Form 990 - Susquehanna University

Form 990 - Susquehanna University

Form 990 - Susquehanna University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

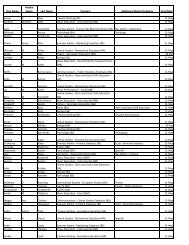

Schedule R (<strong>Form</strong> <strong>990</strong>) 2010<br />

SUSQUEHANNA UNIVERSITY 23-1353385<br />

Page 3<br />

Part V<br />

Transactions With Related Organizations (Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 34, 35, 35a, or 36.)<br />

Note. Complete line 1 if any entity is listed in Parts II, III, or IV of this schedule.<br />

Yes No<br />

1<br />

a<br />

b<br />

c<br />

d<br />

e<br />

During the tax year, did the organization engage in any of the following transactions with one or more related organizations listed in Parts II-IV?<br />

Receipt of (i) interest (ii) annuities (iii) royalties or (iv) rent from a controlled entity ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 1a<br />

Gift, grant, or capital contribution to other organization(s)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Gift, grant, or capital contribution from other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Loans or loan guarantees to or for other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Loans or loan guarantees by other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1b<br />

1c<br />

1d<br />

1e<br />

X<br />

X<br />

X<br />

X<br />

X<br />

f<br />

g<br />

h<br />

i<br />

Sale of assets to other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Purchase of assets from other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Exchange of assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Lease of facilities, equipment, or other assets to other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1f<br />

1g<br />

1h<br />

1i<br />

X<br />

X<br />

X<br />

X<br />

j Lease of facilities, equipment, or other assets from other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

k<br />

l<br />

Performance of services or membership or fundraising solicitations for other organization(s)<br />

Performance of services or membership or fundraising solicitations by other organization(s)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

m Sharing of facilities, equipment, mailing lists, or other assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

n Sharing of paid employees ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1j<br />

1k<br />

1l<br />

1m<br />

1n<br />

X<br />

X<br />

X<br />

X<br />

X<br />

o<br />

p<br />

Reimbursement paid to other organization for expenses ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Reimbursement paid by other organization for expenses<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1o<br />

1p<br />

X<br />

X<br />

q<br />

r<br />

2<br />

Other transfer of cash or property to other organization(s) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Other transfer of cash or property from other organization(s) <br />

If the answer to any of the above is "Yes," see the instructions for information on who must complete this line, including covered relationships and transaction thresholds.<br />

1q<br />

1r<br />

X<br />

X<br />

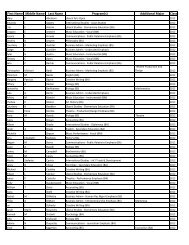

(a) (b) (c) (d)<br />

Name of other organization<br />

Transaction Amount involved<br />

Method of determining<br />

type (a-r)<br />

amount involved<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(5)<br />

(6)<br />

032163 12-21-10<br />

Schedule R (<strong>Form</strong> <strong>990</strong>) 2010