Downing Planned Exit VCT 2 - G Shares - The Tax Shelter Report

Downing Planned Exit VCT 2 - G Shares - The Tax Shelter Report

Downing Planned Exit VCT 2 - G Shares - The Tax Shelter Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TrackRecordoftheCompany<br />

<br />

TrackrecordoftheOrdinary<strong>Shares</strong><br />

<strong>The</strong>Company’sOrdinary<strong>Shares</strong>(launchedinthe2004/05taxyear)soldalltheirinvestmentsandreturnedtheproceeds,mainlyin<br />

2008and2009,whichtotalled90.4pperOrdinaryShareandrepresentedanincreaseof51%onthenetoftaxcostof60pper<br />

OrdinaryShare.<strong>The</strong>compoundreturn(calculatedasanIRRaftertaxreliefs)was11.2%perannumtaxfree,whichisequivalentto<br />

18.7%perannumtoa40%taxpayer.<strong>The</strong>OrdinaryShare'slistingontheLondonStockExchangewascancelledinAugust2012.<br />

<br />

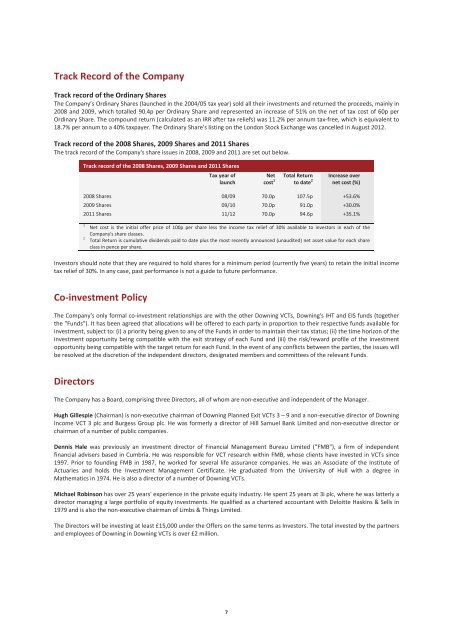

Trackrecordofthe2008<strong>Shares</strong>,2009<strong>Shares</strong>and2011<strong>Shares</strong><br />

<strong>The</strong>trackrecordoftheCompany'sshareissuesin2008,2009and2011aresetoutbelow.<br />

<br />

Trackrecordofthe2008<strong>Shares</strong>,2009<strong>Shares</strong>and2011<strong>Shares</strong><br />

<br />

<br />

<br />

<br />

<br />

<strong>Tax</strong>yearof<br />

Net TotalReturn Increaseover <br />

launch cost 1<br />

<br />

todate 2 <br />

<br />

netcost(%)<br />

2008<strong>Shares</strong> 08/09 70.0p 107.5p +53.6% <br />

2009<strong>Shares</strong> 09/10 70.0p 91.0p +30.0% <br />

2011<strong>Shares</strong> 11/12 70.0p 94.6p +35.1% <br />

<br />

1 Net cost is the initial offer price of 100p per share less the income tax relief of 30% available to investors in each of the<br />

Company'sshareclasses.<br />

2 TotalReturniscumulativedividendspaidtodateplusthemostrecentlyannounced(unaudited)netassetvalueforeachshare<br />

classinpencepershare.<br />

<br />

Investorsshouldnotethattheyarerequiredtoholdsharesforaminimumperiod(currentlyfiveyears)toretaintheinitialincome<br />

taxreliefof30%.Inanycase,pastperformanceisnotaguidetofutureperformance.<br />

<br />

<br />

CoinvestmentPolicy<br />

<br />

<strong>The</strong>Company'sonlyformalcoinvestmentrelationshipsarewiththeother<strong>Downing</strong><strong>VCT</strong>s,<strong>Downing</strong>'sIHTandEISfunds(together<br />

the"Funds").Ithasbeenagreedthatallocationswillbeofferedtoeachpartyinproportiontotheirrespectivefundsavailablefor<br />

investment,subjectto:(i)aprioritybeinggiventoanyoftheFundsinordertomaintaintheirtaxstatus;(ii)thetimehorizonofthe<br />

investmentopportunitybeingcompatiblewiththeexitstrategyofeachFundand(iii)therisk/rewardprofileoftheinvestment<br />

opportunitybeingcompatiblewiththetargetreturnforeachFund.Intheeventofanyconflictsbetweentheparties,theissueswill<br />

beresolvedatthediscretionoftheindependentdirectors,designatedmembersandcommitteesoftherelevantFunds.<br />

<br />

<br />

Directors<br />

<br />

<strong>The</strong>CompanyhasaBoard,comprisingthreeDirectors,allofwhomarenonexecutiveandindependentoftheManager.<br />

<br />

HughGillespie(Chairman)isnonexecutivechairmanof<strong>Downing</strong><strong>Planned</strong><strong>Exit</strong><strong>VCT</strong>s3–9andanonexecutivedirectorof<strong>Downing</strong><br />

Income<strong>VCT</strong>3plcandBurgessGroupplc.HewasformerlyadirectorofHillSamuelBankLimitedandnonexecutivedirectoror<br />

chairmanofanumberofpubliccompanies.<br />

<br />

Dennis Hale was previously an investment director of Financial Management Bureau Limited ("FMB"), a firm of independent<br />

financialadvisersbasedinCumbria.Hewasresponsiblefor<strong>VCT</strong>researchwithinFMB,whoseclientshaveinvestedin<strong>VCT</strong>ssince<br />

1997. Prior to founding FMB in 1987, he worked for several life assurance companies. Hewasan Associateof the Institute of<br />

Actuaries and holds the Investment Management Certificate. He graduated from the University of Hull with a degree in<br />

Mathematicsin1974.Heisalsoadirectorofanumberof<strong>Downing</strong><strong>VCT</strong>s.<br />

<br />

MichaelRobinsonhasover25years'experienceintheprivateequityindustry.Hespent25yearsat3iplc,wherehewaslatterlya<br />

directormanagingalargeportfolioofequityinvestments.HequalifiedasacharteredaccountantwithDeloitteHaskins&Sellsin<br />

1979andisalsothenonexecutivechairmanofLimbs&ThingsLimited.<br />

<br />

<strong>The</strong>Directorswillbeinvestingatleast£15,000undertheOffersonthesametermsasInvestors.<strong>The</strong>totalinvestedbythepartners<br />

andemployeesof<strong>Downing</strong>in<strong>Downing</strong><strong>VCT</strong>sisover£2million.<br />

<br />

<br />

7