Full Version - Essential Energy

Full Version - Essential Energy

Full Version - Essential Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

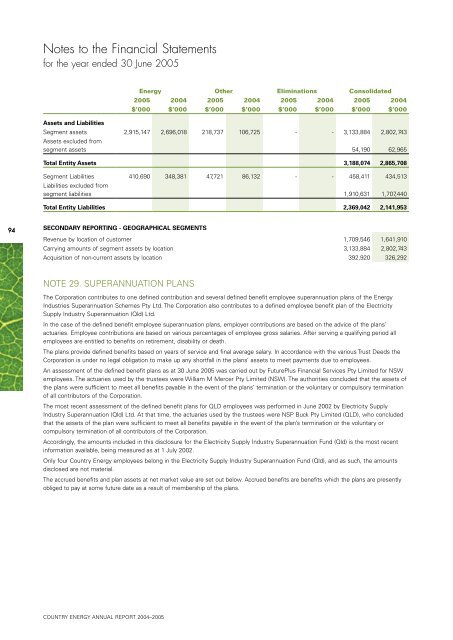

Notes to the Financial Statements<br />

for the year ended 30 June 2005<br />

Assets and Liabilities<br />

<strong>Energy</strong> Other Eliminations Consolidated<br />

2005 2004 2005 2004 2005 2004 2005 2004<br />

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

Segment assets 2,915,147 2,696,018 218,737 106,725 - - 3,133,884 2,802,743<br />

Assets excluded from<br />

segment assets 54,190 62,965<br />

Total Entity Assets 3,188,074 2,865,708<br />

Segment Liabilities 410,690 348,381 47,721 86,132 - - 458,411 434,513<br />

Liabilities excluded from<br />

segment liabilities 1,910,631 1,707,440<br />

Total Entity Liabilities 2,369,042 2,141,953<br />

94<br />

SECONDARY REPORTING - GEOGRAPHICAL SEGMENTS<br />

Revenue by location of customer 1,709,546 1,641,910<br />

Carrying amounts of segment assets by location 3,133,884 2,802,743<br />

Acquisition of non-current assets by location 392,920 326,292<br />

NOTE 29. SUPERANNUATION PLANS<br />

The Corporation contributes to one defined contribution and several defined benefit employee superannuation plans of the <strong>Energy</strong><br />

Industries Superannuation Schemes Pty Ltd. The Corporation also contributes to a defined employee benefit plan of the Electricity<br />

Supply Industry Superannuation (Qld) Ltd.<br />

In the case of the defined benefit employee superannuation plans, employer contributions are based on the advice of the plans’<br />

actuaries. Employee contributions are based on various percentages of employee gross salaries. After serving a qualifying period all<br />

employees are entitled to benefits on retirement, disability or death.<br />

The plans provide defined benefits based on years of service and final average salary. In accordance with the various Trust Deeds the<br />

Corporation is under no legal obligation to make up any shortfall in the plans’ assets to meet payments due to employees.<br />

An assessment of the defined benefit plans as at 30 June 2005 was carried out by FuturePlus Financial Services Pty Limited for NSW<br />

employees. The actuaries used by the trustees were William M Mercer Pty Limited (NSW). The authorities concluded that the assets of<br />

the plans were sufficient to meet all benefits payable in the event of the plans’ termination or the voluntary or compulsory termination<br />

of all contributors of the Corporation.<br />

The most recent assessment of the defined benefit plans for QLD employees was performed in June 2002 by Electricity Supply<br />

Industry Superannuation (Qld) Ltd. At that time, the actuaries used by the trustees were NSP Buck Pty Limited (QLD), who concluded<br />

that the assets of the plan were sufficient to meet all benefits payable in the event of the plan’s termination or the voluntary or<br />

compulsory termination of all contributors of the Corporation.<br />

Accordingly, the amounts included in this disclosure for the Electricity Supply Industry Superannuation Fund (Qld) is the most recent<br />

information available, being measured as at 1 July 2002.<br />

Only four Country <strong>Energy</strong> employees belong in the Electricity Supply Industry Superannuation Fund (Qld), and as such, the amounts<br />

disclosed are not material.<br />

The accrued benefits and plan assets at net market value are set out below. Accrued benefits are benefits which the plans are presently<br />

obliged to pay at some future date as a result of membership of the plans.<br />

COUNTRY ENERGY ANNUAL REPORT 2004–2005