Full Version - Essential Energy

Full Version - Essential Energy

Full Version - Essential Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

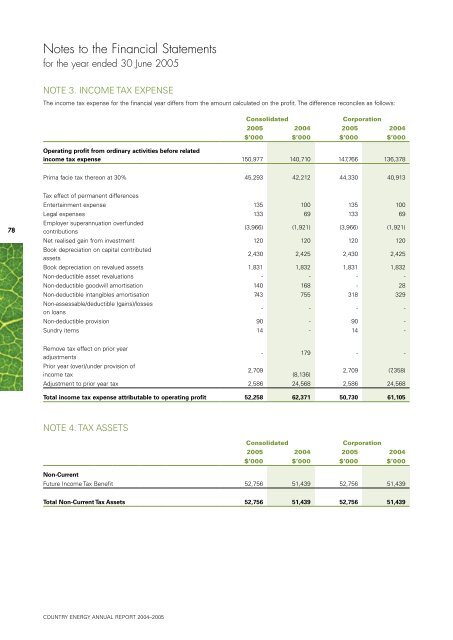

Notes to the Financial Statements<br />

for the year ended 30 June 2005<br />

NOTE 3. INCOME TAX EXPENSE<br />

The income tax expense for the financial year differs from the amount calculated on the profit. The difference reconciles as follows:<br />

Consolidated<br />

Corporation<br />

2005 2004 2005 2004<br />

$’000 $’000 $’000 $’000<br />

Operating profit from ordinary activities before related<br />

income tax expense 150,977 140,710 147,766 136,378<br />

Prima facie tax thereon at 30% 45,293 42,212 44,330 40,913<br />

78<br />

Tax effect of permanent differences<br />

Entertainment expense 135 100 135 100<br />

Legal expenses 133 69 133 69<br />

Employer superannuation overfunded<br />

contributions<br />

(3,966) (1,921) (3,966) (1,921)<br />

Net realised gain from investment 120 120 120 120<br />

Book depreciation on capital contributed<br />

assets<br />

2,430 2,425 2,430 2,425<br />

Book depreciation on revalued assets 1,831 1,832 1,831 1,832<br />

Non-deductible asset revaluations - - - -<br />

Non-deductible goodwill amortisation 140 168 - 28<br />

Non-deductible intangibles amortisation 743 755 318 329<br />

Non-assessable/deductible (gains)/losses<br />

on loans<br />

- - - -<br />

Non-deductible provision 90 - 90 -<br />

Sundry items 14 - 14 -<br />

Remove tax effect on prior year<br />

adjustments<br />

Prior year (over)/under provision of<br />

income tax<br />

2,709<br />

- 179 - -<br />

(8,136)<br />

2,709 (7,358)<br />

Adjustment to prior year tax 2,586 24,568 2,586 24,568<br />

Total income tax expense attributable to operating profit 52,258 62,371 50,730 61,105<br />

NOTE 4. TAX ASSETS<br />

Consolidated<br />

Corporation<br />

2005 2004 2005 2004<br />

$’000 $’000 $’000 $’000<br />

Non-Current<br />

Future Income Tax Benefit 52,756 51,439 52,756 51,439<br />

Total Non-Current Tax Assets 52,756 51,439 52,756 51,439<br />

COUNTRY ENERGY ANNUAL REPORT 2004–2005