Form 990 - Susquehanna University

Form 990 - Susquehanna University Form 990 - Susquehanna University

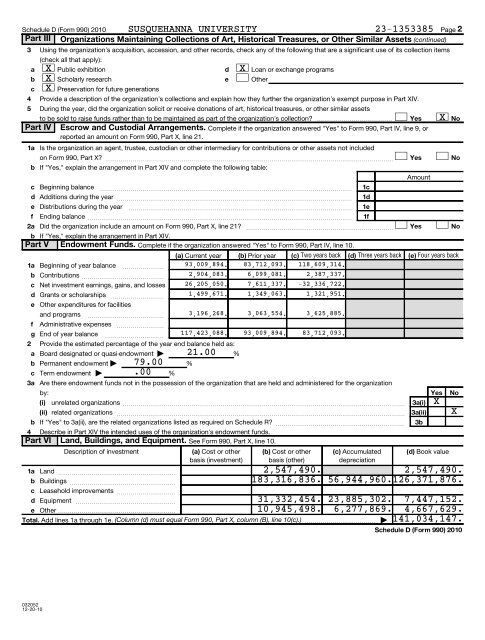

Schedule D (Form 990) 2010 SUSQUEHANNA UNIVERSITY 23-1353385 Page 2 Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued) 3 Using the organization’s acquisition, accession, and other records, check any of the following that are a significant use of its collection items 4 5 a b c b c d e f b If "Yes," explain the arrangement in Part XIV. Part V Endowment Funds. Complete if the organization answered "Yes" to Form 990, Part IV, line 10. 2 b c d e f g a b c b (i) (ii) 4 Describe in Part XIV the intended uses of the organization’s endowment funds. Part VI Land, Buildings, and Equipment. See Form 990, Part X, line 10. 1a b (check all that apply): X Public exhibition X Scholarly research X Preservation for future generations d e Loan or exchange programs Provide a description of the organization’s collections and explain how they further the organization’s exempt purpose in Part XIV. During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assets to be sold to raise funds rather than to be maintained as part of the organization’s collection? Yes Part IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to Form 990, Part IV, line 9, or reported an amount on Form 990, Part X, line 21. 1a Is the organization an agent, trustee, custodian or other intermediary for contributions or other assets not included on Form 990, Part X? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ (a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back 93,009,894. 83,712,093. 118,609,314. 2,904,083. 6,099,081. 2,387,337. 26,205,050. 7,611,337. -32,336,722. 1,499,671. 1,349,063. 1,321,951. 1c 1d 1e 1f Yes Yes Yes 3a(i) X 3a(ii) (a) Cost or other (b) Cost or other (c) Accumulated (d) Book value basis (investment) basis (other) depreciation 2,547,490. 2,547,490. 183,316,836. 56,944,960.126,371,876. c Leasehold improvements ~~~~~~~~~~ d Equipment ~~~~~~~~~~~~~~~~~ 31,332,454. 23,885,302. 7,447,152. e Other 10,945,498. 6,277,869. 4,667,629. Total. Add lines 1a through 1e. (Column (d) must equal Form 990, Part X, column (B), line 10(c).) | 141,034,147. Other If "Yes," explain the arrangement in Part XIV and complete the following table: Beginning balance Additions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Distributions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Ending balance ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2a Did the organization include an amount on Form 990, Part X, line 21? ~~~~~~~~~~~~~~~~~~~~~~~~~ 1a Beginning of year balance Contributions ~~~~~~~~~~~~~~ Net investment earnings, gains, and losses Grants or scholarships Other expenditures for facilities and programs Administrative expenses End of year balance ~~~~~~~ ~~~~~~~~~ ~~~~~~~~~~~~~ ~~~~~~~~ ~~~~~~~~~~ Provide the estimated percentage of the year end balance held as: Board designated or quasi-endowment | 21.00 % Permanent endowment | 79.00 % Term endowment | .00 % 3a Are there endowment funds not in the possession of the organization that are held and administered for the organization by: unrelated organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ related organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? ~~~~~~~~~~~~~~~~~~~~~~ Description of investment Land ~~~~~~~~~~~~~~~~~~~~ Buildings ~~~~~~~~~~~~~~~~~~ X 3,196,268. 3,063,554. 3,625,885. 117,423,088. 93,009,894. 83,712,093. Amount 3b X No No No No X Schedule D (Form 990) 2010 032052 12-20-10

Schedule D (Form 990) 2010 SUSQUEHANNA UNIVERSITY 23-1353385 Part VII Investments - Other Securities. See Form 990, Part X, line 12. (a) Description of security or category (c) Method of valuation: (b) Book value (including name of security) Cost or end-of-year market value (1) (2) (3) Financial derivatives Closely-held equity interests ~~~~~~~~~~~~~~~ ~~~~~~~~~~~ Other (A) REAL ESTATE 9,775,622. END-OF-YEAR MARKET VALUE (B) FUNDS HELD IN TRUST BY (C) OTHERS 3,494,119. END-OF-YEAR MARKET VALUE (D) HEDGE FUNDS 9,540,492. END-OF-YEAR MARKET VALUE (E) ALTERNATIVE INVESTMENTS 1,049,613. END-OF-YEAR MARKET VALUE (F) (G) (H) (I) Total. (Col (b) must equal Form 990, Part X, col (B) line 12.) | 23,859,846. Part VIII Investments - Program Related. See Form 990, Part X, line 13. (1) (2) (3) (4) (5) (6) (7) (8) (9) (a) Description of investment type (10) Total. (Col (b) must equal Form 990, Part X, col (B) line 13.) | Part IX Other Assets. See Form 990, Part X, line 15. (a) Description (1) (2) (3) (4) (5) (6) (7) (8) (9) (b) Book value (c) Method of valuation: Cost or end-of-year market value (10) Total. (Column (b) must equal Form 990, Part X, col (B) line 15.) | Part X Other Liabilities. See Form 990, Part X, line 25. 1. (a) Description of liability (b) Amount (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Federal income taxes ANNUITIES PAYABLE 1,980,300. FUNDS HELD IN CUSTODY FOR OTHERS 1,084,700. OTHER 941,421. US GOVERNMENT ADVANCES REFUNDABLE 2,085,371. FIN47 347,380. (b) Book value Page 3 (11) Total. (Column (b) must equal Form 990, Part X, col (B) line 25.) | 6,439,172. 2. FIN 48 (ASC 740) Footnote. In Part XIV, provide the text of the footnote to the organization’s financial statements that reports the organization’s liability for uncertain tax positions under FIN 48 (ASC 740). 032053 12-20-10 Schedule D (Form 990) 2010

- Page 1 and 2: Form Under section 501(c), 527, or

- Page 3 and 4: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 5 and 6: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 7 and 8: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 9 and 10: Form 990 (2010) Part VII Section A.

- Page 11 and 12: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 13 and 14: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 15 and 16: Schedule A (Form 990 or 990-EZ) 201

- Page 17 and 18: ** PUBLIC DISCLOSURE COPY ** Schedu

- Page 19 and 20: 1 2 Schedule B (Form 990, 990-EZ, o

- Page 21 and 22: Schedule B (Form 990, 990-EZ, or 99

- Page 23 and 24: Schedule C (Form 990 or 990-EZ) 201

- Page 25: SCHEDULE D (Form 990) | Complete if

- Page 29 and 30: Schedule D (Form 990) 2010 SUSQUEHA

- Page 31 and 32: Schedule E (Form 990 or 990-EZ) (20

- Page 33 and 34: Schedule F (Form 990) 2010 Part II

- Page 35 and 36: Schedule F (Form 990) 2010 SUSQUEHA

- Page 37 and 38: SCHEDULE G (Form 990 or 990-EZ) Dep

- Page 39 and 40: Schedule G (Form 990 or 990-EZ) 201

- Page 41 and 42: Schedule I (Form 990) (2010) SUSQUE

- Page 43 and 44: Schedule I (Form 990) SUSQUEHANNA U

- Page 45 and 46: OMB No. 1545-0047 SCHEDULE J (Form

- Page 47 and 48: Schedule J (Form 990) 2010 SUSQUEHA

- Page 49 and 50: Schedule K (Form 990) 2010 Part III

- Page 51 and 52: SCHEDULE L (Form 990 or 990-EZ) Dep

- Page 53 and 54: Schedule L (Form 990 or 990-EZ) 201

- Page 55 and 56: SCHEDULE M (Form 990) 1 2 3 4 5 6 7

- Page 57 and 58: SCHEDULE O (Form 990 or 990-EZ) Dep

- Page 59 and 60: OMB No. 1545-0047 SCHEDULE R (Form

- Page 61 and 62: Schedule R (Form 990) 2010 SUSQUEHA

- Page 63: Schedule R (Form 990) 2010 SUSQUEHA

Schedule D (<strong>Form</strong> <strong>990</strong>) 2010 SUSQUEHANNA UNIVERSITY 23-1353385 Page 2<br />

Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued)<br />

3 Using the organization’s acquisition, accession, and other records, check any of the following that are a significant use of its collection items<br />

4<br />

5<br />

a<br />

b<br />

c<br />

b<br />

c<br />

d<br />

e<br />

f<br />

b If "Yes," explain the arrangement in Part XIV.<br />

Part V Endowment Funds. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 10.<br />

2<br />

b<br />

c<br />

d<br />

e<br />

f<br />

g<br />

a<br />

b<br />

c<br />

b<br />

(i)<br />

(ii)<br />

4 Describe in Part XIV the intended uses of the organization’s endowment funds.<br />

Part VI Land, Buildings, and Equipment. See <strong>Form</strong> <strong>990</strong>, Part X, line 10.<br />

1a<br />

b<br />

(check all that apply):<br />

X Public exhibition<br />

X Scholarly research<br />

X Preservation for future generations<br />

d<br />

e<br />

Loan or exchange programs<br />

Provide a description of the organization’s collections and explain how they further the organization’s exempt purpose in Part XIV.<br />

During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assets<br />

to be sold to raise funds rather than to be maintained as part of the organization’s collection? Yes<br />

Part IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 9, or<br />

reported an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21.<br />

1a<br />

Is the organization an agent, trustee, custodian or other intermediary for contributions or other assets not included<br />

on <strong>Form</strong> <strong>990</strong>, Part X? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back<br />

93,009,894. 83,712,093. 118,609,314.<br />

2,904,083. 6,099,081. 2,387,337.<br />

26,205,050. 7,611,337. -32,336,722.<br />

1,499,671. 1,349,063. 1,321,951.<br />

1c<br />

1d<br />

1e<br />

1f<br />

Yes<br />

Yes<br />

Yes<br />

3a(i) X<br />

3a(ii)<br />

(a) Cost or other (b) Cost or other (c) Accumulated (d) Book value<br />

basis (investment) basis (other)<br />

depreciation<br />

2,547,490. 2,547,490.<br />

183,316,836. 56,944,960.126,371,876.<br />

c Leasehold improvements ~~~~~~~~~~<br />

d Equipment ~~~~~~~~~~~~~~~~~<br />

31,332,454. 23,885,302. 7,447,152.<br />

e Other <br />

10,945,498. 6,277,869. 4,667,629.<br />

Total. Add lines 1a through 1e. (Column (d) must equal <strong>Form</strong> <strong>990</strong>, Part X, column (B), line 10(c).) | 141,034,147.<br />

Other<br />

If "Yes," explain the arrangement in Part XIV and complete the following table:<br />

Beginning balance<br />

Additions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Distributions during the year<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Ending balance ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

2a<br />

Did the organization include an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21? ~~~~~~~~~~~~~~~~~~~~~~~~~<br />

1a<br />

Beginning of year balance<br />

Contributions ~~~~~~~~~~~~~~<br />

Net investment earnings, gains, and losses<br />

Grants or scholarships<br />

Other expenditures for facilities<br />

and programs<br />

Administrative expenses<br />

End of year balance<br />

~~~~~~~<br />

~~~~~~~~~<br />

~~~~~~~~~~~~~<br />

~~~~~~~~<br />

~~~~~~~~~~<br />

Provide the estimated percentage of the year end balance held as:<br />

Board designated or quasi-endowment | 21.00 %<br />

Permanent endowment | 79.00 %<br />

Term endowment | .00 %<br />

3a<br />

Are there endowment funds not in the possession of the organization that are held and administered for the organization<br />

by:<br />

unrelated organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

related organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? ~~~~~~~~~~~~~~~~~~~~~~<br />

Description of investment<br />

Land ~~~~~~~~~~~~~~~~~~~~<br />

Buildings ~~~~~~~~~~~~~~~~~~<br />

X<br />

3,196,268. 3,063,554. 3,625,885.<br />

117,423,088. 93,009,894. 83,712,093.<br />

Amount<br />

3b<br />

X<br />

No<br />

No<br />

No<br />

No<br />

X<br />

Schedule D (<strong>Form</strong> <strong>990</strong>) 2010<br />

032052<br />

12-20-10