Keith Vodden Dr. Douglas Smith - Transports Canada

Keith Vodden Dr. Douglas Smith - Transports Canada

Keith Vodden Dr. Douglas Smith - Transports Canada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

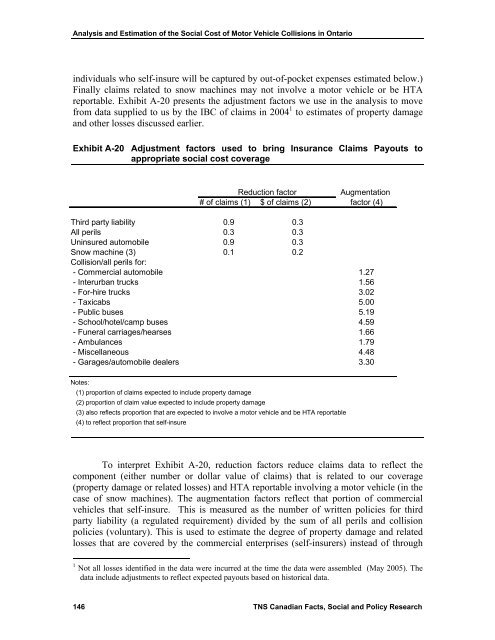

Analysis and Estimation of the Social Cost of Motor Vehicle Collisions in Ontario<br />

individuals who self-insure will be captured by out-of-pocket expenses estimated below.)<br />

Finally claims related to snow machines may not involve a motor vehicle or be HTA<br />

reportable. Exhibit A-20 presents the adjustment factors we use in the analysis to move<br />

from data supplied to us by the IBC of claims in 2004 1 to estimates of property damage<br />

and other losses discussed earlier.<br />

Exhibit A-20 Adjustment factors used to bring Insurance Claims Payouts to<br />

appropriate social cost coverage<br />

Reduction factor<br />

Augmentation<br />

# of claims (1) $ of claims (2) factor (4)<br />

Third party liability 0.9 0.3<br />

All perils 0.3 0.3<br />

Uninsured automobile 0.9 0.3<br />

Snow machine (3) 0.1 0.2<br />

Collision/all perils for:<br />

- Commercial automobile 1.27<br />

- Interurban trucks 1.56<br />

- For-hire trucks 3.02<br />

- Taxicabs 5.00<br />

- Public buses 5.19<br />

- School/hotel/camp buses 4.59<br />

- Funeral carriages/hearses 1.66<br />

- Ambulances 1.79<br />

- Miscellaneous 4.48<br />

- Garages/automobile dealers 3.30<br />

Notes:<br />

(1) proportion of claims expected to include property damage<br />

(2) proportion of claim value expected to include property damage<br />

(3) also reflects proportion that are expected to involve a motor vehicle and be HTA reportable<br />

(4) to reflect proportion that self-insure<br />

To interpret Exhibit A-20, reduction factors reduce claims data to reflect the<br />

component (either number or dollar value of claims) that is related to our coverage<br />

(property damage or related losses) and HTA reportable involving a motor vehicle (in the<br />

case of snow machines). The augmentation factors reflect that portion of commercial<br />

vehicles that self-insure. This is measured as the number of written policies for third<br />

party liability (a regulated requirement) divided by the sum of all perils and collision<br />

policies (voluntary). This is used to estimate the degree of property damage and related<br />

losses that are covered by the commercial enterprises (self-insurers) instead of through<br />

1 Not all losses identified in the data were incurred at the time the data were assembled (May 2005). The<br />

data include adjustments to reflect expected payouts based on historical data.<br />

146 TNS Canadian Facts, Social and Policy Research