Form 990 - Susquehanna University

Form 990 - Susquehanna University Form 990 - Susquehanna University

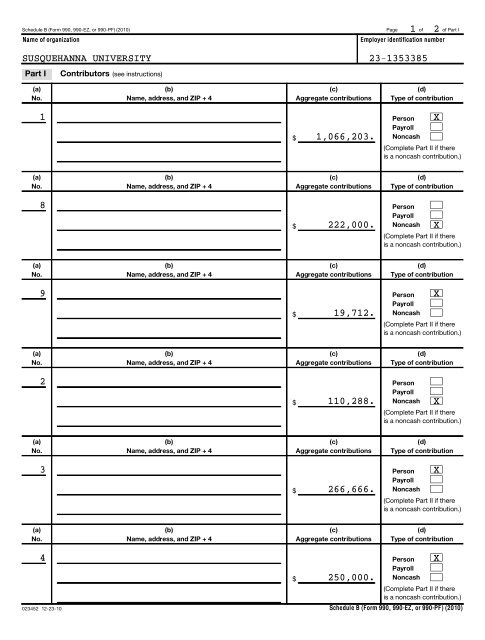

1 2 Schedule B (Form 990, 990-EZ, or 990-PF) (2010) Page of of Part I Name of organization Employer identification number SUSQUEHANNA UNIVERSITY 23-1353385 Part I Contributors (see instructions) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 1 Person Payroll X $ 1,066,203. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 8 $ Person Payroll 222,000. Noncash X (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 9 Person Payroll X $ 19,712. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 2 $ Person Payroll 110,288. Noncash X (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 3 Person Payroll X $ 266,666. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 4 Person Payroll X $ 250,000. Noncash 023452 12-23-10 (Complete Part II if there is a noncash contribution.) Schedule B (Form 990, 990-EZ, or 990-PF) (2010)

1 2 Schedule B (Form 990, 990-EZ, or 990-PF) (2010) Page of of Part I Name of organization Employer identification number SUSQUEHANNA UNIVERSITY 23-1353385 Part I Contributors (see instructions) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 5 Person Payroll X $ 200,540. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 6 Person Payroll X $ 200,000. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 7 Person Payroll X $ 150,400. Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution $ Person Payroll Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution $ Person Payroll Noncash (Complete Part II if there is a noncash contribution.) (a) No. (b) Name, address, and ZIP + 4 (c) Aggregate contributions (d) Type of contribution 023452 12-23-10 $ Person Payroll Noncash (Complete Part II if there is a noncash contribution.) Schedule B (Form 990, 990-EZ, or 990-PF) (2010)

- Page 1 and 2: Form Under section 501(c), 527, or

- Page 3 and 4: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 5 and 6: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 7 and 8: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 9 and 10: Form 990 (2010) Part VII Section A.

- Page 11 and 12: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 13 and 14: Form 990 (2010) SUSQUEHANNA UNIVERS

- Page 15 and 16: Schedule A (Form 990 or 990-EZ) 201

- Page 17: ** PUBLIC DISCLOSURE COPY ** Schedu

- Page 21 and 22: Schedule B (Form 990, 990-EZ, or 99

- Page 23 and 24: Schedule C (Form 990 or 990-EZ) 201

- Page 25 and 26: SCHEDULE D (Form 990) | Complete if

- Page 27 and 28: Schedule D (Form 990) 2010 SUSQUEHA

- Page 29 and 30: Schedule D (Form 990) 2010 SUSQUEHA

- Page 31 and 32: Schedule E (Form 990 or 990-EZ) (20

- Page 33 and 34: Schedule F (Form 990) 2010 Part II

- Page 35 and 36: Schedule F (Form 990) 2010 SUSQUEHA

- Page 37 and 38: SCHEDULE G (Form 990 or 990-EZ) Dep

- Page 39 and 40: Schedule G (Form 990 or 990-EZ) 201

- Page 41 and 42: Schedule I (Form 990) (2010) SUSQUE

- Page 43 and 44: Schedule I (Form 990) SUSQUEHANNA U

- Page 45 and 46: OMB No. 1545-0047 SCHEDULE J (Form

- Page 47 and 48: Schedule J (Form 990) 2010 SUSQUEHA

- Page 49 and 50: Schedule K (Form 990) 2010 Part III

- Page 51 and 52: SCHEDULE L (Form 990 or 990-EZ) Dep

- Page 53 and 54: Schedule L (Form 990 or 990-EZ) 201

- Page 55 and 56: SCHEDULE M (Form 990) 1 2 3 4 5 6 7

- Page 57 and 58: SCHEDULE O (Form 990 or 990-EZ) Dep

- Page 59 and 60: OMB No. 1545-0047 SCHEDULE R (Form

- Page 61 and 62: Schedule R (Form 990) 2010 SUSQUEHA

- Page 63: Schedule R (Form 990) 2010 SUSQUEHA

1 2<br />

Schedule B (<strong>Form</strong> <strong>990</strong>, <strong>990</strong>-EZ, or <strong>990</strong>-PF) (2010) Page of of Part I<br />

Name of organization<br />

Employer identification number<br />

SUSQUEHANNA UNIVERSITY 23-1353385<br />

Part I<br />

Contributors (see instructions)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

1 Person<br />

Payroll<br />

X<br />

$ 1,066,203. Noncash<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

8<br />

$<br />

Person<br />

Payroll<br />

222,000. Noncash X<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

9 Person<br />

Payroll<br />

X<br />

$ 19,712. Noncash<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

2<br />

$<br />

Person<br />

Payroll<br />

110,288. Noncash X<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

3 Person<br />

Payroll<br />

X<br />

$ 266,666. Noncash<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

(a)<br />

No.<br />

(b)<br />

Name, address, and ZIP + 4<br />

(c)<br />

Aggregate contributions<br />

(d)<br />

Type of contribution<br />

4 Person<br />

Payroll<br />

X<br />

$ 250,000. Noncash<br />

023452 12-23-10<br />

(Complete Part II if there<br />

is a noncash contribution.)<br />

Schedule B (<strong>Form</strong> <strong>990</strong>, <strong>990</strong>-EZ, or <strong>990</strong>-PF) (2010)