Institutional Afftliatie of Kmerican 6ongress on Surveying and ... - CLSA

Institutional Afftliatie of Kmerican 6ongress on Surveying and ... - CLSA

Institutional Afftliatie of Kmerican 6ongress on Surveying and ... - CLSA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Of Interest<br />

FIELD NOTES<br />

ACSM/COFPAES. ASPRS Urge<br />

Support for $1.5 Milli<strong>on</strong><br />

Size St<strong>and</strong>ard<br />

A proposal by the Small Business<br />

Administrati<strong>on</strong> to define a small<br />

business in architecture, engineering<br />

<strong>and</strong> surveying as a firm with up<br />

to $1.5 milli<strong>on</strong> in gross annual<br />

receipts received the qualified support<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> ACSM through a comment<br />

submitted by COFPAES <strong>and</strong><br />

ASPRS. Both groups said the proposed<br />

lower size st<strong>and</strong>ard (from $7.5<br />

milli<strong>on</strong> for engineering <strong>and</strong> from<br />

$3.5 milli<strong>on</strong> for architecture <strong>and</strong><br />

surveying) is a step in the right<br />

directi<strong>on</strong>, but indicated that a disproporti<strong>on</strong>ate<br />

share <str<strong>on</strong>g>of</str<strong>on</strong>g> c<strong>on</strong>tracts<br />

will still be set aside <strong>on</strong>ly for small<br />

businesses unless a Federal regulati<strong>on</strong><br />

requiring the set aside <str<strong>on</strong>g>of</str<strong>on</strong>g> any<br />

c<strong>on</strong>tract in which two or more small<br />

businesses might compete is changed.<br />

Both COFPAES <strong>and</strong> ASPRS<br />

called for revisi<strong>on</strong>, repeal or exempti<strong>on</strong><br />

from the "Rule <str<strong>on</strong>g>of</str<strong>on</strong>g> Two." The<br />

comments also indicated support<br />

for the current $85,000 threshold <strong>on</strong><br />

military c<strong>on</strong>structi<strong>on</strong> A/E/S/M set<br />

asides. Finally, appUcati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

proposed size st<strong>and</strong>ard to archititecture,<br />

engineering, surveying <strong>and</strong><br />

photogrammetry was requested.<br />

The public comment period <strong>on</strong> the<br />

SBA proposal closed November 15,<br />

1985. A final decisi<strong>on</strong> by the agency<br />

is expected by March, 1986.<br />

House Passes Corps Water<br />

Projects Bill<br />

The U.S. House <str<strong>on</strong>g>of</str<strong>on</strong>g> Representatives<br />

<strong>on</strong> November 13, 1985 passed<br />

what it hopes to be the first omnibus<br />

water projects bill to be enacted<br />

since 1976. The bill, H.R. 6,<br />

authorizes work <strong>on</strong> more than 230<br />

dam, river, harbor, canal, navigati<strong>on</strong><br />

<strong>and</strong> flood c<strong>on</strong>trol projects, principally<br />

by the Corps <str<strong>on</strong>g>of</str<strong>on</strong>g> Engineers.<br />

Of interest to the surveying <strong>and</strong><br />

mapping science pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong> are key<br />

provisi<strong>on</strong>s which provide permanent<br />

Brooks Bill authority for Corps<br />

surveying <strong>and</strong> mapping c<strong>on</strong>tracts;<br />

require 30 percent <str<strong>on</strong>g>of</str<strong>on</strong>g> architecture,<br />

engineering <strong>and</strong> c<strong>on</strong>structi<strong>on</strong> design<br />

to be performed by c<strong>on</strong>tract<br />

with the private sector <strong>and</strong> m<strong>and</strong>ate<br />

c<strong>on</strong>siderati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> increased Corps reliance<br />

<strong>on</strong> private firms to increase<br />

its capabUities <strong>and</strong> productivity;<br />

<strong>and</strong> require reporting <str<strong>on</strong>g>of</str<strong>on</strong>g> the distributi<strong>on</strong><br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> c<strong>on</strong>tracts to share a fair<br />

distributi<strong>on</strong> to firms <str<strong>on</strong>g>of</str<strong>on</strong>g> all sizes <strong>and</strong><br />

classes <str<strong>on</strong>g>of</str<strong>on</strong>g> ownership.<br />

House Tax Panel Picks Survejring,<br />

Mapping Finns for Cash<br />

Accounting<br />

<strong>Surveying</strong> <strong>and</strong> mapping firms can<br />

c<strong>on</strong>tinue to use the cash method <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

accounting under the tax reform bill<br />

passed December 17, 1985 by the<br />

House <str<strong>on</strong>g>of</str<strong>on</strong>g> Representatives. The<br />

House Ways <strong>and</strong> Means Committee,<br />

at the urging <str<strong>on</strong>g>of</str<strong>on</strong>g> senior committee<br />

member Rep. Sam Gibb<strong>on</strong>s<br />

(D-FL), specified these firms in the<br />

committee's report language clarifying<br />

the exempti<strong>on</strong>s to new limit<br />

<strong>on</strong> cash accounting are as follows:!<br />

"The c<strong>on</strong>unittee bill allows c<strong>on</strong>tinuec led^<br />

use <str<strong>on</strong>g>of</str<strong>on</strong>g> the cash method <str<strong>on</strong>g>of</str<strong>on</strong>g> accounting for<br />

entities where the incidence <str<strong>on</strong>g>of</str<strong>on</strong>g> taxati<strong>on</strong><br />

falls either at the individual level or <strong>on</strong> a<br />

qualified pers<strong>on</strong>al service corporati<strong>on</strong>.<br />

Entities eligible for the excepti<strong>on</strong> include<br />

sole proprietorships, S corporati<strong>on</strong>s,<br />

qualified pers<strong>on</strong>al service corporati<strong>on</strong>s<br />

or other qualified partnerships.<br />

A qualifying partnership is a partnership<br />

in which all <str<strong>on</strong>g>of</str<strong>on</strong>g> the partnership interests<br />

are held by individuals, qualified<br />

pers<strong>on</strong>al service corporati<strong>on</strong>s, S corporati<strong>on</strong>s,<br />

or other qualifying partnerships.<br />

For the purposes <str<strong>on</strong>g>of</str<strong>on</strong>g> this excepti<strong>on</strong>, a<br />

quaHfied pers<strong>on</strong>al service corporati<strong>on</strong> is<br />

a corporati<strong>on</strong> that meets both a functi<strong>on</strong><br />

test <strong>and</strong> an ownership test. The functi<strong>on</strong><br />

test is met if substantially all the activities<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> the corporati<strong>on</strong> are the performance<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> services in the field <str<strong>on</strong>g>of</str<strong>on</strong>g> health,<br />

law, engineering {including surveying<br />

<strong>and</strong> mapping), architecture, accounting,<br />

actuarial science, performing arts or<br />

c<strong>on</strong>sulting. The ownership test is met if<br />

substantially all <str<strong>on</strong>g>of</str<strong>on</strong>g> the value <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

outst<strong>and</strong>ing stock in the corporati<strong>on</strong> is<br />

owned by employees performing se^^<br />

vices for the corporati<strong>on</strong> in a field sati^^k<br />

fying the functi<strong>on</strong> test. , .<br />

^ ^<br />

Had the clarificati<strong>on</strong> not been<br />

made, firms in surveying, mapping<br />

<strong>and</strong> other pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>s would have<br />

been required to use the accrual<br />

method <strong>and</strong> pay taxes <strong>on</strong> fees billed<br />

rather than those actually collected.<br />

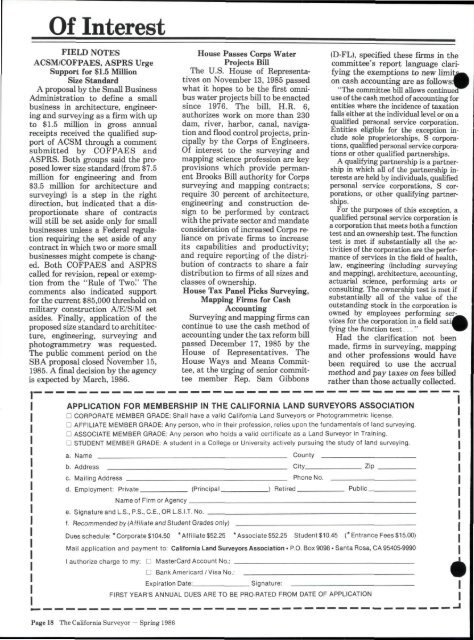

APPLICATION FOR MEMBERSHIP IN THE CALIFORNIA LAND SURVEYORS ASSOCIATION<br />

D CORPORATE MEMBER GRADE: Shall have a valid California L<strong>and</strong> Surveyors or Photogrammetric license.<br />

D AFFILIATE MEMBER GRADE: Any pers<strong>on</strong>, who in their pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>, relies up<strong>on</strong> the fundamentals <str<strong>on</strong>g>of</str<strong>on</strong>g> l<strong>and</strong> surveying.<br />

D ASSOCIATE MEMBER GRADE: Any pers<strong>on</strong> who holds a valid certificate as a L<strong>and</strong> Surveyor in Training.<br />

Q STUDENT MEMBER GRADE: A student in a College or University actively pursuing the study <str<strong>on</strong>g>of</str<strong>on</strong>g> l<strong>and</strong> surveying.<br />

a. Name County<br />

b. Address City Zip<br />

c. Mailing Address<br />

d. Employment: Private.<br />

Name <str<strong>on</strong>g>of</str<strong>on</strong>g> Firm or Agency<br />

e. Signature<strong>and</strong>L.S., P.S.,C.E.,ORL.S.I.T. No.<br />

f. Recommended by (Affiliate <strong>and</strong> Student Grades <strong>on</strong>ly)<br />

Ph<strong>on</strong>e No.<br />

(Principal Retired Public.<br />

Dues schedule: * Corporate $104,50 * Affiliate $52.25 * Associate $52.25 Student $10.45 (* Entrance Fees $15.00)<br />

Mall applicati<strong>on</strong> <strong>and</strong> payment to: California L<strong>and</strong> Surveyors Associati<strong>on</strong> • P.O. Box 9098 • Santa Rosa, CA 95405-9990<br />

I authorize charge to my: D MasterCard Account No.:<br />

D BankAmericard/Visa No.:<br />

Expirati<strong>on</strong> Date:<br />

Signature:<br />

FIRST YEAR'S ANNUAL DUES ARE TO BE PRO-RATED FROM DATE OF APPLICATION<br />

I<br />

I<br />

I<br />

I<br />

I<br />

I<br />

I<br />

Page 18 The California Surveyor - Spring 1986