Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

Please note - Swinburne University of Technology

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For advice on later-year modules, students are strongly<br />

urged to seek advice from the Department (as below).<br />

NB This course was progressively converted from subjects<br />

to modules. In 1996 all accounting subjects were replaced<br />

by modules.<br />

Further information<br />

Department <strong>of</strong> Financial Studies on 9214 8165 (Hawthorn)<br />

or 9214 6828 (Prahran).<br />

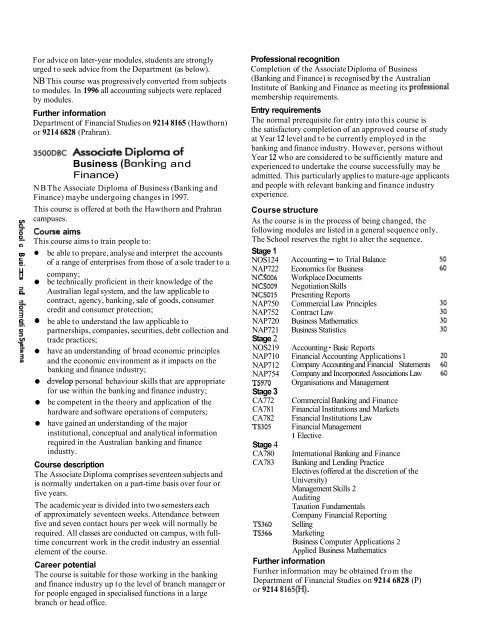

Business (B& ki ng and<br />

Finance)<br />

NB The Associate Diploma <strong>of</strong> Business (Banking and<br />

Finance) maybe undergoing changes in 1997.<br />

This course is <strong>of</strong>fered at both the Hawthorn and Prahran<br />

campuses.<br />

f Course aims<br />

This course aims to train people to:<br />

be able to prepare, analyse and interpret the accounts<br />

6. <strong>of</strong> a range <strong>of</strong> enterprises from those <strong>of</strong> a sole trader to a<br />

H company;<br />

U)<br />

be technically pr<strong>of</strong>icient in their knowledge <strong>of</strong> the<br />

Australian legal system, and the law applicable to<br />

-<br />

contract, agency, banking, sale <strong>of</strong> goods, consumer<br />

4 credit and consumer protection;<br />

5<br />

9. be able to understand the law applicable to<br />

partnerships, companies, securities, debt collection and<br />

g trade practices;<br />

g have an understanding <strong>of</strong> broad economic principles<br />

and the economic environment as it impacts on the<br />

banking and finance industry;<br />

dcvelop personal behaviour skills that are appropriate<br />

for use within the banking and finance industry;<br />

be competent in the theory and application <strong>of</strong> the<br />

hardware and s<strong>of</strong>tware operations <strong>of</strong> computers;<br />

have gained an understanding <strong>of</strong> the major<br />

institutional, conceptual and analytical information<br />

required in the Australian banking and finance<br />

industty.<br />

Course description<br />

The Associate Diploma comprises seventeen subjects and<br />

is normally undertaken on a part-time basis over four or<br />

five years.<br />

The academic year is divided into two semesters each<br />

<strong>of</strong> approximately seventeen weeks. Attendance between<br />

five and seven contact hours per week will normally be<br />

required. All classes are conducted on campus, with fulltime<br />

concurrent work in the credit industry an essential<br />

element <strong>of</strong> the course.<br />

Career potential<br />

The course is suitable for those working in the banking<br />

and finance industry up to the level <strong>of</strong> branch manager or<br />

for people engaged in specialised functions in a large<br />

branch or head <strong>of</strong>fice.<br />

Pr<strong>of</strong>essional recognition<br />

Completion <strong>of</strong> the Associate Diploma <strong>of</strong> Business<br />

(Banking and Finance) is recognised by the Australian<br />

Institute <strong>of</strong> Banking and Finance as meeting its pr<strong>of</strong>essional<br />

membership requirements.<br />

Entry requirements<br />

The normal prerequisite for entry into this course is<br />

the satisfactory completion <strong>of</strong> an approved course <strong>of</strong> study<br />

at Year 12 level and to be currently employed in the<br />

banking and finance industry. However, persons without<br />

Year 12 who are considered to be sufficiently mature and<br />

experienced to undertake the course successfully may be<br />

admitted. This particularly applies to mature-age applicants<br />

and people with relevant banking and finance industry<br />

experience.<br />

Course structure<br />

As the course is in the process <strong>of</strong> being changed, the<br />

following modules are listed in a general sequence only.<br />

The School reserves the right to alter the sequence.<br />

Stage 1<br />

NOS124 Accounting - to Trial Balance<br />

NAP722 Economics for Business<br />

NCS006 Workplace Documents<br />

NCS009 Negotiation Skills<br />

NCS015 Presenting Reports<br />

NAP750 Commercial Law Principles<br />

NAP752 Contract Law<br />

NAP720 Business Mathematics<br />

NAP721 Business Statistics<br />

Stage 2<br />

NOS219 Accounting - Basic Reports<br />

NAP710 Financial Accounting Applications 1<br />

NAP712 Company Accounting and Financial Statements<br />

NAP754 Company and Incorporated Associations Law<br />

TS970 Organisations and Management<br />

Stage 3<br />

CA772 Commercial Banking and Finance<br />

CA781 Financial Institutions and Markets<br />

CA782<br />

TS305<br />

Stage 4<br />

CA780<br />

CA783<br />

Financial Institutions Law<br />

Financial Management<br />

l Elective<br />

International Banking and Finance<br />

Banking and Lending Practice<br />

Electives (<strong>of</strong>fered at the discretion <strong>of</strong> the<br />

<strong>University</strong>)<br />

Management Skills 2<br />

Auditing<br />

Taxation Fundamentals<br />

Company Financial Reporting<br />

TS360 Selling<br />

TS366 Marketing<br />

Business Computer Applications 2<br />

Applied Business Mathematics<br />

Further information<br />

Further information may be obtained from the<br />

Department <strong>of</strong> Financial Studies on 9214 6828 (P)<br />

or 9214 8165(H).