GlobalSupplier - Daimler

GlobalSupplier - Daimler

GlobalSupplier - Daimler

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

28 South Africa<br />

News<br />

Naamsa believes the South African<br />

economy remains in relatively good shape<br />

characterised by sound macro economic<br />

and fiscal fundamentals, including,<br />

significant surpluses on the current<br />

account of the balance of payments, benign<br />

inflationary trends, conservative monetary<br />

and fiscal policies, growth in personal<br />

disposable incomes and scope for further<br />

tax reductions.<br />

For 2001, the industry remained on target<br />

to achieve an improvement in aggregate<br />

sales volumes of around 6,5%.<br />

For 2002, however, based on expectations<br />

of slower growth in the South African<br />

economy and the likelihood of fairly steep<br />

new vehicle price increases in January<br />

(and subsequent quarters) as a result of<br />

continuing exchange rate weakness - the<br />

industry had adopted a more conservative<br />

outlook and current expectations ranged<br />

from a no growth scenario, on the one<br />

hand, to marginal growth in new vehicle<br />

sales of 1,4% during the year ahead.<br />

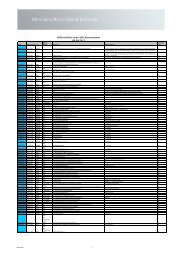

659 3214 54654 3212 3212 32 9875<br />

6564 35 542 6432 6454 545 6345<br />

343 954 654 4687 6552 745 687<br />

654 4687 878 45 629 54 54 3<br />

954 654 4687 3281 354 765 8454<br />

4 224 354 34 4550 65 3554 556<br />

4 54 623 545 354 46 3585 254<br />

4 659 3214 54654 3212 3212 32 9875<br />

6564 35 542 6432 6454 545 6345<br />

54 343 954 654 4687 6552 745 687<br />

54 654 4687 878 45 629 54 54 3<br />

54 654 4687 878 45 629 54 54 3<br />

546 954 654 4687 3281 354 765 8454<br />

4424 224 354 34 4550 65 3554 556<br />

5654 54 623 545 354 46 3585 254954<br />

654 4687 878 45 629 54 54 3<br />

46 954 654 4687 3281 354 765 8454<br />

4 354 34 4550 65 3554 556<br />

545 354 46 3585 254<br />

November sales. New vehicle sales<br />

reported by Naamsa for November<br />

recorded further encouraging gains, and<br />

at 32 006 units reflected a year on year<br />

improvement of 11% compared to the same<br />

month last year when 28 813 sales had<br />

been recorded.<br />

Naamsa says the increase was helped by<br />

pre-emptive purchases to avoid generally<br />

anticipated sharp new vehicle price<br />

increases early in 2002. November’s new<br />

passenger car sales at 19 865 units<br />

reflected an improvement of 1102 units or<br />

5,9% compared to November 2000.<br />

However, compared to October 2001, an<br />

exceptionally strong month for new car<br />

sales, the November sales reflected a fall of<br />

454 6314<br />

464 3222<br />

932 9875<br />

1860 units or 8,5%.<br />

996 7564<br />

432 9454<br />

396 6842<br />

Sales of new light commercial vehicles,<br />

bakkies and minibuses maintained strong<br />

upward momentum during November, and<br />

at 10 938 units was an improvement<br />

of 2034 units or 22,8% compared to<br />

November last year and a slight<br />

improvement of 54 units or 0,5% compared<br />

to October.<br />

The medium and heavy truck segments<br />

turned in a mixed performance with<br />

a drop of 6,6%, for mediums but a<br />

sharp improvement of 14,3% for heavies<br />

compared to November last year.<br />

Combined commercial vehicle sales in<br />

recent months were at the top end<br />

of industry predictions and suggested<br />

an improvement in fixed investment<br />

sentiment in the South African economy.<br />

As expected, exports for October, the latest<br />

available month, staged a strong surge<br />

of 36,3% compared to September, and<br />

aggregate year-to-date new vehicle exports<br />

are now 57,8% ahead of the corresponding<br />

ten months of last year.<br />

Up to the end of October this year, 78 930<br />

cars have been exported, compared to 47<br />

416 during the same period last year<br />

Job losses. The number of persons<br />

employed by the South African new vehicle<br />

manufacturing industry - comprising seven<br />

major new vehicle manufacturers and<br />

eight specialist commercial vehicle manufacturers<br />

- dropped by 210 compared with<br />

the end of September last year to a total<br />

in the last pay week of September 2001 of<br />

32 488.<br />

However, Naamsa said industry<br />

employment numbers have been relatively<br />

stable and at current levels continue to<br />

be modestly ahead of the average monthly<br />

employment level for the 2000 calendar<br />

year of 32 280 jobs.<br />

Three major manufacturers, including<br />

DCSA, now work on a multi-shift basis to<br />

produce cars for export markets while the<br />

balance of the industry tends to operate<br />

11%<br />

Tough year predicted for 2002<br />

South Africa’s vehicle sales have shown an 11% increase on last year on the back of strong light and heavy<br />

commercial vehicle sales, but the National Association of Automobile Manufacturers of South Africa (Naamsa)<br />

cautions that the global economic slowdown will also put the brakes on domestic growth.<br />

on a single shift basis, although a number<br />

operate double shifts in certain production<br />

areas.<br />

Component supply. The availability and<br />

supply of imported original equipment<br />

components during the third quarter<br />

remained good, and prices from source<br />

country remained stable.<br />

However, upward price pressure on<br />

imported components continues to be<br />

experienced due to the weakening Rand.<br />

The availability of imported raw materials,<br />

where applicable, remained good and<br />

price movements remained a function<br />

of material prices on the London Metal<br />

Exchange and the Rand exchange rate.<br />

In local supply, fuel and energy costs and<br />

increases in steel prices continued to place<br />

upward pressure on costs.<br />

Local steel quality and delivery<br />

performance continued to improve, with<br />

local steel prices remaining a source of<br />

concern and continue to be the subject<br />

of ongoing discussions between Iscor and<br />

vehicle manufacturers.<br />

Production capacity. Average motor<br />

vehicle assembly industry capacity<br />

utilisation levels improved during the third<br />

quarter and continued to reflect conditions<br />

in the domestic and export markets.<br />

The averages for the third quarter ranged<br />

between 64,7% capacity utilisation for<br />

Light Commercial Vehicles to 80,5% for<br />

Medium CVs. Passenger Car capacity<br />

utilisation averaged 73,9%.<br />

Naamsa said that South Africa’s vehicle<br />

manufacturing capacity utilisation rate<br />

continued to trend upwards closer to the<br />

global average capacity utilisation rate of<br />

about 76,0%.<br />

89586

![Download Global Supplier Magazin [Ausgabe 02/2003] - Daimler](https://img.yumpu.com/20737092/1/190x253/download-global-supplier-magazin-ausgabe-02-2003-daimler.jpg?quality=85)

![Download Global Supplier Magazin [Ausgabe 02/2002] - Daimler](https://img.yumpu.com/9325024/1/190x248/download-global-supplier-magazin-ausgabe-02-2002-daimler.jpg?quality=85)

![Download Global Supplier Magazin [Ausgabe 01/2003] - Daimler](https://img.yumpu.com/8073798/1/190x253/download-global-supplier-magazin-ausgabe-01-2003-daimler.jpg?quality=85)

![Download Global Supplier Magazin [Ausgabe 02/2007] - Daimler](https://img.yumpu.com/5703060/1/190x247/download-global-supplier-magazin-ausgabe-02-2007-daimler.jpg?quality=85)