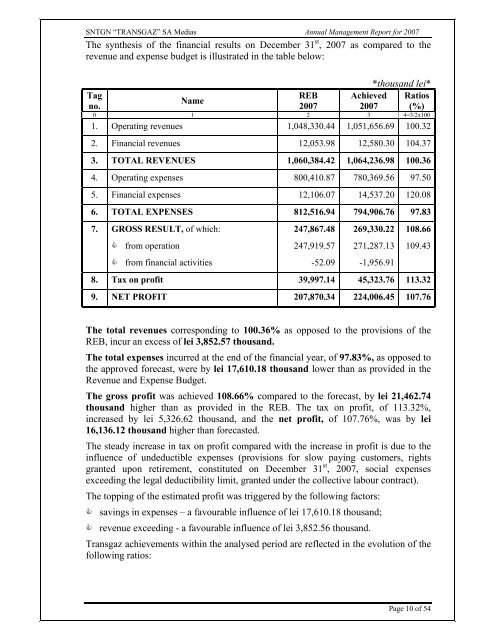

SNTGN “TRANSGAZ” SA Medias Annual Management Report for 2007 The synthesis of the financial results on December 31 st , 2007 as compared to the revenue and expense budget is illustrated in the table below: *thousand lei* Tag REB Achieved Ratios Name no. 2007 2007 (%) 0 1 2 3 4=3/2x100 1. Operating revenues 1,048,330.44 1,051,656.69 100.32 2. Financial revenues 12,053.98 12,580.30 104.37 3. TOTAL REVENUES 1,060,384.42 1,064,236.98 100.36 4. Operating expenses 800,410.87 780,369.56 97.50 5. Financial expenses 12,106.07 14,537.20 120.08 6. TOTAL EXPENSES 812,516.94 794,906.76 97.83 7. GROSS RESULT, of which: 247,867.48 269,330.22 108.66 from operation 247,919.57 271,287.13 109.43 from financial activities -52.09 -1,956.91 8. Tax on profit 39,997.14 45,323.76 113.32 9. NET PROFIT 207,870.34 224,006.45 107.76 The total revenues corresponding to 100.36% as opposed to the provisions of the REB, incur an excess of lei 3,852.57 thousand. The total expenses incurred at the end of the financial year, of 97.83%, as opposed to the approved forecast, were by lei 17,610.18 thousand lower than as provided in the Revenue and Expense Budget. The gross profit was achieved 108.66% compared to the forecast, by lei 21,462.74 thousand higher than as provided in the REB. The tax on profit, of 113.32%, increased by lei 5,326.62 thousand, and the net profit, of 107.76%, was by lei 16,136.12 thousand higher than forecasted. The steady increase in tax on profit compared with the increase in profit is due to the influence of undeductible expenses (provisions for slow paying customers, rights granted upon retirement, constituted on December 31 st , 2007, social expenses exceeding the legal deductibility limit, granted under the collective labour contract). The topping of the estimated profit was triggered by the following factors: savings in expenses – a favourable influence of lei 17,610.18 thousand; revenue exceeding - a favourable influence of lei 3,852.56 thousand. Transgaz achievements within the analysed period are reflected in the evolution of the following ratios: Page 10 of 54

SNTGN “TRANSGAZ” SA Medias Annual Management Report for 2007 Tag no. 1. Profitability ratio a) EBITDA in total sales b) EBITDA in own capital c) Rate of gross profit d) Rate of return on capital 2. Liquidity ratios a) Current liquidity ratios b) Quick liquidity ratio 3. Risk ratios a) Leverage ratio b) Interest coverage rate 4. Activity ratios a) speed of debit - customers b) speed of credit - suppliers Ratio Calculation formula 2005 2006 2007 EBITDA Turnover EBITDA Own capital Gross profit Turnover Net profit Own capital Floating assets Short term liabilities Floating assets - Stocks Short term liabilities Loan capital Own capital EBIT Interest expenses 32.99% 40.95% 34.17% 24.58% 31.07% 22.65% 22.73% 31.49% 25.93% 13.40% 19.85% 14.30% 0.89 0.95 1.84 0.75 0.82 1.74 0.18 0.11 0.08 11.72 20.45 23.08 Customer average balance x 365 days 115.60 99.95 91.85 Turnover Supplier average balance x365 days 50.47 50.01 39.33 Turnover Evolution of profitability ratios The profitability ratios indicate the efficiency of a company’s activity, i.e. the company’s ability to gain profit of the resources available each year. 60.00% 40.00% 20.00% 0.00% 2005 2006 2007 EBITDA/turnover 32.99% 40.95% 34.17% EBITDA/own capital 24.58% 31.07% 22.65% Gross profit/turnover 22.73% 31.49% 25.93% Net profit /own capital 13.40% 19.85% 14.30% Page 11 of 54

- Page 1 and 2: SNTGN “TRANSGAZ” SA Medias Annu

- Page 3 and 4: SNTGN “TRANSGAZ” SA Medias Annu

- Page 5 and 6: SNTGN “TRANSGAZ” SA Medias Annu

- Page 7 and 8: SNTGN “TRANSGAZ” SA Medias Annu

- Page 9: SNTGN “TRANSGAZ” SA Medias Annu

- Page 13 and 14: SNTGN “TRANSGAZ” SA Medias Annu

- Page 15 and 16: SNTGN “TRANSGAZ” SA Medias Annu

- Page 17 and 18: SNTGN “TRANSGAZ” SA Medias Annu

- Page 19 and 20: SNTGN “TRANSGAZ” SA Medias Annu

- Page 21 and 22: SNTGN “TRANSGAZ” SA Medias Annu

- Page 23 and 24: SNTGN “TRANSGAZ” SA Medias Annu

- Page 25 and 26: SNTGN “TRANSGAZ” SA Medias Annu

- Page 27 and 28: SNTGN “TRANSGAZ” SA Medias Annu

- Page 29 and 30: SNTGN “TRANSGAZ” SA Medias Annu

- Page 31 and 32: SNTGN “TRANSGAZ” SA Medias Annu

- Page 33 and 34: SNTGN “TRANSGAZ” SA Medias Annu

- Page 35 and 36: SNTGN “TRANSGAZ” SA Medias Annu

- Page 37 and 38: SNTGN “TRANSGAZ” SA Medias Annu

- Page 39 and 40: SNTGN “TRANSGAZ” SA Medias Annu

- Page 41 and 42: SNTGN “TRANSGAZ” SA Medias Annu

- Page 43 and 44: SNTGN “TRANSGAZ” SA Medias Annu

- Page 45 and 46: SNTGN “TRANSGAZ” SA Medias Annu

- Page 47 and 48: SNTGN “TRANSGAZ” SA Medias Annu

- Page 49 and 50: SNTGN “TRANSGAZ” SA Medias Annu

- Page 51 and 52: SNTGN “TRANSGAZ” SA Medias Annu

- Page 53 and 54: SNTGN “TRANSGAZ” SA Medias Annu

SNTGN “TRANSGAZ” SA Medias Annual Management Report for 2007<br />

The synthesis of the financial results on December 31 st , 2007 as compared to the<br />

revenue and expense budget is illustrated in the table below:<br />

*thousand lei*<br />

Tag<br />

REB Achieved Ratios<br />

Name<br />

no.<br />

2007 2007 (%)<br />

0 1 2 3 4=3/2x100<br />

1. Operating revenues 1,048,330.44 1,051,656.69 100.32<br />

2. Financial revenues 12,053.98 12,580.30 104.37<br />

3. TOTAL REVENUES 1,060,384.42 1,064,236.98 100.36<br />

4. Operating expenses 800,410.87 780,369.56 97.50<br />

5. Financial expenses 12,106.07 14,537.20 120.08<br />

6. TOTAL EXPENSES 812,516.94 794,906.76 97.83<br />

7. GROSS RESULT, of which: 247,867.48 269,330.22 108.66<br />

from operation 247,919.57 271,287.13 109.43<br />

from financial activities -52.09 -1,956.91<br />

8. Tax on profit 39,997.14 45,323.76 113.32<br />

9. NET PR<strong>OF</strong>IT 207,870.34 224,006.45 107.76<br />

The total revenues corresponding to 100.36% as opposed to the provisions of the<br />

REB, incur an excess of lei 3,852.57 thousand.<br />

The total expenses incurred at the end of the financial year, of 97.83%, as opposed to<br />

the approved forecast, were by lei 17,610.18 thousand lower than as provided in the<br />

Revenue and Expense Budget.<br />

The gross profit was achieved 108.66% compared to the forecast, by lei 21,462.74<br />

thousand higher than as provided in the REB. The tax on profit, of 113.32%,<br />

increased by lei 5,326.62 thousand, and the net profit, of 107.76%, was by lei<br />

16,136.12 thousand higher than forecasted.<br />

The steady increase in tax on profit compared with the increase in profit is due to the<br />

influence of undeductible expenses (provisions for slow paying customers, rights<br />

granted upon retirement, constituted on December 31 st , 2007, social expenses<br />

exceeding the legal deductibility limit, granted under the collective labour contract).<br />

The topping of the estimated profit was triggered by the following factors:<br />

savings in expenses – a favourable influence of lei 17,610.18 thousand;<br />

revenue exceeding - a favourable influence of lei 3,852.56 thousand.<br />

Transgaz achievements within the analysed period are reflected in the evolution of the<br />

following ratios:<br />

Page 10 of 54