Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

Annual Report 2010–2011, Part 2: Financial (1.8 ... - Tourism Victoria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

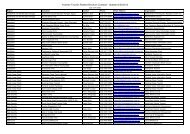

Note 14. <strong>Financial</strong> instruments (continued)<br />

Net holding gain/(loss) on financial instruments by category<br />

<strong>Financial</strong> assets<br />

2011 2010<br />

$ $<br />

Cash and deposits 1,105,877 904,071<br />

Total financial assets 1,105,877 904,071<br />

<strong>Financial</strong> liabilities<br />

Finance lease 9,280 (25,925)<br />

Total financial liabilities 9,280 (25,925)<br />

The net holding gains or losses disclosed above are determined as follows:<br />

• For cash and deposits, loans or receivables, the net gain or loss is calculated by taking the interest revenue, plus or minus foreign exchange<br />

gains or losses arising from revaluation of the financial assets, and minus any impairment recognised in the net result;<br />

• For financial liabilities measured at amortised cost, the net gain or loss is calculated by taking the interest expense, plus or minus foreign<br />

exchange gains or losses arising from the revaluation of financial liabilities measured at amortised cost;<br />

• For financial asset and liabilities that are held-for-trading or designated at fair value through profit or loss, the net gain or losses calculated<br />

by taking the movement in the fair value of the financial asset or liability.<br />

(b) Credit risk<br />

Credit risk refers to the risk that a counterparty will default on its contractual obligations resulting in financial loss to <strong>Tourism</strong> <strong>Victoria</strong>. <strong>Tourism</strong><br />

<strong>Victoria</strong> has adopted a policy of only dealing with creditworthy counterparties and obtaining sufficient collateral where appropriate, as a<br />

means of mitigating the risk of financial loss from defaults. <strong>Tourism</strong> <strong>Victoria</strong> measures credit risk on a fair value basis.<br />

<strong>Tourism</strong> <strong>Victoria</strong> does not have any significant credit risk exposure to any single counterparty or any group of counterparties having similar<br />

characteristics. The credit risk on liquid funds and derivative financial instruments is limited because the counterparties are banks with creditratings<br />

assigned by international credit rating agencies.<br />

The carrying amount of financial assets recorded in the financial statements, net of any allowances for losses, represents <strong>Tourism</strong> <strong>Victoria</strong>’s<br />

maximum exposure to credit risk without taking account for the value of any collateral obtained.<br />

Provision of impairment for contractual financial assets is recognised when there is objective evidence that <strong>Tourism</strong> <strong>Victoria</strong> will not be able<br />

to collect a receivable. Objective evidence includes financial difficulties of the debtor, default payments, debts which are more than 60 days<br />

overdue, and changes in debtor credit ratings.<br />

47