“Direct-to-Market Access” is Here! Learn how you ... - TD Waterhouse

“Direct-to-Market Access” is Here! Learn how you ... - TD Waterhouse

“Direct-to-Market Access” is Here! Learn how you ... - TD Waterhouse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWS<br />

<strong>TD</strong> WATERHOUSE INVESTOR SERVICES<br />

N O V E M B E R 2 0 0 0<br />

<strong>“Direct</strong>-<strong>to</strong>-<strong>Market</strong> <strong>Access”</strong><br />

<strong>is</strong> <strong>Here</strong>! <strong>Learn</strong> <strong>how</strong> <strong>you</strong> may<br />

be able <strong>to</strong> execute <strong>you</strong>r<br />

trades faster<br />

Value Investing Versus<br />

Growth Investing<br />

WebBroker Select –<br />

Real-time, streaming<br />

financial data<br />

www.tdwaterhouse.ca

2<br />

<strong>“Direct</strong>-<strong>to</strong>-<strong>Market</strong> <strong>Access”</strong> <strong>is</strong> <strong>Here</strong>!<br />

<strong>Learn</strong> <strong>how</strong> <strong>you</strong> may be able <strong>to</strong> execute <strong>you</strong>r trades faster<br />

Did <strong>you</strong> know, that until recently, all<br />

Canadian d<strong>is</strong>count brokers, including <strong>TD</strong><br />

<strong>Waterhouse</strong>, were required <strong>to</strong> review each<br />

trade order before forwarding them <strong>to</strong><br />

the appropriate market?<br />

When d<strong>is</strong>count brokerage services were<br />

introduced approximately 16 years ago,<br />

securities regula<strong>to</strong>rs applied ex<strong>is</strong>ting<br />

regulations that required the review of all<br />

trades before order entry. However, th<strong>is</strong><br />

“suitability” review meant that each order<br />

had <strong>to</strong> be interrupted and analyzed by the<br />

brokerage service <strong>to</strong> determine whether<br />

it matched or was cons<strong>is</strong>tent with the<br />

client’s stated investment objectives.<br />

For example, say a client wanted <strong>to</strong> buy<br />

a volatile tech s<strong>to</strong>ck, but stated in their<br />

account application, (on file with<br />

<strong>TD</strong> <strong>Waterhouse</strong>) that their investment<br />

objectives were income and low r<strong>is</strong>k.<br />

Since the order presented falls outside of<br />

these parameters, a <strong>TD</strong> <strong>Waterhouse</strong><br />

Representative would be required <strong>to</strong> contact<br />

the client <strong>to</strong> d<strong>is</strong>cuss their investment<br />

profile before entering the order.<br />

With <strong>to</strong>day’s fast-paced markets and<br />

higher trading volumes, th<strong>is</strong> suitability<br />

review process often leads <strong>to</strong> significant<br />

delays in order execution.<br />

Thanks <strong>to</strong> a wealth of educational and<br />

on-line research services available from<br />

<strong>TD</strong> <strong>Waterhouse</strong> and other industry<br />

sources, inves<strong>to</strong>rs <strong>to</strong>day are far more<br />

knowledgeable. In fact, <strong>TD</strong> <strong>Waterhouse</strong><br />

has led the way in providing these<br />

services, offering our clients more<br />

than 1,000 investment seminars each<br />

year across Canada, access <strong>to</strong> an<br />

unparalleled selection of online<br />

investment research and resources,<br />

and the opportunity <strong>to</strong> consult with<br />

expert Investment Special<strong>is</strong>ts.<br />

As a result, many <strong>TD</strong> <strong>Waterhouse</strong> clients<br />

are now better equipped <strong>to</strong> make informed<br />

and timely investment dec<strong>is</strong>ions and,<br />

therefore, want their trades executed as<br />

quickly as possible.<br />

On behalf of our clients, <strong>TD</strong> <strong>Waterhouse</strong><br />

spent considerable time and effort<br />

lobbying the securities industry <strong>to</strong> permit<br />

elimination of th<strong>is</strong> extensive manual<br />

review process. We believe th<strong>is</strong> will<br />

better serve the needs of <strong>to</strong>day’s<br />

Canadian inves<strong>to</strong>rs.<br />

These efforts have paid off, and we are<br />

pleased <strong>to</strong> report that recent regula<strong>to</strong>ry<br />

changes now permit approved firms, such<br />

as <strong>TD</strong> <strong>Waterhouse</strong>, that do not offer advice<br />

<strong>to</strong> self-directed inves<strong>to</strong>rs, <strong>to</strong> process orders<br />

without th<strong>is</strong> suitability review.<br />

These new regulations pave the way for<br />

<strong>TD</strong> <strong>Waterhouse</strong> <strong>to</strong> offer <strong>you</strong> an enhanced<br />

service that will give <strong>you</strong> more immediate<br />

access <strong>to</strong> the markets, making it possible<br />

<strong>to</strong> execute <strong>you</strong>r trades faster –<br />

particularly if <strong>you</strong> use any of our<br />

Electronic Brokerage Services such as<br />

<strong>TD</strong> <strong>Waterhouse</strong> WebBroker8.<br />

Th<strong>is</strong> enhanced service from<br />

<strong>TD</strong> <strong>Waterhouse</strong>, called Direct-<strong>to</strong>-<br />

<strong>Market</strong> Access, <strong>is</strong> available <strong>to</strong> <strong>you</strong>,<br />

effective Monday, November 27, 2000,<br />

providing <strong>you</strong> choose <strong>to</strong> accept the<br />

change in the way we process <strong>you</strong>r orders.<br />

Benefits of Direct-<strong>to</strong>-<strong>Market</strong> Access<br />

At <strong>TD</strong> <strong>Waterhouse</strong>, we believe that rapid<br />

and efficient access <strong>to</strong> fast-moving<br />

securities markets <strong>is</strong> one of the most<br />

valuable services we can provide <strong>to</strong> selfdirected<br />

inves<strong>to</strong>rs. However, suitability<br />

reviews can takeup valuable time,<br />

especially during peak trading periods.<br />

When <strong>you</strong> opt for Direct-<strong>to</strong>-<strong>Market</strong><br />

Access, a suitability review <strong>is</strong> not<br />

required for eligible trades, so <strong>you</strong>r order<br />

can be forwarded directly <strong>to</strong> the s<strong>to</strong>ck<br />

exchange floor for execution. Not only<br />

will th<strong>is</strong> mean <strong>you</strong>r order may be filled<br />

faster, it may also result in <strong>you</strong>r<br />

obtaining a better price for a s<strong>to</strong>ck <strong>you</strong><br />

buy or sell, since share prices in <strong>to</strong>day’s<br />

high-energy markets fluctuate both<br />

frequently and rapidly.<br />

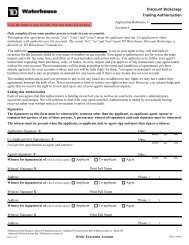

The dec<strong>is</strong>ion <strong>is</strong> entirely <strong>you</strong>rs<br />

It’s important <strong>to</strong> note that the dec<strong>is</strong>ion on<br />

whether <strong>to</strong> change the way <strong>you</strong>r orders<br />

are processed <strong>is</strong> completely up <strong>to</strong> <strong>you</strong>:<br />

It’s also important <strong>to</strong> be aware that the<br />

change <strong>to</strong> Direct-<strong>to</strong>-<strong>Market</strong> Access <strong>is</strong> not<br />

done au<strong>to</strong>matically. Securities regula<strong>to</strong>rs<br />

require that <strong>you</strong> agree <strong>to</strong> take full<br />

responsibility for <strong>you</strong>r trading activity<br />

before <strong>TD</strong> <strong>Waterhouse</strong> can apply th<strong>is</strong><br />

change <strong>to</strong> <strong>you</strong>r trade orders.<br />

In addition, not all trades are eligible for<br />

Direct-<strong>to</strong>-<strong>Market</strong> access and there are<br />

certain circumstances in which a trade<br />

could still be reviewed by a <strong>TD</strong> <strong>Waterhouse</strong><br />

Investment Representative (i.e. credit or<br />

margin-related <strong>is</strong>sues, over-limits, ensuring<br />

compliance with exchange policies).<br />

• If <strong>you</strong> would like <strong>to</strong> take advantage of<br />

the benefits available through our<br />

Direct-<strong>to</strong>-<strong>Market</strong> Access service, <strong>you</strong><br />

can choose from one of three<br />

convenient options. (See below.)<br />

• However, if <strong>you</strong> would prefer not <strong>to</strong><br />

change the way <strong>you</strong>r orders are processed,<br />

<strong>you</strong> can decline the acknowledgment<br />

and <strong>you</strong>r trades will continue <strong>to</strong> be<br />

reviewed against <strong>you</strong>r stated<br />

investment objectives and r<strong>is</strong>k level.<br />

<strong>Here</strong>’s <strong>how</strong> <strong>to</strong> let us know<br />

You will be notified through a mail<br />

campaign that begins with active<br />

electronic brokerage service (EBS)<br />

users. (That <strong>is</strong> clients who regularily use<br />

WebBroker, TalkBroker ▲ , Wireless or<br />

TeleMax 8 <strong>to</strong> execute trades.) Clients<br />

trading through an Investment<br />

Representative will be contacted over<br />

the next few months. If <strong>you</strong> would like<br />

<strong>to</strong> select Direct-<strong>to</strong>-<strong>Market</strong> Access service<br />

for <strong>you</strong>r trading, <strong>you</strong> can choose any of<br />

the following options <strong>to</strong> make the change:<br />

1. In the mailing <strong>you</strong> will be provided<br />

with a personal password. Armed with<br />

th<strong>is</strong> password, simply call the<br />

<strong>TD</strong> <strong>Waterhouse</strong> Interactive Voice<br />

Response System at 1-866-440-7681,<br />

l<strong>is</strong>ten <strong>to</strong> the statement (reproduced<br />

below) and indicate <strong>you</strong>r acceptance.<br />

Your response will be recorded and<br />

the change <strong>to</strong> Direct-<strong>to</strong>-<strong>Market</strong><br />

processing will be activated within<br />

one business day.<br />

2. Alternatively, if <strong>you</strong> use our electronic<br />

brokerage services (WebBroker,<br />

TalkBroker, Wireless and/or TeleMax),<br />

the easiest way <strong>to</strong> obtain Direct-<strong>to</strong>-<br />

<strong>Market</strong> access <strong>is</strong> by logging on <strong>to</strong> the<br />

electronic brokerage service <strong>you</strong><br />

currently use. (There <strong>is</strong> no need for a<br />

special password.) Read or l<strong>is</strong>ten <strong>to</strong><br />

the message (reproduced below),<br />

which explains the change in service,<br />

and indicate <strong>you</strong>r acceptance.

3. You may also contact any of our<br />

1,200 Investment Representatives <strong>to</strong><br />

indicate <strong>you</strong>r preference. Your<br />

selection of Direct-To-<strong>Market</strong> will<br />

be reflected in <strong>you</strong>r account status<br />

the next day.<br />

Whether <strong>you</strong> contact us by phone or<br />

on-line, <strong>you</strong>’ll be asked <strong>to</strong> acknowledge<br />

th<strong>is</strong> message:<br />

“I acknowledge that <strong>TD</strong> <strong>Waterhouse</strong><br />

does not give me investment advice or<br />

recommendations and does not accept<br />

any responsibility <strong>to</strong> adv<strong>is</strong>e me on the<br />

suitability of any of my investment<br />

dec<strong>is</strong>ions or transactions. I acknowledge<br />

that I am responsible for the financial<br />

impact of my investment dec<strong>is</strong>ions.”<br />

In addition, <strong>you</strong>r acknowledgment<br />

includes <strong>you</strong>r agreement with the<br />

following statement:<br />

“I understand all transactions made for<br />

my account will be subject <strong>to</strong> the rules<br />

governing the exchanges or markets and<br />

clearing houses (if any) where the orders<br />

are executed, and I agree <strong>to</strong> comply with<br />

these requirements. Orders entered by<br />

me may be sent directly <strong>to</strong> the exchange<br />

or market without prior review by<br />

<strong>TD</strong> <strong>Waterhouse</strong>. However, <strong>TD</strong> <strong>Waterhouse</strong><br />

reserves the right <strong>to</strong> review any of my<br />

trades prior <strong>to</strong> entry <strong>to</strong> the exchange<br />

or market. I understand that<br />

<strong>TD</strong> <strong>Waterhouse</strong> has the right <strong>to</strong> reject,<br />

change or remove any order entered<br />

by me or <strong>to</strong> cancel any trade resulting<br />

from an order entered by me.”<br />

If <strong>you</strong> agree with these statements and<br />

acknowledge <strong>you</strong>r acceptance of th<strong>is</strong><br />

change in processing <strong>you</strong>r orders, <strong>you</strong>r<br />

future eligible orders will be processed<br />

on a Direct-<strong>to</strong>-<strong>Market</strong> bas<strong>is</strong> (effective<br />

November 27, 2000.) It’s that simple!<br />

Direct-<strong>to</strong>-<strong>Market</strong> access <strong>is</strong> yet another<br />

example of <strong>how</strong> <strong>TD</strong> <strong>Waterhouse</strong><br />

continually provides <strong>you</strong> with the <strong>to</strong>ols<br />

and support <strong>to</strong> be the best inves<strong>to</strong>r <strong>you</strong><br />

can be and achieve <strong>you</strong>r financial<br />

goals.<br />

If <strong>you</strong> have not received a letter,<br />

but would like Direct-<strong>to</strong>-<strong>Market</strong><br />

access please contact <strong>you</strong>r<br />

Investment Representative.<br />

If <strong>you</strong> have questions about th<strong>is</strong><br />

service, v<strong>is</strong>it our website at<br />

www.tdwaterhouse.ca, contact us, or<br />

v<strong>is</strong>it <strong>you</strong>r local <strong>TD</strong> <strong>Waterhouse</strong> office<br />

(1-800-465-5463).<br />

Value Investing Versus Growth Investing<br />

It has been said that there are as many<br />

investment strategies as there are inves<strong>to</strong>rs.<br />

True enough, but most investment<br />

strategies fall in<strong>to</strong> one of the two broad<br />

categories based on their underlying<br />

philosophy. These categories are Value<br />

Investing and Growth Investing.<br />

Value Investing<br />

Value investing <strong>is</strong> based on the simple<br />

prem<strong>is</strong>e that the cheaper <strong>you</strong> can buy a<br />

s<strong>to</strong>ck, the greater the profit <strong>you</strong> can<br />

make on it. Consequently, a value<br />

inves<strong>to</strong>r concentrates h<strong>is</strong> efforts on<br />

finding s<strong>to</strong>cks that are trading at low<br />

prices measured by various criteria. For<br />

example, s<strong>to</strong>ck prices are often related<br />

<strong>to</strong> the profits of the underlying company<br />

by the Price-<strong>to</strong>-Earnings Ratio (P/E).<br />

S<strong>to</strong>cks whose P/Es are low (as compared<br />

<strong>to</strong> the broad market indices, other s<strong>to</strong>cks<br />

in the same industry, or the past h<strong>is</strong><strong>to</strong>ry<br />

of the s<strong>to</strong>ck under consideration) are<br />

often called value s<strong>to</strong>cks.<br />

While the logic of value investing (“buy<br />

low, sell high”) appears <strong>to</strong> be seductively<br />

obvious, the actual performance of most<br />

value inves<strong>to</strong>rs in the past two decades<br />

has been far from impressive. The key<br />

<strong>to</strong> their under-performance lies in the<br />

second half of the “magic formula”.<br />

Buying low <strong>is</strong> easy, but in order <strong>to</strong> sell<br />

high, the s<strong>to</strong>cks bought at bargain prices<br />

must move up after the purchase. In order<br />

<strong>to</strong> achieve th<strong>is</strong> result, a value inves<strong>to</strong>r<br />

must find the s<strong>to</strong>cks that are cheap now,<br />

but have a compelling reason <strong>to</strong> become<br />

much more expensive in the future.<br />

Finding such s<strong>to</strong>cks was not so difficult<br />

in the past, when there were many good<br />

companies overlooked by the investing<br />

community. At the present, <strong>how</strong>ever, all<br />

l<strong>is</strong>ted s<strong>to</strong>cks are screened and analyzed by<br />

a multitude of professional analysts and<br />

investment managers on a regular bas<strong>is</strong>.<br />

As a result, truly great s<strong>to</strong>cks rarely trade at<br />

low prices. Most inves<strong>to</strong>rs who buy s<strong>to</strong>cks<br />

cheaply, later d<strong>is</strong>cover serious fundamental<br />

problems that justified the low s<strong>to</strong>ck<br />

price. In our view, th<strong>is</strong> <strong>is</strong> the reason that<br />

value investing has delivered below<br />

average results in the past two decades.<br />

Growth Investing<br />

A growth inves<strong>to</strong>r <strong>is</strong> not particularly<br />

concerned with P/Es or other yardsticks for<br />

s<strong>to</strong>ck prices. Instead, he selects the<br />

companies whose shares have already<br />

exhibited a pattern of strong growth. The<br />

inves<strong>to</strong>r then uses various analytical <strong>to</strong>ols<br />

trying <strong>to</strong> assess the probability that the strong<br />

performance will continue in the future.<br />

As a result, the growth inves<strong>to</strong>r usually<br />

pays much higher prices for h<strong>is</strong> shares<br />

(measured by P/Es, etc.) than the value<br />

inves<strong>to</strong>r. The philosophy of growth<br />

investing (“buy high, sell higher”) <strong>is</strong><br />

supported by the fact that the best s<strong>to</strong>cks,<br />

like the best products in most other fields,<br />

usually command high prices. The only<br />

time the growth inves<strong>to</strong>r gets a chance<br />

<strong>to</strong> buy h<strong>is</strong> favourite s<strong>to</strong>cks at a d<strong>is</strong>count<br />

<strong>is</strong> after a general market decline.<br />

By paying high prices, the growth<br />

inves<strong>to</strong>r leaves himself open <strong>to</strong> very<br />

high levels of volatility. D<strong>is</strong>appointing<br />

news and broad declines in s<strong>to</strong>ck prices<br />

hurt high-flying s<strong>to</strong>cks much more than<br />

sleepy laggards. Th<strong>is</strong> <strong>is</strong> why value<br />

inves<strong>to</strong>rs usually shine during s<strong>to</strong>ck<br />

market declines, when their portfolios<br />

fall less than those of growth inves<strong>to</strong>rs.<br />

Th<strong>is</strong> fact has led <strong>to</strong> the belief that an<br />

inves<strong>to</strong>r might do well by switching<br />

from growth s<strong>to</strong>cks <strong>to</strong> value s<strong>to</strong>cks and<br />

back at appropriate times.<br />

Unfortunately, th<strong>is</strong> argument contains a<br />

logical flaw. Profitable switching<br />

requires an accurate forecast of market<br />

declines. But if such forecasting were<br />

possible, one would save more money by<br />

selling all of h<strong>is</strong> s<strong>to</strong>cks before a decline,<br />

rather than switching in<strong>to</strong> value s<strong>to</strong>cks.<br />

In reality, nobody has been able <strong>to</strong><br />

cons<strong>is</strong>tently forecast s<strong>to</strong>ck market moves.<br />

To sum up, value investing <strong>is</strong> more<br />

appealing than growth investing on an<br />

intuitive level. It also leads <strong>to</strong> less volatile<br />

portfolios. Yet during periods of economic<br />

expansion, growth inves<strong>to</strong>rs enjoy better<br />

long-term performance than value inves<strong>to</strong>rs.<br />

The recommendations and opinions expressed herein<br />

are those of Alexander Gluskin Investments Inc. and<br />

do not neccessarily reflect those of <strong>TD</strong> <strong>Waterhouse</strong><br />

and are not specifically endorsed by <strong>TD</strong> <strong>Waterhouse</strong>.<br />

3

F O C U S O N R E S E A R C H<br />

Surveys Rank <strong>TD</strong> <strong>Waterhouse</strong> Research #1!!<br />

The results are in – <strong>TD</strong> <strong>Waterhouse</strong> <strong>is</strong><br />

Canada’s Best D<strong>is</strong>count Broker. Based<br />

on the 2 nd annual Canadian Business<br />

Magazine d<strong>is</strong>count broker report<br />

card, Oc<strong>to</strong>ber 16, 2000, not only <strong>is</strong><br />

<strong>TD</strong> <strong>Waterhouse</strong> Number One for the<br />

second year running, but best in class<br />

for four out of the six categories:<br />

<strong>Here</strong> <strong>is</strong> a recent sample of th<strong>is</strong> award-winning research:<br />

<strong>TD</strong> Securities Morning email Action Note Highligh –<br />

4<br />

• Online Trading<br />

• Telephone Service<br />

• Mutual Funds & Products<br />

• Research & Value Added Service<br />

Their survey said: “<strong>TD</strong> <strong>Waterhouse</strong><br />

made the first tier [for Online Trading]<br />

because of the ease of navigating the<br />

site – we could get just about anywhere<br />

with just two clicks of a mouse. We<br />

especially liked <strong>Waterhouse</strong>’s new<br />

eServices feature, which s<strong>to</strong>res and<br />

sends electronic copies of trade<br />

confirmations and statements <strong>to</strong> cus<strong>to</strong>mers.”<br />

In their “Research” category, Canadian<br />

Business noted, “On <strong>to</strong>p of free research,<br />

several brokers offer premium reports<br />

for sale through their sites. We bought<br />

a few <strong>to</strong> see <strong>how</strong> useful they are. The<br />

best stuff comes from <strong>TD</strong> <strong>Waterhouse</strong>,<br />

which actually sells <strong>TD</strong>’s own analysts’<br />

reports [online], complete with<br />

buy-sell recommendations.”<br />

<strong>TD</strong> <strong>Waterhouse</strong> provides access <strong>to</strong><br />

<strong>TD</strong> Securities Inc. research, which offers<br />

conc<strong>is</strong>e reports with valuable information,<br />

comparative analys<strong>is</strong> and key<br />

recommendations. WebBroker clients<br />

have access <strong>to</strong> individual reports on<br />

Canadian and U.S. companies, Action<br />

L<strong>is</strong>t industry reports spanning 18 major<br />

sec<strong>to</strong>rs, and daily e-mails of Action<br />

Notes, including upgrades and downgrades.<br />

The complete <strong>TD</strong> Securities<br />

Subscription Service includes 10<br />

company reports and timely delivery<br />

of a daily e-mail that includes specific<br />

ratings, changes and developments.<br />

The subscriptions can be purchased<br />

for as little as $13.75/month. Sign up<br />

for WebBroker now and receive<br />

1 month of all available research free!<br />

annual interest rates<br />

Effective May 18, 2000 (subject <strong>to</strong> change without notice)<br />

$CDN $US<br />

<strong>TD</strong> Bank Prime<br />

lending rate 7.50%<br />

U.S. Prime 9.50%<br />

lending rate<br />

Margin Debit Balances<br />

Direct Trading<br />

All Balances P + 1.0% P + 1.0%

Focus on the<br />

economy<br />

Macro and Micro<br />

Economics – what the<br />

inves<strong>to</strong>r should know<br />

Investment dec<strong>is</strong>ions involve many types<br />

of choices. Among them <strong>is</strong> the dec<strong>is</strong>ion<br />

<strong>to</strong> invest in a country, a broad economic<br />

sec<strong>to</strong>r, a specific industry or an<br />

individual company. Some people invest<br />

in an individual country – quite literally<br />

– by putting their money in a countryspecific<br />

mutual fund. Others invest in<br />

specific sec<strong>to</strong>rs or industries through<br />

sec<strong>to</strong>r- or industry-specific mutual funds<br />

or through baskets of individual s<strong>to</strong>cks.<br />

And many inves<strong>to</strong>rs focus on specific<br />

companies. Few inves<strong>to</strong>rs would make a<br />

country-, sec<strong>to</strong>r- or industry-specific<br />

investment without doing some research<br />

on the country, sec<strong>to</strong>r or industry. But<br />

even inves<strong>to</strong>rs who focus solely on<br />

individual companies do some research<br />

on the broader national economic <strong>is</strong>sues<br />

and the forces driving the country in<br />

which the company operates. It <strong>is</strong> much<br />

more likely for a sec<strong>to</strong>r or company <strong>to</strong><br />

do well when the country’s economy <strong>is</strong><br />

doing well. Regardless of their investing<br />

focus, inves<strong>to</strong>rs should look at both the<br />

“big” and “small” pictures. That <strong>is</strong> why<br />

both macro and micro economic analys<strong>is</strong><br />

<strong>is</strong> important for all inves<strong>to</strong>rs.<br />

Macro economics – the big picture<br />

Macro economics looks at the big<br />

economic picture – at the health and<br />

performance of national economies.<br />

Economic growth, inflation, labour<br />

markets and unemployment,<br />

international trade, interest rates,<br />

currency trends, and broad economic<br />

policies such as monetary and f<strong>is</strong>cal<br />

policies are all part of the macro<br />

economic picture.<br />

Typical inves<strong>to</strong>r questions that macro<br />

economic analys<strong>is</strong> can answer are:<br />

• How fast <strong>is</strong> a country’s economy<br />

growing? Is its growth rate at, above,<br />

or below its longer-term cru<strong>is</strong>ing<br />

speed? Is growth likely <strong>to</strong> slow down<br />

or speed up in the near term?<br />

• What <strong>is</strong> the national rate of inflation?<br />

Indexes: 1996=100<br />

250<br />

200<br />

125<br />

100<br />

”New Economy” Industries –<br />

a micro economic measure<br />

Total Economy –<br />

a marco economic measure<br />

50<br />

50<br />

1996 1997 1998 1999 2000F 2001F 2002F<br />

F: forecast by <strong>TD</strong> Economics as at Oc<strong>to</strong>ber 2000<br />

Source: Stat<strong>is</strong>tics Canada, <strong>TD</strong> Economics<br />

Is it accelerating or slowing down?<br />

• How rapidly <strong>is</strong> employment<br />

increasing? Is there a high rate of<br />

unemployment, with an accompanying<br />

drain on the country’s unemployment<br />

insurance fund? Or <strong>is</strong> the<br />

unemployment rate so low that upward<br />

pressure on wages may trigger<br />

inflationary pressures?<br />

• How involved <strong>is</strong> the country in the<br />

rapidly growing amount of international<br />

trade around the globe? Does it achieve<br />

a balance in its international current<br />

account (trade in goods and services<br />

and flows of interest and dividends in<br />

and out of the country) on average –<br />

every few years, or does it run<br />

pers<strong>is</strong>tent surpluses or deficits?<br />

• Is the government budget in balance?<br />

If not, <strong>is</strong> the government likely <strong>to</strong><br />

change its taxation or spending policies<br />

<strong>to</strong> balance the budget?<br />

• Are its interest rates high or low –<br />

h<strong>is</strong><strong>to</strong>rically, and/or relative <strong>to</strong> interest<br />

rates in other countries? Are they r<strong>is</strong>ing<br />

or falling?<br />

• Is the country’s currency fixed in<br />

relation <strong>to</strong> another currency, or does it<br />

float? Is it appropriately valued relative<br />

<strong>to</strong> that of its major trading partner(s)?<br />

If not, <strong>how</strong> soon <strong>is</strong> it likely <strong>to</strong> adjust?<br />

• Does the central bank (e.g. the Bank of<br />

Canada, the U.S. Federal Reserve)<br />

have an inflation target? If current<br />

inflation <strong>is</strong> outside the target range, <strong>is</strong><br />

the central bank likely <strong>to</strong> adjust shortterm<br />

interest rates <strong>to</strong> influence the<br />

inflation rate?<br />

Answers <strong>to</strong> these questions tell an<br />

inves<strong>to</strong>r a great deal about the current<br />

performance of a national economy. The<br />

interaction among these various macro<br />

economic variables can help an inves<strong>to</strong>r<br />

predict <strong>how</strong> the economy <strong>is</strong> likely <strong>to</strong><br />

perform in the future. If they are so<br />

inclined, inves<strong>to</strong>rs can go deeper in<strong>to</strong><br />

250<br />

200<br />

125<br />

100<br />

CANADA’S ECONOMIC GROWTH<br />

Macro and Micro Economics<br />

Peter Drake,<br />

Deputy Chief Econom<strong>is</strong>t,<br />

<strong>TD</strong> Bank Financial Group8 2<br />

macro economic analys<strong>is</strong>, delving in<strong>to</strong><br />

areas such as the economy’s demographic<br />

make-up (the age-structure of its<br />

population), or its international<br />

competitiveness (its ability <strong>to</strong> successfully<br />

sell goods and services in foreign markets).<br />

The latter <strong>is</strong> especially important in a<br />

world where international trade <strong>is</strong><br />

increasing rapidly and <strong>is</strong> key <strong>to</strong> most<br />

countries’ economic prosperity. Of course,<br />

macro economic analys<strong>is</strong> also provides<br />

inves<strong>to</strong>rs with the knowledge <strong>to</strong> allocate<br />

their investments among various countries.<br />

Micro economics – focusing on sec<strong>to</strong>rs,<br />

industries and companies<br />

Micro economics focuses on individual<br />

parts of the economy – specific sec<strong>to</strong>rs,<br />

industries and companies. It concerns<br />

itself with the economic character<strong>is</strong>tics of<br />

industries and companies – <strong>how</strong> they<br />

behave <strong>to</strong>ward each other, <strong>how</strong> they behave<br />

<strong>to</strong>ward their cus<strong>to</strong>mer, <strong>how</strong> they are<br />

regulated, what government policies affect<br />

them and what drives their profit growth.<br />

An inves<strong>to</strong>r thinking of making an<br />

investment in a particular economic<br />

sec<strong>to</strong>r, industry or company could look<br />

<strong>to</strong> micro economic analys<strong>is</strong> <strong>to</strong> help<br />

answer the following questions:<br />

• How many firms are in the industry?<br />

How competitive <strong>is</strong> the industry? Are<br />

there few enough firms that an individual<br />

company <strong>is</strong> able <strong>to</strong> change the prices of<br />

its products without worrying about<br />

what its competition will do?<br />

• Is the industry protected from foreign<br />

competition, or must it compete globally?<br />

• Are companies in the industry free <strong>to</strong><br />

set their own prices or must they get<br />

perm<strong>is</strong>sion from a regula<strong>to</strong>ry body?<br />

• Are companies in the industry free <strong>to</strong><br />

enter new markets or must they get<br />

perm<strong>is</strong>sion from a government or<br />

public agency?<br />

continued on page 8<br />

5

ondcorner<br />

Want Monthly Income? …<br />

Consider MBS<br />

Brought <strong>to</strong> <strong>you</strong> by <strong>TD</strong> Securities8 3<br />

Mortgage-Backed Securities (MBS) are<br />

ideal for inves<strong>to</strong>rs looking for monthly<br />

income from a safe investment that<br />

provides a competitive rate of return.<br />

What are they?<br />

MBS are fixed rate investments, which<br />

represent an ownership interest in a pool<br />

of mortgages. The monthly payments<br />

they provide <strong>to</strong> inves<strong>to</strong>rs represent a<br />

share of the interest and principal<br />

payments generated by these mortgages.<br />

Mortgage-Backed Securities are<br />

guaranteed by the Canadian Mortgage<br />

and Housing Corporation (CMHC), an<br />

agency of the Government of Canada.<br />

Th<strong>is</strong> guarantee of timely and complete<br />

payment of both principal and interest<br />

means an MBS carries low r<strong>is</strong>k and has<br />

the same credit rating as Government of<br />

Canada Bonds.<br />

There are two main types of MBS:<br />

1. Open MBS represent ownership in a<br />

pool of residential mortgages<br />

containing prepayment prov<strong>is</strong>ions.<br />

Since any prepayments from the<br />

underlying mortgages must be paid <strong>to</strong><br />

inves<strong>to</strong>rs in the next installment, the<br />

monthly income may fluctuate above<br />

the guaranteed monthly payment<br />

amount and the principal amount will<br />

be repaid faster.<br />

2. Closed MBS represent ownership in a<br />

pool of ‘no prepayment option’<br />

mortgages, which then offers a fairly<br />

predictable level of monthly income<br />

and a known maturity date. Inves<strong>to</strong>rs<br />

looking for monthly income will tend<br />

<strong>to</strong> invest in Closed MBS because of<br />

the certainty of the cash flows they<br />

will receive.<br />

With a Closed MBS, generally about 4%<br />

<strong>to</strong> 10% of the principal <strong>is</strong> repaid <strong>to</strong> the<br />

inves<strong>to</strong>r over the life of the investment,<br />

with the remainder paid at maturity.<br />

Unlike most fixed income investments,<br />

MBS do not simply pay a constant level<br />

of income but rather, a scheduled<br />

blended payment of mostly interest and<br />

some principal that will always be above<br />

a certain minimum amount.<br />

Benefits<br />

MBS are liquid investments and are<br />

actively traded on the secondary market.<br />

Like most fixed income investments, the<br />

market values of MBS fluctuate<br />

inversely with interest rates. However, if<br />

held <strong>to</strong> maturity, the rate of return on<br />

<strong>you</strong>r original investment <strong>is</strong> guaranteed.<br />

Fixed Income products are an important<br />

part of a diversified portfolio and can<br />

offer many benefits <strong>to</strong> match inves<strong>to</strong>rs’<br />

needs. Traditionally, interest bearing<br />

bonds pay a fixed coupon rate semiannually.<br />

One of the primary benefits of<br />

MBS, <strong>how</strong>ever, <strong>is</strong> the monthly income<br />

stream they generate. Th<strong>is</strong> makes it well<br />

suited <strong>to</strong> provide retirement income,<br />

inside or outside an RRIF or <strong>to</strong> an<br />

inves<strong>to</strong>r seeking monthly cash flows <strong>to</strong><br />

manage other financial obligations.<br />

Since the typical Canadian mortgage<br />

term tends <strong>to</strong> be fairly short, MBS with<br />

investment terms of 10 years and shorter<br />

are most common.<br />

If <strong>you</strong> are looking for a predictable cash<br />

flow, contact <strong>TD</strong> <strong>Waterhouse</strong> <strong>to</strong> find<br />

out more about our current offerings<br />

of closed MBS’ that might suit <strong>you</strong>r<br />

investment portfolio. Call <strong>you</strong>r local<br />

<strong>TD</strong> <strong>Waterhouse</strong> office or one of the<br />

<strong>TD</strong> <strong>Waterhouse</strong> Fixed Income Special<strong>is</strong>ts<br />

at 1-888-9<strong>TD</strong>-BOND (983-2663).<br />

WebBroker Select<br />

Real-time, streaming financial data Access industry-grade information<br />

6<br />

If <strong>you</strong>’re an extremely active trader, it’s<br />

critical <strong>to</strong> react quickly <strong>to</strong> changing<br />

market conditions. Frequently, that<br />

means subscribing <strong>to</strong> costly financial<br />

news services and charting services <strong>to</strong><br />

keep up <strong>to</strong> date with shifting market<br />

dynamics.<br />

That’s why <strong>TD</strong> <strong>Waterhouse</strong> <strong>is</strong> pleased<br />

<strong>to</strong> announce the recent introduction of<br />

WebBroker Select, our latest, most<br />

powerful investment resource that<br />

makes it easier – and more costeffective<br />

– than ever <strong>to</strong> track market<br />

movements and anticipate trends.<br />

Currently available exclusively <strong>to</strong> our<br />

Platinum President’s Account8 clients,<br />

WebBroker Select gives <strong>you</strong> free access<br />

<strong>to</strong> <strong>to</strong>ols and information not previously<br />

available <strong>to</strong> the average retail inves<strong>to</strong>r.<br />

Link <strong>to</strong> major s<strong>to</strong>ck markets across<br />

North America<br />

The central feature of WebBroker Select<br />

<strong>is</strong> its Dynamic <strong>Market</strong> Data Portal,<br />

which provides <strong>you</strong> with a direct<br />

connection <strong>to</strong> every major s<strong>to</strong>ck market<br />

in North America. Through the<br />

Dynamic <strong>Market</strong> Data Portal, <strong>you</strong>’ll<br />

receive real-time, streaming financial<br />

data that updates au<strong>to</strong>matically when<br />

information changes. In addition <strong>to</strong><br />

quotes and charts, <strong>you</strong> also receive news<br />

and trade information generated directly<br />

through the market exchanges, giving<br />

<strong>you</strong> real-time access <strong>to</strong> <strong>Market</strong> Depth<br />

and NASDAQ Level II data.<br />

Track up <strong>to</strong> 250 individual s<strong>to</strong>cks<br />

The primary page <strong>you</strong>’ll consult when<br />

making investment dec<strong>is</strong>ions <strong>is</strong> called<br />

Tracker. With Tracker, <strong>you</strong> can<br />

simultaneously view up <strong>to</strong> 25 s<strong>to</strong>ck<br />

symbols per portfolio, in as many as ten<br />

portfolios – providing <strong>you</strong> with the ability<br />

<strong>to</strong> track up <strong>to</strong> 250 individual s<strong>to</strong>cks. By<br />

selecting any one of those individual<br />

symbols, <strong>you</strong>’ll get instant information<br />

access <strong>to</strong> the in-depth, real-time market<br />

data associated with that particular<br />

s<strong>to</strong>ck. You can even receive cus<strong>to</strong>mized<br />

information about the <strong>to</strong>p gainers and<br />

losers, as well as house positions, on<br />

the major North American markets of<br />

<strong>you</strong>r choice.<br />

Powerful technical charting <strong>to</strong>ols<br />

WebBroker Select’s powerful technical<br />

charting <strong>to</strong>ols can be cus<strong>to</strong>mized <strong>to</strong> suit<br />

continued on page 8

Term Insurance: Fast and Easy Online<br />

What <strong>you</strong> really need <strong>to</strong> know<br />

We insure our homes and our cars without<br />

a second thought. But what about <strong>you</strong>r<br />

family’s most valuable assets – <strong>you</strong>, <strong>you</strong>r<br />

spouse, and <strong>you</strong>r children?<br />

Indeed, Canadians recognize the value of<br />

life insurance – the majority of households<br />

have individual life insurance policies 1 .<br />

Th<strong>is</strong> <strong>is</strong> not surpr<strong>is</strong>ing given the<br />

availability of flexible, cost-effective<br />

term life insurance policies.<br />

Term insurance <strong>is</strong> the most widely held<br />

life insurance product in Canada<br />

accounting for almost 60% of the <strong>to</strong>tal<br />

life insurance purchased. 1<br />

One of the reasons so many Canadians<br />

choose term life insurance <strong>is</strong> its<br />

affordability. The premiums are low<br />

because <strong>you</strong>’re buying pure insurance,<br />

with no costly components tacked-on.<br />

Specific needs<br />

Although these policies are available in<br />

terms ranging from one year <strong>to</strong> 100<br />

years, the most popular <strong>is</strong> 10-year term.<br />

It offers great value and <strong>is</strong> ideal for<br />

safeguarding specific needs. <strong>Here</strong> are a<br />

few examples.<br />

• Your family’s lifestyle and <strong>you</strong>r<br />

children’s education. With a standalone<br />

term life policy, <strong>you</strong> can retain<br />

control over <strong>you</strong>r insurance coverage.<br />

The death benefit does not decrease,<br />

N O V E M B E R T R A D E R S’ S N A P S H O T<br />

• Among the <strong>to</strong>p three months of the<br />

year along with December and January<br />

• Also start of the best six months of<br />

the year<br />

• Four great Novembers in a row<br />

• Up 32 times, down 17 on S&P<br />

• Day before and after Thanksgiving Day<br />

combined only 7 losses in 47 years<br />

• Last 14 elections 7 Republican<br />

vic<strong>to</strong>ries averaged 2.6% gain on<br />

Dow, 7 Democrats, 0.5%<br />

• Largest Dow gains followed wins by<br />

Clin<strong>to</strong>n in 1996 (8.2%) and Reagan in<br />

1980 (7.4%); largest loss 1948 Truman<br />

upsets Dewey<br />

<strong>you</strong> get <strong>to</strong> choose the beneficiary, and<br />

the money can be used by <strong>you</strong>r<br />

beneficiary for anything from<br />

burdensome debts and day-<strong>to</strong>-day<br />

expenses, <strong>to</strong> music lessons and<br />

university tuition fees.<br />

• An at-home parent. Insuring a stay-athome<br />

partner makes good economic<br />

sense, particularly if <strong>you</strong> have children.<br />

The replacement costs of child-care and<br />

homemaking services can be significant<br />

and can create additional stress <strong>to</strong> an<br />

already difficult time.<br />

• Your investment portfolio. If <strong>you</strong> own<br />

capital property or other non-reg<strong>is</strong>tered<br />

investments, or don’t have a qualifying<br />

beneficiary for <strong>you</strong>r reg<strong>is</strong>tered<br />

investments, the tax bill at death could<br />

erode more than half the value of those<br />

assets. Insurance can provide an<br />

immediate, tax-free source of cash <strong>to</strong><br />

cover the tax obligations and any other<br />

final expenses.<br />

Buy direct and save with <strong>TD</strong> Life 2<br />

Ten-year term life insurance <strong>is</strong> affordable<br />

and flexible. But premiums can vary<br />

widely so it pays <strong>to</strong> shop around. How<br />

do the major companies compare? You<br />

be the judge.<br />

In many categories of term life,<br />

<strong>TD</strong> 10-Year Term Life 3 has the lowest<br />

monthly rates. 4<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

Probability of the S&P 500 r<strong>is</strong>ing on each<br />

trading day in November.<br />

Copyright the Hirsch Organization Inc. 2000.<br />

Publ<strong>is</strong>hed by Yale Hirsch. The Almanac <strong>is</strong> a<br />

combination market encyclopedia, forecasting<br />

<strong>to</strong>ol and desk diary that pinpoints crucial trends<br />

and dozens of potential profit opportunities<br />

based on proven h<strong>is</strong><strong>to</strong>rical patterns. Excerpt<br />

from the S<strong>to</strong>ck Trader’s Almanac.<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

$65.93<br />

Empire Life<br />

$61.20<br />

Sun Life<br />

$51.30 $50.18<br />

Imperial Life<br />

Commercial Union Life<br />

$49.05<br />

Great West Life<br />

$41.35<br />

<strong>TD</strong> Life<br />

10<br />

Monthly Premiums: Male, Age 45, Non-Smoker, $250,000 Policy*<br />

As <strong>you</strong>’ve come <strong>to</strong> expect with<br />

<strong>TD</strong> <strong>Waterhouse</strong>, <strong>TD</strong> Life’s 10-Year Term<br />

Life insurance plan offers tremendous<br />

value along with savings and the<br />

convenience of dealing direct. There are<br />

no comm<strong>is</strong>sions, no appointments, and<br />

no hassles. You get do-it-<strong>you</strong>rself<br />

coverage and a team of licensed<br />

special<strong>is</strong>ts ready <strong>to</strong> ass<strong>is</strong>t should <strong>you</strong><br />

need advice.<br />

<strong>TD</strong> 10-Year Term Life <strong>is</strong> available <strong>to</strong><br />

Canadian residents aged 18-70. It <strong>is</strong><br />

guaranteed renewable without a medical<br />

exam <strong>to</strong> age 80. As well, should <strong>you</strong>r<br />

needs change, <strong>you</strong> can convert it <strong>to</strong> a<br />

permanent policy without a medical<br />

exam <strong>to</strong> age 69.<br />

Call 1-888-982-0080 <strong>to</strong>day <strong>to</strong> speak<br />

with licensed non-comm<strong>is</strong>sioned<br />

<strong>TD</strong> Insurance 8 special<strong>is</strong>ts. 5 They’ll<br />

take <strong>you</strong>r application by phone<br />

conveniently and hassle-free. Or v<strong>is</strong>it<br />

www.tdinsurance.com <strong>to</strong> get <strong>you</strong>r own<br />

no-obligation quotes from up <strong>to</strong> 25 life<br />

insurers. You can apply online<br />

anytime and could qualify for<br />

immediate coverage.<br />

1<br />

Life Insurance <strong>Market</strong>ing Research Association,<br />

2000. 2 Toron<strong>to</strong> Dominion Life Insurance Company.<br />

3<br />

Underwritten by Toron<strong>to</strong> Dominion Life Insurance<br />

Company (<strong>TD</strong> Life). Not available in PEI, New<br />

Brunswick or Quebec. 4 Based on a review of term<br />

life insurance rates available on the Compulife ® life<br />

insurance rate compar<strong>is</strong>on software program<br />

conducted by <strong>TD</strong> Life for amounts of $100,000 and<br />

above, in September 2000. ® Compulife <strong>is</strong> a reg<strong>is</strong>tered<br />

trademark of Compulife Inc. *Position of <strong>TD</strong><br />

10-Year Term Life insurance monthly costs versus<br />

Empire Life, Sun Life, Imperial Life, Commercial<br />

Union Life, and Great West Life. Monthly costs<br />

compiled from the Compulife ® life insurance rate<br />

compar<strong>is</strong>on software program as of September 2000.<br />

Coverage <strong>to</strong> at least age 75, convertible <strong>to</strong> age 60,<br />

non-preferred r<strong>is</strong>k, guaranteed renewable premiums.<br />

Differences among compared products may ex<strong>is</strong>t.<br />

5<br />

Licensed life insurance agents of <strong>TD</strong> Life.<br />

7

WebBroker Select...<br />

continued from page 6<br />

<strong>you</strong>r needs. In addition <strong>to</strong> d<strong>is</strong>playing<br />

results in line, ticker, or candlestick<br />

formations, the charting feature allows<br />

<strong>you</strong> <strong>to</strong> choose from technical indica<strong>to</strong>rs<br />

such as On Balance Volume, RSI, and<br />

MACD, and price indica<strong>to</strong>rs such as<br />

Bollinger Bands and Moving Averages.<br />

Results can be d<strong>is</strong>played for intraday,<br />

or for a period of up <strong>to</strong> ten years.<br />

Price and news alerts<br />

At <strong>TD</strong> <strong>Waterhouse</strong>, we understand the<br />

importance of reacting <strong>to</strong> unanticipated<br />

market movements as quickly as<br />

possible. Because WebBroker Select <strong>is</strong><br />

an online platform, <strong>you</strong> can stay in<br />

<strong>to</strong>uch with <strong>you</strong>r portfolio anytime, from<br />

anywhere <strong>you</strong> happen <strong>to</strong> be. WebBroker<br />

Select will even send real-time alerts <strong>to</strong><br />

<strong>you</strong>r pager, <strong>you</strong>r e-mail enabled digital<br />

PCS phone, or by e-mail on such<br />

critical information as price, volume,<br />

and news for the s<strong>to</strong>cks <strong>you</strong>’re most<br />

interested in.<br />

WebBroker Select <strong>is</strong> exclusively<br />

available <strong>to</strong> <strong>TD</strong> <strong>Waterhouse</strong> Platinum<br />

President’s Account clients for free*<br />

by simply reg<strong>is</strong>tering at<br />

http://www.tdwaterhouse.ca/select. If<br />

<strong>you</strong> are a Platinum President’s Account<br />

client, <strong>you</strong> have been pre-reg<strong>is</strong>tered for<br />

WebBroker Select, and should already<br />

have received <strong>you</strong>r WebBroker Connect<br />

ID, Login, and Trading password in the<br />

mail. To get that information<br />

immediately, or <strong>to</strong> find out <strong>how</strong> <strong>to</strong><br />

become a Platinum President’s Account<br />

client, contact us <strong>to</strong>ll-free at<br />

1-800-281-4227 – and begin <strong>to</strong> track<br />

the securities markets with<br />

unprecedented accuracy and depth.<br />

*Brokerage industry professionals must pay<br />

monthly exchange fees using major credit cards.<br />

Fees will be reimbursed in the form of a credit <strong>to</strong><br />

their <strong>TD</strong> <strong>Waterhouse</strong> account.<br />

Focus on the economy...<br />

continued from page 5<br />

• Are companies in the industry free <strong>to</strong><br />

merge with or acquire other companies<br />

in the industry or must they go through<br />

a lengthy review process?<br />

• Is the regula<strong>to</strong>ry climate for the industry<br />

becoming more or less stringent?<br />

• How responsive are labour markets <strong>to</strong><br />

changing conditions in specific industries?<br />

Are there adequate education and<br />

training resources for specific skills<br />

needed by specific industries?<br />

• What <strong>is</strong> the <strong>to</strong>tal industrial make-up of<br />

a country? Do the various industries<br />

that ex<strong>is</strong>t complement each other?<br />

How <strong>is</strong> the mix of industries responding<br />

<strong>to</strong> changes in global demands for<br />

goods and services?<br />

Like macro economic analys<strong>is</strong>, micro<br />

economic analys<strong>is</strong> can be quite useful in<br />

making inter-country compar<strong>is</strong>ons of<br />

specific industries. With many firms<br />

expanding their global reach, the microeconomic<br />

environment in each country<br />

where a firm operates can have an<br />

important bearing on the company’s<br />

success and bot<strong>to</strong>m line.<br />

Micro and macro – the full economic <strong>to</strong>olkit<br />

It should be clear by now that inves<strong>to</strong>rs<br />

can get the most help from economic<br />

analys<strong>is</strong> by taking the time <strong>to</strong> consider<br />

both macro and micro economic <strong>is</strong>sues.<br />

In an ideal world, inves<strong>to</strong>rs would be<br />

able <strong>to</strong> confine their investments <strong>to</strong><br />

those where both macro and micro<br />

economic fac<strong>to</strong>rs are favourable. But it<br />

doesn’t always work that way. There can<br />

be situations where a company which<br />

represents an excellent investment<br />

opportunity <strong>is</strong> operating in a less-thanfavourable<br />

macro economic<br />

environment. Obviously, the inves<strong>to</strong>r<br />

needs <strong>to</strong> do some extra due diligence in<br />

such circumstances, but the investment<br />

may still be worthwhile.<br />

Finding the information on macro and<br />

micro economic <strong>is</strong>sues<br />

Inves<strong>to</strong>rs can go directly <strong>to</strong> the various<br />

government agencies <strong>to</strong> get both macro<br />

and micro economic information. In<br />

Canada, two useful web sites are those<br />

of Stat<strong>is</strong>tics Canada (www.statcan.ca)<br />

and Industry Canada<br />

(www.strateg<strong>is</strong>.ic.gc.ca). It <strong>is</strong> also<br />

helpful <strong>to</strong> get some analys<strong>is</strong> <strong>to</strong> go along<br />

with the stat<strong>is</strong>tics. <strong>TD</strong> Economics’ web<br />

site (www.tdbank.ca/tdeconomics)<br />

contains both macro and micro<br />

economic analys<strong>is</strong> and forecasts. Nearly<br />

all financial institutions have their own<br />

economic web sites. Non-profit<br />

economic think tanks and forecasting<br />

organizations can also provide useful<br />

information. In Canada, the C.D. Howe<br />

Institute (www.cd<strong>how</strong>e.org), the Fraser<br />

Institute (www.fraserinstitute.ca) and the<br />

Conference Board of Canada<br />

(www.conferenceboard.ca) are good<br />

places <strong>to</strong> start. One of the best sites,<br />

especially for economic information on<br />

other countries, <strong>is</strong> the Organization of<br />

Economic Cooperation and<br />

Development (OECD) (www.oecd.org).<br />

Each of the country surveys deals<br />

specifically with macro economic<br />

performance and policies and with<br />

(micro economic) structural <strong>is</strong>sues and<br />

policies. Regardless of where <strong>you</strong> start<br />

surfing, <strong>you</strong> will find numerous sites <strong>to</strong><br />

obtain useful information.<br />

Like almost everything connected with<br />

economic analys<strong>is</strong>, inves<strong>to</strong>rs will soon<br />

d<strong>is</strong>cover that different economics<br />

organizations express different opinions<br />

or draw differing conclusions from what<br />

appear <strong>to</strong> be similar data. For th<strong>is</strong><br />

reason, smart inves<strong>to</strong>rs take the time <strong>to</strong><br />

consider views and opinions from<br />

several sources before drawing their<br />

own conclusions and making their own<br />

investment dec<strong>is</strong>ions.<br />

Th<strong>is</strong> newsletter <strong>is</strong> brought <strong>to</strong> <strong>you</strong> by <strong>TD</strong> <strong>Waterhouse</strong> Inves<strong>to</strong>r Services (Canada) Inc. (“<strong>TD</strong> <strong>Waterhouse</strong>”). Th<strong>is</strong> newsletter <strong>is</strong> for informational purposes only. Investments should be evaluated relative <strong>to</strong> each<br />

individual’s investment objectives. <strong>TD</strong> <strong>Waterhouse</strong> and the <strong>TD</strong> Bank and/or its officers, direc<strong>to</strong>rs, subsidiaries or representatives may hold some of the securities mentioned herein and may from time <strong>to</strong> time<br />

purchase and/or sell same on the s<strong>to</strong>ck market or otherw<strong>is</strong>e. The information contained in th<strong>is</strong> newsletter <strong>is</strong> not, and should not be<br />

construed as investment advice <strong>to</strong> any party. All 3rd party products and services referred <strong>to</strong> or advert<strong>is</strong>ed in th<strong>is</strong> newsletter are sold by the<br />

company or organization named. While these products or services may serve as valuable aids <strong>to</strong> the independent inves<strong>to</strong>r, <strong>TD</strong> <strong>Waterhouse</strong><br />

does not specifically endorse any of these products or services. <strong>TD</strong> <strong>Waterhouse</strong> makes the 3rd party products and services referred <strong>to</strong>, or<br />

advert<strong>is</strong>ed in th<strong>is</strong> newsletter available as a convenience <strong>to</strong> its cus<strong>to</strong>mers only and <strong>is</strong> not liable for any claims, losses or damages <strong>how</strong>ever<br />

ar<strong>is</strong>ing out of any purchase or use of 3rd party products or services. Some of the products l<strong>is</strong>ted are Reg<strong>is</strong>tered Trademarks and are the<br />

property of their respective holders. <strong>TD</strong> <strong>Waterhouse</strong> Inves<strong>to</strong>r Services (Canada) Inc. (“<strong>TD</strong> <strong>Waterhouse</strong>”) <strong>is</strong> a subsidiary of <strong>TD</strong> <strong>Waterhouse</strong><br />

Group, Inc., a subsidiary of <strong>TD</strong> Bank. <strong>TD</strong> <strong>Waterhouse</strong> Member - CIPF. † Based on a study publ<strong>is</strong>hed in Canadian Business Magazine,<br />

Oct. 16, 2000. 1 <strong>TD</strong> Bank <strong>is</strong> a licensed user of the trademark. 2 The <strong>TD</strong> Bank Financial Group means The Toron<strong>to</strong>-Dominion Bank and its<br />

affiliated companies, who provide deposit, investment, securities, trust, insurance and other products or services. 3 <strong>TD</strong> Securities represents<br />

<strong>TD</strong> Securities Inc., <strong>TD</strong> Securities (USA) Inc. and certain investment and corporate banking activities of <strong>TD</strong> Bank. Copyright 2000 of<br />

<strong>TD</strong> Bank, all rights reserved. 8 Trade-mark of <strong>TD</strong> Bank, <strong>TD</strong> <strong>Waterhouse</strong> <strong>is</strong> a licensed user. ▲ Trade-mark of <strong>TD</strong> <strong>Waterhouse</strong>.<br />

www.tdwaterhouse.ca<br />

tdwnews@tdbank.ca<br />

1-800-465-5463