The Philippine Tariff Commission (TC)

The Philippine Tariff Commission (TC)

The Philippine Tariff Commission (TC)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Contents<br />

Page<br />

<strong>The</strong> <strong>Philippine</strong> <strong>Tariff</strong> <strong>Commission</strong> ……………………………………………….. 1<br />

Historical Background……………………………………………………. 3<br />

Structure ………………………………………………………………….. 4<br />

<strong>Tariff</strong> <strong>Commission</strong> Organizational Chart…………………………….… 5<br />

Education and Information……………………………………………….. 5<br />

Publications ………………………………………………………………. 6<br />

Internet Website………………………………………………………….. 6<br />

Fees………………………………………………………………………… 6<br />

Inquiries & Complaints…………………………………………………… 7<br />

Liaison ……………………………………………………………………. 7<br />

Functions, Duties & Responsibilities of the <strong>Tariff</strong> <strong>Commission</strong>………………. 8<br />

Section 401 Modification of Duties (Flexible <strong>Tariff</strong> Clause)………….. 8<br />

Section 402 (Promotion of Foreign Trade)……………………………. 9<br />

Section 1313A (<strong>Tariff</strong> Classification…………………………………….. 11<br />

Section 506 (Assistance to the President & Congress……………….. 12<br />

Related Legislations………………………………………………………………. 13<br />

R.A. 8752 (Anti-Dumping)………………………………………………. 13<br />

R.A. 8751 (Countervailing Duty)……………………………………….. 15<br />

R.A. 8800 (Safeguard Measures)……………………………………… 18<br />

<strong>The</strong> <strong>Tariff</strong> <strong>Commission</strong>: Service Pledge & Commitments……………………. 21<br />

Annexes<br />

“ A “ Instructions in Accomplishing the Information for <strong>Tariff</strong><br />

Adjustment (<strong>TC</strong> Form No. 3)<br />

“ B “ Section 401 Flow Chart<br />

“ C “ Instructions for Accomplishing <strong>TC</strong> Form No. 4<br />

(Request for Withdrawal/Suspension of Concessions under<br />

Section 402<br />

“ D “ Section 402 Flow Chart<br />

“ E “ Request for <strong>Tariff</strong> Classification Ruling (<strong>TC</strong> Form 1 – a)<br />

“ F “ Section 1313 – a Flow Chart<br />

“ G “ Flowchart of Procedures of the <strong>TC</strong>’s<br />

Formal Investigation under Section 301<br />

“ H “ Flowchart of Procedures of the <strong>TC</strong>’s<br />

Formal Investigation under Section 302<br />

“ I “ Flowchart of Procedures of the <strong>TC</strong>’s Formal Investigation on<br />

Safeguard Measures under RA 8800<br />

“ J “ Revised Schedule of Fees and Charges<br />

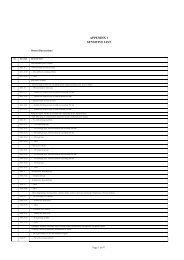

“ K “ <strong>Tariff</strong> <strong>Commission</strong> Directory<br />

ii

<strong>The</strong> <strong>Philippine</strong> <strong>Tariff</strong> <strong>Commission</strong> (<strong>TC</strong>)<br />

<strong>The</strong> <strong>Tariff</strong> <strong>Commission</strong> is a key adviser to the executive and legislative<br />

branches of government on tariff and related matters, is an independent adjudicatory<br />

body on trade remedy cases and an advocate of industry competitiveness and<br />

consumer welfare.<br />

Under the <strong>Tariff</strong> and Customs Code of the <strong>Philippine</strong>s (<strong>TC</strong>CP), the <strong>Tariff</strong><br />

<strong>Commission</strong> is mandated to:<br />

a) develop, formulate and recommend tariff policies and programs<br />

consistent with national economic objectives;<br />

b) enforce and administer the tariff provisions of the <strong>Tariff</strong> and Customs<br />

Code, including the conduct of public hearings/consultations on tariff<br />

modification and issuance of classification rulings on products to be<br />

imported when not specifically classified in the <strong>Tariff</strong> Code;<br />

c) investigate and decide on cases of unfair trade practices of dumping<br />

and subsidization;<br />

d) investigate and recommend safeguard action in cases of injurious<br />

import surges under fair trade conditions; and<br />

e) determine contestability of local/foreign markets in the economy.<br />

<strong>The</strong> <strong>Commission</strong> is one of the member agencies of the Committee on <strong>Tariff</strong><br />

and Related Matters (CTRM) involved in the formulation of the tariff reform programs<br />

implemented since 1980 up to the present.<br />

Under Executive Order No. 143 (Instituting Effective Operational Mechanisms<br />

and Strategies in the <strong>Tariff</strong> <strong>Commission</strong>) dated 21 August 1999, the following<br />

functions of the <strong>Commission</strong> are strengthened and emphasized:<br />

a) institutionalization and acceleration of economic reforms to raise levels<br />

of competition, encourage economic efficiency, and improve consumer<br />

welfare;<br />

b) intensification of all measures to strengthen <strong>Philippine</strong> trade relations<br />

with all other countries, economies, and institutions in the international<br />

community;<br />

c) provision of trade assistance and facilitation to domestic industry;<br />

d) investigation of anti-dumping practices of foreign industries affecting<br />

the <strong>Philippine</strong> economy, and expedite the fair and thorough<br />

adjudication of all cases involving trade measures;<br />

1

e) reinforcement of all research activities that study levels of competition<br />

and contestability in our economy and monitor the trade practices and<br />

activities of all other countries, economies, and institutions in the<br />

international community; and<br />

f) conduct of a continuing program of advocacy to promote new<br />

developments in international trade and tariff policy.<br />

2

Historical Background<br />

Dates<br />

June 20, 1953 First <strong>Philippine</strong> <strong>Tariff</strong> <strong>Commission</strong> was established (Republic Act No. 911).<br />

Headed by a Collegial Body consisting of a Chairman and two<br />

<strong>Commission</strong>ers<br />

Under the supervision of the Office of the President.<br />

August 17, 1953 <strong>TC</strong> officials and employees took their oaths of office<br />

<strong>TC</strong> foundation day<br />

1956 <strong>TC</strong> was reorganized and became a division of the then Department of<br />

Finance under the special provisions of the General Appropriations Act of<br />

1956<br />

1957 <strong>TC</strong> was re-established under the <strong>Tariff</strong> and Customs Code of the <strong>Philippine</strong>s<br />

(R.A. 1937) as an independent body<br />

Headed by a <strong>Commission</strong>er and an Assistant <strong>Commission</strong>er<br />

Under the supervision of the Office of the President<br />

1972 <strong>TC</strong> was reconverted into a Collegial Body consisting of a Chairman and two<br />

Member-<strong>Commission</strong>ers (under Presidential Decree No. 1)<br />

Under the supervision of the National Economic and Development Authority<br />

(NEDA) as an attached agency<br />

April 1, 2000<br />

Effectivity of the latest <strong>TC</strong> reorganization pursuant to EO No. 143 entitled<br />

“Instituting Effective Operational Mechanism and Strategies in the <strong>Tariff</strong><br />

<strong>Commission</strong>”<br />

Headed by a Collegial Body consisting of a Chairman and two Member-<br />

<strong>Commission</strong>ers<br />

Shift from a sectoral to a functional set-up<br />

Remains under the supervision of NEDA<br />

3

Structure<br />

Under Executive Order No. 143, the <strong>Commission</strong>’s organizational set-up<br />

(please see attached <strong>TC</strong> organizational chart) is composed of a Collegial Body<br />

headed by a Chairman and two Member <strong>Commission</strong>ers.<br />

<strong>The</strong>re are three Directors that head each of the Departments: Research and<br />

Investigation, Technical Support Services and Finance and Administrative.<br />

<strong>The</strong> Research and Investigation Department provides the <strong>Commission</strong> with<br />

economical, efficient and effective services relating to research and investigation<br />

activities. It comprises four (4) divisions, namely: <strong>The</strong> Economic Studies Division,<br />

Financial Studies Division, Commodities Studies Division and the Legal Division.<br />

<strong>The</strong> Technical Support Services Department provides the <strong>Commission</strong> with<br />

economical, efficient and effective services relating to planning, programming, and<br />

projects development coordination. It is responsible for scheduling, coordinating and<br />

providing technical support services and proper documentation for certain cases<br />

referred to the <strong>Commission</strong> and the corresponding release of information for public<br />

consumption. It comprises three (3) divisions, namely: the Planning, Program<br />

Development and Monitoring Division, Information Division and the Management<br />

Information Division.<br />

<strong>The</strong> Finance and Administrative Department plans, directs, coordinates and<br />

supervises all matters pertaining to financial and administrative/personnel functions.<br />

It comprises two (2) divisions, namely: the Finance Division and Administrative<br />

Division.<br />

4

<strong>Tariff</strong> <strong>Commission</strong> Organizational Chart<br />

PER EXECUTIVE ORDER No. 143<br />

CHAIRMAN<br />

COMMISSIONER<br />

COMMISSIONER<br />

COMMISSION<br />

SECRETARIAT<br />

RESEARCH AND<br />

INVESTIGATION<br />

DEPARTMENT<br />

TECHNICAL SUPPORT<br />

SERVICES<br />

DEPARTMENT<br />

FINANCE AND<br />

ADMINISTRATIVE<br />

DEPARTMENT<br />

ECONOMIC<br />

STUDIES<br />

DIVISION<br />

FINANCIAL<br />

STUDIES DIVISION<br />

COMMODITIES<br />

STUDIES DIVISION<br />

LEGAL<br />

DIVISION<br />

PLANNING, PROGRAM<br />

DEVELOPMENT AND<br />

MONITORING DIVISION<br />

INFORMATION<br />

DIVISION<br />

MANAGEMENT<br />

INFORMATION<br />

SYSTEMS DIVISION<br />

FINANCE DIVISION<br />

ADMINISTRATIVE<br />

DIVISION<br />

Education and Information<br />

Education and information activities play a vital role in the <strong>Commission</strong>’s work.<br />

To ensure it reaches all its stakeholders, it uses a variety of methods including<br />

publications, the Internet, regional public information campaign, and in-house<br />

seminars and workshops.<br />

<strong>The</strong> <strong>Commission</strong> devotes considerable resources to programs and activities<br />

designed to improve public awareness of the provisions of the <strong>Tariff</strong> and Customs<br />

Code and the latest developments in trade and tariff policy.<br />

5

Publications<br />

<strong>The</strong> <strong>Commission</strong> has a wide range of publications on tariff and related<br />

matters.<br />

<strong>The</strong> <strong>Commission</strong> produces an updated <strong>Tariff</strong> and Customs Code (Vols. 1 &<br />

2); Primer on the Latest Developments in Trade and <strong>Tariff</strong> Policy; Compendium of<br />

<strong>TC</strong> Rulings; <strong>Philippine</strong> CEPT Concessions Exchange Manual (CCEM); and<br />

Alphabetical Index.<br />

For the list of all current publications contact the Information Division of the<br />

<strong>Commission</strong> at 433-58-96, or visit the <strong>Commission</strong>’s website.<br />

<strong>The</strong>re is a charge at minimal cost for the publications.<br />

Internet Website<br />

<strong>The</strong> <strong>Commission</strong> has its own Internet website which is updated regularly to<br />

make new and sought-after information available quickly to the public.<br />

<strong>The</strong> address is http://www.tariffcommission.gov.ph<br />

Fees and Charges<br />

<strong>The</strong>re are fees the <strong>Commission</strong> is charging for applications under Sections<br />

401, 402 and 1313-a and for investigation under Sections 301 and 302 and R.A.<br />

8800. <strong>The</strong> legal bases for the collection of fees and charges are Administrative<br />

Order No. 00-017A and Administrative Order No. 00-103 issued on April 19, 2000<br />

and July 27, 2000, respectively, pursuant to Executive Order No. 197 (dated January<br />

13, 2000).<br />

6

Inquiries and Complaints<br />

<strong>The</strong> <strong>Commission</strong> welcomes inquiries on technical matters concerning tariff<br />

and related matters as well as complaints from its stakeholders about what they<br />

perceive to be the lapses and shortcomings of the <strong>Commission</strong> staff.<br />

Staff are available during office hours for consultations and advise. <strong>The</strong> public<br />

can contact the <strong>Commission</strong> by phone, fax, letter, in person or by e-mail. Please see<br />

attached <strong>Commission</strong> directory for contact details.<br />

If they cannot help, the staff will suggest the appropriate government<br />

department or agencies to contact or other options that may be available.<br />

<strong>The</strong>re is no fee or charge for making a complaint or inquiry.<br />

Liaison<br />

<strong>The</strong> <strong>Commission</strong> has extensive links, both formal and informal, with other<br />

government departments and agencies with whom it shares common policy<br />

concerns, as well as business, professional and consumer organizations and bodies.<br />

<strong>The</strong>re has been a considerable strengthening of links with the <strong>Philippine</strong><br />

Mission in Geneva and the ASEAN and APEC Secretariats.<br />

7

Functions, Duties and Responsibilities of the <strong>Tariff</strong> <strong>Commission</strong><br />

<strong>The</strong> <strong>Tariff</strong> <strong>Commission</strong> is mandated to discharge its duties and responsibilities<br />

under the following provisions under the <strong>Tariff</strong> and Customs Code of the <strong>Philippine</strong>s<br />

(<strong>TC</strong>CP), as amended.<br />

Section 401- Modification of Duty (Flexible <strong>Tariff</strong> Clause)<br />

1. What is Section 401?<br />

Section 401 of the <strong>Tariff</strong> and Customs Code provides the legal<br />

basis by which the President may: (1) change the level and form of<br />

import duties, (2) impose an import quota or ban imports, and (3) levy<br />

an additional duty on all imports.<br />

2. Who can file a Section 401 petition for tariff modification?<br />

Any interested party including domestic manufacturers,<br />

importers, exporters, customs brokers, and government agencies may<br />

file a Section 401 petition for tariff modification.<br />

<strong>The</strong> <strong>Commission</strong> conducts investigations on the petitions it<br />

receives during which public hearings are held to afford interested<br />

parties reasonable opportunity to present their views. <strong>The</strong> <strong>Commission</strong><br />

submits its findings and recommendations to NEDA, which then<br />

schedules these for deliberation by the <strong>Tariff</strong> and Related Matters<br />

(TRM) Technical and Cabinet Committees.<br />

Final approval is granted by the NEDA Board after which, the<br />

<strong>Commission</strong> prepares the implementing Executive Order.<br />

3. What is the procedure for filing a Section 401 petition for tariff<br />

adjustments?<br />

A petitioner is required to accomplish <strong>Tariff</strong> <strong>Commission</strong> Form<br />

No. 3 (Information for <strong>Tariff</strong> Adjustment), which is available at the<br />

<strong>Commission</strong> (see Annex “A”).<br />

4. Are there any fees to be paid by petitioners?<br />

Petitions found to be meritorious under Section 401 are subject<br />

to a processing fee of one hundred twenty pesos (P120.00) per article,<br />

collected upon assessment of the petition, and a filing fee of two<br />

thousand pesos (P2,000.00) per one (1) or more, but not exceeding<br />

five (5) articles, falling in the same Harmonized System (HS) Heading<br />

or Chapter, which is collected prior to the conduct of public hearing.<br />

8

Petitioners also share in the publication cost of the<br />

<strong>Commission</strong>’s Notice of Public Hearing (which is published in two [2]<br />

newspapers of general circulation). A petitioner’s share in the<br />

publication cost is based on the number of products petitioned for tariff<br />

modification and subject of the public hearing.<br />

5. What is the timetable for completion of a Section 401<br />

investigation?<br />

<strong>The</strong> <strong>Commission</strong> completes its investigation and submits its<br />

report of findings and recommendations to NEDA within thirty (30) days<br />

after the termination of the public hearing.<br />

A flowchart of the <strong>Commission</strong>’s investigation procedure for<br />

Section 401 petitions is shown in Annex “B”. Said flowchart is posted at<br />

the lobby of the <strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong> Heart<br />

Center Building.<br />

Section 402 (Promotion of Foreign Trade)<br />

1. What is Section 402?<br />

Section 402 of the <strong>Tariff</strong> and Customs Code provides the legal<br />

basis by which the President may enter into trade agreements with<br />

foreign governments and modify import duties and other import<br />

restrictions as part of these trade agreements.<br />

2. Who can file and what are the filing procedures under Section<br />

402 petition for tariff modification, withdrawal/suspension of<br />

concessions under international trading arrangements??<br />

Interested parties may file with the <strong>Tariff</strong> <strong>Commission</strong> petitions<br />

for tariff modification under Section 402. A petitioner is required to<br />

accomplish <strong>Tariff</strong> <strong>Commission</strong> Form 4 (See Annex “C”).<br />

<strong>The</strong> <strong>Commission</strong> conducts investigations on the petitions it<br />

receives during which public consultations are held to afford interested<br />

parties reasonable opportunity to present their views. <strong>The</strong> <strong>Commission</strong><br />

submits its findings and recommendations to NEDA, which then<br />

schedules these for deliberation by the <strong>Tariff</strong> and Related Matters<br />

(TRM) Technical and Cabinet Committees.<br />

Final approval is granted by the NEDA Board after which, the<br />

<strong>Commission</strong> prepares the draft implementing Executive Order.<br />

9

3. Are there any fees to be paid by petitioners?<br />

Petitions found to be meritorious under Section 402 are subject<br />

to a processing fee of One Hundred Twenty Pesos (P120.00) per<br />

article, collected upon assessment of the petition, and a filing fee of<br />

Two Thousand Pesos (P2,000.00) per one (1) or more, but not<br />

exceeding five (5) articles, falling in the same Harmonized System (HS)<br />

Heading or Chapter, which is collected prior to the conduct of a public<br />

consultation.<br />

Petitioners also share in the publication cost of the<br />

<strong>Commission</strong>’s Notice of Public Consultation (which is published in two<br />

[2] newspapers of general circulation). A petitioner’s share of the<br />

publication cost is based on the number of products he is petitioning for<br />

withdrawal/suspension of tariff concession and subject of the public<br />

consultation.<br />

4. What is the timetable of a Section 402 investigation?<br />

Section 402 <strong>Tariff</strong> Modification<br />

<strong>The</strong> <strong>Commission</strong> completes its investigation and submits its<br />

Report of Findings and recommendations to NEDA within thirty (30)<br />

days after the termination of the public consultation.<br />

A flowchart of the <strong>Commission</strong>’s investigation procedure for<br />

Section 402 petitions is shown in Annex “D”. Said flowchart is posted at<br />

the lobby of the <strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong> Heart<br />

Center Building.<br />

Article 6 (Suspension/Withdrawal of Concessions)<br />

Taking into account the emergency nature of an Article 6<br />

petition, the <strong>Commission</strong> completes its investigation and submits its<br />

Report of Findings and recommendations to NEDA within sixty (60)<br />

days from receipt of a properly documented petition.<br />

<strong>Commission</strong> Order No. 02-01 provides the rules and regulations<br />

governing the conduct of the <strong>Commission</strong>’s formal investigation on the<br />

withdrawal and/or suspension of concessions under Section 402 of the<br />

<strong>Tariff</strong> and Customs Code (available for reproduction at cost).<br />

10

Section 1313-A (<strong>Tariff</strong> Commodity Classification)<br />

1. What is Section 1313-A?<br />

Articles imported into the <strong>Philippine</strong>s are classified in the<br />

Harmonized System <strong>Tariff</strong> and Customs Code. However, when a<br />

commodity imported or intended to be imported is not specifically<br />

provided for in the <strong>Tariff</strong> Code, any interested party may file with the<br />

<strong>Tariff</strong> <strong>Commission</strong> a request for a commodity classification ruling under<br />

this Section.<br />

2. What are the requirements?<br />

<strong>The</strong> applicant is required to submit in triplicate a notarized and<br />

duly accomplished <strong>TC</strong> Form1-a (Request for <strong>Tariff</strong> Classification<br />

Ruling) (see Annex “E”) available at the <strong>Commission</strong>. He is also<br />

required to submit sample or samples of the product (if available),<br />

technical brochures/catalogues indicating its specifications, material or<br />

chemical composition, intended application and other relevant<br />

information.<br />

3. How much is the filing fee?<br />

A filing fee of Two Hundred Pesos (P200.00) is collected for<br />

every ruling requested pursuant to Executive Order 159 dated<br />

February 19, 1994.<br />

4. What is the normal processing time for the <strong>Commission</strong> to issue<br />

ruling?<br />

<strong>Tariff</strong> Commodity Classification (<strong>TC</strong>C) Rulings can be issued<br />

within ten (10) working days from date of filing when and if all the<br />

requirements are met.<br />

A flowchart of the <strong>Commission</strong>’s Section 1313-a procedure is<br />

shown in Annex “F”. Said flowchart is posted at the lobby of the<br />

<strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong> Heart Center Building.<br />

5. Is the <strong>Tariff</strong> <strong>Commission</strong> ruling binding with the Bureau of<br />

Customs?<br />

Pursuant to Section 1313-a of the <strong>Tariff</strong> and Customs Code of<br />

the <strong>Philippine</strong>s, rulings of the <strong>Commission</strong> are binding with the Bureau<br />

of Customs. However, in case of conflict, the ruling is elevated to the<br />

Secretary of Finance for final decision.<br />

11

Section 506 (Assistance to the President and Congress)<br />

What is Section 506?<br />

Under this Section, assistance is extended by the <strong>Commission</strong><br />

to the Office of the President and both Houses of Congress through the<br />

conduct of studies and/or submission of position papers / comments on<br />

tariff and related matters being discussed in Congress or in domestic<br />

and international trade fora.<br />

12

Related Legislation<br />

<strong>The</strong> <strong>Commission</strong> has additional major responsibilities as a<br />

quasi-judicial body under the following legislation related to its core<br />

work.<br />

Republic Act (R.A.) 8752 (Anti-Dumping)<br />

1. What is dumping?<br />

Dumping is a form of price discrimination between two national<br />

markets. It occurs when foreign producers sell their products to an<br />

importer in the domestic market at prices lower than in their own<br />

national markets, or at prices below cost of production, the sale or<br />

importation of which injures or threatens to injure a domestic industry<br />

producing like or comparable products or retards the establishment of a<br />

potential industry.<br />

2. What is the Anti-Dumping Act of 1999?<br />

R.A. 8752, otherwise known as the “Anti-Dumping Act of 1999,”<br />

which amended Section 301 of the <strong>Tariff</strong> and Customs Code of the<br />

<strong>Philippine</strong>s, provides protection to a domestic industry which is being<br />

injured, or is likely to be injured, by the dumping of products imported<br />

into or sold in the <strong>Philippine</strong>s.<br />

3. When was R.A. No. 8752 signed? effective?<br />

R.A. 8752 was signed on August 12, 1999 and took effect on<br />

September 4, 1999.<br />

4. What are the elements of dumping?<br />

<strong>The</strong>re are four (4) elements of dumping, namely:<br />

• Like Product - product produced by the domestic industry<br />

which is identical or alike in all respects to the article<br />

under consideration, or in the absence of such a product,<br />

another product which, although not alike in all respects,<br />

has characteristics closely resembling those of the<br />

product under consideration.<br />

13

• Price Difference - amount by which the normal value (the<br />

price prevailing in the exporting country) exceeds the<br />

export price (selling price to an importer in the<br />

<strong>Philippine</strong>s).<br />

• Injury - material injury to a domestic industry, threat of<br />

material injury or material retardation of the establishment<br />

of a domestic industry. Injury test must be based on<br />

positive evidence and must involve an objective<br />

examination of both (a) the volume of the dumped<br />

imports and the effect of dumped imports on the prices of<br />

like product in the domestic market, and (b) the<br />

consequent impact of these imports on the domestic<br />

producers of such products.<br />

• Causal Link - must exist between the injury being<br />

suffered by the domestic industry and the dumped<br />

imports. It must be clear that the injury suffered is directly<br />

attributable to the alleged dumping.<br />

In an anti-dumping petition, all the four (4) elements must be<br />

established.<br />

5. Who may file an anti-dumping protest?<br />

A protest may be filed by, or on behalf of, the domestic industry,<br />

in writing and embodied in a notarized form.<br />

6. Are there fees to be paid for formal investigation of an anti-dumping<br />

case?<br />

Petitions found to be meritorious under R. A. 8752 are subject to<br />

a filing fee of ten thousand pesos (P10,000.00) per article.<br />

7. Who else, aside from the domestic industry, may initiate an antidumping<br />

investigation?<br />

In special circumstances, the Department of Trade and Industry<br />

(DTI) or the Department of Agriculture (DA) may, on its own motion,<br />

initiate an anti-dumping investigation without having received a written<br />

application by or on behalf of a domestic industry. <strong>The</strong> concerned<br />

authorities should have sufficient evidence of dumping, injury and a<br />

causal link to justify the initiation of the investigation.<br />

14

8. What is the role of the <strong>Tariff</strong> <strong>Commission</strong> in anti-dumping<br />

investigations?<br />

<strong>The</strong> <strong>Commission</strong> conducts formal investigation and submits<br />

report of findings to either Secretary for the issuance of a Department<br />

Order imposing the definitive anti-dumping duty (in case of affirmative<br />

findings).<br />

A Manual on Anti-Dumping Investigation comprising of the<br />

procedures and principles followed by the <strong>Commission</strong> on anti-dumping<br />

investigation serves to assist the <strong>Commission</strong> to conduct its<br />

investigations more effectively and consistently. It also provides the<br />

stakeholders an overview of the procedures followed during an<br />

investigation and serves to make the process more open and<br />

predictable.<br />

9. What is the timetable for the completion of the formal investigation<br />

by the <strong>Commission</strong>?<br />

<strong>The</strong> <strong>Commission</strong> shall submit within one hundred twenty (120)<br />

calendar days from receipt of the case its Final Report of Findings and<br />

decision to the DTI Secretary (in the case of industrial goods) or to the<br />

DA Secretary (in the case of agricultural products) for the issuance of<br />

the appropriate Department Order.<br />

A flowchart of the <strong>Commission</strong>’s investigation procedure for<br />

Section 301 petitions is shown in Annex “G”. Said flowchart is posted at<br />

the lobby of the <strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong> Heart<br />

Center Building.<br />

Republic Act (R.A.) 8751 (Countervailing Duty)<br />

1. What is a countervailing duty?<br />

A "countervailing duty" is a special duty levied, in addition to the<br />

regular duty and other charges, by an importing country on its imports<br />

which have been found to be subsidized in the country of origin or<br />

exportation. It is equal to the ascertained amount of subsidy,<br />

calculated in terms of subsidization per unit of the subsidized exported<br />

product.<br />

15

2. What is a countervailing bond?<br />

A "countervailing bond" is a security (cash deposit or bond)<br />

equal to the amount of the provisionally calculated amount of<br />

subsidization. It is required to be posted when the investigating<br />

authorities determine that such measure is necessary to prevent injury<br />

being caused to the domestic industry during the investigation.<br />

3. What is the Countervailing Duty Act of 1999?<br />

R.A. 8751, otherwise known as the “Countervailing Duty Act of<br />

1999,” which amended Section 302 of the <strong>Tariff</strong> and Customs Code of<br />

the <strong>Philippine</strong>s, provides protection to a domestic industry which is<br />

being injured, or is likely to be injured, by subsidized products imported<br />

into or sold in the <strong>Philippine</strong>s.<br />

4. When was R.A. 8751 signed? Effective?<br />

R.A. 8751 was signed on August 7, 1999 and took effect on<br />

August 31, 1999.<br />

5. What are the elements or factors to be considered before a<br />

countervailing duty may be imposed?<br />

<strong>The</strong>re are four (4) elements or factors which must be considered<br />

before a countervailing duty may be imposed, namely:<br />

• Like Product - product produced by the domestic<br />

industry which is identical or alike in all respects to the<br />

article under consideration, or in the absence of such a<br />

product, another product which, although not alike in all<br />

respects, has characteristics closely resembling those of<br />

the product under consideration.<br />

• Subsidy - any financial assistance extended to the<br />

production, manufacture, carriage or export of goods.<br />

• Injury - material injury to a domestic industry, threat of<br />

material injury or material retardation of the growth or the<br />

prevention of the establishment of a domestic industry.<br />

Injury test must be based on positive evidence and must<br />

involve an objective examination of both (a) the volume of<br />

the subsidized imports and the effect of subsidized<br />

imports on the prices of like product in the domestic<br />

market, and (b) the consequent impact of these imports<br />

on domestic producers of such products.<br />

16

• Causal Link - the material injury suffered by the domestic<br />

industry is the direct result of the importation of the<br />

subsidized product.<br />

Like in anti-dumping, all the four (4) elements must be<br />

established in a petition for countervailing duty.<br />

6. Who may file a petition for countervailing action?<br />

A petition may be filed by or on behalf of the domestic industry<br />

in writing and should be embodied in a notarized form.<br />

7. Who else, aside from the domestic industry, may initiate a<br />

countervailing investigation?<br />

In special circumstances, the Department of Trade and Industry<br />

(DTI) or the Department of Agriculture (DA) may, on its own motion,<br />

initiate a countervailing action. <strong>The</strong> concerned authorities should have<br />

sufficient evidence of subsidization, injury and a causal link to justify<br />

the initiation of the investigation.<br />

8. Are there fees to be paid for a countervailing case?<br />

Petitions found to be meritorious under Section 8751 are subject<br />

to a filing fee of ten thousand pesos (P10,000.00) per article.<br />

9. What is the role of the <strong>Tariff</strong> <strong>Commission</strong> in subsidies and<br />

countervailing investigations?<br />

<strong>The</strong> <strong>Commission</strong> conducts formal investigation and submits<br />

report of findings to either the DTI or the DA Secretary for the issuance,<br />

in case of affirmative findings, of a Department Order concerning the<br />

imposition of the definitive countervailing duty.<br />

10. What is the timetable for the completion of the formal<br />

investigation by the <strong>Commission</strong>?<br />

<strong>The</strong> <strong>Commission</strong> shall submit within one hundred twenty (120)<br />

calendar days from receipt of the case its Final Report of Findings and<br />

decision to the DTI Secretary (in the case of industrial goods) or to the<br />

DA Secretary (in the case of agricultural products) for the issuance of<br />

the appropriate Department Order<br />

17

A flowchart of the <strong>Commission</strong>’s investigation procedure for<br />

Section 302 petitions is shown in Annex “H”. Said flowchart is posted at<br />

the lobby of the <strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong> Heart<br />

Center Building.<br />

Republic Act (R.A.) 8800 (Safeguard Measures)<br />

1. What is the law on the application of safeguard measures?<br />

R.A. 8800, otherwise known as the “Safeguard Measures Act”<br />

provides for<br />

• general safeguard measures to relieve domestic<br />

industries suffering from serious injury as a result of<br />

increase in imports; and<br />

• special safeguard measures (additional duty not<br />

exceeding 1/3 of the existing rate of duty) on agricultural<br />

products marked ”SSG’ in Schedule LXXV-<strong>Philippine</strong>s,<br />

when the import volume exceeds its trigger level or when<br />

the actual c.i.f. import price falls below a trigger price<br />

level.<br />

<strong>The</strong> reason for the application of safeguard measures is to give<br />

the affected domestic industry time to prepare itself against, and adjust<br />

to, increased import competition because of the reduction of tariffs or<br />

the lifting of quantitative restrictions.<br />

2. When was R.A. 8800 signed? effective?<br />

President Estrada signed the law on July 19, 2000. R.A. 8800<br />

was published on July 24, 2000 and took effect on August 9, 2000, i.e.,<br />

fifteen (15) days following its complete publication in newspaper of<br />

general circulation.<br />

3. Who may file a petition for safeguard measures?<br />

petition:<br />

For general safeguard measures, the following may file a<br />

i. Domestic producers as a whole, of like or directly<br />

competitive products manufactured or produced in the<br />

<strong>Philippine</strong>s, or those whose collective output of like or<br />

directly competitive products constitutes a major<br />

proportion of the total domestic production of those<br />

products;<br />

18

ii.<br />

iii.<br />

<strong>The</strong> President, or the House or Senate Committee on<br />

Agriculture, or the House or Senate Committee on Trade<br />

and Commerce; and<br />

<strong>The</strong> Secretary of the Department of Trade and Industry<br />

(DTI) or the Secretary of the Department of Agriculture<br />

(DA), motu proprio, if there is evidence of increased<br />

imports of the product under consideration.<br />

For special safeguard measures, the following may file a<br />

petition:<br />

i. Any person, whether natural or juridical may request a<br />

verification if a particular agricultural product can be<br />

imposed a special safeguard duty.<br />

ii.<br />

<strong>The</strong> DA Secretary may, motu proprio, initiate the<br />

imposition of a special safeguard measure following the<br />

satisfaction of the conditions for imposing the measure.<br />

4. Are there any fees to be paid for formal investigation of a<br />

general safeguards case?<br />

Petitions found to be meritorious under R. A. 8800 are subject to<br />

a filing fee of ten thousand pesos (P10,000.00) per article.<br />

5. Where to file?<br />

Petitions for general safeguard action shall be filed with the DTI<br />

Secretary involving non-agricultural products, or with the DA Secretary<br />

in cases relating to agricultural products. <strong>The</strong> concerned Secretary<br />

shall determine whether or not the petition is proper in form and<br />

substance and whether or not the documentary requirements are<br />

complied with.<br />

Petitions for special safeguard measures shall be filed with the<br />

DA Secretary.<br />

6. What is the role of the <strong>Tariff</strong> <strong>Commission</strong> in general safeguards<br />

investigation?<br />

<strong>The</strong> <strong>Commission</strong> conducts the formal investigation to determine:<br />

a. if the domestic product is a like product or a product<br />

directly competitive to the imported product under<br />

consideration;<br />

19

. if the product is being imported into the <strong>Philippine</strong>s in<br />

increased quantities (absolute or relative to domestic<br />

production);<br />

c. the presence and extent of serious injury or threat<br />

thereof to the domestic industry that produces like or<br />

directly competitive product; and<br />

d. the existence of a causal relationship between the<br />

increased imports of the product under consideration and<br />

the serious injury or threat thereof to the affected<br />

domestic industry.<br />

A Manual on Safeguards Investigation comprising of the<br />

procedures and principles followed by the <strong>Commission</strong> on safeguards<br />

investigation serves to assist the <strong>Commission</strong> to conduct its<br />

investigations more effectively and consistently. It also provides the<br />

stakeholders an overview of the procedures followed during an<br />

investigation and serves to make the process more open and<br />

predictable.<br />

7. What is the timetable for the completion of the formal investigation<br />

by the <strong>Commission</strong>?<br />

<strong>The</strong> <strong>Commission</strong> shall conclude its formal investigation and<br />

submit a report of its findings and conclusions to the Secretary within<br />

one-hundred-twenty (120) calendar days from receipt of the request<br />

from the Secretary, except when the Secretary certifies that the same<br />

is urgent, in which case the <strong>Commission</strong> shall complete the<br />

investigation and submit the report within sixty (60) calendar days.<br />

Upon its positive determination, the <strong>Commission</strong> shall<br />

recommend to the Secretary an appropriate definitive measure.<br />

A flowchart of the <strong>Commission</strong>’s investigation procedure for<br />

safeguard cases investigations is shown in Annex “I”. Said flowchart is<br />

posted at the lobby of the <strong>Commission</strong> on the 5 th floor of the <strong>Philippine</strong><br />

Heart Center Building.<br />

20

THE TARIFF COMMISSION: SERVICE PLEDGE AND COMMITMENTS<br />

<strong>The</strong> <strong>Tariff</strong> <strong>Commission</strong> is committed to adopt programs and operational<br />

strategies to best promote the growth of efficient, self-reliant, innovative and globally<br />

competitive <strong>Philippine</strong> industries. In assessing the feedback by which the<br />

<strong>Commission</strong> can evaluate its relevance and effectiveness, the views and positions<br />

ventilated by concerned stakeholders – industries and consumers – during public<br />

hearings and consultations shall always merit judicious consideration.<br />

As a quasi-judicial body on laws providing domestic industries with the “safely<br />

nets” against the unfair trade practices of dumping and foreign subsidization, the<br />

<strong>Commission</strong> will do its level best to be true to this mandate. <strong>The</strong> investigation of<br />

injurious import surges under fair trade conditions will be done with the same zeal<br />

and commitment to ensure that our recommendations will serve the public interest.<br />

In the performance of our functions on trade remedy laws, we shall see to it that our<br />

tasks are carried out in accordance with <strong>Philippine</strong> obligations under the pertinent<br />

WTO Agreements taking into account due process of law.<br />

Cognizant of the sensitive nature of our functions, we, the <strong>Commission</strong> staff<br />

will discharge our duties in accordance with the core values of competence,<br />

professionalism, objectivity, commitment, and most of all, integrity. We shall not only<br />

endeavor to maintain the integrity of this agency but also to check any contrary<br />

perception that may threaten to diminish the public’s faith in us.<br />

In the international front, we remain convinced that the conduct of foreign<br />

relations for economic development is a major and necessary tool. We shall wield<br />

this tool, in collaboration with other agencies, to intensify our efforts to buttress and<br />

sustain our trade relations with the rest of the world, particularly in multilateral and<br />

regional trading arrangements where we shall actively pursue the national interest.<br />

Confronted with rapid technological change, we shall adopt programs aimed<br />

at continuously upgrading the capability and knowledge of those who constitute this<br />

agency. In these programs, we shall ensure that as we hone their skills, we also<br />

nurture their intellect, vision and moral values.<br />

We affirm our strict compliance with government’s call for no less than the<br />

diligent discharge of our responsibilities. We shall heed this summons in the age-old<br />

tradition of faithful adherence to the highest ethical standards of public service.<br />

In abiding by these commitments, we aim to demonstrate not only the true<br />

meaning of public service. We also aim to display the strength of our nation and our<br />

race through our government’s unrelenting efforts to push the nation toward<br />

sustainable economic progress.<br />

21

ANNEX “A”<br />

TARIFF COMMISSION<br />

5 th Flr. <strong>Philippine</strong> Heart Center Bldg.,<br />

East Avenue Diliman, Quezon City<br />

Tel Nos. 928-84-19; 926-87-31; Fax No. 921-79-60<br />

INSTRUCTIONS IN ACCOMPLISHING THE INFORMATION<br />

FOR TARIFF ADJUSTMENT<br />

(TARIFF COMMISSION FORM NO. 3)<br />

A. Accomplish form and submit four (4) copies with the Records Section of the <strong>Tariff</strong><br />

<strong>Commission</strong> with the following:<br />

1. A covering letter indicating:<br />

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

Name of article (s)<br />

Requested tariff modification<br />

Reasons for the request<br />

Other products produced by the firm<br />

2. Audited Financial Statements for the last three (3) years including Statement<br />

of Cost of Goods Manufactured.<br />

3. Certified statement showing stockholders’ citizenship and equity.<br />

4. Certificate of subject article’s quality and results of tests conducted, if any,<br />

from:<br />

(i)<br />

(ii)<br />

National Institute of Science and Technology, and/or<br />

Concerned government office or agency<br />

5. Share of subject article to total operation (value).<br />

B. Information deemed confidential should be so marked.<br />

C. Additional data and information relative to the petition may be requested by the<br />

<strong>Commission</strong> when deemed necessary.<br />

D. Party will be notified of the status of the petition and may be requested to attend<br />

consultations that may be held for the purpose of hearing the petition.<br />

E. Filing fee of Two Thousand Pesos (P2,000) shall be charged for petition of one or<br />

more but not to exceed five (5) articles.<br />

<strong>TC</strong> Form No. 3 – Revised October, 2001<br />

22

Republic of the <strong>Philippine</strong>s<br />

National Economic and Development Authority<br />

TARIFF COMMISSION<br />

INFORMATION FOR TARIFF ADJUSTMENT<br />

GENERAL INFORMATION<br />

A. PETITIONER<br />

1. Name of Petitioner : __________________________________<br />

2.<br />

Office Address Tel./Fax Nos. Contact Person<br />

3.<br />

Factory Address Tel./Fax Nos. Contact Person<br />

4. Name of President/General Manager: _________________________<br />

5. BOI/SEC Registration No. __________________________________<br />

Date Registered __________________________________________<br />

6. ISO Certification (type and no.) ______________________________<br />

Date Registered ___________________________________________<br />

23

II. PRODUCT INFORMATION<br />

A. Subject Articles(s)<br />

Rate of Duty (%)<br />

Description HS Heading. No. Present Requested<br />

B. Brief Description and Uses of Subject Article(s)<br />

C. Reasons for the Request<br />

D. Production flowchart and brief description of production process of subject article(s) or of<br />

product(s) and its usage.<br />

III. RELEVANT ECONOMIC AND FINANCIAL DATA<br />

(For the last three (3) years to date)<br />

A. Production of subject article<br />

(If subject article is an input, please indicate production of the finished<br />

product.) Use separate sheets if there are more than one product.<br />

PRODUCTION CAPACITY:<br />

ACTUAL PRODUCTION<br />

YEAR Volume Value<br />

24

B. Sales of subject articles<br />

(Sales figures for the final product if subject article is an input.) If the product<br />

is exported, distinguish between domestic sales and exports. Use separate<br />

sheets if there are more than one product.<br />

PRODUCT:<br />

DOMESTIC<br />

EXPORT<br />

YEAR Volume Value Volume Value<br />

Domestic Market Share: (%)__________<br />

C. Ending Inventory (Finished Product)<br />

YEAR VOLUME VALUE<br />

D. Purchases of subject articles: Please distinguished products purchased<br />

domestically from those that are imported. Use separate sheets if there are<br />

more than one product.<br />

PRODUCT:<br />

DOMESTIC<br />

IMPORTED<br />

YEAR Volume Value Volume Value<br />

E. Employment and Compensation Data<br />

Total Employees<br />

Employees directly involved in<br />

the production:<br />

Skilled<br />

Unskilled<br />

Number<br />

Annual<br />

Compensation<br />

25

F. Comparative prices of imported and domestically produced subject articles.<br />

Product<br />

Selling or purchase price of<br />

subject articles in the domestic<br />

market<br />

Price of imported<br />

counterpart<br />

G. Investment Expansion<br />

Year Type Value<br />

H. Percentage of Foreign Currency Denominated Loan to Total Loan (highly<br />

confidential). Submit in sealed envelope.<br />

I. Production Cost: Please fill up attached <strong>TC</strong> Form 3-1 for each product<br />

manufactured.<br />

CERTIFIED TRUE AND CORRECT:<br />

Printed Name<br />

Signature<br />

Position<br />

26

<strong>TC</strong> Form 3 1<br />

REPUBLIC OF THE PHILIPPINES P.O. Box 2479 MANILA<br />

TARIFF COMMISSION FAX 9217960<br />

5 th Floor PHCA East Avenue<br />

Quezon City<br />

Production Cost (Note: If product is of different sizes, types, models of brands, choose one that<br />

is most representative and or saleable).<br />

Product Specification _________________________________________________________<br />

Unit of Measure _________________________________________________________<br />

Sales <strong>Tariff</strong> Duty<br />

1. Unit Costs of Production Tax If Applicable Per Unit Cost<br />

Materials and Supplies:<br />

Direct raw materials (local)<br />

(1) __________________ ________ ____________ ______________________<br />

(2) __________________ ________ ____________ ______________________<br />

(3) __________________ ________ ____________ ______________________<br />

(4) __________________ ________ ____________ ______________________<br />

(5) Others (specify) ________ ____________ ______________________<br />

Direct raw materials (imported)<br />

(1) __________________ ________ ____________ ______________________<br />

(2) __________________ ________ ____________ ______________________<br />

(3) __________________ ________ ____________ ______________________<br />

(4) __________________ ________ ____________ ______________________<br />

(5) Others (specify) ________ ____________ ______________________<br />

Direct Labor<br />

______________________<br />

Manufacturing (Overhead):<br />

Indirect Labor<br />

______________________<br />

Fuels:<br />

Gasoline<br />

Diesel<br />

Bunker<br />

Others<br />

Electricity<br />

Water<br />

Containers<br />

Packaging Supplies<br />

Depreciation<br />

Other Costs<br />

_____________________________<br />

_____________________________<br />

_____________________________<br />

TOTAL UNIT COST<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

______________________<br />

________________________<br />

________________________<br />

________________________<br />

P_______________________<br />

27

Administrative Expenses<br />

_______________________<br />

Selling Expenses<br />

_______________________<br />

_______________________<br />

2. Total Cost to Produce and Sell _______________________<br />

Selling Price<br />

_______________________<br />

3. Wholesale Price of Imported Counterpart P ____________<br />

28

Annex “B”<br />

SECTION 401 FLOW CHART<br />

PETITIONER<br />

Letter Request and <strong>TC</strong> Form 3<br />

(4 copies)<br />

Sample(s)<br />

Catalog/Brochures, Technical<br />

Specifications/Chemical<br />

Composition<br />

Others<br />

Day 1<br />

COMMODITY SPECIALIST<br />

⇒ For Assessment<br />

CASHIER<br />

Day 1<br />

⇒ For payment of Processing Fee<br />

5 Days<br />

Day 1<br />

Day 1<br />

TECHNICAL TEAM<br />

⇒ Evaluation / Investigation<br />

⇒ Briefing Paper<br />

CHAIRMAN /<br />

COMMISSIONERS<br />

DIRECTOR FOR RESEARCH<br />

RECORDS<br />

⇒ Indicates Investigation No.<br />

1 Day<br />

COLLEGIAL BODY<br />

⇒ Deliberates on merit of the case<br />

TECHNICAL TEAM<br />

RECORDS<br />

PETITIONER<br />

NEDA<br />

Director General<br />

RECORDS<br />

1 Day<br />

⇒ Prepares standard letter-reply<br />

that petition is denied / deferred<br />

NO<br />

Conduct<br />

public<br />

hearing?<br />

ACCOUNTING / CASHIER<br />

⇒ Collects payment of fees &<br />

charges and publication<br />

Position Papers<br />

5 - 10 Days<br />

5 Days<br />

TECHNICAL TEAM<br />

⇒ Draft Final Report<br />

YES<br />

TECHNICAL TEAM<br />

⇒ Prepares notice of public<br />

hearing (PH) and list of<br />

interested parties to be<br />

notified<br />

⇒ Advises petitioner to pay<br />

filing fee and pay or share in<br />

publication bill<br />

⇒ Plant Visit / Ocular<br />

Inspection<br />

⇒ Briefing Paper for general<br />

circulation<br />

1 Day<br />

INFORMATION DIVISION<br />

⇒ Publishes and sends out notices<br />

of public hearing<br />

⇒ Reproduces and distributes<br />

copies of briefing paper during<br />

public hearing (last week of<br />

each month)<br />

BOARD SECRETARY<br />

COLLEGIAL DELIBERATION<br />

⇒ Reviews the report as to<br />

conformity with collegial<br />

deliberation<br />

⇒ Prepares transmittal letter to<br />

NEDA DG<br />

TECHNICAL<br />

TECHNICAL<br />

TEAM<br />

TEAM<br />

⇒ Final Report and<br />

Recommendation<br />

5 Days<br />

<strong>Tariff</strong> <strong>Commission</strong><br />

September 2000<br />

29

Annex “C”<br />

INSTRUCTIONS FOR ACCOMPLISHING <strong>TC</strong> FORM NO. 4<br />

(Request for Withdrawal / Suspension of Concessions<br />

Under Section 402)<br />

A. Accomplish form and submit five (5) copies with the Records Section of the <strong>Tariff</strong><br />

<strong>Commission</strong> with the following:<br />

1. A covering letter indicating:<br />

a. Name of article(s)<br />

b. Nature of request<br />

c. Reasons for the request<br />

d. Other products produced by the firm<br />

2. Audited financial statements for the last three (3) years including Statement of<br />

Cost of Goods Manufactured.<br />

3. Certified statement showing stockholders’ citizenship and equity.<br />

4. Certificate of subject article’s quality and results of tests conducted, if any, from:<br />

a. National Institute of Science and Technology, and/or;<br />

b. Concerned government office or agency.<br />

5. Share of subject article to total operation (value).<br />

B. Information deemed confidential should be so marked.<br />

C. Additional data and information relative to the petition may be requested by the<br />

<strong>Commission</strong> when deemed necessary.<br />

D. Party will be notified of the status of the petition and may be requested to attend<br />

consultations that may be held for the purpose of hearing the petition.<br />

30

<strong>TC</strong> Form No. 4<br />

National Economic and Development Authority<br />

TARIFF COMMISSION<br />

<strong>Philippine</strong> Heart Center Bldg., Quezon City<br />

----------------------------------------------------------------------------------------------------<br />

A. Petitioner<br />

INFORMATION FOR WITHDRAWAL / SUSPENSION<br />

OF TARIFF CONCESSIONS UNDER SECTION 402<br />

1. Name of Petitioner: _______________________________________________<br />

2. Office Address Tel. No. Contact Person<br />

_________________________ ______________<br />

_________________________ ______________<br />

___________________<br />

___________________<br />

3. Factory Address Tel. No. Contact Person<br />

_________________________ _______________<br />

_________________________ _______________<br />

___________________<br />

___________________<br />

4. Name of President / General Manager: _______________________________<br />

5. Name and address of other manufacturers:<br />

a. __________________________________________________________<br />

b. __________________________________________________________<br />

c. __________________________________________________________<br />

d. __________________________________________________________<br />

B. Subject Article(s)<br />

<strong>Tariff</strong> Hdg. Rate of Margin of<br />

Subject Article (s) __(H.S.) Duty Preference<br />

___________________________ __________ _______ ____________<br />

___________________________ __________ _______ ____________<br />

___________________________ __________ _______ ____________<br />

C. Nature of Request (Specify)<br />

--------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------<br />

31

D. Brief description and use(s) of subject article(s)<br />

--------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------<br />

E. Please attach production flow chart and brief description of production process of<br />

subject article(s) or of product(s) where this is used.<br />

F. Production Cost (Note: If product is of different sizes, types, model or brands,<br />

choose one that is most representative and/or saleable.)<br />

Product Specification : _______________________________________________<br />

Unit of Measure : _______________________________________________<br />

Per Unit Cost<br />

(latest)<br />

Direct Raw Materials<br />

Direct Labor<br />

Manufacturing Overhead<br />

_______________<br />

_______________<br />

_______________<br />

Total Unit Cost ==============<br />

Sales Tax<br />

Selling and administrative expenses<br />

________________<br />

________________<br />

G. Net Profit (net loss) (last three years)<br />

19___ 19___ 19___<br />

Sales<br />

Cost of goods manufactured<br />

and sold<br />

Gross Profit<br />

Selling Expenses<br />

Administrative Expenses<br />

=====================================<br />

Volume : Value : Volume : Value : Volume :<br />

Value<br />

=====================================<br />

:_______:______:________:_______:________:_____<br />

:_______:______:________:_______:________:_____<br />

:_______:______:________:_______:________:_____<br />

:_______:______:________:_______:________:_____<br />

:_______:______:________:_______:________:_____<br />

:_______:______:________:_______:________:_____<br />

Net Profit (Loss) ====== ======= =====<br />

32

H. Inventory and Production Data (last three years)<br />

=========================================================<br />

: Beginning : Ending :<br />

: Inventory : Inventory : Production<br />

Y e a r :--------------------------------------------------------------------------------<br />

: Qty. : P Value : Qty. : P Value: Qty. : P. Value<br />

=============================================================<br />

1. _________:________:__________:________:_______:__________:_________<br />

2. _________:________:__________:________:_______:__________:_________<br />

3. _________:________:__________:________:_______:__________:_________<br />

I. Employment and Compensation Data (last three years)<br />

Number<br />

Total<br />

Compensation<br />

19___ 19___ 19___ 19___ 19___ 19___<br />

(a) Total No. of employees _____ ____ _____ _____ _____ _____<br />

(b) Employees directly<br />

employed in the production<br />

of subject<br />

article:<br />

Skilled _____ _____ _____ _____ _____ ____<br />

Unskilled _____ _____ _____ _____ _____ ____<br />

(c) Aliens employed _____ _____ _____ _____ _____ ____<br />

J. Importation (last 5 years)<br />

1. Imports<br />

Year Volume $ CIF Value<br />

-------------- --------------------- -------------------------<br />

-------------- --------------------- -------------------------<br />

-------------- --------------------- -------------------------<br />

-------------- --------------------- -------------------------<br />

-------------- --------------------- -------------------------<br />

2. Wholesale Price (Per __________) P _________________<br />

33

K. Major Producers in ASEAN/Concerned Exporting Countries<br />

1. Country<br />

_____________________________________________________________<br />

_____________________________________________________________<br />

2. Name of Company<br />

_____________________________________________________________<br />

_____________________________________________________________<br />

3. Planned Expansion of Capacity<br />

_____________________________________________________________<br />

_____________________________________________________________<br />

L. Machinery and Equipment Used or to be used in the Production Process<br />

1. Petitioner’s<br />

a. Existing or installed:<br />

Year Expected Acquisition<br />

Type Purchased Life Cost<br />

1) _____________ _________ ________ _________<br />

2) _____________ _________ ________ _________<br />

3) _____________ _________ ________ _________<br />

4) _____________ _________ ________ _________<br />

5) _____________ _________ ________ _________<br />

b. To be installed or acquired:<br />

Possible date Acquisition<br />

Type of Installation Cost<br />

1) ______________________ ____________ ___________<br />

2) ______________________ ____________ ___________<br />

3) ______________________ ____________ ___________<br />

4) ______________________ ____________ ___________<br />

5) ______________________ ____________ ___________<br />

34

2. Other Manufacturers<br />

a. Existing or installed:<br />

Year Expected Acquisition<br />

Type Purchased Life Cost<br />

1) _____________ _________ ________ ______________<br />

2) _____________ _________ ________ ______________<br />

3) _____________ _________ ________ ______________<br />

4) _____________ _________ ________ ______________<br />

5) _____________ _________ ________ ______________<br />

b. To be installed or acquired:<br />

Possible date Acquisition<br />

Type of Installation Cost<br />

1) ______________________ ____________ ___________<br />

2) ______________________ ____________ ___________<br />

3) ______________________ ____________ ___________<br />

4) ______________________ ____________ ___________<br />

5) ______________________ ____________ ___________<br />

M. Rated Plant Capacity and Capacity Utilization<br />

a. Existing machinery or<br />

facilities:<br />

Daily (8 hrs.) Monthly Annually<br />

Maximum ____________ _________ __________<br />

Normal ____________ _________ __________<br />

Actual ____________ _________ __________<br />

b. Machineries or facilities<br />

to be installed or acquired:<br />

Maximum ____________ _________ __________<br />

Normal ____________ _________ __________<br />

Actual ____________ _________ __________<br />

35

N. Comparative Unit Price (Wholesale)<br />

=========================================================<br />

: : : Current :<br />

: : Price of Product : Price of Imported :<br />

: Product : Produced by Firm : Counterpart :<br />

: :----------------------------------------------------------:<br />

: : Ex-factory : : Other : :<br />

: : Previous : Current : VAT : Taxes : $ CIF :<br />

:=========================================================<br />

:-------------------------------:------------:--------------:---------:-----------------:-----------:<br />

:-------------------------------:------------:--------------:---------:-----------------:-----------:<br />

:-------------------------------:------------:--------------:---------:-----------------:-----------:<br />

:-------------------------------:------------:--------------:---------:-----------------:-----------:<br />

:-------------------------------:------------:--------------:---------:-----------------:-----------:<br />

Please submit Price List for previous year.<br />

O. Sales of Subject Article(s):<br />

=========================================================<br />

Domestic<br />

Exports<br />

------------------------------ -------------------<br />

Year Volume Value Volume Value<br />

( $ F O B )<br />

=========================================================<br />

-------------------- ------------------ --------------- -------------- --------------<br />

-------------------- ------------------ --------------- -------------- --------------<br />

-------------------- ------------------ --------------- -------------- --------------<br />

-------------------- ------------------ --------------- -------------- --------------<br />

-------------------- ------------------ --------------- -------------- --------------<br />

P. Market Share: __________________________<br />

Q. Assets, Liabilities and Stockholder’s/Equity or Capital<br />

19____ 19____ 19____<br />

Total assets ____________ __________ _________<br />

Total Liabilities ____________ __________ _________<br />

Total S/E ____________ __________ _________<br />

36

Please submit audited financial statement for the last three preceeding years<br />

immediately.<br />

Certified true and correct:<br />

____________________<br />

Printed Name<br />

____________________<br />

Signature<br />

____________________<br />

Position<br />

______________________<br />

Date<br />

37

SECTION 402 FLOW CHART<br />

Annex “D”<br />

PETITIONER<br />

Letter Request and <strong>TC</strong> Form 4<br />

(4 copies)<br />

Sample(s)<br />

Catalog/Brochures, Technical<br />

Specifications/Chemical<br />

Composition<br />

Others<br />

Day 1<br />

COMMODITY SPECIALIST<br />

⇒ For Assessment<br />

CASHIER<br />

Day 1<br />

⇒ For payment of Processing Fee<br />

TECHNICAL TEAM<br />

5 Days<br />

⇒ Evaluation / Investigation to<br />

establish prima facie case<br />

⇒ Prepares letter of invitation<br />

CHAIRMAN /<br />

COMMISSIONERS<br />

Day 1<br />

DIRECTOR FOR RESEARCH<br />

RECORDS<br />

⇒ Indicates Investigation No.<br />

Day 1<br />

1 Day<br />

4 Days<br />

PRESIDING OFFICER<br />

TECHNICAL TEAM<br />

NO<br />

Prima Facie<br />

YES<br />

⇒ Conducts preliminary<br />

conference with petitioner and<br />

ASEAN exporters/supplier and<br />

other government agency<br />

ACCOUNTING / CASHIER<br />

⇒ Prepares notice of public<br />

consultation and list of<br />

interested parties to be notified<br />

⇒ Advises petitioner to pay filing<br />

fee and pay or share in<br />

publication bill<br />

⇒ Plant Visit / Ocular Inspection<br />

⇒ Briefing Paper for general<br />

circulation<br />

Inform Petitioner<br />

⇒ Collects payment of fees &<br />

charges and publication<br />

1 Day<br />

NEDA<br />

Director General<br />

RECORDS<br />

BOARD SECRETARY<br />

3 Days<br />

⇒ Reviews the report as to<br />

conformity with collegial<br />

deliberation<br />

⇒ Prepares transmittal letter to<br />

NEDA DG<br />

1 Day<br />

Public Consultation<br />

5 Days<br />

Submission of Position Papers<br />

3 Days<br />

TECHNICAL TEAM<br />

⇒ Draft Final Report<br />

COLLEGIAL DELIBERATION<br />

5 Days<br />

TECHNICAL TEAM<br />

⇒ Final Report and 38<br />

Recommendation<br />

INFORMATION DIVISION<br />

⇒ Publishes and sends out notices<br />

of public consultation<br />

⇒ Reproduces and distributes<br />

copies of briefing paper during<br />

public hearing (scheduled public<br />

hearings normally held on the<br />

last week of the month)<br />

<strong>Tariff</strong> <strong>Commission</strong><br />

June 2001

<strong>TC</strong> Form 1-a<br />

<strong>TC</strong>C No.: _________<br />

(To be submitted in triplicate) Date: _________<br />

<strong>The</strong> Chairman<br />

<strong>Tariff</strong> <strong>Commission</strong><br />

5 th Floor , Phil. Heart Center<br />

East Ave., Diliman<br />

Quezon City<br />

Sir:<br />

Annex “E”<br />

SUBJECT: REQUEST FOR TARIFF CLASSIFICATION RULING<br />

Pursuant to the provisions of Section 1313-a of the <strong>Tariff</strong> and Customs Code, as<br />

amended, a ruling is requested on the proper tariff classification and corresponding rate of<br />

duty on the following article/s:<br />

I hereby certify that no import entry has been filed on said article/s nor is it a subject<br />

of a pending protest at the Bureau of Customs.<br />

Enclosed are sample(s), catalog(s), and/or brochure(s) of the subject article(s).<br />

Very truly yours,<br />

______________________<br />

Applicant<br />

Company<br />

Address<br />

Tel. No.<br />

Fax No.<br />

: __________________<br />

: __________________<br />

: __________________<br />

: __________________<br />

Subscribed and sworn to before me this __th day of _________________, 2001,<br />

affiant, exhibited his/her Residence Certificate No. _____________ issued at ________<br />

_____________ on ______________________.<br />

Doc. No.: ___________<br />

Page No.: ___________<br />

Book No.: ___________<br />

Series of<br />

NOTARY PUBLIC<br />

EVALUATION SLIP<br />

39

Enclosures:<br />

[ ] Sample<br />

[ ] Catalog/Brochure(s)<br />

[ ] Technical specification / Chemical composition<br />

[ ] Others (Specify) ________________________<br />

Assessment: __________________________________ (P) ___________)<br />

For acceptance:<br />

__________________<br />

<strong>Tariff</strong> Specialist<br />

………………………………………………………………………………………………<br />

<strong>The</strong> Cashier:<br />

Please collect a filing fee of ________________________________________ Pesos<br />

(P _________) from applicant.<br />

_________________<br />

Chief of Branch<br />

(Filing fee of P 200.00 per article is pursuant to E.O. 197 dated 13 January 2000 effective 15<br />

February 2000)<br />

………………………………………………………………………………………………<br />

1 st Indorsement<br />

Respectfully transmitted to the Records Section, applicant having paid the amount<br />

indicated above as evidenced by O.R. No. _______________ dated _________________.<br />

LUDIVINA P. AQUINO<br />

Cashier II<br />

40

SECTION 1313-a FLOW CHART<br />

Day 1<br />

Day 1<br />

Annex “F”<br />

REQUEST FOR<br />

TARIFF<br />

CLASSIFICATION<br />

RULING<br />

⇒ FILLING UP OF T.C.<br />

FORM 1-A<br />

COMMODITY<br />

SPECIALIST<br />

1<br />

⇒ FOR ASSESSMENT<br />

2<br />

CASHIER<br />

⇒ FOR PAYMENT<br />

1 Day<br />

Day 1<br />

3<br />

⇒ FOR RELEASE *<br />

11<br />

⇒ TARIFF COMMISSION<br />

WEB SITE<br />

(www.tariffcommission.gov.ph)<br />

10<br />

RECORDS<br />

SECTION<br />

CHAIRMAN<br />

9<br />

⇒ FOR SIGNATURE<br />

1 Day<br />

1 Day<br />

8<br />

7<br />

EXECOM<br />

COLLEGIAL<br />

⇒ FOR DECISION<br />

4<br />

1 Day<br />

5 Days Day 1<br />

EXECUTIVE<br />

ASSISTANT TO<br />

THE CHAIRMAN<br />

6<br />

COMMODITIES<br />

STUDIES<br />

DIVISION<br />

⇒ FOR PREPARATION<br />

OF RULING<br />

5<br />

DIRECTOR<br />

(RESEARCH AND<br />

INVESTIGATION<br />

DEPARTMENT)<br />

41

Annex “G”<br />

Flowchart of Procedures of the <strong>Tariff</strong> <strong>Commission</strong>’s Formal Investigation<br />

under Section 301, as amended by RA 8752<br />

(Number of Days: 120 Days)<br />

RECORDS SECTION<br />

Indorsement/Advice from the DTI / DA Secretary<br />

Day 1<br />

CHAIRMAN / COMMISSIONERS<br />

DIRECTOR FOR RESEARCH and<br />

INVESTIGATION DEPARTMENT<br />

CASHIER<br />

Collection of Investigation Fees<br />

TASK FORCE<br />

(created upon receipt of Notice of Initiation from the DTI-BIS / DA) Issuance<br />

and Publication of Notice of Formal Investigation and<br />

Preliminary Conference; Issuance of Notice of Billing<br />

Preliminary Conference<br />

Issuance of Briefing Paper<br />

Day 1 – 3<br />

(working)<br />

Day 4 – 6<br />

(calendar)<br />

Day 7<br />

Issuance of Order re: Agreements<br />

during the Preliminary Conference<br />

Submission by Parties of Initial Memoranda / Position Papers<br />

Day 15<br />

Day 8-22<br />

Submission of Report of<br />

Findings to the Secretary;<br />

Publication of Notice of Conclusion;<br />

and Furnish<br />

Parties Public Version<br />

of Report<br />

Day 117-120<br />

(calendar)<br />

Collegial Deliberation<br />

Day 116<br />

Finalization of Report<br />

Day 106-115<br />