carpets and other - Philippine Tariff Commission

carpets and other - Philippine Tariff Commission

carpets and other - Philippine Tariff Commission

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

295<br />

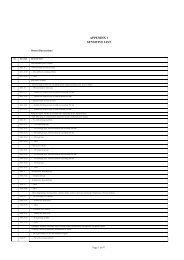

Chapter 57<br />

Carpets <strong>and</strong> <strong>other</strong> textile floor coverings<br />

Notes.<br />

1. For the purposes of this Chapter, the term “<strong>carpets</strong> <strong>and</strong> <strong>other</strong> textile floor coverings” means<br />

floor coverings in which textile materials serve as the exposed surface of the article when in<br />

use <strong>and</strong> includes articles having the characteristics of textile floor coverings but intended for<br />

use for <strong>other</strong> purposes.<br />

2. This Chapter does not cover floor covering underlays.<br />

________________________________________________________________________________

296<br />

Hdg.<br />

No.<br />

AHTN Code<br />

2012<br />

DESCRIPTION<br />

Rate of Duty (%)<br />

MFN<br />

2012 - 2014 - ATIGA<br />

2013 2015<br />

ASEAN<br />

Member<br />

States<br />

Enjoying<br />

Concession<br />

(1) (2) (3) (4) (5) (6) (7)<br />

57.01 Carpets <strong>and</strong> <strong>other</strong> textile floor coverings,<br />

knotted, whether or not made up.<br />

5701.10 - Of wool or fine animal hair:<br />

5701.10.10 - - Prayer rugs 15 15 0 All.<br />

5701.10.90 - - Other 15 15 0 All.<br />

5701.90 - Of <strong>other</strong> textile materials:<br />

- - Of cotton:<br />

5701.90.11 - - - Prayer rugs 15 15 0 All.<br />

5701.90.19 - - - Other 15 15 0 All.<br />

- - Other:<br />

5701.90.91 - - - Prayer rugs 15 15 0 All.<br />

5701.90.99 - - - Other 15 15 0 All.<br />

57.02 Carpets <strong>and</strong> <strong>other</strong> textile floor coverings,<br />

woven, not tufted or flocked, whether or not<br />

made up, including “Kelem”, “Schumacks”,<br />

“Karamanie” <strong>and</strong> similar h<strong>and</strong>-woven rugs.<br />

5702.10.00 - “Kelem”, “Schumacks”, “Karamanie” <strong>and</strong> similar 15 15 0 All.<br />

h<strong>and</strong>-woven rugs<br />

5702.20.00 - Floor coverings of coconut fibres (coir) 15 15 0 All.<br />

- Other, of pile construction, not made up:<br />

5702.31.00 - - Of wool or fine animal hair 15 15 0 All.<br />

5702.32.00 - - Of man-made textile materials 15 15 0 All.<br />

5702.39 - - Of <strong>other</strong> textile materials:<br />

5702.39.10 - - - Of cotton 15 15 0 All.<br />

5702.39.20 - - - Of jute fibres 15 15 0 All.<br />

5702.39.90 - - - Other 15 15 0 All.<br />

- Other, of pile construction, made up:<br />

5702.41 - - Of wool or fine animal hair:<br />

5702.41.10 - - - Prayer rugs 15 15 0 All.<br />

5702.41.90 - - - Other 15 15 0 All.<br />

5702.42 - - Of man-made textile materials:<br />

5702.42.10 - - - Prayer rugs 15 15 0 All.<br />

5702.42.90 - - - Other 15 15 0 All.<br />

5702.49 - - Of <strong>other</strong> textile materials:<br />

- - - Of cotton:<br />

5702.49.11 - - - - Prayer rugs 15 15 0 All.<br />

5702.49.19 - - - - Other 15 15 0 All.<br />

5702.49.20 - - - Of jute fibres 15 15 0 All.<br />

5702.49.90 - - - Other 15 15 0 All.<br />

5702.50 - Other, not of pile construction, not made up:<br />

5702.50.10 - - Of cotton 15 15 0 All.<br />

5702.50.20 - - Of jute fibres 15 15 0 All.<br />

5702.50.90 - - Other 15 15 0 All.<br />

- Other, not of pile construction, made up:<br />

5702.91 - - Of wool or fine animal hair:<br />

5702.91.10 - - - Prayer rugs 15 15 0 All.<br />

5702.91.90 - - - Other 15 15 0 All.<br />

5702.92 - - Of man-made textile materials:<br />

5702.92.10 - - - Prayer rugs 15 15 0 All.<br />

5702.92.90 - - - Other 15 15 0 All.<br />

5702.99 - - Of <strong>other</strong> textile materials:<br />

- - - Of cotton:<br />

5702.99.11 - - - - Prayer rugs 15 15 0 All.<br />

5702.99.19 - - - - Other 15 15 0 All.

297<br />

Hdg.<br />

No.<br />

AHTN Code<br />

2012<br />

DESCRIPTION<br />

Rate of Duty (%)<br />

MFN<br />

2012 - 2014 - ATIGA<br />

2013 2015<br />

ASEAN<br />

Member<br />

States<br />

Enjoying<br />

Concession<br />

(1) (2) (3) (4) (5) (6) (7)<br />

5702.99.20 - - - Of jute fibres 15 15 0 All.<br />

5702.99.90 - - - Other 15 15 0 All.<br />

57.03 Carpets <strong>and</strong> <strong>other</strong> textile floor coverings,<br />

tufted, whether or not made up.<br />

5703.10 - Of wool or fine animal hair:<br />

5703.10.10 - - Floor mats, of a kind used for motor vehicles 20 /h 20 /h 0 All.<br />

of heading 87.02, 87.03 or 87.04<br />

5703.10.20 - - Prayer rugs 15 15 0 All.<br />

5703.10.90 - - Other:<br />

5703.10.90A - - - Carpets, of a kind used for motor vehicles of 20 /g 20 /g 0 All.<br />

headings 87.02, 87.03 or 87.04<br />

5703.10.90B - - - Other 15 15 0 All.<br />

5703.20 - Of nylon or <strong>other</strong> polyamides:<br />

5703.20.10 - - Prayer rugs 15 15 0 All.<br />

5703.20.90 - - Other 15 15 0 All.<br />

5703.30 - Of <strong>other</strong> man-made textile materials:<br />

5703.30.10 - - Prayer rugs 15 15 0 All.<br />

5703.30.90 - - Other 15 15 0 All.<br />

5703.90 - Of <strong>other</strong> textile materials:<br />

- - Of cotton:<br />

5703.90.11 - - - Prayer rugs 15 15 0 All.<br />

5703.90.19 - - - Other 15 15 0 All.<br />

- - Of jute fibres:<br />

5703.90.21 - - - Floor mats, of a kind used for motor vehicles 20 /h 20 /h 0 All.<br />

of heading 87.02, 87.03 or 87.04<br />

5703.90.29 - - - Other:<br />

5703.90.29A - - - - Carpets, of a kind used for motor vehicles 20 /g 20 /g 0 All.<br />

of headings 87.02, 87.03 or 87.04<br />

5703.90.29B - - - - Other 15 15 0 All.<br />

- - Other:<br />

5703.90.91 - - - Floor mats, of a kind used for motor vehicles 20 /h 20 /h 0 All.<br />

of heading 87.02, 87.03 or 87.04<br />

5703.90.99 - - - Other:<br />

5703.90.99A - - - - Carpets, of a kind used for motor vehicles 20 /g 20 /g 0 All.<br />

of headings 87.02, 87.03 or 87.04<br />

5703.90.99B - - - - Other 15 15 0 All.<br />

57.04 Carpets <strong>and</strong> <strong>other</strong> textile floor coverings, of<br />

felt, not tufted or flocked, whether or not<br />

made up.<br />

5704.10.00 - Tiles, having a maximum surface area of<br />

15 15 0 All.<br />

0.3 m2<br />

5704.90.00 - Other 15 15 0 All.<br />

57.05 Other <strong>carpets</strong> <strong>and</strong> <strong>other</strong> textile floor<br />

coverings, whether or not made up.<br />

- Of cotton:<br />

5705.00.11 - - Prayer rugs 15 15 0 All.<br />

5705.00.19 - - Other 15 15 0 All.<br />

- Of jute fibres:<br />

5705.00.21 - - Non-woven floor coverings, of a kind used for 15 15 0 All.<br />

motor vehicles of heading 87.02, 87.03 or<br />

87.04<br />

5705.00.29 - - Other 15 15 0 All.<br />

/h 15% when imported with certification from the Board of Investments.<br />

/g 3% when imported with certification from the Board of Investments.

298<br />

Hdg.<br />

No.<br />

AHTN Code<br />

2012<br />

DESCRIPTION<br />

Rate of Duty (%)<br />

MFN<br />

2012 - 2014 - ATIGA<br />

2013 2015<br />

ASEAN<br />

Member<br />

States<br />

Enjoying<br />

Concession<br />

(1) (2) (3) (4) (5) (6) (7)<br />

- Other:<br />

5705.00.91 - - Prayer rugs 15 15 0 All.<br />

5705.00.92 - - Non-woven floor coverings, of a kind used for 15 15 0 All.<br />

motor vehicles of heading 87.02, 87.03 or<br />

87.04<br />

5705.00.99 - - Other 15 15 0 All.<br />

________________________________________________________________________________________________